2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

When concluding a sales contract with a foreign supplier, in addition to the selling price of the goods, it is necessary to take into account the associated costs: transport, customs, etc. Counterparties operating in different jurisdictions and not knowing the nuances of the legislation of another country try to indicate in the contract that in In case of disputes, issues are resolved according to the legislation of their country. The other party usually disagrees with such a clause, considering it an unacceptable advantage.

An attempt to foresee all possible complications makes the contract unreadable, it is difficult to coordinate it with the bank and customs. Omissions in the contract can lead to negative consequences and legal costs.

What is Incoterms and where is it used

The International Chamber of Commerce made life easier for merchants participating in foreign economic activity (FEA) by issuing in 1936 the first set of international commercial rules called Incoterms. This document has become universal, allowing to resolve disputes between sellers, buyers, forwarding companies andother participants in foreign economic activity.

Since 2011, Incoterms rules have been allowed to be used in domestic trade as well. The current version is Incoterms 2010.

Despite being recognized by all countries, the requirement to use international Incoterms rules is not enshrined in national legislation. The contracting parties themselves decide how to regulate the relationship under the transaction. The application of Incoterms requires the mandatory inclusion in the contract of a reference to a specific rule with an indication of the edition, for example, "Delivery basis - CIF Incoterms 2010". It is important to bear in mind that the provisions of the contract are dominant. If there is a clause in the contract that contradicts the content of the Incoterms basic delivery condition specified in the contract, in the event of a dispute, the court will make a decision based on the provision of the contract, and not the Incoterms rules.

Incoterms has the status of an international normative document and is a glossary of terms used by participants in the logistics supply chain, defining the conditions for freight forwarding and transferring the risks of transporting goods from the exporter to the importer.

Incoterms 2010 contains eleven rules. The terms formulated in it cover the following areas of international trade:

- tasks related to sending goods;

- determination of the parties and the date of execution of the contract;

- distribution of responsibilities and risks;

- delivery of goods;

- payment of insurance fees;

- customs clearance;

- taxation.

Incoterms delivery terms do not affect pricing and payment methods, transfer of ownership of the goods and liability of the parties for violation of the terms or terms of the contract.

These issues should be resolved within the framework of the contract, they are either specified in separate clauses or regulated by applicable law.

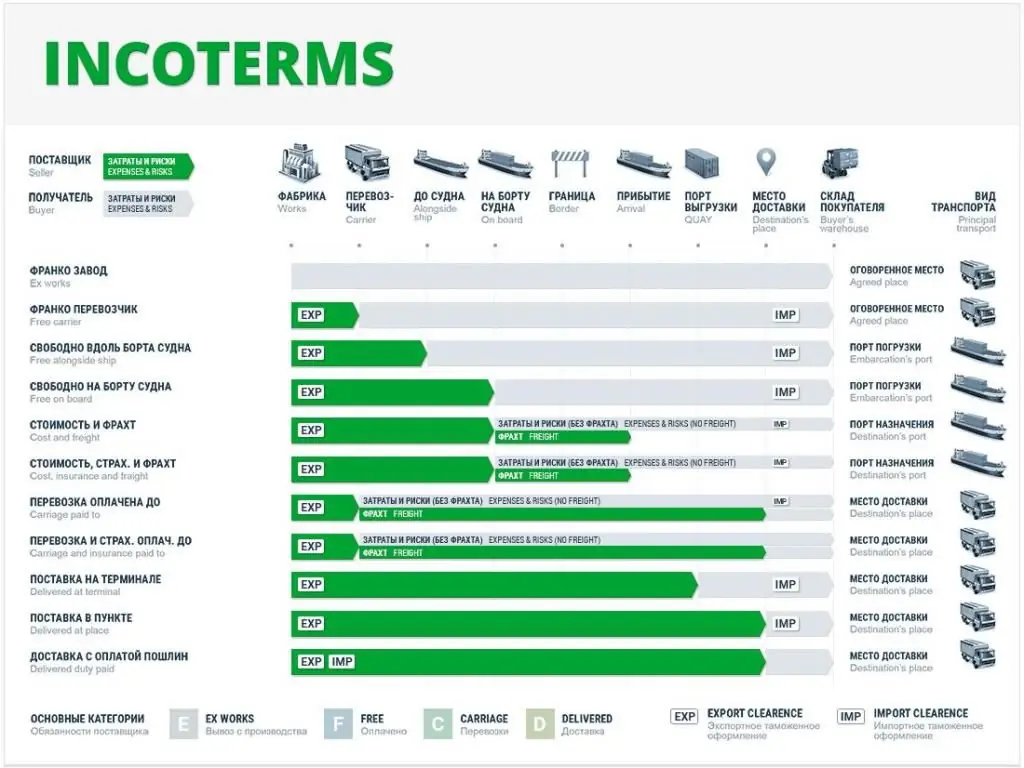

Unification of variants of the basic conditions of Incoterms has simplified the procedure for concluding contracts. Instead of listing the obligations of the parties for transportation, the Incoterms rule is indicated. What it is? An abbreviation of three letters, each of which is assigned specific obligations of the exporter and importer. The thirty-eight-page glossary of Incoterms is displayed as the diagram below:

Incoterms rules are grouped. The letter standing first in the name of the rule determines the moment of transfer (free) of risks during subsequent transportation from the exporter to the importer:

- E - at the point of shipment, in the warehouse or at the seller's production;

- F - at the beginning of the main carriage, which is not paid by the seller;

- C - at the beginning of the main carriage, which is paid by the supplier;

- D - in buyer's warehouse.

From the list it is clear that the most profitable delivery option for the supplier is category C, for the buyer - D.

In each following line of the table, one or morepoints, and the last line becomes a mirror image of the first. In the aggregate, the international Incoterms maintains a balance of interests of the participants in the transaction.

For a better understanding of the differences in the following description of terms, only changes to the Incoterms rules relative to the previous set of rules are considered.

Of the listed basic delivery conditions, categories E, C and D are applicable for transportation by any mode of transport. Category F applies if the majority of the delivery route (main transportation) is carried out by water transport.

EXW - Pickup

A transaction scenario in which the exporter is only responsible for the production of the required quantity of goods and its packaging. This rule is nothing more than a simple and understandable self-delivery. The supplier has fulfilled its obligations under the EXW basic delivery condition as soon as it has provided the buyer with access to the goods. This is an Incoterms rule with minimum obligations for the exporter and maximum obligations for the importer.

In case of domestic trade, EXW is preferable to others. In the domestic market, the buyer has transport links and supply chains that he uses. These links may be cheaper than the option offered by the exporting seller.

In the international market, this is a risky contract for the buyer. When applying an EXW arrangement, the buyer must consider the following costs:

- fee for loading and docking;

- transport costs;

- customs duties;

- relevant taxes;

- insurance;

- warehousing.

The above items include many variables that are quite costly to business and can lead to a significant increase in the cost of the purchased product. It should be remembered that the customs value of the goods is formed from the sum of all costs incurred by the buyer outside the country. If you choose the EXW Incoterms rule on the basis of the lowest selling price of the supplier, then the customs value of the goods at the final delivery point may be significantly higher than the expected value.

Like all other international Incoterms, EXW has its advantages and disadvantages. When using it, the buyer-importer can choose the forwarding and insurance company, the amount of insurance coverage, delivery time.

At the same time, a non-resident importer may face customs clearance difficulties if licenses or permits are required under the law of the country of origin to export the product. The preparation of such documents usually requires additional costs of money and time. Suppliers always have the necessary documents for the export of manufactured goods.

When choosing EXW as the basic delivery condition, you should make sure that such an Incoterm does not contradict the national legislation of the country of the counterparty, since in the customs legislation of some jurisdictions there is a ban on export clearance of goods by a non-resident company.

FCA - free carrier

The FCA Incoterms rule is often used. What is so attractive about thisdelivery basis for importers? The agreement, under which the supplier undertakes to pack and deliver the goods to a port ready for export, is a multimodal one. It is applicable to transportation by any mode of transport: road, air, rail and water. The supplier's obligations are considered fulfilled as soon as he has handed over the goods to the forwarding agent-carrier.

The text of the contract should indicate the specific address of the point of delivery of the goods, it is here that the risks are transferred to the importer. Other procedures for organizing the delivery of goods are also the responsibility of the buyer. If sea freight is used, then the shift of responsibility and risk from the exporter to the importer takes place in the container warehouse.

Because it is the responsibility of the supplier to get the goods through customs, this is much less problematic than the terms of the EXW rule. Sellers have the appropriate licenses required to export outside the country, as well as the best relationship with customs brokers.

FAS - freely along the side of the ship

The contract indicates the specific berth to which the ship will moor. FAS is a multi-modal rule, it is used for delivery by several modes of transport, but most of the way must pass through the waterways.

FAS ideal for delivery:

- oil and other liquid raw materials;

- grain and other bulk cargo;

- oversized cargo;

- ore, coal and other goods transported without packaging.

FAS is not used for containerized cargo because it isthe Incoterms rule implies delivery to the pier. Containers are handled in a warehouse or terminal, so in the case of container shipping, the FCA rule is chosen. The remaining paragraphs of the FAS and FCA bases for the obligations of the seller-exporter and the buyer-importer are the same.

FOB - free on board

The difference between FOB and FAS is that the supplier delivers the goods not to the ship, but to the ship specified in the text of the contract. The responsibilities and risks of the exporter and importer in applying this Incoterm are balanced.

The very name "free on board" speaks eloquently of what Incoterms is and where it is used: only in the case of the main carriage by water.

CFR - Cost and Freight Paid

The delivery scenario obliges the supplier to pay the cost of transporting goods delivered by water transport to the port of destination specified by the buyer in the contract. This is the main difference between CFR and FOB. The transfer of responsibility and risk to the buyer occurs upon the arrival of the ship at the port of destination.

The word "freight" means in the name of this Incoterms delivery condition that such a condition is used exclusively for transportation by international sea or river inland transport.

CIF - cost, freight, insurance paid

The condition under which the supplier pays for insurance, cargo customs duties and transportation costs to the port of destination. The rule requires the supplier to provide at least 110% insurance coverage. If athe buyer wants to insure the purchased goods for a large amount, this is specified in the contract as a separate clause, and the amount of additional insurance is included in the seller's invoice. Damage to the goods during unloading and port charges become the responsibility of the buyer. The risks are transferred to the buyer as soon as the goods are loaded onto the vessel. The seller is responsible for the safety of the goods only until they are loaded onto the ship.

CIF and FOB are the most common terms for the carriage of goods by water.

CPT - carriage paid to the terminal

Unlike CIF, CPT does not require the exporter to insure the goods upon shipment. The risk passes to the importer when the goods are handed over to the freight forwarder. Everything else is the responsibility of the consignee. CPT is applicable when transported by any mode of transport.

CIP

Freight, carriage and insurance paid to destination. In this case, the supplier's obligation to insure the goods for at least 110% of the cost has been added to the requirements of the CPT rules.

DAT - delivery to the terminal

Terminal refers to any place, closed or not, such as a wharf, warehouse, container yard, or road, rail, or cargo terminal. Supplier pays shipping costs, export duty and insurance.

DAP - delivery to point

The goods are provided to the buyer at the agreed place. It is ready for unloading.

DDP - Delivery Duty Paid

DDP imposes on the exportermaximum responsibility: delivery from the place of manufacture directly to the final destination with import customs formalities and payment of taxes and duties.

Exporters are reluctant to agree to the application of this rule, because such an Incoterm clause is difficult to meet due to bureaucratic obstacles when processing imports. It is usually used for the supply of large quantities of goods, the price of which is not subject to sharp significant fluctuations.

For a novice in foreign economic activity, it may seem that such an Incoterm is the most beneficial for the buyer, and this is true in certain jurisdictions. In the Russian Federation, the application of this rule may have consequences in the form of an increase in the tax burden on businesses and an increase in the cost of goods.

Tax implications of Incoterms

Including in the contract the terms of delivery according to the international trade rules Incoterms, you should check them for compliance with the tax and customs legislation of the country of residence. If the norms of national legislation and the prevailing business and legal practices in the country, especially in terms of taxation, create an additional burden on business, it is wiser to choose something else.

An exporter, not understanding the complex and bureaucratic procedures of customs clearance in the country of destination, may make mistakes and miscalculations that delay the execution of an import customs declaration and the stay of goods in a temporary storage warehouse. This causes a rise in the cost of delivery.

The tax authorities pay the most to any foreign trade contactclose attention. In the event that the contract prices accepted for calculating the taxable base deviate by more than 20% from the market price for identical goods, the importing company's tax liabilities are calculated based on the market value. In addition to paying the additional amount of tax, the company will have to pay the amount of fines and pen alties. VAT paid by a non-resident exporter when registering imports, according to the tax legislation of the Russian Federation, is not refundable. The seller will include the customs fees and duties paid for the buyer in the amount of the invoice. Customs duties and fees will be calculated from the invoiced price of the goods.

It is necessary to take a very balanced approach to the inclusion of DDP rules in the Incoterms contract.

Existing business practice for export-import clearance

Analysis of foreign economic contracts shows that according to the established practice in international transportation, the seller company performs customs clearance of exported goods in the country of departure, and the buyer company performs customs formalities for imports in the country of destination. This is due to the fact that companies are better versed in the customs law in the country of residence, often have a professional customs broker on staff, or established business relations with customs officials, from whom they can always get comprehensive advice.

The prohibition by national customs laws of some countries to clear customs for non-resident companies also prevents the widespread use of basicdelivery terms EXW and DDP.

Tax laws in some countries sometimes make it impossible for a non-resident legal entity to pay value added tax. Even with VAT paid by the non-resident supplier for the importer, the latter loses the opportunity to present it for reimbursement. To the above reasons, bureaucratic difficulties and numerous nuances of tax and customs legislation are added. Companies registered in a given country are much more likely to figure out these intricacies.

This is the reason why counterparties are reluctant to include DDP Incoterms in contracts.

Recommended:

How much do artists earn: place, working conditions, professional requirements, terms of an employment contract and the possibility of concluding it on their own terms

Not everyone has a talent for drawing. Therefore, for the majority, the profession of an artist is shrouded in romance. It seems that they live in a unique world full of bright colors and unique events. However, this is the same profession as all the others. And knowing how much artists earn, you will most likely be surprised. Let's get to know this profession better

Terms of delivery according to Incoterms-2010

The Incoterms Rules (2010 edition) contain seven basic procedures for all modes of transport and four procedures for inland water transport and maritime transport. Consider the main points of the terms of delivery of Incoterms-2010 in this article

Terms of delivery CPT. Delivery on CPT terms

Logistics has been massively developed in recent years. This is facilitated by some growth in the development of regions, in connection with which the importance of cargo transportation in the country has increased. Of course, the number of entrepreneurs who would like to do this has also increased significantly

DDP terms of delivery. Delivery of goods on DDP terms

The transportation business is a dynamically developing area of the economy. Every year more and more new players come to it, some of which have little idea of work in this industry. To fix this, we bring to your attention an article that describes the terms of delivery of DDP

Delivery condition - FCA. Delivery on FCA terms

FCA (Free Carrier) is a delivery condition under which the buyer is responsible for almost all transportation. He can choose transport, use his own delivery channels, conclude contracts for the supply of goods. This delivery on FCA terms differs from all standard methods of transportation accepted both in our country and around the world