2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Just two years ago, each individual entrepreneur was under strict state control, and the sanctions imposed in the form of fines on this type of business did not differ significantly from the amounts paid by large organizations. This alignment caused strong unrest among entrepreneurs. In this article, we will talk about how IP is checked today.

Reason for checks

Since 2016, structural changes have begun in the inspection system. The Ministry of Economic Development proposed to replace the first fine with a warning. Until the end of 2018, there are verification holidays, which the Government of the Russian Federation intends to extend for 6 years.

However, IP still has obligations in favor of the state. You can check debts for individual entrepreneurs on the Federal Payment Portal, on the website of the Federal Tax Service or on the Unified Portal of Public Services.

All checks for individual entrepreneurs are described in the law of December 26, 2008 No. 294-FZ. The audit is divided into two categories: scheduled, providing for specific deadlines and times, and unscheduled. Type 2 checks are assigned if:

- there is an orderthe head of the state control body or the prosecutor's claim;

- the period set for the correction of violations has expired;

- the control authorities received a written statement with complaints about the violations identified in the IP in terms of the rights of workers, consumers.

Unscheduled control is allowed by law after informing the entrepreneur at least 24 hours in advance. Exceptions may be unforeseen circumstances in which the IP is involved in causing harm to the environment, animals, people.

Structure

The time and date of scheduled inspections are displayed on the official website of the Prosecutor General's Office. At any time, you can check the IP by TIN or OGRN IP, as well as other details. Some entrepreneurs have not managed to get rid of state inspections. Some of them are excluded from the list. For this you need:

- provide audit services;

- provide medical or educational services and products;

- exercise control of housing and communal services of apartment buildings (managing organizations).

If the production facilities of the enterprise belong to the first or second class of industrial safety, an exception to the rules of state inspections also works.

Views

How is IP checked? All checks are of two types: documentary or field. In the first case, it is necessary to provide the entire set of reporting documentation to the inspectors, in the second- They visit the office themselves. In practice, it happens that one check flows into another. If the auditor began to conduct an inspection of documents, during which he identified debatable points, he has the right to announce the upcoming departure to the businessman's office.

The main authorities conducting IP verification include:

- MES;

- IFTS;

- Rostrud;

- oversight organizations in various fields (transport, agriculture, he alth, environment and technology).

Any verification, regardless of the instance, begins with familiarization with the IP certificate and licenses, constituent documents, with the results of the latest inspections.

Tax office

The question of how to check the taxation of individual entrepreneurs is one of the most relevant for the IFTS. Of great interest to tax officials are individual entrepreneurs who report on too low wages for full-time employees or on unprofitable activities for a long time.

In accordance with Article 14 of the Tax Code of Russia, it is prohibited to re-inspect an individual entrepreneur for the same tax for a period that has already been checked.

There are desk and field checks. In the first option, additional control of the provided documentation is carried out. The auditors have the right to request explanations of the data received or justification of expenses. The duration of this type of audit is three months from the reporting date. Five days are allotted for correction of shortcomings leading to tax underpayment. When serious violations are foundthe entrepreneur is held liable within ten days.

In the second option, in order to check the IP, the Federal Tax Service resorts to a more thorough check. This method is common in relation to gross non-payers and violators. If necessary, witnesses, experts are involved, an inventory is carried out, documentation is seized.

The duration of the audit is two months. It can be extended up to six months under the following conditions:

- several diverse structures as part of IP;

- there was a need for an auxiliary examination;

- the manager violated the deadlines for submitting the required documents.

In addition to financial statements and tax returns, the following are inspected:

- certificates for benefits;

- statements from financial institutions;

- cash receipts.

Inspectors conduct a detailed audit of expenditures and revenues that affect the size of the tax base.

Unscheduled inspections are rarely subject to tax regimes that are independent of actual profits. Consequently, an audit of individual entrepreneurs located on UTII rarely ends with pen alties. Here, a novice businessman or accountant may have a question: how to check the taxation system for an individual entrepreneur, according to which tax payments need to be made? If the IFTS did not submit an application for the application of special tax regimes for individual entrepreneurs (STS, UTII, PSN, UAT), then with almost 100% probability the individual entrepreneur is on the general taxation system.

Tax audit in relation to the liquidated individual entrepreneurallowable within three years from the date of its closure. The main task of the inspection that checks the closing IP is to track discrepancies, tax delays and underpayments.

Rospotrebnadzor

Currently, Rospotrebnadzor is checking the interaction of individual entrepreneurs with customers and their compliance with sanitary standards. He considers other aspects of a working enterprise, they are not interested in how to check individual entrepreneur taxes and similar issues. The inspection applies to all enterprises that provide services or sell products to citizens. The most common verification items:

- consumer corner;

- product expiry date;

- certificates of product conformity;

- ventilation system and lighting;

- price tags, prices, signs;

- sanitary book and uniform of workers.

Grocery stores and catering restaurants are most often subjected to such checks.

Labor Inspection

Rostrud monitors the observance of the rights of hired employees. Under the close supervision of the inspection are individual entrepreneurs who:

- employed citizens without Russian citizenship;

- employed minors;

- pay workers questionably low wages.

During the audit, the following documents of the personnel department are checked for correct execution, compliance with the Labor Code of the Russian Federation and the presence of signatures:

- employment contracts and employee books;

- vacation schedules andpayroll;

- timesheet and staffing.

Fire Inspectorate

How do EMERCOM inspectors check IP? The service controls the availability of fire safety documents for individual entrepreneurs, as well as all the necessary means to fight fire and prevent unintentional fires.

From documentation inspectors check:

- evacuation plan;

- orders of the chief about designated areas for smoking;

- the order of the chief on the systematic passage of fire safety briefings by employees.

In work and production areas, they check for:

- fire extinguishers and other fire safety equipment;

- emergency exits;

- warning systems;

- building plan and evacuation.

The main thing to remember: the fine from the fire inspection is not so terrible as the possible damage from a fire that may occur due to non-compliance with the required standards.

Rostekhnadzor

How do auditors of Rostekhnadzor check IP? Control by Rostekhnadzor is expressed in the granting of licenses and control of certain types of activities: firstly, based on the use of natural resources and, secondly, in contact with hazardous production facilities (transportation, installation, design).

The issue of verification for the inspection is the fulfillment by the IP of the requirements of the legislation in terms of industrial safety.

In most cases, all possible comments are reduced to zero until the IP license is issued. Reviews will continue in the future, but to successfully complete them, it is enough to continue to fulfill all the necessary requirements.

Prosecution

The prosecutor's office is connected to the verification of the IP when there is information about unlawful violations on his part, and the consideration of the case itself does not fall under the jurisdiction of other bodies. In practice, the prosecutor's office carries out the check on its own or transfers the issue for consideration to another department that will conduct it.

In order to check the IP, the tax service offers the resources of its website. In the fields you need to enter the TIN, PSRN and find out the primary data about the individual entrepreneur, including whether it has been liquidated.

Businesses that do business and do not violate the law do not need to worry about scrutiny by the prosecutor's office.

In case of complaints about IP violations from the media, the local population, legal entities, the prosecutor's office will initiate an inspection on fair grounds.

What does a prosecutor do? It establishes the authenticity of the data received, and if this is revealed, further proceedings will be underway. The liability of an individual entrepreneur is directly determined by the severity of the violation committed. The outcome of the audit may vary from the prosecutor's order to improve the current situation to the initiation of a court case.

How to avoid paying a fine

A simple method that does not provide for the payment of a fine after checks is to implementIP activities within the law, following all its norms. It is possible to achieve this.

First you need to familiarize yourself with the legal framework. The list of the most popular fines issued to entrepreneurs based on the results of state inspections is indicated and displayed in Chapter 14 of the Code of Administrative Offenses.

Every businessman should make it a rule to check the IP taxes by TIN and do it on a regular basis, because the accrual of pen alties in combination with fines can reduce business development indicators.

Compliance with the Criminal Code for individual entrepreneurs is mandatory. Article 199 of this document provides for up to six years in prison for tax evasion.

Entrepreneur's actions

According to the law, an on-site inspection is carried out in the presence of a businessman or his deputy. In practice, it happens that the commission encounters violations from the first minutes of their stay on the territory of the IP. It happens that the content of the conversation between two employees of the organization can be attached to the case of the person being checked.

The issue with the arising debts of individual entrepreneurs should be resolved immediately and on a regular basis. You can check the taxes of individual entrepreneurs by TIN on the website of the Federal Tax Service or on the Unified Portal of Public Services, in case of non-payment on time, pen alties are charged.

Before conducting an on-site inspection, it is recommended that an entrepreneur ask for certificates of members of the commission and familiarize himself with the order, which should contain the main provisions: the objectives of the inspection, types of control measures, members of the commission.

The entrepreneur is obliged to provideCommission access to the premises and documentation related to the subject of the audit.

A check log is not required, but it can be useful in some cases.

Inspection act and signs of violation

The result of the audit is summarized in an act, which indicates all the activities carried out by the commission and identified violations. A businessman puts his signature under the act if he agrees with the result of the check. If the entrepreneur does not agree with him, he can add his comments to the act.

A record in the act, where reasoned objections are written, will help the businessman in challenging the results of the audit.

The results of the audit are considered illegal in the following cases:

- Scheduled inspection is carried out more than once every three years.

- Data on the scheduled inspection was not recorded in the schedule on the official website of the Russian Prosecutor's Office.

- Violated the terms of the check indicated in the order.

- The inspectors did not provide an inspection order.

- After the inspection, the inspection certificate was not issued.

How to refute a conclusion

An application to the arbitration court is allowed to be submitted before three months from the date of receipt of the conclusion on the violation. In a written appeal indicate:

- address and name of defendant;

- Plaintiff's details;

- documents, video or audio recordings that confirm the fact of illegal acts;

- norms supported by references to laws.

In practice, a large number of cases are closed in favor of individual entrepreneurs. The court may invalidate the results of the inspection and the fines imposed, as well as award compensation in favor of the IP.

IP is subject to scheduled and unscheduled inspections by many inspections: Rospotrebnadzor, Rostekhnadzor, labor, fire and tax inspections, the prosecutor's office. Other businesses can also check IP. Now the tax service allows you to check the IP by TIN from any computer with Internet access.

Failure to comply with the requirements of the law threatens with regular re-inspections, fines and pen alties, the payments of which are reflected in the financial performance of the IP.

Recommended:

Where can I find out the cadastral value of an apartment? Cadastral value of an apartment: what is it and how to find out

Not so long ago in Russia, all real estate transactions were carried out only on the basis of market and inventory value. The government decided to introduce such a concept as the cadastral value of an apartment. Market and cadastral value have now become two main concepts in the assessment

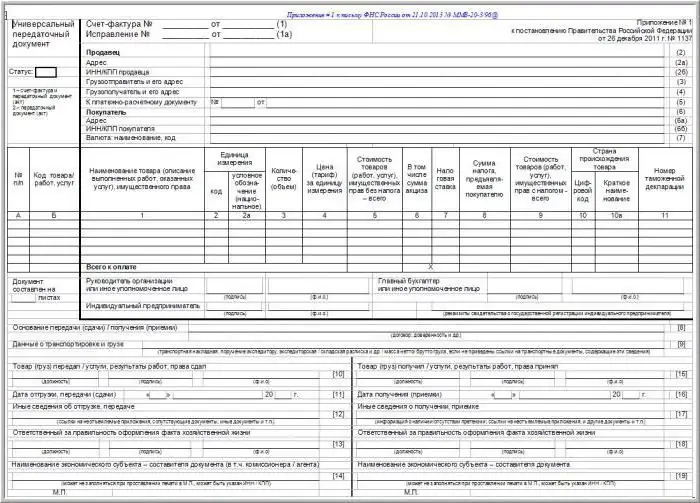

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Nitrates in fruits and vegetables can be checked with a tester

Nitrates are called s alts of nitric acid, extracted by plants from the soil in the process of growth. These s alts are absolutely harmless, but only until they enter our body. Once inside, harmless nitrates in vegetables turn into extremely unsafe nitrites that can block cellular respiration

How to check the "cleanliness" of the apartment when buying yourself? What should be checked when buying an apartment?

When buying a home on the secondary market, there are numerous risks, and therefore it is desirable for the buyer to know how to check the "cleanliness" of the apartment on their own when buying. The main thing is to avoid the main, largest risks, information about which this article contains. First of all, it is required to exclude the possibility of contesting the transaction and the right to the apartment, and therefore the recommendation on how to check the "cleanliness" of the apartment on your own when buying will be given in detail