2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

Every event in the life of a modern person is accompanied by the execution of certain documents. It is good that paper options are gradually becoming a thing of the past - this saves the owner from the eternal fear of losing the necessary paper. Electronic documents are more convenient, but making changes to them involves considerable difficulties.

One of these problems may be the need to enter a new driver into the electronic OSAGO policy. How to make changes and what needs to be done for this - we will tell in this article.

Issue of electronic policies: standard difficulties

The registration of the electronic OSAGO policy online was appreciated by drivers throughout the country. The innovation was especially liked by residents of problematic regions of Russia, where insurance companies simply refused to issue compulsory insurance policies, talking about the unprofitability of this type of protection.

The work of the "Single Agent" has greatly simplified the life of drivers. But after the firststandard questions began to arise about the use of the policy, its prolongation or change. In particular, one of the most popular questions on the Web: how to enter a new driver into an electronic OSAGO policy. Let's try to solve this problem.

Standard and electronic OSAGO: what's the difference?

The current statistics clearly confirm the success of electronic policies: more than 300 thousand people already use the non-paper version of OSAGO. Nevertheless, many drivers in the old fashioned way prefer to always have a paper policy with them. This is especially true for middle-aged and elderly people. It is mainly young drivers who prefer to issue an electronic OSAGO policy online. And for good reason, because the benefits of an electronic insurance certificate are quite convincing.

E-policy benefits

- Main advantage: quick and easy shopping. It takes no more than 20 minutes to issue an electronic OSAGO policy online. No need to waste time and gasoline looking for an insurance agent and stand in a long queue. You can get an electronic version of the insurance certificate without leaving your apartment.

- Exclusion from the list of all additional insurance services. Now the insurance organization is forced to provide a "naked" policy, without imposing additional conditions. Perhaps this is less convenient for the company, but it is certainly beneficial for the driver. The problem of imposing life insurance was often suggested by agents in regions where it was very problematic to get auto insurance. Now it is quite possible to issue an electronic OSAGO policy online without surcharges.

- One moreAn attractive feature of e-OSAGO is that now you do not lose the accumulated discounts and bonuses for a good ride, since all data about you as an insured person is stored in a single PCA register. Therefore, even if you change the insurance company, the scheme for calculating discounts and bonuses will remain the same.

- The absence of an official form with a serial number is not an obstacle to using the policy. Now the document is printed on a regular sheet of paper. If the printout is lost or erased, you can print it again. Problems with the restoration of (paid!) policy are a thing of the past.

- Now you don't need to provide a lot of additional documents: all data about you and your car is available in the PCA registries.

If you are not impressed by the computer version of the autocitizen, and you are used to using policies on standard forms, it's okay. No one is going to cancel paper OSAGO yet

CTP cost online

There is an opinion that an electronic policy is more expensive than a paper one. This is not so: the system of bonuses and discounts applies to each car owner in the same way, regardless of which policy he draws up: paper or electronic. In any case, on the website of each insurer there is an online calculator for calculating the cost of OSAGO. You will pay exactly the same as the numbers shown as a result of the calculations. There you can also get additional information, for example, about whether it is possible to enter a new driver in the CMTPL electronic policy or make otherinsurance changes.

Errors and inaccuracies

It is important to know that when applying for electronic insurance, you should accurately and accurately indicate personal data. The veracity of the information will serve as a guarantee that you will not be denied insurance, and that the question will not arise later on how to make changes to the electronic OSAGO policy. The insurance company should be notified in the following cases:

- if you restored your own driver's license to replace the lost one;

- if you changed your last name;

- if you received a driver's license after revocation.

Remember that the insurance company has every right not to conclude a civil liability insurance contract with you if you provided incorrect data during registration.

Some car owners prefer to independently answer the question of how to enter a driver into an electronic OSAGO policy. They simply add the necessary full names to the document, and then print it out. But such insurance will be considered invalid, and the owner may be held liable. In addition, if you get into an accident, the culprit expects large financial losses. Do not try to enter the driver into the electronic OSAGO policy of Rosgosstrakh or another insurer on your own, but do it according to the rules.

How to change the data in the policy

Unfortunately, it often happens that when applying for insurance in your personal account there are inaccuracies. Then the question arises of how to make changes to the electronic OSAGO policy. Currently, automatic correction of admittedinaccuracies are not expected by law. All changes must be made by an employee of the insurance company. If you are wondering how to enter a driver into an electronic OSAGO policy, you will have to go to the nearest office of the insurer for an answer.

To change the data, you must personally write a corresponding application. The application for changing personal data is processed manually, then the data will be entered into the electronic account of the policy holder. The authenticity of the changed data can be checked by the account owner on their own.

How to enter data about another person

One of the most popular questions on the Web is how to enter a driver in an electronic OSAGO policy. VSK, Rosgosstrakh and other insurance organizations offer a standard algorithm for replenishing the list of drivers who have the right to drive an insured car. For the most part, this applies to car owners who have taken out insurance online.

The problem is this: let's say you first drove the car alone. Then they decided to add a wife, eldest son or friend to the list of users. To expand the list of drivers who are allowed to drive the car, you should contact the insurance company. What you need to take with you:

- the policy itself, where you need to make changes;

- the original driver's license of the person you are about to enter.

In the office, an employee will print out an application for you, which is necessaryfill in manually and sign. After making changes, both you and the other person inscribed in the policy can safely drive a car. In total, no more than five people can be added to the policy.

How much does it cost to add a new driver to the policy?

Insurance companies enter a new person for a fee. Therefore, the question of how much it costs to enter a driver in an electronic OSAGO policy is very relevant. As a rule, the final cost of the changes made directly depends on the following factors:

- The remaining period for which the already issued insurance certificate is calculated. If you issued a policy in January, and enter a new driver in June, then only the remaining months will be taken into account, and not the whole year as a whole.

- KBM and FAC of the driver whose data will be entered into the policy.

The total amount is calculated by the formula:

Cost=new policy price (taking into account the remaining term of insurance) - the initial cost of the policy × the remaining term of insurance.

The calculation of the final amount involves the maximum coefficients that are available in the database for the entered drivers. When the authorized representative's KBM and FAC are higher than that of the policyholder, you will have to pay the specified amount. If these parameters are lower, no surcharge will be charged. As a result, if you want to reduce the cost of OSAGO for your car to the maximum, drivers with a long experience of trouble-free driving should be included in the policy.

Standard Example

Take a practical example of how electronicMTPL policy to enter the driver. If you are going to include a beginner in the document, his coefficients will be:

- FAC: 1, 8;

- MBM: 1.

But you yourself, for example, have a successful driving experience and your KBM is 0.5. For simplicity, let's take the base price of an auto-citizen policy in the amount of 3 thousand rubles. If six months have passed since the registration of the OSAGO policy, you should pay extra according to the above formula. In our example, it will look like this:

Supplement=(cost of a new policy with a novice driver minus the original cost of the policy) × 0.5

Conclusions

As you can see, the final price of insurance is calculated based on the total trouble-free driving experience. Thus, if a driver equal to you in experience fits into the policy, you do not need to pay extra.

But if you initially intend to reduce the cost of the policy, enter a driver with an impeccable driving experience into it. Then you can save about 15% of the starting amount on OSAGO.

To find out how much it costs to add a new driver to OSAGO insurance, you can use the online calculator available on the website of every Russian insurance company. Data from the unified register of insurance associations helps to quickly and accurately determine the required coefficients, and therefore determine the final amount payable.

Recommended:

Driver salary in Moscow. How much does a driver in Moscow earn

The profession of a driver is considered one of the most common and, accordingly, in demand. It is difficult to name an organization that would not need representatives of this profession. The driver, in addition to the main duty, that is, driving a vehicle, can carry out additional

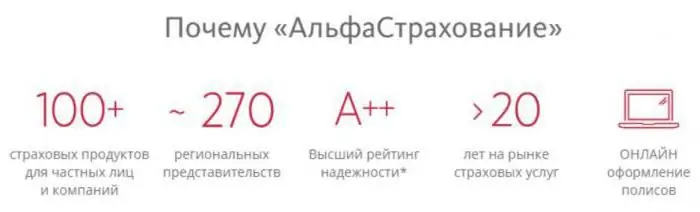

How to issue an electronic OSAGO policy at Alfastrakhovanie? Electronic policy "AlfaStrakhovanie": reviews

AlfaStrakhovanie is one of the most popular and most reliable insurance companies in the country. In more than 400 additional offices in all regions of Russia, the insurer provides a wide range of insurance products. But especially in demand today is the electronic OSAGO policy. How to apply for it in AlfaStrakhovanie?

How much does it cost to enter into the driver's insurance without experience. How much does it cost to include a person in insurance?

Sometimes it becomes necessary to make changes to the OSAGO policy. For example, indicate that another person can drive the transport. About how much it costs to enter into the insurance of a new driver and how to do it, read the article

Psychophysiological basis of the driver's activity. Fundamentals of the psychophysiology of the driver's labor

Coming to a driving course, not every person is ready for the fact that, in addition to learning the rules of behavior on the road, he will have to study the psychophysiological foundations of the driver's activity. But these issues are no less important than the skill of owning a car

How to add a driver to an electronic OSAGO policy? Rules for issuing an electronic OSAGO and making changes

Many are interested in the question of how to add a driver to an electronic OSAGO policy? In fact, the possibilities depend on the chosen insurance company. Some provide their customers with the opportunity to correct data directly via the Internet for some parameters, while most require a personal visit to the office