2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

A separate structural unit is a representative office or branch of an enterprise, at the location of which at least one workplace has been formed for a period of more than 1 month. It will be considered formed, regardless of whether information about it is reflected in the constituent and other organizational and administrative documentation, and on the scope of powers vested in it. This provision is established in Art. 11, p. 2, NK.

Specific workplace

There is no definition of it in the Tax Code. However, it is in TK. A worker is a place where an employee needs to arrive to perform his duties and which is indirectly or directly controlled by the employer. This definition is contained in Art. 209 of the Labor Code. Recently, "virtual" offices have become very popular. This refers to the remote work of specialists onhome. The apartment and property of the employee are not under the control of the employer. In this regard, in this case, the workplace in the normative sense is not formed. Accordingly, such a remote office cannot be considered a separate division.

In addition, the workplace must be formed by the enterprise itself. For example, an organization may rent or purchase a building. If a company sends its employee to another company for a period exceeding a month, and the workplace is created by the host company, then there is also no question of creating a separate division. In this case, the specialist will be considered seconded under Art. 166 TK. Another important condition is the equipment of the workplace. This means that it must be properly equipped for the employee to perform his duties.

Territorial isolation

This is the second key sign of a branch or representative office. The definition of territorial isolation is also absent in the Tax Code. By the meaning of the sign itself, it can be assumed that we are talking about a different address for the location of the branch / representative office. It must be different from the location of the main organization indicated in its constituent documents. In Art. 11, paragraph 2, of the Tax Code states that the location address of a separate subdivision is the place where the main enterprise operates through a branch/representative office.

Classification

In accordance with the Civil Code, a separate subdivision can be formed in the form of a branch or representative office. DefinitionThe latter is given in Art. 55, p.1, Civil Code. According to the norm, a representative office is a separate subdivision of a legal entity that acts in the interests of the main enterprise and protects them. The definition of a branch is somewhat broader. It is considered to be a separate subdivision, which is located outside the territory of the main company, performs all of its functions or only some, including those related to representation.

Important moment

The creation of a separate subdivision is carried out by decision of the general meeting. It discusses key issues related to the activities of a branch or representative office. After the decision is made, an order is issued. A separate unit may, but is not required to have a leader. However, information about a branch or representative office must be indicated in the constituent documentation of the main enterprise. This prescription is contained in Art. 55, p. 3, Civil Code. Registration of a separate subdivision is carried out by sending relevant data to the authorized body. Information is entered into the Unified State Register of Legal Entities. From this moment on, the branch or representative office will be considered established. It should be noted that separate subdivisions are not legal entities and do not act as subjects of civil legal relations. However, they have certain responsibilities. In particular, in accordance with Art. 19 Tax Code separate subdivision must pay taxes.

Registration

Opening a separate subdivision involves submitting documents to the territorialbody of the Federal Tax Service. The main organization operating through a representative office or branch is obliged to send an application for registration within 1 month. from the date of formation. Registration of a separate subdivision is carried out in the Federal Tax Service, located at the address of its work, and not the main enterprise. There are situations when a representative office (or branch) is created, but no activity is carried out through it. Under the law, there is no need to register in this case. However, if after 2 months, for example, the main enterprise starts working through its separate subdivision, it will have an obligation to submit an application to the territorial body of the Federal Tax Service. But in this case, there will be a violation of the deadlines established by law. In this regard, it is advisable to carry out registration within 1 month from the moment the unit was opened, regardless of whether activities are carried out through it or not. If a representative office / branch is formed on the territory of the Moscow Region, within which the main enterprise is located, a notification is submitted to the territorial body of the Federal Tax Service in the manner prescribed by Art. 23, p. 3, NK.

Nuance

In practice, an enterprise can form several branches or representative offices on the territory of one municipality, but in areas under the jurisdiction of different control authorities. In this case, registration is allowed in the inspection at the location of one of the separate subdivisions at the choice of the main office. This provision is enshrined in Art. 83, paragraph 4 of the Tax Code. The main enterprise must notify in writing the territorial body of the Federal Tax Service, whichit chose. Accordingly, the declaration for a separate subdivision will be submitted to this inspection.

Tax liability

There are two norms in the Code related to the registration of an EP. In Art. 116 of the Tax Code provides for a fine in case of violation of the deadline in which the application must be submitted. Its value is 5 thousand rubles, and if the period is overdue by more than 3 months, then 10 thousand rubles. In Art. 117 of the Tax Code establishes responsibility for the implementation of the activities of the enterprise without registration. In this case, the violator faces a monetary pen alty in the amount of 10% of the profit received, but not less than 20 thousand rubles. If the activity without registration was carried out for more than 3 months, the fine is doubled (20% of income, but not less than 40 thousand rubles).

Separate unit income tax

The rules for his deduction are determined by art. 288 NK. Separate division taxes and amounts of advances in the part paid in favor of the fed. budget, are transferred without distribution by branches / representative offices, at the location of the main enterprise. This rule is established in paragraph 1 of the above article. The amounts that are deducted to the regional budgets are distributed among the branches / representative offices and the main office. Payments are made to the addresses where the main enterprise and each separate division are located. The profit that the branch / representative office receives affects the proportions of the distribution of mandatory contributions.

Responsibleoffice

If an enterprise has several divisions within the same region, then it can choose a responsible structure and through it make mandatory contributions to the budget. The amount of payment in this case will be calculated in accordance with the share of income determined by the totality of indicators of branches / representative offices. This rule is provided for in paragraph 2 of Art. 288 NK. The head office informs the Federal Tax Service at the addresses of the other representative offices / branches about which particular separate division was chosen as responsible. Notifications are also sent in case of a change in the procedure for deducting payments, the number of operating branches and other circumstances that affect the fulfillment of obligations to the state.

Location of OP

Currently, such a concept as a legal address is widespread. At the same time, many mean by it the actual location of the organization. Meanwhile, it is determined by the address of state registration. It, in turn, coincides with the place of work of a permanent executive body or a person who is endowed with appropriate powers. This provision is established in Art. 54, p. 2, Civil Code. Information about the location of the executive body is indicated in the constituent documentation.

In addition, such a concept as the actual address is used. It is associated with the place where the organization operates. Some territorial inspectorates of the Federal Tax Service link the actual address to a separate subdivision, and the legal address to the main enterprise. According toexperts, this approach cannot be called correct. A separate subdivision must first of all be territorially separated from the main office, and information about this must be contained in the constituent documentation. If the organization operates at an address other than that specified in the charter, but there is no information about this in it, then it cannot be recognized as a representative office or branch.

Closure of a separate division

When a branch/representative office is liquidated, the main enterprise is obliged to amend the founding documentation. Deregistration in the inspection of the Federal Tax Service will be carried out on the basis of information from the Unified State Register of Legal Entities. To do this, form C-09-3-2 is filled out and sent to the appropriate control body. The closure of a separate subdivision is accompanied by deregistration in both the FSS and the PFR. Relevant notifications must be sent within a month from the date of the decision to liquidate.

Special occasions

It is necessary to take into account the scheme by which a separate subdivision operates. The balance, for example, may not be kept, the current account and employees may be absent. In this case, respectively, the representative office / branch is not registered with the FSS and the PFR. The Ministry of He alth and Social Development, however, in one of the explanatory letters emphasizes that the main enterprise is obliged to inform the territorial departments of funds at the address of its location about the liquidation of any division, regardless of whether it has a current account, a separate balance sheet, charges in favor ofworkers and other individuals. Thus, notifications are sent anyway. If a separate division of an LLC was registered in the funds, the main organization sends:

- In the FSS and the FIU, a message about the liquidation. It is made in any form.

- In the FIU at the address of the unit's accounting:

- application for deregistration of the enterprise at the location of the branch/representative office in the territorial office of the fund;

- copy of the decision to liquidate the OP.

After receiving the specified documents, the FIU deregisters the unit within five days.

Reporting Features

When deciding on the liquidation of a branch/representative office, the updated documentation for the current and upcoming periods is submitted to the inspection at the address of the main office. On the title page of the declaration, in the line on the location, the code 223 is affixed. In the upper part, the checkpoint assigned to the enterprise at the location of the liquidated branch / representative office is indicated. Section No. 1 contains the OKATO code of the settlement on the territory of which the activity was carried out and taxes of the separate subdivision were paid.

Dismissal of employees of the OP located in another area

Termination of labor contracts is carried out in the manner established for the liquidation of an organization (Article 81, paragraph 1 of the Labor Code). From the explanation of the Supreme Court, it follows that another locality is the territory located outside the given settlement. The rules prescribe that in the event of liquidation of an enterprise, employees are notified of this no later than 2 months in advance. until the immediate termination of the contract. The notice is drawn up in writing and is given for review to each employee against signature.

In addition, an order is issued to terminate the employment relationship. It is compiled according to f. T-8 or in the form that the company developed independently. Each employee also gets acquainted with the order against signature. It is mandatory to make an entry in the work book and personal card of the employee. It refers to Art. 81 TK. The employee receives the work book on the day the contract is terminated. At the same time, the employee signs in the accounting book and personal card. The legislation obliges the employer to make a full settlement with employees, including severance pay. Its size is equal to the average earnings per month. Severance pay is paid for 2 months.

Termination of the contract with an employee of the OP located in the same area as the main enterprise

When a representative office/branch is liquidated, employees are dismissed in the manner prescribed for staff reduction. In this case, the employer must:

- Justify the need for your actions with economic, organizational, technical reasons.

- Offer an employee a job based on his/her professional qualities and state of he alth. The employee must be offered all available vacancies that meet the needs of the citizen within the given locality. If the labor or collective agreement provides, the employerinforms the employee about the availability of places outside the territory where the OP is being liquidated. If these instructions are not complied with, the employee has the right to demand reinstatement.

- Comply with the requirements of art. 179 TK. With a reduction in the organization, first of all, there are employees with a higher qualification level, as well as those who are not allowed to be fired. The latter, for example, include pregnant women.

Employees whose contracts will be terminated are notified of this no later than 2 months before the date of dismissal. The procedure is carried out with the obligatory participation of the trade union body of workers. In case of disputes, representatives of the employer and employees can contact the labor inspectorate.

NDFL

According to the general rules, enterprises submit data on the income of individuals to the Federal Tax Service, acting as tax agents. Information is provided at the end of the period during which accruals and payments were made, no later than April 1. If a separate subdivision is liquidated in the middle of the year, the procedure specified in the letter of the Federal Tax Service No. KE-4-3 / 4817 of March 28, 2011 applies. Information on the income of citizens who are employees of representative offices / branches is provided to the Federal Tax Service Inspectorate at which is subject to VAT. If the activity of the unit is terminated in the middle of the year, information is transferred for the last reporting period. It is the time period from the beginning of the year until the end of the liquidation.

Withdrawal fromaccounting in the inspection of the Federal Tax Service

An organization that closes a separate subdivision is obliged to report this to the control body at its location. This must be done within three days from the date of approval of the decision on liquidation. You can send a notification in various ways. For example, the head can provide a notice to the inspection personally or through his representative. The law allows sending a document by registered mail, as well as through information communication channels. In the latter case, the notification must be certified by an enhanced digital signature of the director of the enterprise or an employee with the appropriate authority. After receiving the message, the inspection of the Federal Tax Service removes the OP from the register within ten days. The control body sends the relevant notice to the organization. At the same time, it should be remembered that if an on-site audit is carried out in relation to the enterprise, then at the location of the unit it will not be deregistered until it is completed.

Extra

In case of violation of the terms of notification of the inspection of the Federal Tax Service on the liquidation of a separate subdivision, the main enterprise may be held liable. It is established in Art. 126, p. 1, NK. In addition, administrative punishment is also provided for the head of the organization. It is defined in Art. 15.6 of the Code of Administrative Offenses. So when planning the liquidation procedure, it is important to comply with all the deadlines established by law.

Recommended:

Essence and concept of organization. Form of ownership of the organization. Organization life cycle

Human society consists of many organizations that can be called associations of people pursuing certain goals. They have a number of differences. However, they all have a number of common characteristics. The essence and concept of organization will be discussed in the article

Registration of fixed assets: the procedure for registration, how to issue, tips and tricks

The fixed assets of an enterprise are recognized as material objects used in the production of goods, production of works, provision of services, as well as for management needs. This category includes both exploitable assets and assets that are in stock, leased or mothballed

Liquidation is Briefly about the liquidation of an organization

Sooner or later, the activities of many organizations cease. What is the liquidation procedure? What points are important to observe when liquidating a legal entity so that there are no difficulties?

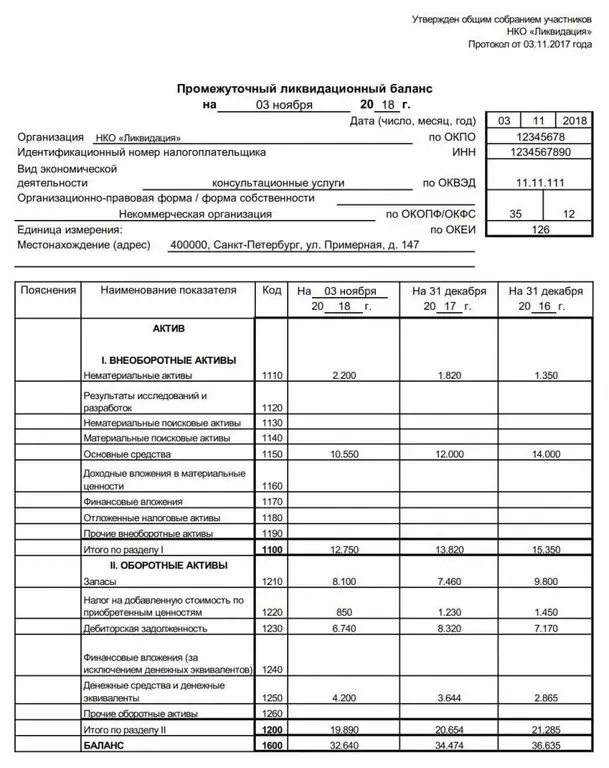

Decision on approval of the interim liquidation balance sheet: sample, procedure and deadlines for registration, tips

Approval of the interim liquidation balance sheet leads to the final liquidation phase. We will not touch on banks and budgetary institutions - they have their own rules for going through this procedure. Our article on how to perform this action for privately owned companies (LLCs) and non-profit organizations (NPOs)

Liquidation balance sheet is Definition of the concept, approval, form and sample of filling out the liquidation balance sheet

The liquidation balance sheet is an important financial act drawn up during the closing of an organization. It can be intermediate or final. The article tells what is the purpose of these documents, what information is entered into them, as well as how and when they are approved and submitted to the Federal Tax Service