2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:33

The closure of any organization is a lengthy and specific process that requires leaders to complete numerous steps and actions. This includes the preparation of special reporting, called the liquidation balance sheet. It can be intermediate or final. The liquidation balance sheet is an important documentation approved by the company's management and submitted to the Federal Tax Service. Therefore, its compilation is given a lot of attention by professional accountants.

Document concept

The liquidation balance sheet is a specific financial statement, compiled exclusively in the process of closing a legal entity. It is with the help of this document that the actual financial condition of the company is assessed.

Before it is drawn up, a liquidation commission consisting of professionals must be appointed. Their duties include drawing up the liquidation balance sheet, but before that they perform many important tasks:

- identify all creditors of the organization;

- appreciatestatus of accounts receivable to see if collection is possible;

- send special notices to lenders that the firm will close soon;

- the document contains information about how long creditors can make claims, and this time period cannot be less than 60 days from the moment information about the closure of the enterprise is posted in the media.

It is imperative that the company retain copies of notices sent to creditors as they confirm that the organization has fulfilled its obligations.

Types of balances

The liquidation balance sheet is the most important document for every closed organization. It can be presented in two varieties:

- Intermediate. Such a document includes all information about the existing assets and debts of the organization. The form of this type of liquidation balance sheet is standard, so the document used to create the annual balance sheet is usually used. Documentation is drawn up by members of the liquidation commission. With its help, you can determine whether the company will be able to cope with existing debts at the expense of assets. The duties of the commission additionally include the identification of all hidden property belonging to the enterprise.

- Final. It is compiled only after the company has repaid all existing debts to creditors. Therefore, financial calculations are initially carried out, repaiddebts to contractors, employees of the company, tax and other organizations, and only after that this documentation is compiled. The main purpose of its formation is the determination of assets remaining after the repayment of debts. They are further distributed among the leaders of the enterprise. The number of assets in this document should not exceed the results of the interim balance, as such a result will be suspicious and will lead to an audit by tax inspectors.

When drawing up a document, the liquidation commission usually uses samples of the liquidation balance sheet. This helps to prevent the presence of various errors in significant documentation.

What form is used?

Filling out the liquidation balance sheet is not a very complicated procedure, usually performed by experienced accountants. To do this, it is enough to prepare in advance the necessary data entered into the document. Specialists involved in mixing should be included in the liquidation commission.

There is no well-defined form to be used for this document. The exceptions are budgetary organizations and banks, as certain strict forms are established for them.

Other firms draw up a liquidation balance sheet according to the standard form of an accounting report. An example of filling out the liquidation balance sheet can be viewed below.

Can it be zero?

Interim document usuallyis drawn up at the very beginning of the liquidation of the company, so it is rarely zero. It includes not only the assets of the enterprise, but also all debts to various people, other organizations and government agencies.

When drawing up the final balance, it often happens that it is zero. In this case, all the company's assets were used to pay off debts, so the company has no debt or property left.

Create zero reporting for each accountant is not difficult, so the procedure does not take much time. For employees of the Federal Tax Service, such a document usually does not cause any doubts or suspicions. It shows that the company will not be subject to any claims from creditors, and the founders will not be able to receive the property, since it was sold in order to pay off the company's debt.

When formed?

The liquidation balance sheet is an important documentation that is generated during the closing of a company, but there are no clear deadlines during which it must be drawn up, approved and submitted to the Federal Tax Service. Therefore, members of the liquidation commission should not strive to make documentation by a specific date.

The only document requirement is to include all assets and debts. An interim document is formed only after all creditors have filed claims, and all the property of the organization has been revealed by the members of the commission.

The final document is drawn up after the repayment of debts, so it indicates whetherthe company after that any property. If the balance is negative, then this indicates that the company was unable to repay debts with its assets, so it cannot be closed in the standard way. In this case, the Federal Tax Service begins the bankruptcy procedure of the company.

Legislative regulation

The procedure for compiling and approving an interim liquidation balance sheet must be carried out taking into account numerous legal requirements. Therefore, the compilers of this document take into account the following regulations:

- FZ No. 127 “On Bankruptcy”, containing information that if the final balance is negative, then the company will have to declare itself insolvent, since it simply does not have assets and funds with which it can pay off debts to creditors;

- GC includes data on how and when the interim and final balance is formed;

- FZ No. 208 "On JSC" contains the rules for opening and closing such companies.

On the basis of the Civil Code, the liquidation balance must necessarily include data on all available property, represented by cash, buildings, equipment or other valuables. Tangible assets must be sold at auction so that the funds received from this process are used to pay off debts. The members of the liquidation commission should be involved in the formation of the document after all creditors have been identified. Additionally, approval of the liquidationbalance sheet by the meeting of shareholders of the company.

Rules and procedure for drafting a document

Usually, the interim and liquidation balance sheets are drawn up according to the same model, since there is no strict uniform form for these documents. It is recommended to use a sample liquidation balance sheet so as not to miss important details. When forming the documentation, the members of the liquidation commission perform the following steps:

- a property inventory is carried out in the company, the main purpose of which is to identify all assets belonging to the organization;

- an appraisal is being implemented, the results of which make it clear what the market value of the property in the company is;

- receivables are determined, if any, and whether these funds can be returned in a short time;

- claims are sent to debtors;

- all creditors of the organization are established;

- then an interim balance is formed;

- determining whether a company can handle debt with available cash;

- if there is not enough money to pay off the debt, then the company's assets are sold, for which bidding is held;

- the final balance is drawn up, which must be zero or positive, since if there is a negative value, the company will have to initiate bankruptcy proceedings.

It is important not only to draw up a direct balance sheet, but also to attach additional documentation to it, which is then surrenderedto the FTS office. This documentation includes an act on the inventory, the claims of creditors and information about all the assets of the company. An example of a liquidation balance sheet allows any accountant to correctly fill out this document.

As stated?

According to the law, it is required not only to correctly draw up this document, but also to approve it by the management of the enterprise. A sample liquidation balance sheet statement can be viewed below.

Of course, this document includes information:

- enterprise name;

- form of the meeting;

- place of decision;

- list of persons present at the meeting;

- agenda;

- decision on every important issue.

If the company has only one founder, then no meeting is required. The decision is made by him alone, after which a document is drawn up approving the liquidation balance.

Who is involved in drafting, approving and signing documents?

The decision to close the company is made only by the management of the enterprise, and for various reasons, a corresponding court decision can be made. The plaintiff in this case may be contractors, the Federal Tax Service or other government agencies.

To close any firm, two balance sheets are required. To do this, the following features of the process are taken into account:

- documentation is being generated by an accountant who mustbe part of the liquidation committee, so the firm's management must ensure that not all of the firm's accountants quit before the company closes;

- documentation is signed by the head of the liquidation commission, and the signature must be notarized;

- the balance is approved by the head of the company, after which the document is also certified by a notary.

Correctly prepared documents are transferred to the employee of the Federal Tax Service at the place of registration of the company, and this process must be completed within three days from the approval procedure. Often there is a need to transfer additional data to the Federal Tax Service, which make it possible to clarify certain information from the balance sheet. In this case, it is allowed to draw up an explanatory note in free form, which is submitted to the inspection together with other papers.

If the bankruptcy procedure is implemented, then the balance sheet is signed and approved only by the bankruptcy trustee, who monitors the identification of all the company's assets with which its debts can be repaid.

How many times is a document formed?

The final balance only needs to be formed once, so it shows how much assets are left after paying off debts to creditors. It is allowed to form a zero liquidation balance if the company has no assets left after paying off the debt.

The interim balance sheet can be drawn up several times, since this process depends on how many creditors remain after the debts are paid off. This is due to the fact that the decisionships, certain creditors can be added to the balance sheet. The decision can be made not only by the court, but also by members of the liquidation commission or the Federal Tax Service.

Mandatory tax audit is carried out in relation to many companies. If in the process of conducting it, inspectors reveal discrepancies in the actual data with the information contained in the balance sheet, then this may become the basis for including assets or creditors in this document, therefore, its re-compilation is required.

Deadline for balances

The interim balance can be released at any time. Part-time documentation is being compiled.

The final balance sheet is required to be submitted to the Federal Tax Service office at the place of registration of the company within three months after the company is deleted from the register. At the same time, it is important that the document is not negative, as this will certainly lead to sad consequences for the company's leaders.

Conclusion

Liquidation balance sheets are required to be drawn up when closing a firm. The procedure can be performed voluntarily by the founders of the enterprise or forcibly, and in the second case, the initiator may be employees of the Federal Tax Service or counterparties.

Each head of the company should understand how the documentation is compiled correctly, how it is approved, and also when it is submitted to the Federal Tax Service. If there are violations, this will be the basis for refusing to liquidate the company.

Recommended:

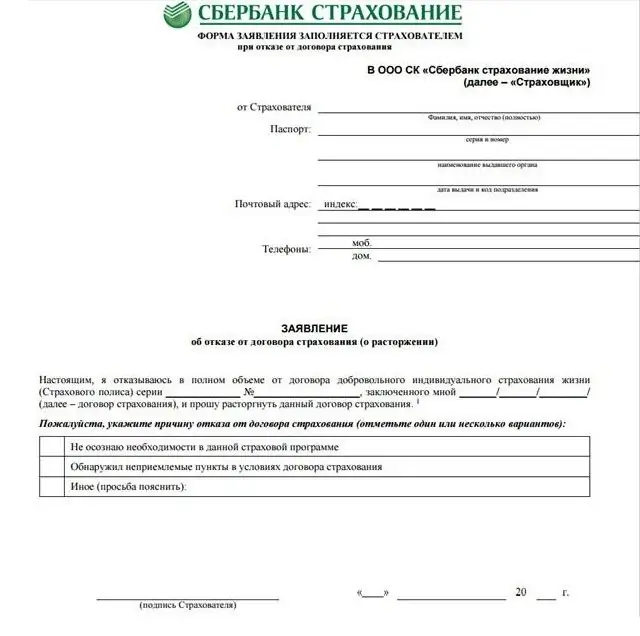

How to return insurance at Sberbank: types, procedures and a sample of filling out the form

In our time, credit institutions are actively trying to increase their profits in a variety of ways. One of them is the purchase by the client of the policy when applying for any banking service. In this regard, you need to know how to return Sberbank insurance in case of early repayment of the loan. In order to have a complete understanding of this program, you need to know what it is

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Filling out a sick leave: the procedure for filling out, norms and requirements, an example

To receive a payment from the employer, it is necessary that the sick leave is filled out correctly. How to do this and how to work with sick leave in general is described later in the article. An example of filling out a sick leave will also be given below

Inventory sheet: form and sample filling

Control of the presence of assets in the enterprise is carried out during the inventory. Goods, cash, stocks and other fixed assets can be the objects of verification. The inventory sheet reflects the results of the audit. Enterprises use the unified form INV-26

Decision on approval of the interim liquidation balance sheet: sample, procedure and deadlines for registration, tips

Approval of the interim liquidation balance sheet leads to the final liquidation phase. We will not touch on banks and budgetary institutions - they have their own rules for going through this procedure. Our article on how to perform this action for privately owned companies (LLCs) and non-profit organizations (NPOs)