2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-06-01 07:12:56

Sberbank of Russia offers individuals an impressive number of deposit programs. You can open an account both in rubles and in foreign currency. Most deposits are in euros or US dollars, but it is possible to save less common banknotes - francs, yen and pounds sterling. In the article, we will consider the conditions that Sberbank puts forward for deposit programs. Foreign currency deposits, despite the reduced percentage of remuneration, remain popular with the population.

Types of deposits

Sberbank always offers its current and potential customers a wide range of deposits with different conditions. This allows you to open a deposit account for different segments of the population, choosing the most suitable program for yourself. All existing foreign currency deposits can be divided into three groups:

- Terms - they differ in the short duration of the transaction. The deposit is opened for a short period (from 3 months).

- Long-term - imply the conclusion of a contract for a long time. The capital is placed up to 3 years, after which it can be extendeddeposit.

- Online. To open them, you do not need to visit the bank, just go to the online account via the Internet and send an application for opening a deposit.

Each of the programs has a number of advantages and disadvantages for a particular client. In order to place the capital with the greatest benefit, the goals and the desired result should be clearly defined.

Opening a deposit account

After being interested in placing funds for safekeeping in foreign monetary units, a potential client is looking for information about the procedure for concluding an agreement. What steps need to be taken to open a currency deposit? Sberbank requires a minimum of documents and time: you only need a passport or a document replacing it. The procedure will take no more than an hour. At the same time, an agreement will be signed on opening the deposit of interest and the minimum amount will be deposited into the account.

A bank client can open a foreign currency deposit even faster and easier. Sberbank offers an online service through which many banking services are provided. Holders of debit and credit cards and accounts have access to it. To send an application you will need:

- authorize in the Sberbank Online system;

- select the "Deposits" section;

- click on the deposit program you are interested in;

- fill out the form, indicating the deposit amount, the term of the contract and the details of the account from which the funds will be transferred;

- recheck the entered data and confirm the application via SMS.

The execution status can be monitored viaPersonal Area. After the completion of registration, the client has the right to perform any actions provided for by the current deposit program.

Features and benefits

Currency deposit in Sberbank for individuals is modern, profitable and convenient. By placing money on a deposit account, the client gets the opportunity not only to save it, but also to win on interest and exchange rate fluctuations. Some programs allow deposits and/or partial withdrawals.

Currency deposit opens the following opportunities for its owner:

- receiving money transfers in foreign denominations;

- fund conversion;

- transfers to other countries;

- payment for services;

- cash out;

- capitalization of interest.

It is convenient to perform any actions on the deposit using online services. There is also an automatic extension of the contract on the same terms.

Review of foreign exchange deposit products

For 2016, there are 9 programs that allow you to accumulate funds on the account of PJSC "Sberbank". Currency deposits are opened on different conditions, but their term is approximately the same - from 3 months to 3 years. There are also term deposits with a minimum validity period of 30 days. Interest rates increase with the increase in the amount and term of the deposit, but the greatest benefit can be obtained under the "Save" program.

Let's consider in the table a brief description of the deposits offered by Sberbank of Russia PJSC:

| Name | Deposit amount from | Minimum term | Replenishment | Withdrawal |

| Save/Save Online@yn | $100, €100 | 1 month | No | No |

| Top up/Top up Online@yn | $100, €100 | 3 months | Yes | No |

| Manage/Manage Online@yn | $1000, €1000 | 3 months | Yes | Yes |

| Multicurrency | $5, €5 | 1 year | Yes | No |

| International | GBP10K, SHF10K, JPY1M | 1 month | No | No |

| Savings account | Unlimited (in USD and EUR) | Indefinitely | Yes | Yes |

The remuneration is higher on those programs where withdrawal and replenishment functions are not provided. The more opportunities the client has to manage his capital, the lower the percentage.

Term deposits "Save" and "International"

The contract for these programs is valid from 1 month without the possibilityreplenishment or withdrawal. The contribution will be useful to those clients who are going to save and increase a certain amount of funds.

Although deposits are available for opening for a minimum term, the interest rate will be low (0.01%). For any currency deposit of Sberbank, the rule is typical: the longer the period of the deposit, the greater the reward. For example, under the “Save” program, the maximum percentage will be for a transaction duration of 1-3 years:

- in dollars - 1.35;

- in euro - 0.3.

For the "Save Online" deposit, the rate is slightly higher: 1.6% and 0.4% respectively. The remaining conditions are the same as the contribution of the same name.

The "International" deposit is similar in terms of conditions to the "Save" program. Only the currency and interest rates are different here:

- in pounds sterling from 0.05% to 1.75%;

- in yen from 0.01% to 0.55%;

- in Swiss francs - 0.01% regardless of the term and amount.

A special feature of the deposit is the method of accrual of remuneration - at the end of the term.

Replenish & Manage

These programs have more convenient conditions for those who are used to systematic savings. A deposit account is opened for a period of 3 months to 3 years. The maximum interest rates on foreign currency deposits of Sberbank in dollars and euros are respectively:

- "Replenish" - 1.1% and 0.2%.

- "Top up Online" - 1.3% and 0.3%.

- "Manage" - 0.85% and 0.05%.

- "Manage Online" - 1.1% and 0.1%.

Provision is made for capitalization of interest and payment of income to a separate account. Deposits are convenient in that the account can be replenished (cash from 100 dollars / euro, non-cash - unlimited). And the Manage program allows you to partially withdraw funds without closing your account.

Interest rates on "Multicurrency" and "Savings Account" deposits

Both programs are unique and interesting in their own way. For example, the “Multicurrency” deposit is opened in three monetary units at once: rubles, euros and dollars. Moreover, the minimum deposit is only 5 characters of each currency. The contract is valid from one to two years with the possibility of automatic renewal. Replenishment of accounts is provided: unlimited by non-cash, and when depositing cash - from 100 euros / dollars and 1000 rubles.

The main purpose of the deposit is to receive income from currency fluctuations. The client has the opportunity to convert funds an unlimited number of times at his discretion. The remuneration is transferred every 3 months to an additional account opened with PJSC Sberbank. Currency deposit in dollars brings from 0.01% to 0.9% per annum. In euro, the rates are more modest - 0.01-0.05%.

The "Savings Account" product was created for the free management of funds. There are no restrictions on either the validity period or the amount of deposits, deposits and withdrawals. Additionally, the client receives from 0.01% to 0.1% per month from the value of the balance on the account.

Other information

The owners of deposits are also interested in the issue of taxation. Will I have to additionally transfer funds to the Federal Tax Service, having a deposit with Sberbank PJSC? A foreign currency deposit in dollars, euros or other banknotes is taxed only at an interest rate of 9% or more. There are no similar values in any of the considered programs. This means that the owner of the deposit is not subject to taxation.

The client also has the right to close the currency deposit ahead of schedule. Sberbank does not impose fines or commissions on this procedure. The account holder freely withdraws the entire amount of the deposit and receives a percentage fee (usually minimal).

Sberbank offers many interesting programs for those who want to save and increase their funds. Currency deposits allow not only to receive monthly interest, but also to win on exchange rate fluctuations. If you invest wisely, you can make good money. The main thing is to carefully read all the conditions and choose the most suitable currency deposit for yourself. Sberbank will do the rest.

Recommended:

Currency accounts in Sberbank for individuals: how to open an account?

Savings Bank today offers its clients the registration of deposits, including opening foreign currency accounts in Sberbank for individuals. You can open deposits in euros, pounds, yen and francs. But the most popular is the American dollar, because depending on the stability of the economy, the ruble can become cheaper or more expensive, and the US dollar has firmly established its position in the currency market

Deposit "Seasonal" in VTB 24: deposit reviews for individuals, conditions

How to choose the most profitable deposit and what to look for? Deposit "Seasonal" bank "VTB 24": conditions and customer reviews

Interest on a deposit in Sberbank. The most profitable deposits for individuals in Sberbank

In times of economic uncertainty, many people want to save their money. This can be done in various ways: purchase valuables, hide money or invest it in a Sberbank account. This financial institution is the most popular among investors due to its stability

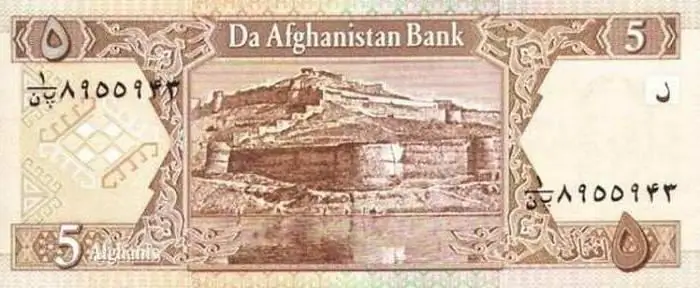

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article