2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:29

In the context of the current global crisis, a very difficult economic situation has developed in our country. But despite this, most people continue to make savings, increase their funds, invest in the future. Someone long and patiently saves money to realize their dreams (for example, buying a new car), someone, if possible, saves a little from time to time for a "rainy day". It's no secret that the most common means of accumulation in our country has been and remains bank deposits or, in economic terms, bank deposits.

What is a deposit?

Deposit (lat. depositum - "a thing deposited") - a deposit in a bank, funds stored in a bank for a certain time, with the possibility of accruing interest on this amount.

Starting from the oldest, familiar to almost every adult citizen of the country, Sberbank of Russia, which provides traditional services to the population in offices (which are even in the most remote villages of our homeland), and ending with recently created new banks serving customersexclusively remotely (via the Internet), everyone uses almost identical types of deposits (deposits) in their work.

What are deposits?

There are certain criteria by which deposits are divided into types and subtypes. Bank deposits are differentiated according to the following parameters:

- deposits can be classified according to the period of placement into demand and term deposits;

- there are types of bank deposits for certain categories of citizens (deposits for pensioners, children's deposits, deposits for employees of certain enterprises);

- types of deposits by currency in which they are issued;

- types of deposits by interest calculation method.

Term deposits

To begin with, let's determine that a bank deposit can be issued under a demand contract, that is, the bank is obliged to give the client the money invested by him on demand. Since the bank accepted a deposit from the client on the terms of a refund at any time convenient for the client, minimum rates are charged on such a deposit, from 0.1 to 1-1.5%.

Term deposits are different. Clients place such types of deposits for certain periods specified in the bank deposit agreement. There is a registration of deposits for one, three, six months or one to three years. The interest rate offered by the bank for each individual deposit usually increases in proportion to the length of the term, that is, the longer the credit institution keepscash on deposit, the more attractive rate it offers to the client in return. However, in order to receive the entire amount of interest accumulated over a certain period, the client must keep the money on deposit during the entire term of the bank deposit agreement. In case of early closure, the client receives a penny benefit - the interest on the deposit will be equal to the rate on the demand deposit. There is justice here, because the bank could not use the client's funds for exactly the period specified in the bank deposit agreement, which means that it lost a certain profit. However, due to the growing competition in the banking sector, in order to retain the client, almost all banks offer more loyal early termination of the deposit (applies to deposits opened for a period of more than 6 months), namely, after the money has lain on the account for more than 6 months, upon closing the deposit, the client receives 2/3 of the interest rate, which was originally specified in the bank deposit agreement.

Term deposits are divided into separate subspecies according to the possibility of movement of funds on the deposit: savings, savings, settlement. Let's dwell on each in more detail.

- Savings is the simplest kind of term deposit, "put it and forget it". Such a deposit cannot be replenished or partially withdrawn from it (in some cases only monthly interest can be withdrawn), however, banks set the highest interest rates for such deposits. Most often, such deposits are made by clients who have sold real estate or received a suddeninheritance - those who have a large amount of money.

- Cumulative - the deposit is allowed to be replenished during the entire term of the contract. Basically, such deposits attract clients who want to gradually save up a large amount for an expensive purchase (car, apartment, vacation abroad).

- Settlement - for this type of deposit, the client has the greatest freedom of action, manages his savings in the way that is convenient for him: replenishes or withdraws funds at any necessary time, as often as he wants. It is easy to guess that the bank usually offers the lowest interest rate on this deposit.

Types of deposits for certain categories of citizens

There are deposits for different categories of clients.

- Deposits for pensioners - as a rule, the bank offers deposits to this segment of citizens at very attractive rates with more favorable and convenient conditions than for other individuals.

- Children's deposit - a target deposit opened in the name of a child by a depositor who has reached the age of 18 (that is, parents, guardians, relatives). According to the law in force in our country, a person who has reached the age of 14 can perform any actions on a deposit, until this moment the deposit is managed by the depositor. Such deposits are the longest-term, up to 5 years on average, but this is their advantage, because it makes it possible to save the desired amount for the child without the temptation for parents to spend money.

- Deposits for employees of certain enterprises - a type of bank deposits, usually withhigher interest rate than for other individuals. These deposits are offered for employees of the bank's salary projects or for employees of enterprises - corporate clients of the bank.

Currency deposits

Bank deposits can be differentiated by the type of currency in which they are opened. Modern banks provide not only the usual currencies for storage - the US dollar and the euro, but also others, such as the Swiss franc, Japanese yen, British pound, etc.

It is also possible to make a multi-currency deposit. The bank opens one account, in which the amount of money is placed in several currencies at once. One of the most attractive facts that encourages a client to open this type of deposit is the possibility of a good additional income in case the currency suddenly starts to grow. Then, in addition to the interest rate stated in the bank deposit agreement, an increase in the exchange rate of a certain currency is also added, in ruble equivalent, which can increase the deposit amount by several times. Therefore, one of the risks of this type of deposit is a decrease in funds in the event of a fall in the exchange rate. Therefore, foreign currency deposits are most often opened by clients who have closely studied the fluctuations in currency quotes, carefully monitored the trends of ups/downs in the exchange rate of the currency of interest.

Types of deposits by method of interest calculation

Depending on the type of deposit, the bank can most often offer customers three waysinterest calculation:

- Calculate monthly payments and make capitalization, which means transferring interest to the amount of the deposit. In this case, interest is charged not only on the invested funds, but also on the interest itself, which gives a large profit to the client.

- Calculate interest on the deposit amount quarterly - most often for seasonal deposits (in other words, promotional deposits), the deposit amount will be increased by the amount of interest once every three months.

- Charge interest at the end of the deposit term - this type of bank deposits deposits, as a rule, are opened for a year or more, do not automatically renew, but the bank offers temptingly high interest rates on them. Most often, the bank offers the execution of these deposits on the eve of any holidays, such as Victory Day, New Year, etc.

Conclusion

So, in this article we have de alt with the types of bank deposits, their description and conditions. Now, if you have a desire not only to save your money, but also to increase it, you can safely go to any bank, already competently contact a specialist and choose the most profitable and convenient deposit for you.

Recommended:

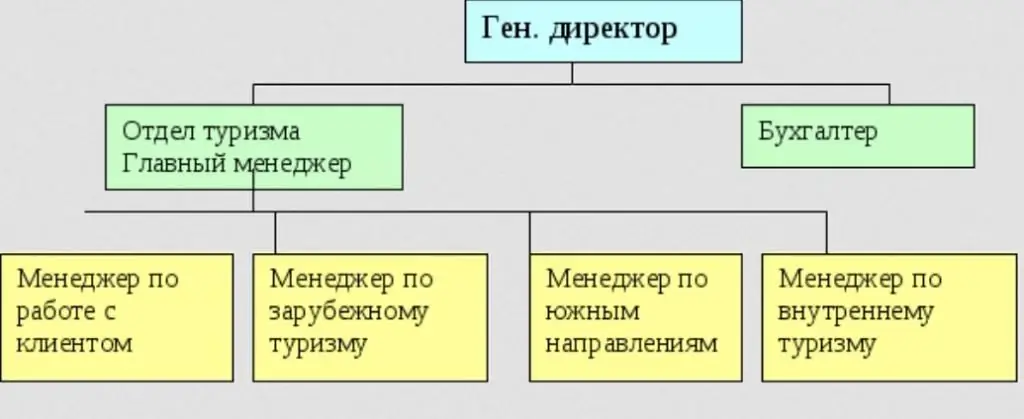

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

Non-ferrous, precious and ferrous types of metals and their characteristics

Metals are a large group of simple elements with characteristic features such as high thermal and electrical conductivity, positive temperature coefficient and more. To properly classify and understand what's what, you need to deal with all the nuances. Let's try with you to consider such basic types of metals as ferrous, non-ferrous, precious, as well as alloys. This is quite an extensive and complex topic, but we will try to put everything on the shelves

Bank deposits. Bank deposits of individuals

There really are a great variety of banking services. This article will talk about deposits, their types and how not to miscalculate and choose the right bank that will be your reliable financial partner

Reserves of banks and their formation. Required bank reserves and their norm

Bank reserves ensure the availability of funds for the uninterrupted fulfillment of payment obligations regarding the return of deposits to depositors and settlements with other financial institutions. In other words, they act as a guarantee

Frozen deposits of Sberbank. Can deposits be frozen? How secure are deposits in Russian banks?

The frozen deposits of Sberbank in 1991 are systematically paid out by a financial institution. The bank does not refuse from its obligations, and guarantees the complete safety of their funds to new depositors