2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Due to the fact that prices have risen on OSAGO, a fake policy is much more common today than it was before. Drivers deliberately take the risk that in the event of an accident they will have to pay monetary compensation out of their pocket. But of course they are counting on that not to happen.

It also happens when, having ordered a document, they later find out that the OSAGO policy turned out to be fake. Today's article is devoted to this problem, the scale of which is only increasing so far.

Why do they issue fake OSAGO?

It is known that last year there were only registered sales of fake policies by 10% more than in 2014. How many there are in fact, is unknown. In addition to the fact of the sale, there were many cases when insurance companies with false documents were asked to compensate for damage after an accident. It turns out that there are manycases when car owners do not even know that they have purchased a fake OSAGO policy.

According to many experts, the turnover of OSAGO policies is becoming rampant for several reasons.

Firstly, there are scammers who distribute false forms, making money on it.

Secondly, policies can simply be stolen.

Thirdly, there are forms that were lost by the UK and fell into the hands of swindlers.

Fourthly, some insurers lose or lose their license, suspended their activities, went bankrupt.

The leadership of the PCA believes that drivers, when they prioritize, basically know that OSAGO is a fake policy. They strive to pay less without thinking that if they get into an accident, they will not receive any payment.

Besides being cheap, getting such a policy is very easy. That is, for this you do not need to go through the usual technical inspection procedure, receive a diagnostic card, and so on. Everything is much simpler: agreed, paid the money, received the policy.

Sometimes scammers use extensive advertising to attract a large number of customers. And if a person is very busy, he simply may not pay attention to the moments that should be done. Thus, some policies are acquired simply because of inattention and ignorance. Therefore, law-abiding citizens can be deceived.

Sometimes it happens that a fake document was purchased from a company that does not even belong to the insurance category.

Almost legal

Insurers check policies against a database. And if your number is not there, then there can be no question of any payment. Therefore, before purchasing OSAGO, it is better to stock up on sufficient information in order not to fall for the bait of scammers or not to decide on an illegal act by buying a fake of your own free will. Fraudsters may say that the policy is "virtually legal" or "almost legal", referring to the fact that if desired, you can verify its authenticity.

Don't fool yourself. The concept of "almost legal" does not exist. A policy is either legal or it is not. Therefore, when you are offered an order of magnitude cheaper "practically legal" OSAGO document, think about it.

Even if the forms are authentic, the way how they got into hands is important. After all, if, for example, they were lost by an insurance company, then a priori they ceased to be legal.

What are fake OSAGO policies?

Fakes are of the most rude kind, where low quality is simply evident. However, now they have learned to print fakes of higher quality. These are easy to "calculate" both visually and through the website of the PCA or insurers by driving in the CMTPL number.

A fake policy may have a real state sign, as well as other signs of authenticity. It's just that for some reason the company is no longer functioning, and the forms fell into the hands of fraudsters by criminal means. Its illegality is established in the same way as in the previous case.

How to distinguish a fake OSAGO policy?

So, you can check the authenticity of only one type as follows.

- The real policy is about a centimeter larger than A4 sheet.

- On the front side there is a thin bluish-greenish microscopic grid. It fills the entire space of the front side and consists, as it were, of microsections woven into a circle.

- Holding the form up to the light reveals the watermarks and the PCA emblem.

- The first thing you can see on the back is the 2mm metal strip on the right side.

- Also, there are red villi in the paper itself. If you look closely, you can definitely see them.

- To the touch, the policy number has a convex structure. It consists of ten digits.

- Since the end of 2014, letterheads have changed to "EEE". Until that time, the designation in the policies was "CCC". But the old forms have ceased to be issued from April 1, 2015. Therefore, if you purchase a policy that, by all visible signs, seems like a real one, but with the letter series “CCS”, having issued it from the current year, it is clear that the document cannot have legal force.

- According to the PCA database, you can check all OSAGO forms. A fake policy will issue a series, number, issue date. In addition to the official website of the PCA, there are websites of other insurers, whose rating is highly rated and which the Russian Union of Motor Insurers trusts. This information is checked there.

What to do if the culprit's OSAGO policy is fake?

Many people do not know how to behave if, having got into an accident, they find out that the culprit has a fake document. In this situation, we can advise the following.

Make sure by all the above signs that the document is fake.

If everything is in order, it is additionally recommended to check his number on the PCA website if you have access to the Internet. But you can also call the insurance company and find out this information there.

Of course, it's best to call the traffic police inspector. But according to the law, the injured party is en titled to compensation in any case. Therefore, you can continue to draw up documents even when the policy of the perpetrator does not include his last name. Know: if the insurer refuses to pay, you have the right to sue and receive monetary compensation.

How do I get compensation?

If the culprit of the accident has a fake OSAGO policy, the court needs evidence. To do this, you can request information from the PCA, indicating the fact of the accident. If you attach all the documents to the court and received from the PCA, then the case will be considered faster.

The insurance company itself can also file a lawsuit to resolve the issue of who to pay the payment for OSAGO. Compensation can be paid:

- SK;

- insurance broker;

- RSA;

- perpetrator of the accident.

The court will decide based on the circumstances of the case.

Responsibility for using a fake policy

Responsibility comes not only when the culprit has a fake OSAGO policy. The law is violated by the one who simply uses it. Such an offense qualifies as fraud and falls under Article 159 of the Criminal Code of the Russian Federation. Punishment under it can be a fine of up to 120,000 rubles or sending a convicted person to corrective labor for up to 2 years.

Criminal liability, however, occurs only in relation to those persons whose fake OSAGO insurance policies are completely fake. That is, if they were purchased from companies that went bankrupt, then the maximum that the car owner risks is in refusing to pay the insurance company. However, in order for criminal liability to arise, in any case, law enforcement agencies will have to have a rather complicated procedure for bringing them to justice. After all, it is necessary to prove the fact of the deliberate use of a fake. And it is not the responsibility of the buyer to verify the authenticity of the document. He can trust the seller if he claims that the document is real. Russia has a presumption of innocence, which means that a person is presumed innocent until proven otherwise.

Criminal liability may also arise under another article, namely under 327 of the Criminal Code of the Russian Federation. It provides for punishment for the forgery, use and distribution of such documents. The offender may face a fine of up to 80,000 rubles or corrective labor. But most often such cases are qualified by the administrative code, that is, as an administrative offense, not a crime, and the fine under the Code of Administrative Offenses will be much lower. itis not done for humanitarian reasons, but simply because the process of proving intentional acts is very difficult.

Responsibility does not come…

There is a case when, regardless of whether a fake policy was purchased intentionally or not, liability does not arise. What to do if the OSAGO policy is fake? Just go to the police and point out this fact. In such a case, there is no liability. The case will, of course, be filed. But a car owner who has acquired a fake document will act as a witness in it, and not as an accused. Then they will identify and prosecute persons who are engaged in the production and distribution of an illegal product.

More expensive but better

To be sure that the policy you are purchasing is legal, just follow a few simple rules.

- Policy should only be bought in large UK.

- Before purchasing, check if the company's license is valid (on the website of the Central Bank of Russia).

- Check the OSAGO number on the PCA or UK website.

- After purchase, make a visual check of the document on the above grounds.

- If at least one sign of illegality is detected, you should contact the police with a statement. If this is not done, then a situation may occur that will lead to serious negative consequences.

Conclusion

Of course, a legal compulsory insurance policy is more expensive. This is the main reason: car owners seek to save. But is it worth it to do this, deliberately breaking the law and risking paying much more in the event of an accident? People say: "The miser pays twice." Consider if this is your case?

Recommended:

Signs of the authenticity of banknotes: how to distinguish a fake banknote from a real one

The main signs of the authenticity of banknotes of 200, 500, 1000, 2000 and 5000 rubles of the Bank of Russia and foreign currencies. Methods for verifying the authenticity of banknotes, precautions and consequences for the distribution of counterfeit banknotes

How to distinguish a finger from the original? Expert advice

This article details how to distinguish fakes of famous brands from original things in practice

How to enter a driver in an electronic OSAGO policy? How to make changes to the electronic OSAGO policy

How to calculate the cost of the policy if you need to enter a driver or make other changes to it? The principle of calculating the cost of an OSAGO policy with a new driver

RSA. Checking the policy: tips for motorists on how to purchase a real OSAGO policy

Any modern person must responsibly approach the conclusion of a transaction. Purchasing an OSAGO policy is no exception. Authentication may be required if you bought a compulsory insurance contract not at the official office of the insurance company, but from an agent who represents the products of many companies

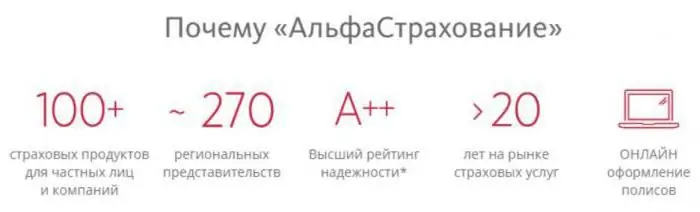

How to issue an electronic OSAGO policy at Alfastrakhovanie? Electronic policy "AlfaStrakhovanie": reviews

AlfaStrakhovanie is one of the most popular and most reliable insurance companies in the country. In more than 400 additional offices in all regions of Russia, the insurer provides a wide range of insurance products. But especially in demand today is the electronic OSAGO policy. How to apply for it in AlfaStrakhovanie?