2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

Assets that are used in trading in the financial market have a fundamental relationship. This is best seen by traders in Forex and other financial markets. Assets that are placed in the trading window follow each other's movements. With the release of the news about the deterioration in the labor market in the euro area, the EUR/USD pair will begin to decline in price, followed by the GBP/USD, but to a lesser extent. Although the UK voted to leave the European Union, it still depends heavily on it.

Definition

Correlation is a term that refers to the trend of change between data series. Changes in one market affect the dynamics of another. Therefore, traders often use the currency pair correlation indicator when trading.

Views

Correlation of currency pairs can be sliding and direct. The first gives more accurate results. In the case of a direct correlation, both indicators move synchronously, and in the case of a reverse one, they move in opposite directions.

Let's consider the situation on the example of trading two currency pairs: USD/CHF and EUR/USD. The trader trades the USD/CHF instrument. If the results of technical analysis show that there is a direct relationship between the two indicators, then you can open positions in different directions. Knowing the relationship reduces the number of random signals. But reliable results can only be achieved when working with a large amount of data. Moving or inverse correlation of currency pairs is shown in time on the shifted data set. The change in the USD/CHF exchange rate today reflects the movement of the EUR/USD pair in the future. The more detailed information, the easier it is to build a strategy on it.

Data analysis

You can calculate the correlation of currency pairs using a special program downloaded from the Internet, or in Excel. The built-in function "CORREL" reflects the relationship of two sets of data. To determine a direct correlation, you need to use data taken from one period of time (for example, 2013), and for the reverse - from different (2013 and 2014). In the first case, the value of the indicator should be closer to "+1", and in the second - to "-1". An indicator value of "0" indicates that there is no relationship between the data.

The relationship is not constant as the market changes. It's harder to find an inverse correlation. For example, the price of gold most often outperforms the GBP/USD. The relationship for this pair should be calculated almost for every trading day. Some pairs move in different directions, others move in the same direction, but with a time delay, and others completely copy each other. It is better to track the dynamics of movement once a month orquarter.

Applying correlation

Traders try to avoid positions that balance each other in the same time frame. For example, a trader decides to work with USD/CHF and EUR/USD pairs, which have an inverse relationship. When USD/CHF starts to fall in price, EUR/USD will rise.

It is better to refuse such combinations. The profit received from the first site may not cover the loss. A trading strategy should be based on a series of data with a direct relationship.

In financial markets, there are several currencies that have a direct correlation with the dollar: AUD/USD, GBP/USD, NZD/USD and EUR/USD. Tracking the relationship between currency pairs helps reduce the risk of loss and redirect investments to other assets in time.

Currency pair correlation strategy

The Grail does not exist in the financial market. No strategy will always be profitable. Even if it is based on the correlation of currency pairs. But in the short term, trading based on a direct relationship is possible. You only need to find assets with a high degree of correlation (from 0.8) for the last year. The essence of pair trading is to find points of maximum price divergence through the correlation indicator of currency pairs, sell a more expensive asset and buy a cheaper one.

Benefits of the strategy

The main advantage of the pair trading strategy is the lack of load on the deposit. Losses of one of the correlated pairs will be covered by profits from the other. This strategy is alsocalled a hedging because the second trade is opposite the first.

The second advantage is that there is no need for fundamental or technical analysis. It is only necessary to determine the maximum divergence of pairs and not be distracted by the chaotic price movement. But this is also the main disadvantage of the strategy. The correlation between currency pairs will not continue all the time. Its duration cannot be determined.

Currency pair correlation indicator for MT4

Forex trading is usually carried out through a special platform. Most often it is MT4, less often MT5. To work according to the chosen strategy, a special indicator is installed on the platform, which superimposes the charts of currency pairs on top of each other.

Specially for pair trading, you can use the OverLayChart indicator. With its help, you can determine the correlated currency pairs from the charts. The principle of operation is the following. In the platform window, you need to open a chart of any asset, for example EUR/USD, and attach an OverLayChart to it. In the settings window, enter the name of the correlated asset in the SubSymbol parameter, for example, GBP/USD, and select the color of the bars of the second asset. If the relationship between the parameters is inverse, then in the indicator settings window, set the Mirroring parameter to true, and if the relationship is direct - false.

After launching the indicator, two charts will appear in one window instead of one. You can work with them in the same way as with a regular chart: change color, timeframe, scale.

Scriptsfor trading

In addition to indicators, you can also use Expert Advisors and scripts to help traders. To work on the previously discussed strategy, you can use the Correlations script, which makes it easy to find interdependent instruments. In the settings you should set:

- StartTime - the period during which the program will search for correlated instruments.

- Rank - relationship type.

If you need to find a direct relationship between assets, the program will calculate the Pearson coefficient. To determine the inverse relationship, the Spearman coefficient is calculated. The weaker the relationship, the closer the calculated value of the indicator to “0”.

After the launch of the program, the relationship is searched for all the instruments indicated in the Market Watch. The process itself can be observed in the left corner of the screen. As soon as the correlation of each other's currency pairs is found, they will be written to the terminal log. Even if his work is interrupted, the records will be saved. Upon completion of the work, the Correlations.txt file is generated, which displays the results. Before running the script, you need to download the quote history of all assets that will be analyzed.

Trading algorithm

How is the currency pair correlation strategy applied in practice? First of all, you need to decide on the trade entries, that is, find on the chart the pairs that diverged from each other as much as possible, and calculate the number of points of this discrepancy. Next, you need to determine the averagethe significance of these deviations. They will be used to calculate the correlation of currency pairs. For example, the average asset divergence is 80 points. This means that the next trade will need to be opened when the divergence reaches 70-80 pips.

No one can predict how the market will move in the future. The described preliminary analysis will help to avoid losing trades.

The trading rules are as follows. When the calculated discrepancy is reached, two trades should be opened at once. A more expensive asset (the one that is located on the top of the chart) needs to be sold, and a cheap asset should be bought. You need to exit trades as soon as the charts cross at the zero point.

This strategy can be applied on timeframes from 5 minutes to one hour. The greater the time difference, the fewer signals there will be, and the greater the profit of one trade.

Insurance

This trading strategy based on the correlation of currency pairs does not involve the use of stop losses or take profits. But you can insure yourself against further divergence losses by using pending orders. For example, a trader opened a position to buy EUR/USD when the divergence reaches 80 points. The results of the preliminary analysis showed that the maximum difference between the pairs was 110 points. Therefore, you can immediately open a pending order for the sale of an asset when a discrepancy of 100 points is reached. The same should be done for the cheaper pair. Open an order to buy an asset when a divergence of 100 points is reached.

Correlation in options trading

This type of trading is very similar to "Forex", but has its own characteristics.

If the correlation coefficient is close to "+1", then transactions in one direction cannot be concluded. In case of negative changes in the market, the trader will receive a double loss. If the value of the coefficient is “-1”, then you should not open deals in different directions for the same reason. Features of trading on correlations should be used for good. That is, in order to hedge risks, conclude transactions on differently directed positions with a positive correlation. Even if one instrument makes a loss, the second guarantees a profitable exit.

Example: a trader made a deal to buy AUD/USD. The price started to drop. In this case, you need to make a deal on the correlated pair NZD/USD for sale. Profit from the second asset will cover the loss from the first one.

Binary options based on the correlation of currency pairs have their own characteristics. Unlike Forex, a pending order cannot be placed on them. That is, you will have to observe the changes online and stop the transaction manually.

The second feature of trading comes from the first. When opening a binary options trade, you must immediately specify its timeframe. Therefore, it is necessary to carry out preliminary testing of the trading strategy on a demo account or on the history of charts.

Assets to trade

On the Internet, you can find tables that present calculated correlation values for all populartools. Among currency pairs, the coefficient value close to "+1" is observed in AUD/USD and AUD/NZD, AUD/JPY and AUD/CHF, AUD/CAD and AUD/SGD, as well as AUD/USD and NZD/USD, GBP /USD and EUR/USD, etc. All assets that have the same currency in first or second place are correlated.

Among commodities, a positive correlation is observed in energy carriers (OIL and GAS) and metals (GOLD and SILVER). For stocks, this principle applies to stocks of companies in the same industry (such as IBM and Microsoft).

Conclusion

Correlation of currency pairs occurs when the movement of assets is interconnected. It can be unidirectional, multidirectional or parallel. Any price change is based on an economic interpretation. In financial markets trading, correlation can be used to find trade entry and exit points.

The essence of the strategy, which is based on correlation, is as follows: you need to make deals on unidirectional assets in different directions, and on multidirectional assets - in one. Only in this case, you can avoid double losses and make a profit.

Hedging is not required, but every trader should know the basic rules of trading.

Recommended:

What are and how bank cards differ from each other

For a long time bank cards have become an essential attribute of a modern person. There are several varieties of them, which are quite seriously different from each other in the first place

Agurbash Nikolay: science and business as the best complements of each other

Until recently, the name Agurbash in our country was associated with the singer Angelica, but her husband Nikolai became a media person after they officially announced their divorce

The most volatile currency pairs on Forex: review, features and reviews

Forex 2018 is pretty consistent. There were no major incidents in the global economy and this was reflected in the major currency pairs in the market. But some currencies have recorded higher volatility relative to each other than others. The article provides a table of the most volatile Forex currency pairs and an overview of currencies in mid-2018

Australian currency. AUD is the currency of which country other than Australia? History and appearance

The Australian dollar is the official currency of the member states of the Commonwe alth of Australia. AUD is the currency of which country or countries? In addition to Australia, these include the Cocos Islands, the Norfolk Islands and the Christmas Islands

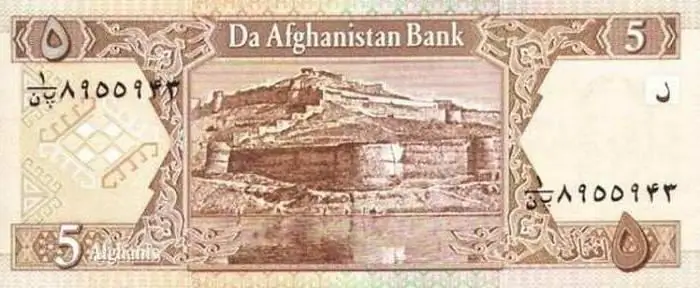

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material