2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

Today we have to figure out how to spend money correctly. This topic is of interest to citizens of all countries. And constantly. After all, money is a means of existence. And they should provide the citizens as much as possible. Not everyone knows how to properly manage them. And even more so how to postpone. When you have your own family and children, the issues related to finances are seriously exacerbated. To avoid this, you just need to be able to spend money. How to learn it? What will help save and manage the family budget? The best tips and tricks will be presented below. All of the above is not a panacea, but it will help not to overspend. In some cases, this will help you spend less and save more, without compromising your purchases.

Family budget is an eternal dispute

Maintaining a family budget is a real art, which is not subject to everyone. But to master it, at least try to do it, is recommended to every person. With proper planning, financial problems are not terrible. They simply won't. Except when wages are delayed. Andthen the scale of the problems will be minimal.

Family budget refers to all financial receipts in the family for the month. And planning it is a waste that has to be done. Many do not know how to spend money properly. Hence, certain problems arise in the distribution of income received. What can help you avoid falling into a financial hole, not get bogged down in debt, live within your means, and save some money for a rainy day? Lots of tips and tricks. The following are the best and most effective.

Analysis of past purchases

The first stage is an analysis of all purchases made in the past month. Some are not able to properly distribute funds. And so they find themselves in a financial hole. To understand what was wrong, you need to look at all purchases.

It is likely that a lot of money is spent on less important things. Quite often, after receiving a salary, people spend most of their finances on entertainment, and then they don’t have enough for the necessary. Of course, you shouldn't do that. It is for this reason that it is required to analyze everything purchased. Each person will certainly have a whole list of things that one could do without. Only the most prudent will not have such a column. But such people perfectly plan the family budget even without analysis.

Priorities

How to manage money properly? The question is difficult. After all, each person has his own income, as well as his own demands for life. AndEveryone has different priorities too. After analyzing the purchases, you will have to break them into several components. Namely:

- first necessity (high priority);

- necessary;

- desired;

- unnecessary.

Accordingly, everything that is not included in the first 2 columns can be excluded from spending for the future. And first of all, spend money only on the most necessary and important things for life. The rest of the funds or save, or spend on what you want. It will be difficult to prioritize at first, but over time, this problem will disappear.

Required ingredients

What can you spend money on? It has already been said - all people have their own requirements for life and spending. However, everyone has mandatory expenses. They usually converge. Funds from the family budget should first of all be spent on priority items.

What are they? As a rule, mandatory expenses in each month include:

- utility payments;

- training (if there are children);

- drugs;

- clothes;

- shoes;

- travel/travel expenses;

- products.

All these are necessary purchases. Entertainment at the initial stage of budget planning is best excluded. Then it will become noticeable how much money remains at the end of the month. And you can spend them wherever you want. Or postpone.

Products

How to spend money on groceries? Many people ask exactly this question. Practice shows that hugeexpenses are related to food. That is why it is important to remember a few rules that contribute to savings.

What advice do you have for people who don't know how to spend less money? Regarding the purchase of products recommend:

- Study stocks in stores. You can save a lot during them.

- Buy for future use. This includes the purchase of: cereals, pasta, canned food, "freezes". Especially when it comes to acquisitions on profitable stocks.

- Buy at wholesale bases. They are in every city. This solution saves a lot of money. Buying in advance, and even at discounted prices, is the key to success.

- Make a shopping list. And most importantly, don't back down from it. No extra products, even if you really want to. At first it will be difficult, but you need to try.

- "No" to fast food and cafes. While a person is thinking about how to spend money correctly, it is not recommended to eat in cafes and fast food. Even the most "modest" lunch will cost a lot. It will be possible to return such food only after a well-established budget planning system.

Nothing difficult about it. It is enough even among the products to highlight the necessary components and those without which you can do without. It is recommended to cook at home as much as possible. A good housewife will cook most of the expensive delicacies at home. For example, delicious pizza. Cheap and delicious!

Collecting checks

The next tip is to collect checks. All purchases that have just been made must be recorded. And checks are great for that. They arecontribute to the correct analysis of everything acquired.

The main thing is not to forget to take into account anything. This is the key to successful budgeting. Through checks, you can understand where and what is more expensive, what expenses can be excluded. Actually very good advice. But following it will be extremely difficult. Even bus travel will have to be fixed. However, the presence of checks greatly simplifies the accounting of purchases. Especially when they are entered in the appropriate spending table.

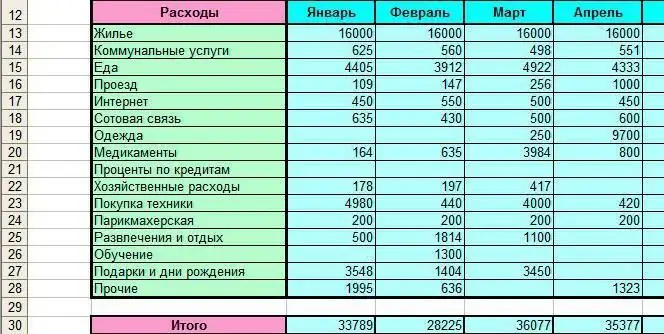

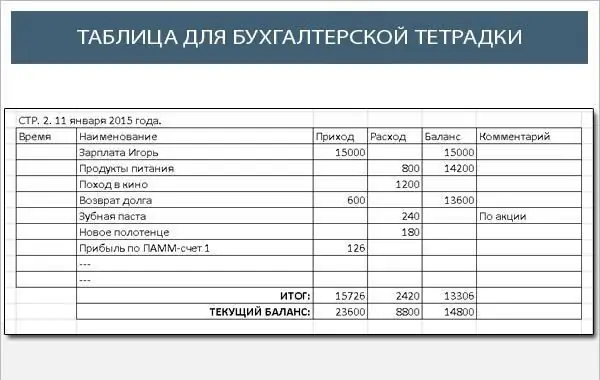

Expense table

Home bookkeeping is something that requires careful planning. Proper budget allocation will help you quickly learn how to save and live within your means. In order to record all purchases, and then analyze them with maximum accuracy, it is proposed to maintain a table of expenses. And income including.

This is the principle of home bookkeeping. The table may contain different costs. But, as a rule, the most primitive summary sheet contains the following items:

- income from each family member;

- products;

- utility payments;

- clothes;

- travel;

- household goods;

- shoes;

- training;

- accumulation;

- products;

- drugs;

- gifts;

- totals (for expenses at the end of the month, for income, the difference between profit and expenses);

- other.

Every day, on the basis of checks, you will have to record expenses here. Accurate to the day of purchases or the next profit. Someseparately paint the item "products". In order not to deal with this problem, you can simply apply checks. This is a great time saver.

Balance at the end of the month

Accordingly, all this will help answer how to spend money correctly. Most likely, some amount will remain "free" at the end of the month. It can be spent on additional wishes. For example, going to a cafe with the whole family. Or a gift for a child. The main thing is that the "free" amount of money can be spent at your discretion. Or postpone.

It is recommended to distribute funds from time to time so that the balance at the end of the month increases. It is not required, but it is desirable to do so. When all necessary purchases are made and mandatory payments are closed, you can give some freedom in spending.

How to save money

Some are interested in how to manage money properly and at the same time learn how to save. Actually it's not that difficult. Especially if you follow all the previously listed tips.

By the way, you can set aside money every month, and at the same time keep "free" money. How exactly? There is one rather interesting method. He helps many.

It is about putting a certain amount of all income received into an envelope or into a bank. What has been deferred is not taken into account in family accounting. That is, when receiving a salary, it is required to remove the agreed amount, thereby forming a "safety cushion". Usually peoplesave 10% of profits.

What does this mean? For example, the situation will look like this:

A person earns 25,000 rubles. Plus, he monthly makes a profit from renting an apartment of 5,000. The monthly income will be 30 thousand rubles. Of this amount, 10% is removed "into the envelope" immediately. And an emergency reserve is formed. 27,000 remains for all expenses. This amount is distributed according to the compiled table of the family budget for expenses: mandatory, desired, utility payments.

Very good way to save money and create savings. Many, as already mentioned, are recommended to open a deposit in a bank and transfer money there. This will help not to touch the funds and save them. In any case, the "emergency reserve" should be in difficult access. Only in emergency situations is it allowed to spend savings data.

Plan and facts

How to spend money in the family? For those who have already mastered the previously listed methods, you can slightly expand the table of income and expenses. And add to it such components as "plan" and "in fact".

In the first column, it is necessary to prescribe in advance what expenses and for what amount are planned. The second contains information about real costs. Quite an interesting way of planning "free money". It is recommended to reduce the "in fact" column on a monthly basis. In the same way as the "plan" section. Of course, taking into account the fact that the decrease in these indicators does not harm the life and well-beingfamily.

"No" to loans

How to spend less money? Some people think that loans are a good way to save money. In fact, most citizens who have learned to live within their means and save well say otherwise.

It is not recommended to take loans when planning a budget. But you do not need to exclude them from the pivot table if available. Lack of credit is a positive outlook. If a person has no debts, then you can save the previously paid amount for a rainy day.

Personal needs

How to spend money correctly? Some don't understand this. If we are talking about one person, then there are no special problems with budget planning. But as soon as a family appears, certain difficulties arise, as already mentioned.

It's all about the fact that everyone has personal needs. What each person wants for himself. While learning how to plan and do home bookkeeping, you need to put your desires on the back burner.

By the way, all "free" money at the end of the month is recommended to be distributed among family members for personal needs. Or enter separate columns in the expense and income accounting table for this purpose. Allocate a solid sum of money to everyone for desires.

Example

This is the right way to manage a family budget. The table example below is far from the most advanced method. Rather, it is suitable for beginners. Through it, you can easily learn how to distribute finances so as not to get intofinancial hole.

An approximate table of expenses and income looks like this.

| Article | Plan | Fact | Difference |

| Income | 50,000 | 50,000 | 0 |

| Products | 10,000 | 11 500 | -1 500 |

| Utility payments | 5,000 | 4 500 | 500 |

| Household chemicals | 1,000 | 0 | 1,000 |

| Personal needs | 5,000 | 8 000 | -3,000 |

| Travel | 10,000 | 7 000 | 3,000 |

| Result | 31,000 | 31,000 | 0 |

| Delayed | 5,000 | 5,000 | 0 |

This, as already mentioned, is not the most common option for cost accounting. But it does help in the beginning. In general, planning a home budget is a crucial moment. And it is recommended to entrust this lesson to those who are best at it. A little patience and strength - and you can easily learn how to distribute money, as well as save well.

Recommended:

Sample and example of a receipt: how to write it correctly?

Many people, when they borrow some money, do not even think about the fact that they might not get it back. In such cases, the ability to write receipts may come in handy. This is a simple matter, but a document drawn up incorrectly may not have any legal significance. In this article, we will analyze an example of a receipt for receiving funds and documents. We will also talk about what items must be specified so that it does not lose its force

Home economy. Personal finance management. How to keep a home budget

Households are considered political economy as one of the four basic elements of the economy, and we will now consider the features of personal finance management within this object

How to do home bookkeeping: expert advice

How to do home bookkeeping correctly and why is it necessary? The answers to these questions are of interest to all people who are responsible for financial planning in their own families. We will try to understand all the secrets of the home economy with the help of experts

How to plan a home budget and manage money wisely?

Understand how much money we really earn every month and how much we spend, everyone wants. How to plan a home budget and always have funds for the necessary expenses? Is it possible to learn how to save without denying yourself what you need?

How to calculate income tax: an example. How to calculate income tax correctly?

All adult citizens pay certain taxes. Only some of them can be reduced, and calculated exactly on their own. The most common tax is income tax. It is also called income tax. What are the features of this contribution to the state treasury?