2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

In accordance with domestic law, all organizations are required to keep free finances in the bank. At the same time, most of the settlements of legal entities should be made among themselves in a non-cash form. For cash flow, you need a cash desk, an employee who will work with it, and a book in which transactions will be recorded. Next, we will consider in more detail the features of filling out the documentation.

Cash book: why is it needed and how to keep it?

As practice shows, in most organizations the turnover of funds is carried out in a non-cash form. However, this does not mean at all that cash is not used in the course of the activities of these companies. If there is at least a small percentage of transactions concluded using banknotes, then the enterprise must have a cash book. How to keep this journal? Who should enter information into it? These questions worry many entrepreneurs. It should be noted that according toSince 2014, businesses that have a ledger of income and expenses may not issue warrants for cash transactions. Accordingly, the cash book, the sample filling of which will be described below, may not be maintained by them. However, some entrepreneurs continue to use it. However, many organizations compile it incorrectly. In order to avoid problems with the tax office, sanctions and other pen alties, you should carefully consider the operations performed and know how to keep a cash book correctly.

Regulatory framework

Before the new recommendations on accounting for cash transactions came into force, there were no direct indications in the legislation that all entrepreneurs should have a cash book. The fill pattern was also not set. In the practice of arbitration courts, there were cases when the decision was made in favor of entrepreneurs who did not take into account cash transactions in the journal. Since 2012, the procedure for filling out the cash book has been adopted. The instruction prescribes the obligatory presence of a transaction journal for all entrepreneurs, regardless of which taxation system they use if they carry out cash transactions. For incorrect preparation of documentation and other violations of accounting discipline that will be revealed during the audit, a fine may be imposed on the organization.

Document feature

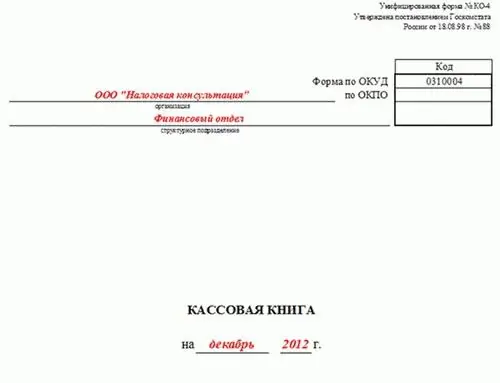

Before telling how to keep a cash book correctly,should explain what it is. From the above information, it is clear that this is a special journal for recording all cash transactions. In addition, the cash book is included in the list of accounting documentation. The resolution of the State Statistics Committee approved the form of the accounting journal. It is called KO-4. The correct procedure for filling out the cash book is determined by the relevant Regulations. The instructions were approved by the Central Bank in 2011. Knowing how to keep a cash book correctly is very important, since the controlling inspectorates check it quite often. A new document is drawn up for each year.

Sample for filling out and maintaining a cash book: basic provisions

A document has 50 or 100 pages. As for the question of when it is necessary to keep a cash book, in accordance with the law, it is established that the journal is compiled from the beginning of the year and in ascending order. The title page indicates the period of validity of the document. If the journal ended before the end of the year, a new one is compiled. Recordings are not interrupted and continue in chronological order. The title page of the new journal indicates the start and end date of its compilation. In this case, the sequence of documents will be easy to determine. As a rule, an enterprise acquires a ready-made cash book printed in a printing house, with lined columns and graphs. You can also draw up a document in electronic form (how to keep a cash book in this format correctly will be described below). All pages are numbered immediately throughout the magazine. Total numbersheets are affixed at the end (on the last page). The specified number is certified by the signatures of the head and the responsible person. The stitched book is sealed with a wax or mastic seal.

Responsible person

At the enterprise there is an employee in charge of the cash book. How to properly maintain this log is indicated in the relevant recommendations that the employee should know. This employee performs cash transactions and enters information about them in the document. The completed sheet is certified by a signature. This means that the employee assumes full responsibility for the operations performed and the information entered. At the end of the working day, the employee transfers the balance of cash to the accounting department. Together with it, all documentation is transmitted - primary receipts and debit orders. The completed sheet of the book is also signed by the accepting accountant. If the latter is not at the enterprise, the head puts the signature. This procedure is performed daily. In order to carry out cash transactions, a responsible employee authorized by the head must be familiarized with his duties, rights and responsibilities against signature. If we talk about how to keep an individual entrepreneur's cash book, then the process itself is similar to that carried out in an organization. However, an individual entrepreneur does not always have a staff, and in particular, there is not necessarily a person responsible for performing and accounting for cash transactions. If the individual entrepreneur works alone, then he receives and consumesfunds. Accordingly, he makes entries in the journal himself and signs the completed pages. For those who do not know how to properly maintain a cash book, the tips for an accountant below will help you navigate the requirements.

Title page

This page should contain the following information:

- For a legal entity - the full name of the organization, for an individual entrepreneur - the full name of the entrepreneur, the name of the unit (if it is a branch).

- Magazine validity period. It can be a year or a specific date if there are several documents.

- OKPO.

The inside of the document

Speaking about how to draw up a cash book correctly, it should be noted that entries, both expense and income, are entered on one page. At the end of the day, the remainder is reduced and the total is summed up. A report is prepared on the transactions performed. Each sheet of the book consists of two parts with a tear line. The first half is a log page that contains information about operations. The second part is the report of the cashier. You can fold the sheet along the tear line and keep carbon paper notes. After entering the information, the sheet is cut. The first part of the page must be bound. Attached to the report are documents that confirm the conduct of operations (these papers are called "primary"). For example, it can be an extract from an order, a cash receipt order, an application for an advance payment, a power of attorney, and so on.

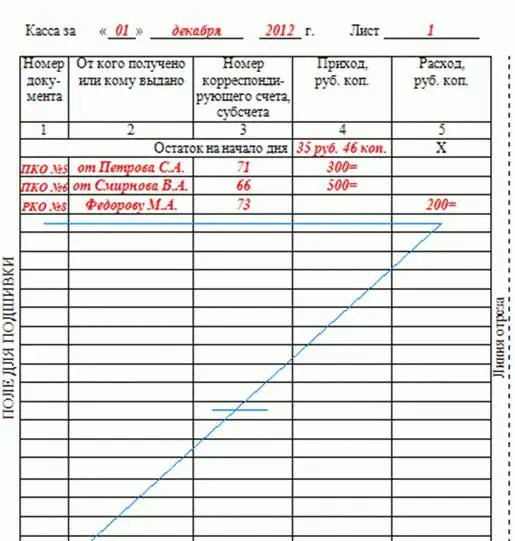

Entering information into columns

At the top of the page shouldthe date the information was entered. Filling out the sheet begins with a column indicating the balance at the beginning of the shift. Here the amount is entered, which is transferred from the end of the previous page. Next, enter the serial number for the cash warrant. It is indicated in the column "Document number". The next line is entered by the person to whom this paper was issued or from whom this paper was received. If this is an individual, then the full name is entered, if the legal entity is the name of the organization. In the next column indicate the number of the corresponding account or sub-account. Enter information that indicates the method of receipt or expenditure of cash. For example, r / s - sch. 51, salary - sc. 70, customers and buyers - sch. 62. It should be noted here that these lines are not filled in by individual entrepreneurs.

Next are the columns "Expense" and "Income". They indicate the amounts in rubles in figures. Pennies are indicated after the comma. For example, the amount of funds that are issued is as follows: 129.05 p. Each transaction is recorded immediately after completion. Entries are made only on the basis of primary documents. The column "Transfer" contains information about the amount of operations on the previous lines. At the end, you need to calculate the total result. It is entered in the "Total for the day" column. The result is calculated separately for the money issued and the funds received. Next is "Remainder". It is necessary to add up all the cash that came in and remained from the previous day. From this amountdisbursed funds are withdrawn. The figure recorded in the book must match the actual state of cash on hand. Those lines that remain free should be crossed out. This is necessary so that no one fills in the empty columns. This is done with the letter Z. At the end of the page, the names of the cashier and accountant are indicated. In addition, the number of incoming and outgoing orders drawn up per day is indicated. If no cash transactions were made during the day, the page is left blank. In this case, the balance available at the end of the day is transferred to the next without adjustments.

Electronic version

The widespread introduction of computer technology has not bypassed the cash book. The electronic version of compiling the journal greatly facilitates the work of employees. A special program is used to maintain the book. It displays the log on the computer screen. The columns are filled in the same way as described above. Every day, the responsible employee enters the necessary information, and at the end of the shift prints out a sheet. The paper version should have two parts: the report itself and the supplementary half. The cashier signs the page. If the employee has an electronic signature, then it is allowed to use it, as well as a regular one. Each such page is numbered. At the end of the year, a book is formed from printed sheets. The last page shows the total number of inserts. It is certified by the signatures and seal of the enterprise. An e-book is allowed to be compiled once a quarter, not a year. Reports and accompanying documentation are sent to the finance department.

Income and expense

The receipt of cash is issued by a cash receipt order. The receipt - its tear-off part - must be filed with the bank statement. Operations for the disposal of funds are executed, respectively, by one or more expense orders. When cash is handed over to the bank, the employee is issued a receipt and an order. The first is filed to the cashier, and the second to the statement.

Corrections in the magazine

If a mistake was made in the book that does not have a significant impact on the reporting, it can be corrected. It is strictly forbidden to tear out pages from the magazine. It is also not allowed to use a stroke, marker, wiping with a blade, eraser and other similar manipulations. If the typo does not entail changes in the remains of any period, then its correction is carried out as follows: the incorrect entry is carefully crossed out, and the correct one is placed next to it. Correction must be necessarily certified by signatures. The cashier and accountant must sign. If there are several corrections on the page, then each of them must be certified. If a serious mistake is made, then the cashier draws up an application addressed to the chief accountant. The head of the enterprise gathers a commission that will be responsible for corrections. Based on the error, an accounting statement is drawn up. It describes the nature of the inaccuracy and the method for correcting it.

Checking reporting discipline

Correct dribblingThe cash journal has the right to control the banking organization servicing the account of the enterprise. The manager will be notified by notification that an audit will be carried out. It will be necessary to provide the bank for evaluation with loose sheets, fully executed, cashier's reports along with the attached documentation and advance papers, if the money was issued under the report. If the check will affect the current year, there is no need to stitch the journal (this is done at the end of the year). Upon completion of control activities, the book will be returned to the enterprise. In this case, the authorized body will issue an act on the completed verification of the reporting discipline. If the document contains comments, they must be eliminated within the period established by the supervisory authority. Also, the correctness of filling out the cash book can be checked by the tax office. Sanctions may be applied for violations identified during control activities. At the same time, it should be said that the inspector can impose a fine on the enterprise if errors were detected within two months from their admission.

Recommended:

TTN - what's this? How to fill out TTN correctly? Sample filling TTN

TTN is a consignment note. Filling out this document is distinguished by a lot of features and subtleties that are useful for everyone working in the field of transportation of goods to know

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Incoming and outgoing cash orders: registration procedure, filling rules and sample

Incoming and outgoing cash orders act as primary documents. They confirm financial transactions related to the issuance and receipt of funds. Registration of incoming and outgoing cash orders is carried out according to certain rules

Book market in Lyubertsy and the bookstore "Book labyrinth": addresses, general information

Don't know where to buy books in Lyubertsy? On the south side of the city there is a large book market, and on the north side in the Svetofor shopping center there is a Book Labyrinth store. Do you want to know more? Then read the article

All about the cash discipline of IP: cash register, cash book, Z-report

It is not uncommon for newly registered IPs to experience difficulties associated with a huge number of responsibilities that have suddenly fallen on them. One of these difficulties is a cash register and a lot of documents that need to be drawn up with its appearance. Everything is much simpler than it might seem at first glance! The article in an accessible form will tell about the conduct of cash transactions