2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:39

Proper organization of the storage of accounting documentation is a guarantee of the absence of fines for violation of discipline. Unstapled sheets of important documents allow manipulations with papers, that is, forgeries and replacements. Therefore, the employer is obliged to put the documents in order at the end of the reporting period, that is, to think about how to staple the book.

Document flow rules

Apart from the general guidelines outlined in the paperwork instructions, there are no set guidelines for stapling documents. Tax officials require that financial documents be protected from the possibility of loss and forgery. There are no such requirements for documents such as balance sheets and order journals, since they are, in fact, secondary.

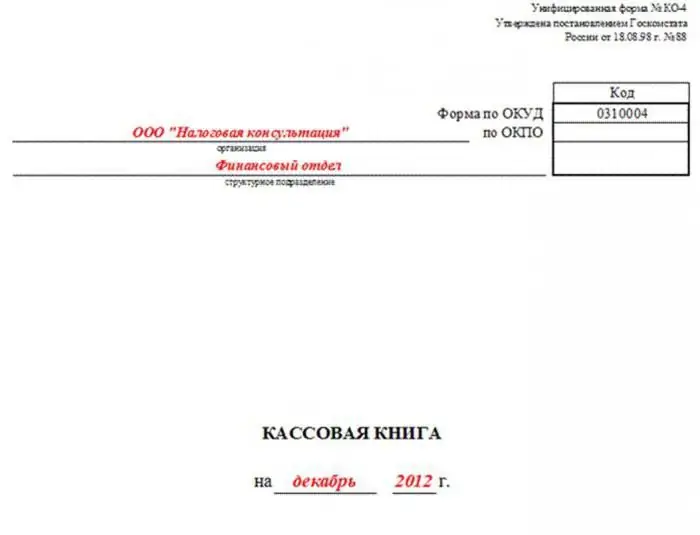

But primary documentation must be bound. Be sure to flash the cash book and the book of income. But how to bind a book if the law does not prescribe the rules?

The cash book is considered a significant tool in the field of cash flow accounting, so it must be kept within strict discipline. The cash book is compiled in a single copy, and it must be in all enterprises, as well as in individualentrepreneurs if they work with cash.

General questions on keeping a cash book

If the company has several divisions, then the original cash books are stored at the place of work with cash. Only copies of primary documents are provided to the head office. You can keep a cash book:

- in the accounting program;

- on a unified form electronically or by hand.

According to the rules of cash discipline, the book is kept incrementally throughout the year. Order numbers start at one every year. Continuous numbering is used. The person in charge must print the sheets in two copies - for the cashier's report and the cash book. Each sheet must be numbered.

If the cash register is kept in an accounting program, then these actions are not difficult. The program automatically puts down page numbering, assigns numbers to documents in order and prints a ready-made sheet according to a unified form. In the program, the title page of the book is formed, which must contain the required attributes:

- OKPO company;

- company name or full name IP;

- time period;

- name of the subdivision, if available.

For what period to stitch the cash book

Thinking about how to stitch the cash book for the year, you first need to decide whether there is a need to set such a time period. Depending on the size of the turnover, the cash book can be stapled fordifferent periods:

- Monthly.

- Quarterly.

- Once a year.

This is due to the convenience of work, since there is no point in putting everything into one heavy volume if there are a lot of operations. The huge thickness will turn the action “how to sew a book with your own hands” into hard work. The subtleties of working with documentation should be spelled out in the accounting policy of the organization and in orders for establishing cash discipline.

If the organization adopted not a year, but a month or a quarter for a time period, then the numbering of pages in the cash book should start from the very beginning upon the reporting date. This rule does not apply to the numbering of cash orders.

How to sew everything yourself?

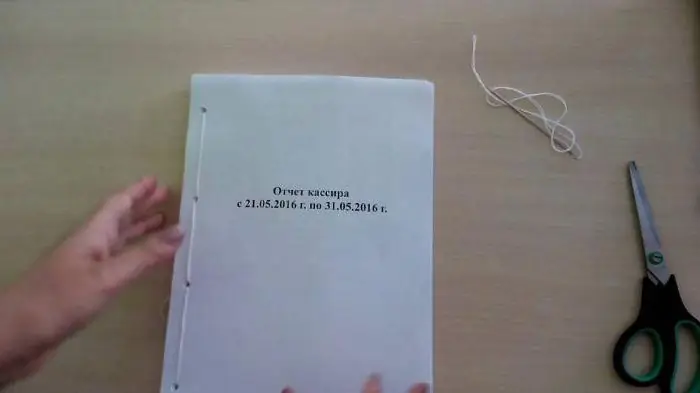

It is definitely forbidden to fasten the book with glue, tape or staples, only threads are allowed. How to stitch a cash book correctly if it is maintained in an accounting program? It is necessary to print out the slip sheet and the cashier's report daily. Insert sheets make up the cash book, but they must be sewn together at the end of the reporting period.

It is necessary to fold all the sheets in order, attach a properly designed title on top and pick up:

- igloo;

- awl;

- hole punch.

Which tool to use depends on the thickness of the bundle being fastened. Threads are used severe. If they are not strong enough, the book may fall apart.

How many holes do you need?

There are different opinions about how many holes to make in a book. Basically, if notconfidence that the brochure will be reliable, you can pierce 5 holes. But it is not forbidden to make 3 holes. Many organizations make do with two holes made with a hole punch. However, this design makes it easy to replace the sheets in the book, so it does not meet with enthusiasm from the reviewers.

So, the sheets should be folded in an even pile so that the book has an orderly appearance. Holes are made on the left side strictly vertically. Then a thread or twine is pulled into the holes twice so that the tips are on the wrong side. An example of how to sew a cash book can be seen in the photo above. The ends of the threads are tied with a strong knot several times to keep everything secure.

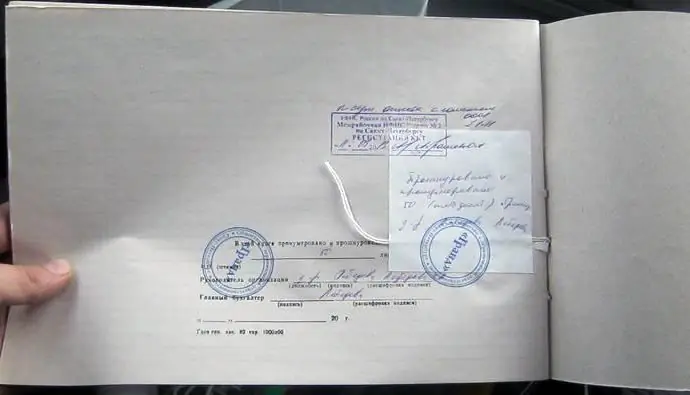

How to fasten what is sewn

In the Word program or any other equivalent, a sticker is created on the wrong side of the book. The content of the sticker should be as follows: “in the bundle numbered, laced, signed and stamped _ sheets.” The line below prescribes the transcript of the position and signature of the authorized person and the chief accountant.

The sticker should not be too big or small. Its size should be enough to close the knots and part of the threads. The ends of the threads stick out a little from under the sticker. It is advisable to use good stationery glue so that it is difficult to change the label. After the number of sheets and the signature of an authorized person are affixed to the sticker, a seal is placed on top so that part of the print is on the book and on the sticker.

How to sew a cash book if it is notconducted in an accounting program? The procedure will be the same, only you will have to number each sheet by hand and fill in the title. When you need to sew a cashier's report, you need to remember that not only the sheet with turnovers at the cash desk is numbered, but also all orders with applications.

If the book is kept by hand

If the cash book is maintained without the help of a computer, then a standard journal is bought for these purposes. The question of how to stitch a book filled out manually does not arise, since the magazine is already stitched. All sheets are numbered and sealed at the beginning of the book. Inside the magazine there is a slip sheet and a cashier's report horizontally. Before starting the recording, the cashier's report is torn off, and the entries on it are duplicated from the slip sheet for carbon copy. Of course, the cashier's report will have to be flashed by yourself.

In case of high complexity of the book binding process, you can use printing services. Cardboard cover and hardcover will give the cash book additional safety. In addition, it will not be possible to cut the binding to replace the sheets. The risk of sheet replacement cannot be excluded when the book is self-binding. In the end, the threads can be pulled out and folded all over again.

Do I need to staple with electronic document management

Recently, organizations have begun to actively switch to electronic document management in order to reduce paper work. There are a number of advantages in electronic document management:

- no need to carry papers to sign;

- nohaving to spend money on a lot of paper and toner;

- do not need document delivery.

But this raises the question of compliance with cash discipline. How to stitch a book if a digital signature is used? The cash book produced in the electronic turnover system is not printed or stapled. There are technical means by which the book is protected from interference and digitally signed.

Especially for self-employed people

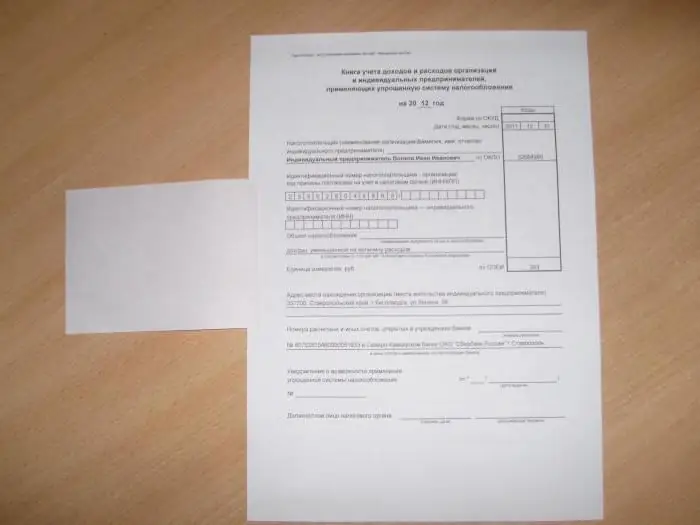

Individual entrepreneurs using the simplified taxation system are required to keep a book of income and expenses. This accounting format is used to calculate the tax base. By law, entrepreneurs are prohibited from changing the data in the ledger, as this may lead to a distortion of the taxable amount.

The law clearly regulates how to properly stitch the book of income and expenses. There is a special order of the Ministry of Finance, which approves the forms of accounting and reporting for individual entrepreneurs working on a simplified system and a patent. The order states that the book of income and expenses must be laced, numbered, signed and sealed, if any.

The book can be handwritten or electronic. There is also the possibility to keep it in the accounting program. If the book is kept electronically, then at the end of the year it is printed out. All sheets are numbered and stacked neatly.and stitched together. The title page should go first.

It is noteworthy that the blank pages of the book must also be printed and stapled in a common row. Even if an organization or individual entrepreneurs hand over zero balances and do not conduct activities, they still have to print and staple the book. The form must be sealed and signed by the head (entrepreneur) on the last sheet. To do this, use a sticker containing the same sheet count data as on the cash book.

Patent registration form

If entrepreneurs use the patent system, then he only needs to keep a book of income. This form of accounting is used only to reflect income from patents at the time of their receipt. The question of how to sew a book of income can be avoided if you know the principles of stitching previously studied documents. The order is no different. The book can also be maintained in electronic or handwritten form throughout the year. She should:

- numbered;

- stitch;

- signed and sealed by the head.

If an individual entrepreneur, in addition to patent activities, has other areas of work, then in parallel he must keep a book of income and expenses. It will reflect all transactions, except for income from patents.

Recommended:

Quail food: composition, norm, recipe and price. How to make quail food with your own hands?

Own home garden for many has become a symbol of their own vegetables and fruits, which allow you to diversify your table with fresh and environmentally friendly products. Some breed chickens, geese and ducks in order to provide themselves with meat

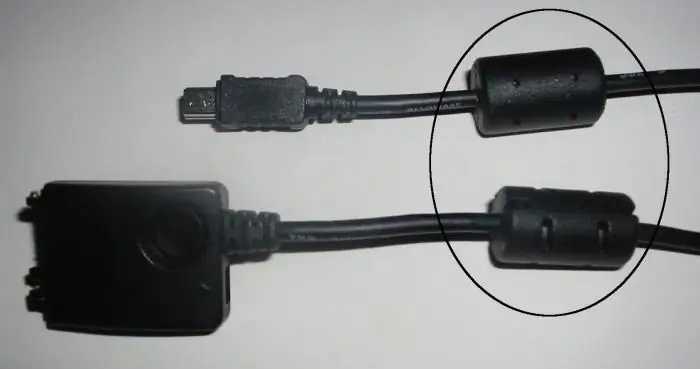

Ferrite ring - what is it? How to make a ferrite ring with your own hands?

Each of us has seen small cylinders on power cords or on cables for matching electronic devices. They can be found on the most common computer systems in the office and at home, at the ends of the wires that connect the system unit to the keyboard, mouse, monitor, printer, scanner, etc. This element is called the "ferrite ring". In this article, we will look at the purpose for which manufacturers of computer and high-frequency equipment equip their cable products with these elements

How to make a substrate for oyster mushrooms with your own hands at home

Growing mushrooms at home allows you to harvest all year round and earn extra income. You can grow these plants in any room where you can create an optimal microclimate. To get a good harvest, it is necessary to prepare the mycelium and substrate for oyster mushrooms and other types of mushrooms

All about the cash discipline of IP: cash register, cash book, Z-report

It is not uncommon for newly registered IPs to experience difficulties associated with a huge number of responsibilities that have suddenly fallen on them. One of these difficulties is a cash register and a lot of documents that need to be drawn up with its appearance. Everything is much simpler than it might seem at first glance! The article in an accessible form will tell about the conduct of cash transactions

How to keep a cash book correctly. Cash book: sample filling

In accordance with domestic law, all organizations are required to keep free finances in the bank. At the same time, most of the settlements of legal entities should be made among themselves in a non-cash form. For cash flow, you need a cash desk, an employee who will work with it, and a book in which transactions will be recorded