2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-06-01 07:12:56

In the framework of this article, we will consider in detail the procedure for introducing a simplified tax system - the use of the simplified tax system. We will study the main criteria that a taxpayer must meet in order to switch to it. We will determine what documents need to be presented in connection with the transition, what to do if the right to benefit from simplification is lost. Answers to these questions in this article.

Definition

STS is understood as a popular tax regime, which implies a special procedure for calculating tax and replacing a series of payments with a single tax. This special mode is mainly aimed at small and medium-sized businesses.

This mode replaces the following taxes as shown in the table below.

| Organization | IP |

| Income tax | NDFL |

| Property | Property tax on objects that are used for business purposes |

| VAT | VAT |

It should be noted that maintenance responsibilitiesreporting and paying taxes for employees remain with both legal entities and individual entrepreneurs.

Advantages and disadvantages of the system

STS is attractive for businesses due to its fairly low workload and ease of accounting and reporting.

The advantages of the system are as follows:

- tax rates under the simplified tax system are lower than those of the basic;

- no need to provide accounting records to the Federal Tax Service;

- opportunity to reduce advance payments through insurance payments;

- labor intensity of reporting and tax calculation is reduced. Reporting is represented by only one declaration;

- when using the “income” object, careful cost accounting is not needed;

- year is a tax period;

- simplified bookkeeping and accounting;

- optimization of the tax burden;

- exemption from personal income tax for individual entrepreneurs;

- object of taxation can be chosen by an economic entity independently.

The shortcomings of the USN are as follows:

- restrictions on activities;

- impossibility to open branches;

- do not invoice;

- even if the company has a loss for the year, the tax in the form of a minimum amount must still be paid.

Who can apply?

All organizations and individual entrepreneurs can apply this special regime, if they do not fall under a number of restrictions.

The list of categories of taxpayers who cannot apply this special regime is given in the Tax Code of the Russian Federation:

- banks, pawnshops;

- organizations withbranches;

- budget companies;

- organizations operating in the field of gambling;

- foreign companies;

- when the share of other companies and their participation in the UK is above 25%;

- if the cost of the OS is more than 150 million rubles.

It is forbidden to apply the simplified tax system to those companies that are engaged in the following activities:

- produce excisable goods;

- mining and selling minerals;

- those who switched to ESHN;

- with over 100 employees.

Conditions for the application of the USN

Both organizations and individual entrepreneurs can use the simplified tax calculation option.

The conditions for applying the simplified tax system for organizations and individual entrepreneurs are somewhat different. There are restrictions on the number of employees (up to 100 people) and the condition of non-fulfillment of a number of types of work in which the system cannot be applied (clause 3 of article 346.12 of the Tax Code of the Russian Federation).

The criteria for losing the right to use this system are similar for them: the amount of income received in the course of work should not exceed 150 million rubles. (Clause 4, Article 346.13 of the Tax Code of the Russian Federation).

The transition criteria for a legal entity are as follows:

- received income for 9 months, which precedes the application of the simplified tax system, does not exceed 112.5 million rubles;

- residual value of fixed assets does not exceed 150 million rubles;

- legal entity has no divisions;

- participation of other companies in the authorized capital of the organization should not exceed twenty-five percent (except for NCOs).

For individual entrepreneurs, these restrictions are not used. Also for them the conditionthe achievement of maximum income for the year has not been established.

Transition order

There are two transition options, as shown in the table below.

| Switching to "simplified" along with registration | Switching to "simplified" mode from other modes |

| The letter on the application of the simplified tax system is submitted along with other registration documents. Consideration within 30 days is acceptable. | The transition can only be made next year. Notification must be sent no later than 31.12. |

If a company wants to change the object of taxes, then this procedure can also be done only next year. At the same time, you must submit an application to the Federal Tax Service before December 31.

Rates and settlement procedure

The formula for calculating tax using the simplified tax system is simple:

N=CHB, where SN is the tax rate, %

B - tax calculation base, t.r.

Possible betting options:

- with the object "income" the rate is 6%, it can be reduced to 1% in different subjects;

- with the object "income minus expenses" the rate is 15%, the rate limits can vary from 5 to 15% in different subjects of the Russian Federation at the local level;

- rule of "minimum tax": if according to annual results the amount of calculated tax is less than 1% of the amount of income, then the "minimum threshold value" is indicated and paid.

Calculation example

Initial data ontax using the simplified tax system:

- income for the year amounted to 25,000 thousand rubles;

- Expenditures amounted to 24,000 t.r.

Tax calculation:

- calculation of the tax base: 25000 - 24000=1000 t.r.;

- calculation of the amount of tax: 100015%=150 tr;

- minimum tax calculation: 250001%=250 tr.

- payable: minimum amount of 250k.r.

Institutional Benefits and Restrictions

After the introduction of the simplified tax system, some organizations and individual entrepreneurs are en titled to additional benefits. This point should be taken into account when deciding on the need to undergo and conduct a comparative analysis of the tax overload.

In accordance with the procedure for implementing the simplified tax system for enterprises in the Crimea and the city of Sevastopol, local laws can establish preferential single tax rates until 2021 (clause 3 of article 346.2).

Individual entrepreneurs who have passed state registration for the first time, who plan to engage in the scientific field, social work, can be considered preferential categories according to the law of the constituent entities of Russia. The advantage is that they set a tax rate of 0% for a period of up to 2 years (clause 4 of article 346.20).

But this category of IP is subject to special requirements in the form of securing at least 70% of the share in sales revenue acquired in the reporting period at a zero rate in the total amount of all income acquired by IP. And also the subject of the Russian Federation can set for such individual entrepreneurs a limit on income acquired during the year, but more than 15 million rubles.

Organizations and individual entrepreneurs using the simplified tax system have lower ratesinsurance payments for certain types of work. To receive such benefits, the type of work of an individual entrepreneur must correspond to the list indicated in subpara. 5.1 Art. 427 of the Tax Code of the Russian Federation.

The procedure for applying the simplified tax system

In the case of newly registered taxpayers, the 30-day period is established from the date indicated on the certificate. During this period, they must submit a notice of the transition to the simplified tax system. In this case, they are listed as "simplified" from the time they were registered with the tax authorities.

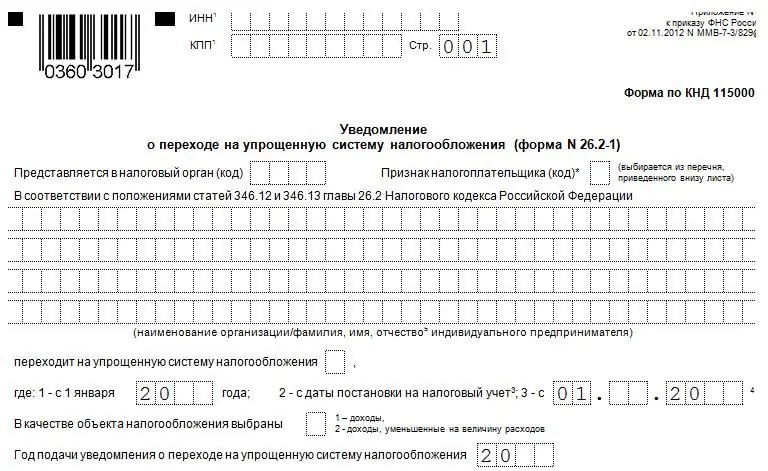

In accordance with the procedure for the introduction of "simplification", the taxpayer, who is already working on this system, should not take any action. If he has not violated the conditions giving the right to apply the simplified tax system, then he can continue to use the chosen tax system until he notifies the tax authority of the refusal. This notice is reflected in the photo below.

If there has been a violation of one or more of the mandatory criteria for filing applications under the simplified tax system, then the taxpayer loses the right to apply this tax system from the beginning of the quarter in which the discrepancy is found. Then he moves to the general tax system and must notify the tax office by sending a message in the form 26.2-2 before the 15th day of the first month after the start of the quarter.

The taxpayer can return to the simplified tax system no earlier than next year.

An entity that wants to apply the simplified tax system must notify the Federal Tax Service of its own decision. To do this, the Federal Tax Service at the place of registration of the organization(IP registration address) a notification in the form of 26.2-1 must be submitted. The notification of the organization indicates the amount of income acquired for 9 months and the residual value of fixed assets.

An example of filling out appeal 26.2-1 is shown below in the photo.

The transition is made only from the moment the new taxation period begins. But the application can be submitted no earlier than October 1 and no later than October 31. If the taxpayer delays filing applications, then he will not be able to switch to the simplified tax system.

The application must indicate the tax object: "Income" or "Income minus expenses".

Only from the beginning of next year, the taxpayer can switch from one type of taxation to another at the request of the USN. In this case, a notice in the form 26.2-6 must be submitted to the Federal Tax Service before 12/31.

A sample application is provided below.

The tax period is a year. The reporting period is a quarter, 6 and 9 months.

How to switch from the simplified tax system to other tax systems

The requirements for the transition from the simplified tax system to other systems depend on the circumstances of this transition.

TC RF approves a ban on replacing the USN regime with another tax system throughout the year. The exceptions are the following:

- "simplifier" should lose the right to apply the simplified tax system due to violation of those specified in Art. 346.12 of the Tax Code of the Russian Federation of criteria, in this case, until the end of the year, he will apply OSNO;

- transition to UTII for certain types of "simplistic" work from any date (in a situationcombination of different modes by type of activity).

If a "simplifier" wants to make the transition from the beginning of the year to other regimes, then he must submit a notice to the tax office in the form 26.2-3. It must be presented before 15.01.

In the event of the end of the commercial work of the company, which is carried out on the simplified tax system, it must provide a form 26.2-8 of the tax office.

Notification procedure

Notifications between the Federal Tax Service and the payer are drawn up in accordance with established standards. Forms of documents related to cooperation with the tax authorities on the implementation of the simplified tax system were approved in accordance with the Order of the Federal Tax Service dated November 2, 2012 No. ММВ-7-3 / 829 @.

A taxpayer can file a notice in three ways:

- during a personal visit to the head of the organization / individual entrepreneur or his representative on the basis of a power of attorney;

- sending a valuable letter with an inventory of attachments;

- electronic.

Object selection

The object of the USN are:

- income;

- revenue minus costs.

The economic entity can choose the object at its own discretion.

In accordance with paragraph 1 of Art. 346.13 the subject of the tax is selected before the start of the tax calculation period in which the simplified tax system is applied for the first time. At the same time, after filing an application for the transition to a simplified taxation system, the taxpayer can change the object of taxation by notifying the Federal Tax Service before December 20, whichprecedes the year in which the simplified tax system was applied for the first time.

The organization does not have the right to change the object of taxation for three years from the date of the introduction of the simplified tax system.

USN "income" is one of the simplest tax systems. You only need to keep track of operating income for tax purposes. When choosing the subject of taxation "income", the tax base is calculated without taking into account costs.

However, the organization maintains the current procedures for conducting cash transactions and submitting statistical reports, regardless of the choice.

The tax implies the following rates specified in art. 346.20 RF Tax Code:

- "income" - 6%;

- "income minus costs" - 15%.

Procedure of actions

Companies pay tax at their location, and individual entrepreneurs at their place of residence.

The algorithm of actions is as follows:

- Payment of advance tax payments no later than the 25th day of the following month. These advances can be credited against the payment of the tax itself. Important to clarify!

- Filling out a tax return using the simplified tax system is carried out according to annual indicators. For organizations - no later than March 31 of the post-reporting year, for individual entrepreneurs - no later than April 30.

- Paying tax charges. Organizations no later than 31.03 of the post-reporting year, and individual entrepreneurs - no later than 30.04 of the post-reporting year.

There are various ways to pay tax. It is possible to choose the most convenient.

Methods of paying tax in connection with the application of the simplified tax system:

- through a client bank;

- execute a payment order;

- receipt for non-cash payment.

Responsibility for violations

The following violations are possible.

| Violation | Consequences |

| Delay in filing a tax return due to the application of the simplified tax system for more than 10 days |

|

| Failure to pay duty |

20% to 40% fine |

Popular questions

The main frequently asked questions on the simplified tax system are presented in the table below.

| Question | Answer |

| If an organization ceases to operate, how is the reporting and fee paid? | Declaration in connection with the application of the simplified tax system is formed no later than the 25th day of the next month. The tax is paid no later than the deadline set for filing a tax document |

| What is the procedure for notifying the transition to another regime due to the loss of the possibility of using the simplified tax system? | By filing a notice with the Federal Tax Service within 15 calendar days after the end of the quarter in which the right was lost |

| What is the procedure for notifying the transition to another mode inconnection with the voluntary desire to transition? | You can switch to the new regime only from the new year, while providing a tax notice no later than December 31 |

Calculation example

For a more accurate representation of the calculation of the tax paid in connection with the application of the simplified tax system, we will give a specific example.

The table shows the initial data of Start LLC for 2018.

| Period | Income, rub. | Expense, rub. | Tax base, rub. |

| 1 quarter | 750000 | 655000 | 95000 |

| Half-year | 850000 | 690000 | 160000 |

| 9 months | 1250000 | 876000 | 374000 |

| Year | 1780000 | 950000 | 830000 |

Advance amount for 1 quarter:

950000, 15=RUB 14250

Advance payment amount for the half-year cumulative total:

1600000, 15=24000 RUB

We have the right to reduce the amount for the half year by the amount of advance payments for the 1st quarter:

24000 - 14250=RUB 9750

Advance amount for 9 months:

3740000, 15=RUB 56100

Total amount of advances for the 3rd quarter:

56100 - 14250 - 9750=RUB 32100

Calculationannual values:

8300000, 15=124500 RUB

Decrease by the amount of advance payments for all three quarters:

124500 - 14250 - 9750 - 32100=68400 rubles.

Thus, at the end of the year, Start LLC must pay 68,400 rubles to the budget.

Conclusion

Planning for the transition to the simplified tax system must be carried out in the company in advance, having studied all the possible conditions and restrictions that are provided for in Ch. 26.2 of the Tax Code of the Russian Federation. This will help avoid mistakes.

Recommended:

Notification of the application of the simplified tax system: a sample letter. Notification of the transition to USN

The result is formed by the supply market. If a product, service or work is in demand, then the notification form on the application of the simplified tax system in the contract package will not turn into an obstacle to business relations

How to make the transition to the simplified tax system: step by step instructions. Transition to the simplified tax system: VAT recovery

The transition of IP to the simplified tax system is carried out in the manner prescribed by law. Entrepreneurs need to apply to the tax authority at the place of residence

Simplified tax system. Betting system and features

The system of rates under the simplified taxation system for individual entrepreneurs. How to calculate the amount of tax and what expenses are not taken into account in the calculation of the "income minus expenses" system

Minimum tax under the simplified taxation system (simplified taxation system)

All start-up entrepreneurs who have chosen a simplified taxation system are faced with such a concept as the minimum tax. And not everyone knows what lies behind it. Therefore, now this topic will be considered in detail, and there will be answers to all relevant questions that concern entrepreneurs

Do I need a cash register for individual entrepreneurs with the simplified tax system? How to register and use a cash register for individual entrepreneurs under the simplified tax

The article describes the options for processing funds without the participation of cash registers (CCP)