2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

The activities of organizations in many matters are subject to careful control and are regulated by many rules. One of them is samples of filling out a consignment note, invoice, and other primary documentation. In order for the activities of the company to fully comply with the requirements of the law, when filling out these documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations.

Primary documentation and its purpose

All operations in the company's activities must be documented and reflected in tax, accounting and management records. In the future, all this data is systematized, summarized, analyzed and used by various users for various purposes. The most important of these is reportingresults of financial and economic activity before the regulatory authorities.

The category of primary documentation includes a number of documents intended for registration of certain events in the commercial life of the company. Their distinguishing feature is filling at the time of the transaction or immediately after it. Primary documentation is proof that the operation was actually performed. Such documents include a consignment note, waybill (TTN), invoice, specification, incoming and outgoing cash order and some other documents.

Assignment of consignment note

Consignment note - the primary transfer document, which is compiled at the time of shipment of goods to the buyer by the supplier. Evidence that the item was sold. It must be issued in two or more copies. Additional papers are drawn up if the goods are purchased on credit or leasing, with the participation of a commission agent, agent, as well as using state subsidies or budgetary funds. One copy is supposed to be left with the supplier, the second is intended for the buyer, the third - for the bank, another financial institution, intermediary, budgetary institution.

Any trade operation of legal organizations and entrepreneurs must be accompanied by a bill of lading. The form, sample filling and features of the appearance of the document may vary slightly. The legislation provides for several options for registration. Butthere are also requirements that all sales invoice templates must meet.

Consignment note design options

Organizations can frame events in their day-to-day activities in different ways. This also applies to the samples of filling out the consignment note. Below is a list of options a firm can take:

- Using the official unified form TORG-12. Why re-create the wheel if it has long been invented? TORG-12 is suitable for organizations with any legal form, working in all areas and with any goods. At the same time, the official form was developed taking into account all the requirements of regulatory authorities, with the wishes of companies for convenience and simplicity. All versions of 1C electronic databases that are used by accountants to work with company records are equipped with standard TORG-12 forms.

- Development and approval of your own form, taking into account the needs of the organization and all legal requirements. Some organizations, for the convenience of internal users, make adjustments to the TN, supplement it with the necessary columns, tables and details. This is not prohibited by law if the amendments do not change the essence of the document, and it still satisfies users with the information they are looking for.

- The use of a unified UPD form (Universal Transfer Document), which simultaneously plays the role of a consignment note and an invoice, is relevant for organizations that are VAT payers. Convenience lies in the disappearancethe need to separately print the invoice, which saves time, office space for storing papers, material assets (paper and toner), reduces the risk of errors and discrepancies in the package of documents for one business operation, as well as the risk of losing its components during storage.

- Use the electronic version of documents. Some modern companies have long switched to electronic document management. The requirements for electronic invoices are the same as for paper invoices. To use this form of workflow, you will have to acquire an electronic signature.

- Using standard magazines-books. Printing houses produce a huge number of books with forms of primary documents, including consignment notes. Individual entrepreneurs prefer this filling pattern, since it does not require special knowledge in accounting and the use of computer technology. This applies to entrepreneurs whose work process has little to do with office activities - traders of market pavilions, traveling entrepreneurs and others.

Consignment note: instructions for filling out

TN must necessarily comply with the requirements of the tax service. The process of its registration is regulated by the provisions of accounting and regulatory legal acts of the controlling authorities. This document must contain a number of required details:

- number and date of the document;

- names and addresses (actual and legal) of the consignor and consignee;

- TIN,current account, information on the basis of the ongoing transaction (agreement, specification, their number and date);

- list of shipped items, quantity of each item, units of measurement, cost per unit, total amount per item, total amount for the entire list, VAT percentage and its monetary value;

- surnames and initials of persons responsible for the operation: who shipped from the warehouse, who gave the order for this, who received it;

- print the sides if used in the activity (some PIs work without printing).

Consignment note

Another document of the standard package for a deal is a bill of lading. It is used in case of participation in the process of sale-acquisition of inventory items of one's own motor transport or third-party carriers. It is necessary both to reimburse the costs of fuel and lubricants, and to confirm the legality of the cargo in the process of transporting the traffic police officer, and to prove the legitimacy of the provision of transport services.

Organizations currently use two forms of waybills in parallel. Forms and filling pattern they differ completely. The composition of the details is almost identical, but is reflected differently in the document. The most important difference between TTN and 1-T forms is the absence of a section with a list of goods in the second one.

Rules for filling out a consignment note

Commodity-The bill of lading contains two sections. The first one contains the following information about the deal:

- date and document number;

- shipper and consignee, their actual addresses, bank details, information on the basis of the transaction;

- place where the goods are delivered;

- table section with a list of goods, their cost, number of places, availability and type of packaging, units of measurement, weight;

- last name and initials of the officials who authorized and made the release of the goods, their signatures and the seal of the sending company;

- position, surname and initials, carrier's signature;

- position, surname and initials, signature of the person who accepted the goods and seal of the recipient.

The second section of the TTN contains information about the car carrying out the transportation and its driver. This part of the form must include:

- make, model, car registration number;

- Full name of the driver, his signature in the columns on the acceptance of cargo for transportation, indicating the number of seats and on the delivery of cargo to the recipient;

- other information informing about the characteristics of the cargo - toxicity, explosiveness, radioactivity and so on.

Differences of the new form 1-T

When transporting on their own, organizations use the above-described sample of filling out the TTN. The bill of lading form 1-T is used in cases where the cargo is transported by a third-party organization or a private driver. Without it, it is impossible to prove the existencecontractual relationship with a driver or a transport company, respectively, it is impossible to write off the costs of paying for their services in accounting and tax accounting.

The main difference between these two forms is that the 1-T form does not contain a commodity section and detailed information about the cargo being transported. You can specify in it only the number of places, the characteristics of the cargo and packaging, as well as the declared value.

What to follow when filling out?

The following is a list of legislative decisions regarding the execution of the above documents:

- Government Decree No. 272 of April 15, 2011 - approval of form 1-T.

- Letter from the Ministry of Finance of November 6, 2014 - on the recognition of the contractual relationship between the carrier and the customer;

- Letter from the Federal Tax Service dated March 21, 2013 - on the use of TTN forms when calculating income tax;

- Decree of the State Statistics Committee No. 132 of December 28, 1998 - approval of the TORG-12 form.

Why is it necessary to fill out primary documents correctly?

Any commercial organization operates for profit. From its amount, it is obliged to pay taxes and other contributions to the state. The calculation of their amounts depends entirely on the correctness of the primary documentation. If errors were made or violations were established, the organization may subsequently be subject to largetaxes than expected. For example, if documents confirming expenses that an organization has the right to deduct from the taxable base are incorrectly executed, the Federal Tax Service may not recognize them. In this case, the organization will have to bear the costs out of its own pocket, and not by including them in the final cost of production.

Sanctions for the absence or incorrect filling of documents

The lack of copies of primary documents can cause a wave of unscheduled inspections by the Federal Tax Service. Each detected violation may be subject to a fine. If the tax service sees fraud, criminal intent or an attempt to evade taxes in errors or lack of documentation, the organization will face more unpleasant consequences - fines, tax sanctions, administrative and criminal liability provided for by the articles of the relevant codes.

Recommended:

Outgoing correspondence: registration logs, accounting, samples, filling rules

Accounting for incoming and outgoing correspondence is part of the office work that must be maintained in any enterprise. How to properly format and maintain a correspondence log? What methods of its registration exist?

Rules for filling out UPD: types of services, procedure for registration with samples, necessary forms and relevant examples

There are many questions about the rules for filling out the UPD (universal transfer document), because there are a limited number of samples with already entered data. The tax authorities are accustomed to returning the paper for correction without explaining what exactly is incorrectly drawn up and how to correct the error

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

All Complaint Samples: Complaint Samples

How, where and what do they complain about? The concept of a complaint is widespread in Russian legislation. Now you can find sample complaints for any reason. But still there are problems of correct preparation, submission of such paper, and the expected result

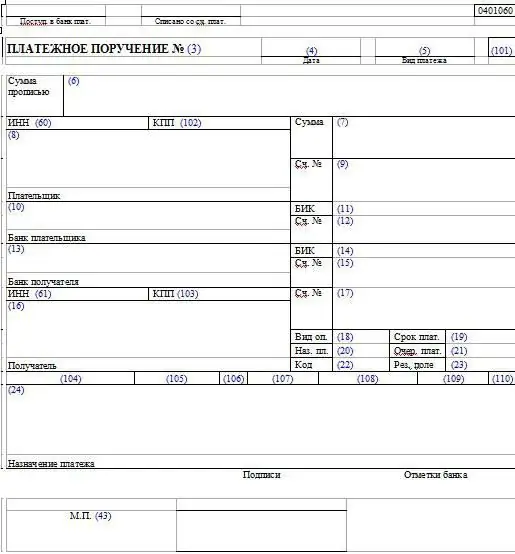

Samples of filling out payment orders. Payment order: sample

Most enterprises pay various taxes and fees to the budget. Most often this is done with the help of payment orders. How to compose them correctly?