2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

The world community does not include many countries whose monetary system has been based on the issue of the same currency for decades. Great Britain occupies the leading position in the list of such powers. For more than eleven centuries, gentlemen from the Old World have kept the English pound in their wallets.

History of origin of the name

Even long before the territorial and administrative structure of Great Britain acquired a distinct outline of a centralized great state, these banknotes had already begun to circulate on its lands. This name of the currency is far from accidental. There are several options to choose from. One of them is the "weight" option. It is believed that pence was originally minted from one pound of silver. It turned out about 240 coins. Sterling is the second name for the received metal banknotes. Hence the name of the currency that has come down to us.

There is also an intermediateunit. It's called a shilling. It includes 12 pence. Thus, each English pound consists of 20 shillings.

Gold coins and banknotes

For four centuries (from the 14th to the 18th), a bimetallic money circulation system has been operating on the territory of the country. In commodity-money relations there was a golden English pound and silver change shillings and pence. In addition to metal banknotes, paper banknotes were also in circulation on the territory of the state. The value of each banknote was backed by gold. This continued during the war between England and France, although it was then impossible to exchange banknotes for valuable metal. The restoration of the system of free and duty-free purchase and sale of gold coins using paper banknotes was put back into circulation in the twenties of the 19th century.

At the same time, a clear balance was established between the exchanged banknotes and stocks of valuable metals. This means that the issue of banknotes should not exceed the availability of gold. This rule was violated only during the economic crisis. There were three such moments. The Great Crisis of 1847, the First World Crisis of 1857 and the Luxembourg Crisis of 1866, which had a deplorable effect on the economy of England. To stabilize the financial situation, the country's parliament gave permission for the British pound, issued on paper, not to be properly backed by gold. That is, the issue of banknotes exceeded the allowable volumes.

Lossstatus and current situation

Until the beginning of the First World War, paper bank notes and gold coins were in circulation in the country. In 1914, the minting of metal banknotes was stopped, and those in circulation were withdrawn. At the same time, in order to cope with military expenses, the country's parliament began to issue treasury notes. Those, in turn, were withdrawn from circulation in 1928, and the national currency, the British pound, again came in their place. Even despite the crisis of the post-war years, the government of the country used only one lever of influence on the monetary unit - the restoration of the monetary system. Gold was again introduced into circulation, but not coins, but ingots. Backed by the precious metal, paper British pounds gained strength, but failed to become the leading reserve currency of world banking operations again.

The UK is currently part of the European Union. Therefore, it is not surprising that the euro is in circulation in the country. However, the British pound remains the only national currency. The country does not yet seek to switch to the euro. The UK explains this by the fact that in this step there is no benefit for the economic situation in the country. At the same time, for one British pound at a money exchange office, you can get about 1.2 euros.

Recommended:

The Syrian pound is the national currency of Syria

The article tells about the national currency of Syria, which is called the Syrian pound. Collected information about the history of the banknote, its description, the exchange rate against other world currencies, exchange transactions and interesting facts

British pound sterling: the history of appearance

The British pound is one of the world's oldest currencies. For the first time, it has been mentioned on British soil since 1666. In 1158, the sterling was appointed by King Henry as the national currency

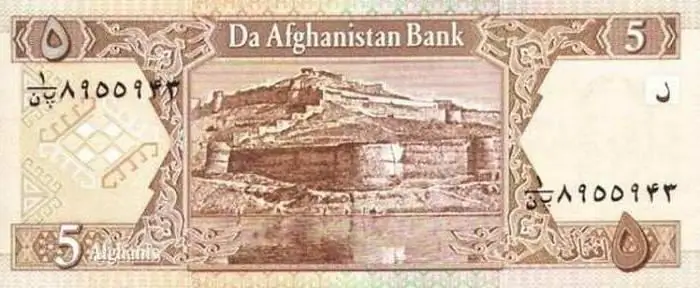

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article

UAH - what is this currency? National currency of Ukraine

Ukraine, as a sovereign state, has its own national currency, which is far from stable and subject to strong inflationary risks