2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

The Envelopes indicator is a tool that serves to determine the upper and lower limits of the trading range. The chart of price activity displays two lines, one of which, at a distance set by the trader, repeats the moving average above, and the other below it.

Along with trading ranges, this technical analysis tool is commonly used to identify extreme overbought and oversold market conditions.

How to use the Envelopes indicator

Traders interpret this instrument in different ways. Many use it to determine a trading range. When the price tests the upper limit, it is considered overbought and a sell signal is formed. In contrast, when the price bottoms out, the asset becomes oversold, which is an invitation to buy. This rule is based on the law of alternation.

The upper and lower lines of the indicator are naturally defined in such a way that under standard conditions the price tends to stay within the range of Envelopes.

When dealing with a volatile asset, investors using this instrument can set a high rejection percentage to avoid receiving too many signals. For less volatile assets, a more moderate setting will generate the required number of trading alerts.

To increase the likelihood of success, the Envelopes indicator is often deployed in conjunction with other forms of technical analysis.

For example, traders can identify possible market entry points when price surges cross the boundaries of the indicator lines, while observing trading volume indicators and market movement patterns to determine a possible reversal point.

This is the right approach as financial assets end up trading in oversold or overbought conditions for a long time.

Calculating Envelopes

The formula for calculating both components of the indicator is as follows:

- Top line=SMA (Close, T)[1 + K / 100].

- Bottom line=SMA (Close, T)[1-K / 100].

Here SMA is a simple moving average, Close is the closing price, Т is the averaging period, K is the offset value from the average (measured as a percentage).

The main purpose of using the indicator is to detect changes in the trend.

Most of the time, traders are faced with market moves that are strong enough to offset losses incurred on false signals. This shows that Envelopes is indeed a useful tool for traders who want to accept a minimum percentage of winning trades.

Market participants should take volatility into account when changing settings.

It is also necessary to treat assets with low or high volatility differently, since the Envelopes indicator will require narrower or wider ranges to describe their price action.

Understanding basic signals

The trading indicator is based on a moving average, and we should expect that the internal characteristics of the latter will be reflected in Envelopes.

Moving averages are a common tool used to confirm the direction of an asset and also used as a trend-oriented technical analysis tool.

Trending detection

A moving average is used to smooth out price fluctuations so that a trader can see a more general market pattern. If it rises, then this is a confirmation of the bullish mood. If it moves down, it confirms the bearish trend.

The same applies to the Envelopes indicator. A trader can look at his direction to get important information about the market movement. If the band rises, then this indicates a bullish mood, and ifleans down, it confirms the bearish trend.

Increased trading profitability can be achieved by combining Envelopes with CCI.

The indicator is also useful when looking for strong market movements, as a sign of the beginning of a powerful impulse.

When there is a strong downtrend, overbought signals can be placed to spot pullbacks and increase reward profits. Momentum turns bearish again as the CCI indicator enters negative territory.

As for the Envelopes, if the price exceeds the upper limit, then this forms a signal about the beginning of a new trend. If the price, on the other hand, falls below the lower line, this indicates the beginning of a downtrend. Caution should be exercised when such breakouts occur, as most of them will not necessarily form a new trend. Often they return to the previous price range. But if a new trend emerges in the process of development, the change in the value of the asset can become dramatic.

Overbought and oversold

The Envelopes indicator can be used to determine market conditions.

Assets become overbought or oversold and remain so during a strong uptrend or downtrend, respectively. To navigate in this situation, you need to keep track of when the price overcomes the upper line of the indicator and remains above it. This indicates a strong upward movement.

Indeed, the maximum of the indicator starts to grow aftercontinuously exceeding the value of the asset. Theoretically, this may indicate that the market is overbought, but it is also a signal that overbought conditions will persist.

The same is true for oversold conditions.

For example, the price enters the overbought territory when it breaks the upper line of the indicator, and if the CCI is also in this zone, then this is a sign that the asset is also overbought.

A reversal occurs when the CCI line falls below 100, which confirms a sell signal.

Another scenario shows the price falling below the lower limit of the Envelopes, indicating that the market is oversold. This is also confirmed by the CCI indicator when its line does not exceed the level of -100. An upward break confirms a pullback, i.e. a signal to open a long position.

Intraday trading strategies

Scalping (pipsing) with this technical analysis tool is possible using 1-, 5- and possibly 15-minute charts.

It is necessary to adjust the Envelopes indicator by setting the period to 40 and the deviation to 0, 1, and apply it to one of the above timeframes. Experts advise trading when the upper or lower border is broken. If the price closes outside the range, but the previous candle does not, then this is a bearish or bullish signal, respectively.

Day trading strategies

Difficult to use Envelopes in day trading, but changing settings can have a huge impacthelp. You should make sure that long timeframes (hourly, 4-hour or one-day) are set. The indicator must be set for a period of 28 with a deviation of 0.75, and to confirm the signals, add the Williams percentage range.

The Envelopes breakout trading strategy is the most suitable and applicable to day trading. It consists in monitoring when the price breaks the upper line, indicating that the market is overbought. If Williams' percentage range becomes overbought (the aqua line is above -20 and then falls below this level), a sell signal is being formed.

Conversely, if the price breaks the indicator low, the market is in oversold conditions.

We should wait until Williams' percentage range breaks the oversold area (-80.00) for a buy signal.

Swing Trader Strategies

Swing trading is possible when using the Envelopes indicator and is even better when combined with other technical analysis tools (like stochastic) to help spot an overbought or oversold bounce.

It is necessary to set the period of this indicator to 10 and the deviation to 0.75, and the period of the stochastic indicator to 14. The overbought-oversold trading strategy is implemented on the 4-hour timeframe.

Envelopes indicator in binary options

An example of using the indicator inThis type of trade is a channel breakout strategy. In a binary option, the Envelopes indicator creates a price channel. The signal is formed when the candle and the 6-period exponential moving average break the channel up or down. The MACD indicator characterizes the strength of the movement in the direction of a breakout. Its positive value confirms a buy signal, while its negative value confirms a sell signal.

Timeframe is set to 5 minutes for 10, 15 and 30 minutes.

Finally

Envelopes is often used as a trend indicator, but also serves as a tool to identify whether the market is oversold or overbought.

After a period of consolidation, a strong break of the indicator line may be the beginning of a protracted movement.

When a trader sees an uptrend, technical analysts may decide to use along with other momentum indicator systems to identify oversold areas and pullbacks held within such trends.

Overbought conditions along with bounces could start selling in higher bear market conditions.

If there is no strong trend, the indicator lines can function similar to the Williams percentage range oscillator.

Crossing the upper barrier signals overbought, and the lower one warns of oversold.

It is extremely important to use other types of technical analysis to confirm these signals.

Recommended:

Functional strategy is The concept, types and role of functional strategy in management

A well-formed functional strategy is one of the most important elements of the structure of the company itself and a guarantee of high efficiency. In order to properly plan activities and determine priority areas, it is necessary to accurately divide the powers, responsibilities and goals for each department and the employees themselves

Indicator "Zigzag": settings, features of work

Speculators and experts use a wide variety of indicators, resistance and support lines, graphic figures and much more to identify the direction of quotes. The Zigzag technical indicator, which will be discussed in this article, is especially popular with traders, investors and analysts

Bending machines: types, description of designs, characteristics, settings

Bending machines: types, design features, application, photo. Description of machines, technical characteristics, settings, modifications

Differentiation strategy is Advantages and disadvantages of the strategy

Strategy of differentiation is one type of strategy aimed at gaining an advantage over competitors. At the same time, the activity of the enterprise is aimed at providing more benefits to consumers by offering high-level goods, along with a full range of additional services, while the prices are justifiably high

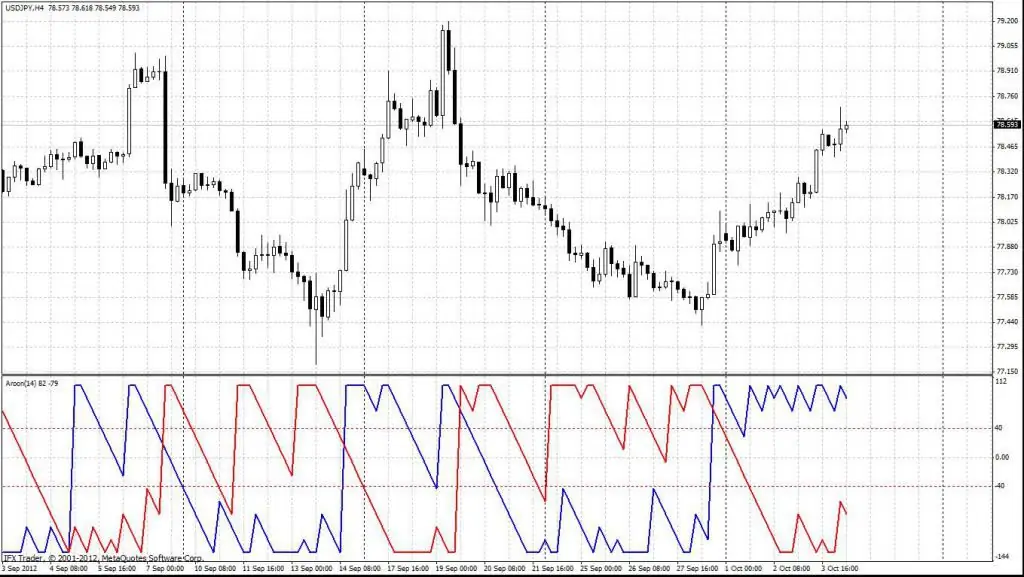

Indicator Aroon: description of the indicator, application in trading

The Aroon indicator is a great tool that every trader should have in their arsenal. It is a visual representation of the market movement that can be easily interpreted to make decisions according to price direction and momentum. You can also significantly increase the chances of a profitable trade if you build a trading technique around Aruna in combination with a breakout strategy or any other based on price movement