2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

The financial system of any country has a key element - financial institutions. These are institutions that are engaged in the transfer of money, lending, investing, borrowing money, using various financial instruments for this.

Goals and objectives

The main task of a financial institution is to organize the efficient transfer of funds from savers to borrowers. That is, all transactions are carried out between those who have money and those who need it. The objectives of financial institutions are:

- save financial resources;

- mediate with borrowers;

- make financial transformations;

- risk transfer;

- organize foreign exchange transactions;

- promote liquidity;

- organize operations to change the legal forms of companies.

Let's look at each goal in more detail.

What is the benefit?

Financial institutions are organizations whose task is to accumulate money thatwill be rationally used later. This way of accumulating funds is more profitable and safe.

Intermediation is the main function of financial institutions, since not only the accumulation of funds is important, but also their rational use in the future. It turns out that financial institutions are intermediaries between the saver and the borrower, and the latter takes funds under certain obligations related to the return of the money received. Financial intermediation has a number of benefits:

- Not all savers can deal with financial transactions themselves and make a really profitable decision.

- Turning to financial companies, the consumer saves his time, effort, nerves and can do the main business.

- The money received works more efficiently.

- Thanks to financial intermediaries, it is possible to accumulate large amounts of money that are invested in profitable projects that are potentially interesting for large investors.

The main thing is the cleanliness of operations

Financial institutions are an opportunity to make short-term monetary assets long-term. In this case, several points play an important role:

- calculations with short-term investors must be done carefully so that all funds taken are returned on time;

- when there are too many depositors, the fluctuations in the amount of cash will level out.

It is beneficial to apply to such organizations for the reason thatany financial transactions are inherently risky, and therefore everyone wants to avoid risks and make the right decision.

Currency transactions

The activity of financial institutions is aimed, among other things, at conducting foreign exchange transactions, in which many companies are involved, especially those that plan to enter the international market. Foreign exchange operations are of interest to joint ventures that help find foreign investors or open a foreign representative office.

Any company operating in the financial market applies to the relevant institutions for funds. And an important role in this process is played by the creation of an insurance reserve of funds that can be used in difficult situations, with accounts payable, for example. To insure oneself against such problems, financial institutions are needed, the role of which is high.

Types and features

There are several types of financial institutions:

- commercial banks;

- non-bank financial institutions;

- investment institutions.

All types of financial institutions conduct their activities with an emphasis on accumulating free funds and subsequently investing them in the country's economy. But, on the other hand, each financial institution works in its own way.

Banks

The main investment potential is concentrated in the institutions of the banking system, whose capabilitiesare exceptional. It is in banks that financial resources are accumulated, which are subsequently distributed to those sectors and industries that are developing most dynamically. At the heart of the modern banking system are commercial banks that conduct operations in various areas of the financial market. But with the specialization of banking services as the main financial institutions, investment banks have become popular, which focus on raising durable capital and providing funds through the issuance and placement of shares, securities, as well as long-term lending.

All investment banks are divided into two types - the first provide services in the field of trading and placement of securities, the second are focused on issuing loans (long-term and medium-term). The first type of banks is popular in England, Canada, USA, Australia, and they cannot accept deposits from the public, organizations. The second type of investment banks is common in Western Europe. They are engaged in lending to various sectors of the economy, implementing various projects.

No less common are financial institutions such as mortgage banks. Their task is to perform credit operations related to attracting and placing funds on a long-term basis on the pledge of land and buildings. Mortgage banks use funds that are raised as a result of issuing bonds, mortgage bonds.

Non-bank organizations

Non-bank financial and credit institutionsare pawnshops, credit partnerships, credit unions, pension funds and insurance companies. Let's describe the features of each species in a few words:

- Pawnshops issue a loan on the security of movable property, can be state, municipal, private and mixed. Pawnshops work without a loan agreement with a client and without collateral.

- Credit partnerships are designed for credit and settlement services for their members, and funds received from the purchase of shares and payment of mandatory insurance premiums are considered capital.

- Credit unions are special cooperatives that are assembled by individuals. They may be involved in attracting deposits, providing loans secured by audit and consulting services.

- Insurance companies sell insurance policies, and the funds received for this are placed in government or corporate securities.

- Private pension funds are independent companies whose resources are regular contributions from employees, deductions from firms.

In a separate group are investment financial institutions that operate in the securities market without other activities.

Problems and prospects

The financial system is the basis for the development of the economy of any country. They not only allow one to judge the investment climate of a particular state, but also allow one to shape it and thereby be responsible for its quality. Today there is a need to develop effective methods of financingenterprises. But because of the financial crisis in Russia, trust in financial institutions is not so high, and the banking system itself is not very technologically advanced. The modern development of financial institutions has certain prospects if the economy grows, but for this it is necessary to develop and modernize fixed assets, attracting investments for this.

Recommended:

Optimization of headcount: types, goals, activities, procedures

Optimization of the number of personnel in the enterprise is the process of determining the number of employees necessary for the efficient and optimal functioning of the company. It is under such conditions that it can be expected that with minimal labor costs for employees, an excellent work of the company will be ensured

Real estate development and its role in economic development. The concept, types, principles and foundations of development

In the framework of this article, we will consider the organization of the real estate development system and its role in economic development. The basic concepts, types and principles of organization of the development system are considered. The characteristic features of the system in Russian conditions are considered

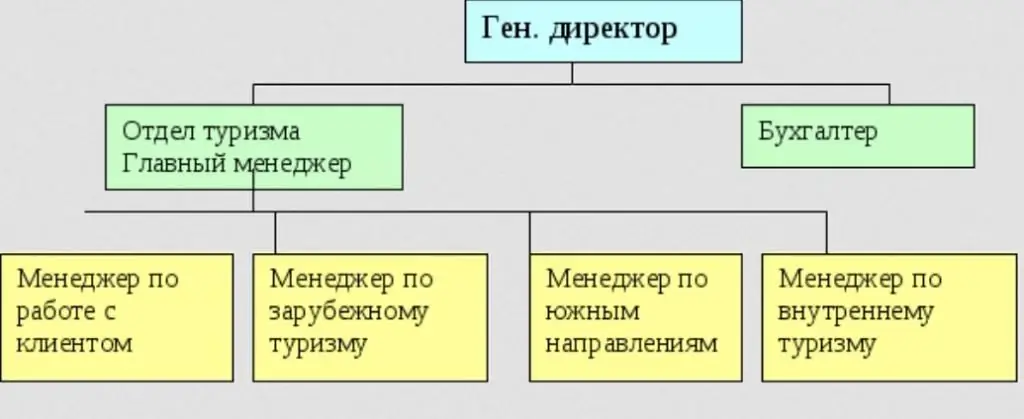

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

Goals of the activities of the Central Bank of the Russian Federation and methods for their implementation

Most countries of the world have established a national bank responsible for the functioning of the country's financial system. In the Russian Federation, the Bank of Russia is vested with similar powers

State loans: their types and significance for the development of the national economy

Government loans are represented by a structure of interrelated elements and types. So, depending on the status of borrowers, the following types of loans can be distinguished: centralized and decentralized