2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

A rather vast territory of the Russian Federation is located in harsh climate conditions. Living and working in such an area is quite difficult. Hence, there are not so many who want to work in the areas of the Far North. In order to encourage citizens to associate their place of work and residence with a given area, the state has introduced a system of financial incentives since the days of the Soviet Union. Let's see how the northern allowances are calculated in the regions of the Far North at the present time. How much do northerners get paid? What conditions affect the amount of the premium?

What is the High North?

Before we go directly to the topic of calculating northern allowances in the regions of the Far North, let's consider which territories are equated to this area.

It is worth noting that their list has changed quite recently - 12/6/2018. List of such areaswas adjusted by the government of the Russian Federation. The amendments affected the following areas:

- Tuva.

- Karelia.

- Buryatia.

- Komi.

- Zabaikalsky Krai.

- Yakutia.

- Khabarovsk Territory.

- Murmansk region.

- Perm Territory.

- Khanty-Mansi Autonomous Okrug.

- Amur Region.

2018 legislative amendments

Let's list the most important legislative changes:

- The village was excluded from the list for Yakutia. Leninsky and N. Kuranakh (Aldan region), the cities of Tommot, Aldan and Neryungri. This is due to the fact that at present transport networks make it possible to deliver fuel to these areas all year round.

- The territory of the Russian Federation is considered the Far North if it is not connected to the "mainland" by year-round transport infrastructure. Or roads are only available during certain seasons of the year.

- The new list was drawn up to form a state support program: early import of food, medicines, clothing, industrial products, as well as to regulate prices for petroleum products.

- As for the calculation of northern allowances in the Far North, they were untouched. Also, the benefits due to the northerners - additional leave, early retirement and others have not been revised.

Legislative regulation of the issue

The calculation of northern allowances in the regions of the Far North is regulated by the Labor Code and Law No. 450-1. In these regulatoryacts determine that residents of the northern regions, working in the same locality, have the legal right to accrue a number of bonuses to their wages.

Under Russian legislation, the following employees are en titled to bonuses:

- For permanent workers.

- Employed part-time.

- Workers remotely (when in the Far North).

- Working on shift.

The size of the allowance for work in the regions of the Far North primarily depends on the duration and length of service of such work. The rules for calculating these material incentives were developed back in 1990. Initially, they were spelled out in the instructions of the Ministry of Labor of the RSFSR.

Defining rules

Let's analyze the main rules for the formation of a bonus for work in the regions of the Far North:

- The bonus will be charged only on labor payments - this is a percentage of the salary of the worker. It is important to remember that the following are not taken into account in the calculations: the northern coefficient, travel allowances, financial assistance, vacation allowances and various one-time payments.

- The length of service for calculating the allowance is taken into account total, without taking into account breaks for activities in another area. Let's take an example. The man worked in the Far North for 3 years. Then he moved to another area, worked there for 5 years. And he decided to return to the north again. In case of re-employment in this case, his northern work experience will not start from scratch. When calculating the amount of the allowance, the accountant must takeinto account those 3 years.

- The obligation to charge allowances in the Far North is assigned to all employers in this area, without exception. The provision also applies to those employers who are legally located in a different area, but in fact their employees work in the Far North.

- The amount of the allowance depends on two conditions: work experience in the Far North and the severity of the climatic conditions of the working area.

- Starting to work in the Far North, a citizen automatically receives a 10% bonus to his first salary. This financial incentive increases by 10% every six months until it reaches the maximum set for the region of his work. The following summers, the employee will receive a salary with this maximum allowance.

What is the highest salary supplement in each of the regions of the Far North? There are four groups for which their values are set. Let's look at them further in detail.

First group of locations (up to 100%)

Let's take a closer look at the size of allowances in the regions of the Far North. The largest maximum value here is 100% of the citizen's salary. It is received by workers in the following areas:

- Koryak Autonomous District.

- Chukotka AO.

- Aleutsky district, located in the Kamchatka region.

- North-Evenki district (Magadan region).

- Islands of the Arctic Ocean and adjacent seas (except those located in the White Sea).

Second groupareas (up to 80%)

The maximum northern allowance in the regions of the Far North of 80% of the salary of a worker is due to workers in the following areas:

- Evenk Autonomous District.

- Yamalo-Nenets Autonomous Okrug.

- Khabarovsk Territory.

- Sakha.

- Kamchatsky Krai.

- Komi.

- Vorkuta.

- Magadan region.

Third group of localities (up to 50%)

50% allowance in the regions of the Far North (from the salary of a citizen) is calculated for workers in the following areas:

- Republic of Karelia.

- Amur Region.

- Komi.

- Arkhangelsk region.

- Primorsky Krai.

- Khanty-Mansi Autonomous Okrug.

- Sakhalin Region.

- Khabarovsk Territory.

- Tomsk region.

- Krasnoyarsk Territory.

- Chita region.

- Amur Region.

- Buryatia.

- Irkutsk region.

Fourth group of localities (up to 30%)

30% is the highest allowance in the Far North of the last, fourth group of harsh climatic areas of the Russian Federation:

- Chita region.

- Buryatia.

- Irkutsk region.

- Komi Republic.

- Southern territories of the Far East.

- Republic of Tuva.

Supplements for beginners

If we turn to the recent past, we will see that even before 2005 there was a benefit for young professionals who started their careers in the Far North. Namely, for citizens under the age of 30 who have a secondary or higher specialized education.

After 2005, the benefit was abolished. However, instead of it, the Government of the Russian Federation has developed an accelerated algorithm for calculating the allowance for young professionals:

- Workers in the area belonging to the first and second groups, do not start their activities with the standard 10 percent, but with a 20 percent increase in salary. Moreover, in the future, it increases every six months, again, not by 10%, but by 20%. Until it becomes 80% for the first group of localities and 60% for the second group of localities. The allowance reaches its maximum (100% and 80%, respectively, for the 1st and 2nd groups) after a year of work of a young specialist in the Far North.

- Workers in the 3rd and 4th groups begin with the standard 10% salary increase. At the same time, it increases every six months by 10% until it reaches its maximum size. This is 50% for the 3rd group and 30% for the 4th group.

Benefits for indigenous people of the Far North

Speaking of wage increases in the regions of the Far North, let us also pay attention to the letter of the Ministry of Social Development and He alth of the Russian Federation No. 697-13 (2005). It notes that additional benefits are being introduced for those citizens who were born and lived in the Far North for at least 5 years on 2004-31-12.

These citizens, getting a job in the regions of the Far North (orareas legally equated to them) are en titled to receive a full percentage increase in salary from the first day of their work. Provided that the employment contract was concluded after 2004-31-12. That is, for example, getting a job in the area of the 1st group, such a citizen already with the first salary receives a 100 percent increase in salary.

As for young professionals (under 30 years old) who began to build their careers in the Far North no later than December 31, 2004 and lived in this area for at least one year, they have the full right to accrue the accelerated northern allowances. Reason for this: Decree No. 458 (1998) "On compensation to citizens living in the regions of the North".

Supplements for workers over 30

We remind you once again that the maximum polar allowance in the regions of the Far North (the first climatic group) is 100% of the salary of a worker.

Let's take a closer look at the order in which the allowance is calculated for citizens over 30 years old who got a job in the regions of the Far North or areas equivalent to them.

- The first group of localities. First 6 months labor - an allowance of 10% of the salary. For each subsequent six months, another 10% is added. Until the surcharge reaches its limit - 100%.

- Second group of localities. The first six months of work - 10% of the salary of the employee's salary. For each subsequent six months of work - another 10%. Until the surcharge reaches the maximum - 80%.

- The third group of localities. First six months of work - 10%from the salary of the worker. For every next 6 months work - another 10%. Up to reaching the highest size - 50%.

- The fourth group of localities. In the first 6 months labor - 10% salary supplement. For every next six months of work, it grows by another 10%. Accordingly, until reaching 30% of the salary.

Supplements for military personnel

Not only civilians work in the Russian regions of the Far North. Various military units are also located in these areas. Is there any allowance for military personnel?

The calculations and rules here are exactly the same as for civilians. The only thing is that the allowance is calculated based not on the size of the salary, but on the amount of monetary allowance. Its size depends on the following conditions:

- Amount of allowance (excluding district coefficients).

- Region of service.

- Duration of service.

And another important thing about the allowances for service in the regions of the Far North. For young military personnel (under 30 years of age), the same conditions for accelerated calculation of additional payments apply as for young civilian specialists.

District coefficients

Don't confuse northern salary increments with such a measure of material incentives as the district coefficient. These are completely different concepts.

The regional coefficient is also a measure of additional financial support for workers in the conditions of both the Far North and the lawregions equivalent to it. Introduced by the state for the reason that the cost of food, household goods and other products for personal use in such areas is slightly higher than the average for the Russian Federation.

The value of the regional coefficient, respectively, depends on the region where the citizen is employed. It is regulated by the labor legislation of the Russian Federation.

The maximum size of this coefficient is 2. It is set for the following regions:

- Sea and islands of the Arctic Ocean (with the exception of islands located in the White Sea).

- Republic of Sakha: in relation to enterprises and construction projects related to diamond mining. In particular, these are the Udachnaya and Aikhal deposits, as well as the Kular and Deputatsky mines.

- Separate districts of the Sakhalin region.

- Chukotka AO.

- Aleutsky district (Kamchatka region).

The regional coefficient according to the legislation of the Russian Federation is calculated on the following:

- Salary.

- Supplements directly related to salary. For example, for long service.

- Supplements directly related to salary. For example, tariffs, for academic degrees, the class of the profession, skill, and so on.

- Compensation for hazardous and life-threatening working conditions.

- The so-called "thirteenth wages" (annual bonuses for conscientious work).

- Salary for seasonal and temporary workers.

- Sick leave payments.

- Payment to persons working part-time or part-timeday.

- Local minimum wage.

In this case, regional coefficients are not taken into account when calculating the following:

- Northern surcharges mentioned above.

- Vacation payments.

- One-time and temporary increases, bonuses and rewards.

Work and permanent residence in the Far North is complicated by the influence of harsh climatic conditions. Therefore, to stimulate workers in such areas, the government of the Russian Federation introduced special northern allowances. Now you know their size, order and terms of accrual.

Recommended:

The size of the dollar in millimeters. Do banknotes vary in size?

What is the size of the US dollar in millimeters? Does the size of a banknote depend on its denomination? What is the rarest currency in the United States? Why is 1 dollar the most common in the world, what is the reason for this? Circulation of the monetary unit outside the country and within it

Cinema business plan: calculation procedure, determination of payback

Almost every person strives to spend their time interesting and exciting. This is a normal desire of those who live not only in metropolitan areas, but also in small towns. Moreover, people are always ready to pay money for their interesting and full of bright emotions leisure. That is why the entertainment business can be considered quite promising

Carpentry workshop business plan: calculation procedure, determination of costs and profits

Now that high-quality pieces of furniture are much more difficult to find on sale, it makes sense to organize your own workshop. A carefully thought-out and well-written business plan for a carpentry workshop will help organize the business and provide a stable income

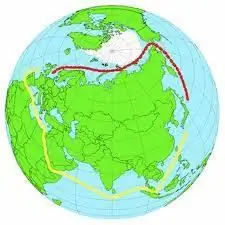

Northern Sea Route. Ports of the Northern Sea Route. Development, significance and development of the Northern Sea Route

In recent years, the Arctic is one of the key regions in terms of Russia's national interests. One of the most important aspects of Russia's presence here is the development of the Northern Sea Route

OSAGO coefficients. OSAGO territory coefficient. OSAGO coefficient by regions

From April 1, 2015, regional coefficients for autocitizenship were introduced in Russia, and two weeks later, the base ones were changed. Tariffs increased by 40%. How much will drivers now have to pay for an OSAGO policy?