2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:47

Mutual actions of participants in a specific form of purchase and sale of material assets, called "bidding", are referred to as "exchange transactions". The types of such coordinated activities fall into four broad types. They, in turn, comprise transactions, the subject of which are various kinds of goods and assets owned by numerous funds. Types of exchange transactions and their characteristics are presented in our article.

General theoretical information

Exchange transactions, the concept and types of which are directly in the field of active actions of their participants, are aimed at acquiring (or alienating) the rights and obligations associated with goods purchased under a specific type of sales contract. In the course of such transactions, objects that are eligible for evaluation and exhibition at the auction are transferred.

As a rule, the processes of the so-called stock market game are characterized by analysts from several sides. They are considered in terms of compliance with legal, economic and simply organizational and ethical standards.

These are exchange transactions, the types of which can befollowing list:

- offering products accompanied by a presentation of their quality samples;

- conclusion of contracts for the supply of goods;

- agreements involving the transfer of ownership of material assets subject to non-urgent payment;

- achieving agreements that result in the right (but not the obligation) to purchase certain securities or specific goods during the agreed period.

Ensuring the bidding process

The right to establish specific procedures for the implementation of the trading procedure on the stock exchange has each individual organization that receives sellers and buyers operating in a special legal field. Common to every institution called an exchange is the requirement for a written agreement between bidders.

In the current sample of a document certifying the fact of a transaction, the following should be written:

- a specific time period within which the item of trade must arrive at the recipient;

- number of items;

- indicators by which one can judge the compliance of acquired material goods with their quality standards;

- general affiliation of the subject of the transaction;

- terms and form of payment under the contract;

- nuances of delivery and the degree of responsibility of the parties.

In the framework of a fixed-term contract, only the last two points ofthe list provided. The price, as a rule, is called conditional. Such arrangements are called futures.

Contracts that give the right to purchase goods and do not provide for obligations are sold as a special kind of paper called options. The bidder who acquires such a document becomes the owner of the right to purchase a specific product within the agreed period together with it. At the same time, these papers can be used both for their intended purpose and sold, along with the opportunity to purchase the object indicated in them.

Cash transactions

One of the varieties of exchange agreements are the so-called transactions of immediate execution. Within their framework, the transfer of securities and settlement takes place on the day the contract is signed. Another type of exchange transactions are term contracts, the content of which is the purchase and sale of the currency of another state.

Deals of immediate execution are called cash and can be simple contracts and agreements with an expected profit. At the same time, based on world practice, payment for transferred securities must be made immediately or no later than the fifth business day after the signing of the relevant documents. If the purchased package includes more than 100 shares, the settlement can be made within two weeks.

The Russian stock market sets slightly different payment terms for immediate settlement transactions. Funds must be transferred no later than two days. Within the samenormal transactions may take three months to settle.

Forward Deals

Such agreements involve the voicing of specific terms of payment and the date of their signing, as well as a transparent form of pricing. The types of these contracts are clearly divided based on the following characteristics:

- calendar period in which the fee can be paid (a predetermined and documented number of days);

- date of the decision on the value (it can be the day of the transaction or any other date);

- nuances of concluding a contract, which primarily depend on its type (with a demonstration of the subject of the agreement, individual, optional, etc.).

In general, such transactions are divided into two types:

- shelving (when a participant in such an agreement, after a specified period, has the legal right to act both as a seller and vice versa);

- report (mutual agreement on the transfer of securities, in which the receiving party undertakes to subsequently redeem them at a higher rate).

There are also exchange transactions, the types of which, when they are concluded, involve a procedure in which one of the parties to the contract acquires the right to demand from the other the delivery of securities, the number of which can be multiplied by a certain coefficient. The cost of each, however, remains fixed and equal to the one that was marked at the time of the conclusion of the agreement.

Deal followed byredemption, option and speculation

Conclusion of contracts of the "report" type is included in the main types of exchange transactions and is one of the types of agreements with deferred settlement, which is associated with a lack of stability in the foreign exchange market. In addition to the above, these include transactions in which securities are transferred for a fee to a pre-selected intermediary. Intermediate holding lasts for a specified period and is paid at a price lower than that set for a subsequent redemption.

Deals that give rise to the right to purchase goods require payment after a specified period, which cannot be less than one working week and more than two months. In the event that the settlement date coincides with a calendar holiday, the obligation to pay the amount due is automatically extended until the next business day.

It is worth noting that the types and features of exchange transactions cannot be fully described without mentioning the speculations carried out as part of trading. At the same time, despite the negative connotation of this term, such operations are called useful by many experts. This is primarily due to the fact that speculative transactions in some way prevent the imbalance of prices and even balance them.

Trading Rules

Exchange transactions are concluded in writing by prior arrangement. In addition, there is an offer made by means of a detailed statement of the conditions in letters,messages on the Internet, telephone conversations, etc.

Those participants in the stock game, which can be classified as professionals, usually conclude transactions only in their own name and at their own expense. According to the rules of the institution, they are obliged to announce prices in advance and not deviate from them at all times of the auction.

Such transactions are certainly registered, which happens only if there is a document properly executed. On this document, the relevant authority makes a note and assigns it a personal serial number. Having received a security at its disposal, its new owner is obliged to notify the issuer of this.

Subjects and objects of contracts on the stock exchange

Since the games on the stock market are carried out according to strictly established rules that form a clear structure and mechanisms of ongoing processes, the list of their participants is subject to clear regulation. These include:

- subjects acting within the framework of the exchange game solely on their own behalf (traders);

- legal or natural persons having the legal status of auction founders;

- brokers acting on behalf of and on behalf of clients.

All of the above participants, carrying out their actions, consider as subjects of transactions:

- all kinds of goods;

- raw materials;

- shares;

- financial documents (derivatives) derived from the main product or service;

- national currency.

Persons who organize the game on the exchange provide direct legal assistance to individual traders, as well as provide general advice for each trading participant without exception, if the types of exchange transactions and the procedure for their execution determine such a need.

Products and basic bidding procedures

Speaking in more detail about which financial products are put up for sale as part of the exchange game, the following are distinguished:

- industrial products;

- consumables for recycling;

- agricultural products.

The price of the listed items of trade is formed in the process of operation of the mechanisms of the exchange. They are based, as a rule, on the free structuring of prices, which, however, is directly dependent on the rules established by the institution conducting the auction, especially in charge of the types of exchange transactions with real goods.

The main list of financial transactions carried out as part of such events includes:

- buying and selling;

- procedure for listing securities admitted to trading;

- monitoring the compliance of securities with the requirements established by the exchange (as well as the processes of the exchange game - with the prescribed conditions);

- registration of the agreements reached;

- setting prices for base and quoted currencies;

- implementation of bail procedures;

- legal supportsettlements;

- cash and non-cash payment of bills;

- keeping statistics for the purpose of studying the financial market and providing relevant information;

- money safekeeping services;

- issuance of securities.

Pricing

As part of the exchange game, the value of assets in general and securities in particular is set depending on several conditions:

- results of agreements between free traders (traders);

- according to current market patterns (taking into account modern macroeconomics);

- based on the basic principles of the auction.

At the same time, the prices set during the negotiations, one way or another, are based on the nature of the current market, which is often the main source of information that is consulted when making a choice in the direction of one or another final decision.

Agreements that the parties come to as part of competition in the form of an auction also fall into the category of “exchange transactions”. The types of such contracts have a number of specific features and are of great interest, being a special financial institution.

Features of auctions

Public trades taking place within the framework of the exchange game are quite clearly divided into two main types - ordinary (classic) or double. The first includes those in which, due to the relatively small demand for the goods offered, it is the sellers who are in fierce competition among themselves. The second type involves active interaction andrivalry between acquirers as dictated by the types and purposes of exchange transactions.

The classic type of auction is the British version of the auction, a characteristic feature of which is the increase in price in the process - from the minimum to the one at which the goods will be eventually sold.

Applications for participation in the auction in the status of sellers are submitted in advance, which is necessary for the study, the initial exchange evaluation of the products offered and the formation of a list of quoted goods. The size of the step, which will increase their value during the auction game, is also set in advance.

Recommended:

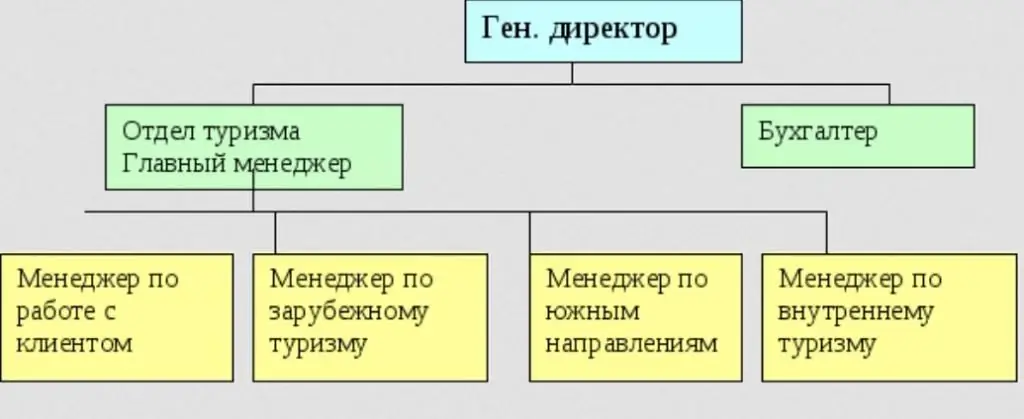

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

REPO transactions. REPO transactions with securities

REPO transactions are procedures during which the sale of any valuables is carried out, accompanied by their repurchase after a specified period at a price fixed at the time of the transaction. Repurchase is mandatory, representing the final (second) stage of the transaction

Currency transactions are a special type of financial transactions

Currency transactions are transactions the subject of which are monetary values. They must be regulated by law or by certain international agreements

Steel support: types, types, characteristics, purpose, installation rules, operation features and applications

Steel poles today are most often used as lighting poles. With their help, they equip the lighting of roads, streets, courtyards of residential buildings, etc. In addition, such structures are often used as supports for power lines

Machine vice: features, characteristics, types and types

Vises are universal devices designed to hold workpieces during manual (in this case, the vise is installed on a bench workbench) or mechanical (special machine vise is used) processing