2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

Not everyone knows that it is possible to return the money that was given to the state as taxes, or not to pay part of it. All working citizens can apply for this. To do this, you should receive a tax deduction.

Classification

Often a person receives only 87% of what he earns, and 13% is paid by the employer as a tax (personal income tax or income tax). This part can be returned in some cases legally. For example, when buying real estate, spending on treatment, training.

Tax deduction can be:

- Standard.

- Social.

- Property.

- Securities.

- Professional.

Standard deductions are provided under certain conditions. For example, if a person's income is not more than a certain amount, he has children.

Social deductions are given when expenses related to education or treatment have been made.

The third type is available when the taxpayer has sold or bought property. By the way, with a mortgage, people can return the interest on the loan.

For securities, deductions are provided if losses have been incurred on financial transactions with them.

On a professional tax deduction cancount some categories of people. These can be, for example, authors of literary works.

How to calculate?

The value of this amount leads to a decrease in the taxable base, which is the amount of funds from which the tax is withheld. There is an opportunity to receive from your state not the entire tax deduction, but 13% of it. There is a limitation. It says that there is no way to get more than what was paid in taxes. For example, 13% of the amount of 1000 rubles is 130 rubles. A person can receive such money only if he paid so many taxes in a year. There is also a certain maximum for the deduction established by law. When purchasing housing, for example, for 2 million 100 thousand rubles, this amount cannot exceed 13%, which is 273 thousand rubles. Only taxes that were paid at the specified rate are allowed to be returned.

If we consider the standard tax deductions for personal income tax, for example, in 2013, they are the same as those that were in effect in 2012.

Some examples

Deduction of 3 thousand rubles, for example, is given to the following citizens:

- Disabled WWII.

- Participants in tests related to radioactive elements and nuclear weapons.

- Servicemen who suffered in defense of the country.

- To participants in the liquidation of the consequences of Chernobyl, who received various diseases.

The amount of tax deductions for children this year also did not change compared to the previous year. They can get them:

- Parents (adopted or natural).

- Guardians, adoptive parents, trustees.

- Spouses of parents.

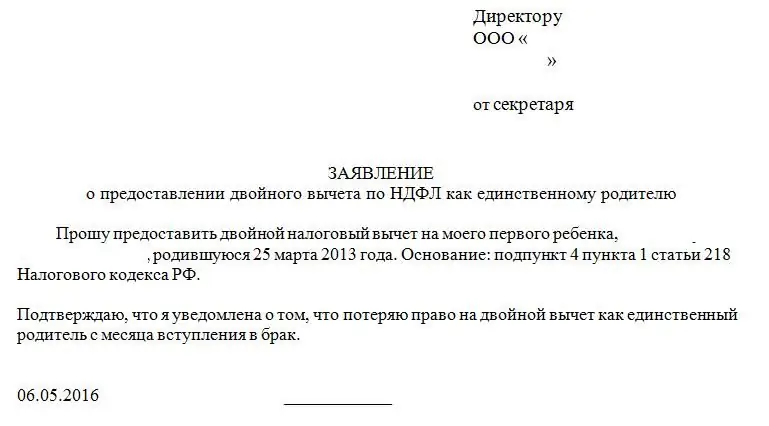

Single parents have the opportunity to receive a double deduction. The limit of income received by an employee at the moment is 280 thousand rubles.

To get a deduction for children, provide your employer with documents:

- Application according to the established model.

- Copies of their children's birth certificates.

- Certificate (this is the 2-personal income tax form) for the year.

- Documents on the child's disability (if any).

- Certificates from the places of study of children.

If for some reason the deductions were not provided, then you can get them for the next year. Submit all documents to the tax office, you will also need a declaration for the previous year (we are talking about the 3-personal income tax form).

There are many different deductions, learn about them all to see what you can qualify for.

Recommended:

List of documents for a tax deduction for an apartment. Property deduction when buying an apartment

Fixing a tax deduction when buying real estate in Russia is accompanied by significant paperwork. This article will tell you how to get a deduction when purchasing a home. What documents will need to be prepared?

Tax deduction at birth of a child: application, who is en titled to a deduction, how to get

The birth of a child in Russia is an event that is accompanied by a certain amount of paperwork. Parents acquire special rights when replenishing the family. For example, for a tax deduction. How to get it? And how is it expressed? Look for the answer in this article

Tax deduction for mortgage interest. property tax deduction

Today, not every citizen has enough free cash to buy an apartment. Many have to use loans. Targeted loans give the right to claim a tax deduction for mortgage interest, provided that the documents are executed in the territory of the Russian Federation

Property tax deduction for an apartment. Mortgage apartment: tax deduction

When buying an apartment, a tax deduction is required. It consists of several parts, but is invariably present and amounts to a significant amount. To work correctly with this aspect, you need to study its features

Tax rate for transport tax. How to find the tax rate for the transport tax?

Today we are interested in the tax rate for transport tax. And not only it, but in general taxes that are paid for the fact that you have this or that means of transportation. What are the features here? How to make calculations? What is the due date for paying transport tax?