2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

Bank loans are considered to be demanded offers of banks. They can be issued for different purposes, but consumer loans are considered the most popular, for which borrowers receive different amounts of funds. They can use this money for any purpose, without reporting to the creditor about where the funds are directed. Getting money on credit from a bank is quite simple, but if a person does not have an official job or a credit history is damaged, then he may encounter some difficulties. At the same time, it is important to understand what interest calculation scheme is used, how interest is calculated, what is the amount of the monthly payment, and what are the nuances of early repayment of the loan.

Legislative regulation

The procedure for issuing cash to borrowers is regulated by numerous legislative acts. The main law that banks, MFIs and other credit organizations are guided by is Federal Law No. 353 “On Consumer Credit”. The credit sphere of activity is fully regulated by the provisions of the Civil Code.

The state establishes the procedure on the basis of which loans are issued. Interest rates applied by banks are regulated, which cannot exceed a certain maximum value.

FZ No. 151 “On Microfinance Organizations” regulates the rules for the work of MFIs. The law states that such firms can only issue loans in the amount of up to 1 million rubles. one borrower. In 2018, additional changes were introduced that affected the accrual of pen alties for late payments by the borrower. MFIs can charge pen alties only on the balance of the loan amount. The total amount of the pen alty must not exceed twice the amount of the remaining amount of the debt.

Where can I get a loan?

Most often, citizens prefer to get money on credit from a bank. You can choose for this different banking organizations that offer their own unique conditions. Some institutions hold special promotions, on the basis of which they offer favorable lending conditions.

But you can borrow money not only from a bank, as there are other ways to receive funds:

- appeal to microfinance institutions offering small amounts of money for a short period of time at high interest rates;

- using private lenders;

- exchanging property for money at pawnshops.

Each method has both pros and cons, but it is most beneficial for citizens to take money on credit inbank.

Pros of going to the bank

Getting a loan from a banking institution has many undeniable advantages. These include:

- all conditions are clearly stipulated in the loan agreement;

- no opportunity to encounter scammers;

- use available interest rates;

- monthly payments are calculated based on the citizen's monthly income.

The risk of large debts is minimized, as the actions of banks are aimed at ensuring that the borrower can easily cope with the credit burden.

How to choose a bank?

There are many credit institutions in Russia, so commercial banks, pawnshops and government organizations offer money on credit. When choosing a specific option, some recommendations are taken into account:

- the reputation of the bank is being studied, for which its rating, statistics and reviews of borrowers are evaluated, which makes it possible to verify the honesty of the institution;

- the terms of the loan are studied in detail, for which you need to read the loan agreement to make sure that there are no hidden fees or other negative consequences of concluding such a contract;

- it is advisable to view the financial statements of the bank, which should be placed in an open form on its official website, in order to check if it is at the stage of bankruptcy.

Once a suitable bank is selected, all available loan programs are examined. Every person wants to profitably take moneyon credit in cash at the bank, so you should choose the most optimal program. To do this, it is taken into account for what purposes you need to receive money, what is the income of a potential borrower, and also for how long the funds will be issued.

What are the requirements for borrowers?

In any bank, you can borrow money only if the borrower exactly meets the requirements of a banking organization. Most often they are as follows:

- the presence of a constant and sufficiently high income, since the loan payment cannot exceed 60% of the citizen's monthly cash receipts;

- official employment, and the work experience cannot be less than six months;

- only adult citizens can receive money;

- a good credit history is considered a significant factor, since if a person has previously taken out loans that he did not repay on time, this leads to the entry of information about the defaulter in the CBI, which any bank employee can receive;

- no other outstanding loans.

Often a really large amount of credit is required, in which case institutions require additional collateral. Money on credit in a bank is issued in a large amount only if there is a guarantee or property transferred by the borrower as collateral.

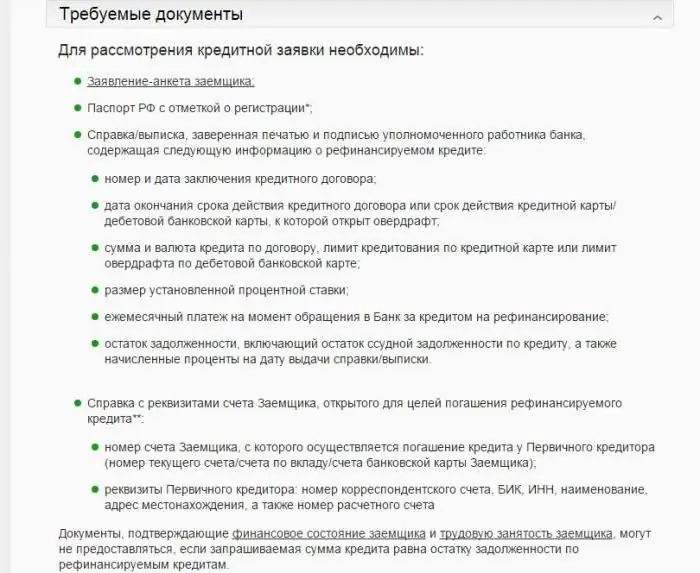

What documents are required?

Each bank independently develops the rules and conditions under which loans are issued. This is normally required fromborrower documentation:

- citizen's passport;

- 2-personal income tax certificate issued at the place of work of a potential borrower;

- copy of work book;

- TIN.

Additionally, banks may require other documentation if needed. If a citizen refuses to bring certain papers, then the bank may simply refuse to issue the loan amount. If property is pledged, title documents for this object are prepared. If a guarantor is involved, then his passport and income statement are required.

Favorable offers from banks

If a citizen urgently needs a certain amount of money, then he thinks about which bank to take a cash loan. Loans on favorable terms are offered by many modern banks. At the same time, interest rates, loan terms and other parameters can differ significantly in them. It is advisable to take loans with favorable conditions, so it is advisable to focus on the following offers:

- Money on credit at Post Bank. The interest rate starts from 12.9%. Funds up to 1 million rubles are offered on credit. for up to 5 years. The decision is made in just a minute. Reduced rates are offered for retirees. The requirements for borrowers are not too stringent, so it is quite easy to get money on credit at Post Bank.

- VTB24. This bank is large and reliable. It offers loans up to 3 million rubles. for a period of six months to 15 years at a rate of up to 16%. Borrower forto receive such a loan must be over 21 years old.

- Raiffeisenbank. Amounts from 90 thousand rubles are provided. up to 2 million rubles for any purpose. The loan term cannot exceed 5 years. Interest rate starts from 12.9%.

- Rosselkhozbank. A loan up to 1 million rubles is offered. for up to five years. The interest rate starts from 12.9%. An adult citizen with a verified income can become a borrower.

It is advisable to apply to several banks at once to increase the likelihood of obtaining approval. After that, the loan option that will be most beneficial for the borrower is selected. If banks do not give credit, where to get the money? Under such conditions, you can turn to pawnshops or MFIs, but you should be prepared for high interest rates and short loan terms.

Interest schemes

Before applying for a loan, it is recommended to understand the interest calculation schemes. Interest is accrued from the moment the loan agreement is signed.

Credit institutions offer their customers two ways to calculate interest:

- annuity payments;

- differentiated.

In any loan agreement, an interest calculation scheme will be indicated. Based on this information, each potential borrower can calculate interest to determine how profitable it is to take money on a cash loan from a bank.

Differentiated payments

This scheme is considered classical. When using it, the entire amountThe loan received is divided into equal parts, but the interest is paid unevenly. Every month, within the prescribed period, the borrower must pay the required amount of funds, including principal and interest.

After the payment is made, the debt on the loan decreases. At the beginning of lending, payments will be the highest. Over time, the contribution will decrease with a simultaneous reduction in the balance of the principal debt. Additionally, the amount of interest decreases.

When choosing this method of calculating interest, strict discipline must be observed by borrowers. Under such a scheme, the bank gives out money on credit quite rarely, since often customers are not ready for significant payments at the very beginning of the loan term. If the borrower is sure that he will cope with a high credit load within a few months, then he can safely choose this scheme, which is considered beneficial compared to annuity payments.

Differentiated payments are offered exclusively to paying customers. If a citizen's income is not enough to repay the loan, according to employees of a credit institution, then he will not be able to get money on credit from a bank.

Suitable for borrowers with unstable income who want to reduce their repayments in the future.

Pros and cons of differentiated payments

Using this scheme has some advantages:

- borrowers easily determine the balance of the debt;

- overpayment on a loan is much lower than with annuity payments;

- if plannedearly repayment, you can significantly reduce the interest.

The disadvantages of such a choice include the fact that under such conditions it is possible to take money on credit from a bank only with high solvency and a good official salary. At the beginning of the loan term, borrowers face a significant loan burden.

Annuity payments

They are most often offered by different banks, as this interest calculation scheme is considered the most profitable for credit institutions. It sets the same monthly payments that do not change over time.

If early repayment is planned, the client can independently choose whether the loan term or the amount of the monthly payment will be reduced. The choice of this method of calculating interest is considered ideal for citizens who receive a stable income. Usually, annuity payments are used when applying for a large loan.

Pros and cons of annuity payments

When choosing this method of accruing interest, the borrower can initially decide whether he can cope with a particular loan load that does not change during the entire loan term.

The disadvantages include a high overpayment, which is considered a negative point for people who want to save their finances. Banks offer money on credit on their own terms, so they usually do not allow borrowers to choose the appropriate interest calculation scheme.

How is a loan processed?

Procedure for obtaining loansfunds in banks may vary slightly in different institutions. As a standard, it involves the implementation of several stages by potential borrowers who want to get money on credit from a bank. You can apply for a loan in the following steps:

- choosing a bank and an optimal lending program;

- an application is being made by the borrower;

- it is submitted to the bank together with other required documents;

- the application is considered by bank employees who additionally evaluate the solvency and credit history of the citizen;

- if the decision is positive, then a loan agreement is drawn up and signed;

- funds are issued to the borrower, and they can be provided in cash or transferred to a bank account;

- a citizen manages the funds at his own discretion;

- according to the provisions of the loan agreement, he must repay the loan monthly.

During the decision-making, various official incomes of citizens are evaluated, which include not only wages, but also scholarships, pensions or various benefits. Banks issue money on credit only when they are sure of the client's solvency.

Early repayment

Banks do not have the right to deny borrowers the opportunity to repay the loan ahead of schedule. Therefore, citizens can deposit funds ahead of schedule at any time. This requires the following steps:

- an application is submitted to the bank for early repayment, which indicates whetherwhether the monthly payment is reduced or the loan term is reduced;

- on the day the funds are debited from the account, the amount specified in the application should be deposited on it;

- if the required amount is not available on the account at the appointed time, no early debiting will occur;

- if the money is successfully debited, the bank employees will recalculate.

The borrower can get a new payment schedule at a bank branch.

Nuances of loan repayment

After receiving the loan from the bank, the borrower receives a loan agreement and a payment schedule. Based on the schedule, it is required to repay the loan, for which a special account is usually opened, from which the required amount of funds is debited by the bank at the appointed time. Additionally, customers can independently deposit money on a loan in different ways:

- transfer of cash to bank employees in the branches of the institution;

- using online banking;

- transfer of funds using terminals, for which it is important to correctly enter payment details;

- deposit money through mail, Svyaznoy or other payment services.

Funds will have to be deposited until the full repayment of the loan. Banks issue money on credit if the borrower meets certain requirements. If he violates the terms of the loan agreement, then various measures of influence may be applied to him.

Consequences of non-payment of the loan

If, for various reasons, borrowers cannot repay the loan, this leads to numerousnegative consequences. These include:

- banks charge significant fines and pen alties;

- if the delay exceeds three months, the institutions go to court to enforce the recovery of funds;

- by a court decision, enforcement proceedings are initiated by bailiffs, which leads to the fact that they can seize the accounts or property of the debtor, restrict the ability to cross the border or use other methods of influence;

- information about the defaulter is transferred to the CBI, so the citizen has a damaged credit history, which does not allow him to count on good credit conditions in the future.

Therefore, before applying to any bank for borrowed funds, it is recommended to carefully assess your financial situation. The credit burden should not be too high, so payments should not exceed 40% of the family income. Only with a responsible attitude to your obligations under the loan agreement can you count on good offers from banks in the future.

Conclusion

Many banks offer citizens the opportunity to get money on credit. Before receiving a loan amount, you should correctly choose the banking institution itself and a specific loan program. The borrower must be familiar with the interest rate scheme and repayment options.

If payments are not made on time, this will lead to fines and damage to the credit history. Therefore, each borrower must first carefully evaluate the possibility of obtaining one or anotherloan.

Recommended:

How to transfer money from Russia to Germany: payment systems, rating, transfer conditions, exchange rates and interest rates

The Russian market, as well as the system of international money transfers, has changed markedly over the past decade. Most banks provide a range of services related to sending foreign currency abroad. Domestic systems of fast money transfers are significantly expanding the geography of their presence. This is only beneficial. Money transfer to Germany is also available

How to get a loan if you have a bad credit history: an overview of banks, loan conditions, requirements, interest rates

Often a loan is the only way to get the required amount within a reasonable time. By what criteria do banks evaluate borrowers? What is a credit history and what to do if it is damaged? In the article you will find step-by-step recommendations on how to still get a loan in such a difficult situation

Interest payments. Fixed interest payment. Monthly loan payment

When it becomes necessary to apply for a loan, the first thing a consumer pays attention to is the loan rate or, more simply, the percentage. And here we are faced with a difficult choice, because banks often offer not only different interest rates, but also a different method of repayment. What are they and how to calculate the monthly loan payment yourself?

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it

CMTPL payments in case of an accident. Amount and terms of payments

Quickly getting paid as a result of an accident is a burning desire of a car owner. But not all insurers pay damages. Sometimes you have to go to court. For more information about what insurance payments can be for OSAGO in case of an accident, read on