2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

A new car is the dream of most car enthusiasts, but the cost of such a vehicle becomes a key problem on the way to fulfilling desires.

As a rule, at such moments, the only way out is lending. The most profitable option for those who want to buy a car are special banking products - car loans. The first question that arises for the future owner of the vehicle is which bank to contact. In this article, we will consider the conditions for a car loan at Sberbank. This financial institution is the most sought after by borrowers.

Where can I get a car loan?

Why does the vast majority of borrowers turn to Sberbank? First of all, because it is an old time-tested bank that has been operating for several decades. In addition, more than fifty percent of Sberbank's shares are controlled by the Central Bank of Russia, which cannot but inspire confidence in potential clients.

The concept of car loans

The purchase of a vehicle on credit involves the issuance of borrowed funds undercertain goals. In this case, to buy a car. At the same time, the guarantee of reimbursement of the issued loan is the pledge of the vehicle.

Thus, the borrower becomes the full owner of the car only after full settlement with the financial institution for the amount of the principal debt and the interest stipulated by the agreement.

A car loan at Sberbank can be issued not only for the purchase of a new vehicle, but also for a used car.

Loans at Sberbank

Currently, Sberbank's customer service includes a wide range of lending services with convenient lending conditions. This is largely why this financial institution is in great demand.

As for special programs for car loans, Sberbank has terminated such programs due to the crisis situation in the country since the end of 2014. Therefore, citizens wishing to purchase a new or used vehicle can use consumer credit.

Consumer car loan

To receive funds for the purchase of a vehicle, you can use one of the following products:

- A consumer loan without collateral, provided for any needs of the borrower. The maximum loan amount for a loan is 3 million rubles for a period of three to sixty months at a rate of 12.9 to 19.9 percent.

- Consumer loan for any needs of the borrower with the involvement of guarantors. The maximum loan amount is 5 million rubles for a period of up tofive years inclusive at a rate of 12.9 percent.

An important condition for the provision of such a loan is as follows: only a citizen of the Russian Federation aged 21 to 75 years can act as a guarantor. Moreover, the upper age barrier should not come before the payment of the last installment on the loan. The guarantor must have a steady income and a good credit history.

Interest rates on loans

When using consumer credit funds to purchase a new car, the interest rate will depend on whether the borrower is a Sberbank client, namely: whether he has a salary account with a credit institution.

According to the salary customers of Sberbank, loans are provided on more favorable terms:

- for clients receiving a pension or salary to an account opened with Sberbank, the interest rate on loans varies from 12.9 to 19.9 percent;

- for other citizens, the interest rate set by the bank will range from 13.9 to 19.9 percent.

Judging by the feedback from borrowers, preferential lending terms plus a maximum loan amount of five million rubles allow you to purchase any model of passenger car, both domestic and foreign, at a rate of 12.9 to 19.9 percent per annum.

Compared to other credit institutions offering car loans, a consumer loan at Sberbank with suchrates can be considered as the best offer.

Other loan terms

Since there is no special direction in terms of providing a car loan among banking products, you can purchase a used car with consumer loan funds provided by the bank without a down payment upon providing the minimum set of required documents. Moreover, the list of documents does not include the right to drive a vehicle.

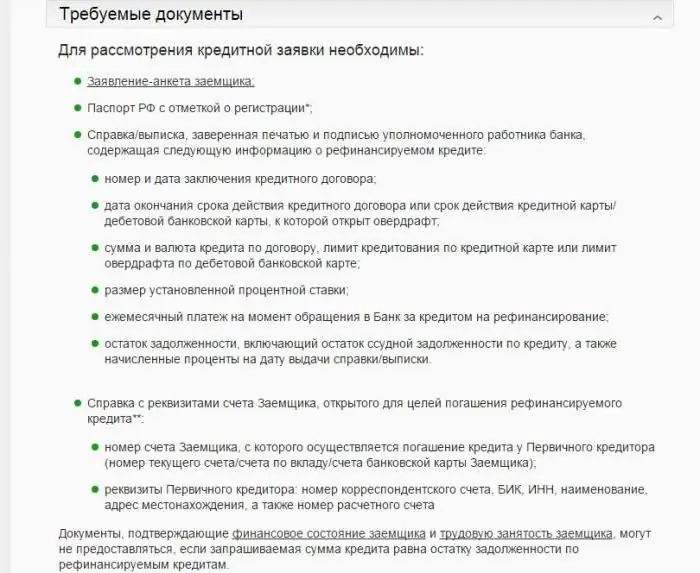

The list of documents required for obtaining a car loan with a guarantor includes the following documents:

- application-questionnaire sent online or filled out in writing at a branch of a credit institution;

- identity document of the borrower and guarantor;

- certificate from the place of employment of the borrower and the guarantor, a copy of the work book, as well as a document confirming their income (certificate 2-personal income tax).

To apply for an unsecured loan for any purpose, the following documents will be required:

- application-questionnaire, as in the previous case, written or sent online;

- loan application;

- an identification document of the borrower, and the passport must contain information about the registration of a citizen in the territory of the Russian Federation;

- certified copy of work book;

- certificate of the borrower's income.

Many borrowers note an important advantage of this financial institution - today Sberbank allows the issuance of a consumer loan in the presence of a temporaryregistration.

Can I use the car loan service at Sberbank today?

Similar lending services previously provided by Sberbank of Russia PJSC are now transferred to special programs of Cetelem Bank, which is its subsidiary.

Car loans through a subsidiary of Sberbank are represented by various programs, the difference of which is the essential terms of the agreement: the interest rate on the loan, the presence or absence of collateral under the loan agreement, the guarantee. After studying the basic conditions for providing funds at interest, the borrower is given the opportunity to choose the most profitable and convenient option for himself.

Special car loan programs at Cetelem Bank are represented by such tariff plans for car loans as "Partnership", "Ford Credit", "Standard", "Special". "Reliable" and other offers.

Depending on the terms of the loan and the model of the vehicle, interest rates in 2018 on a car loan at Sberbank range from 12.6 to 17.5 percent.

Special programs available to citizens wishing to purchase a vehicle can be found on the Cetelem Bank website.

General information on these types of loans contains the following points that may be of interest to motorists:

- The loan amount provided is up to five million rubles.

- Minimumcar loan rate - from 13 percent.

- The initial installment of a car loan at Sberbank is from 15 percent.

- Possibility to repay debt within five years.

Procedure for registration

To get a loan under one of the selected car loan programs at Sberbank for individuals, the borrower needs to do the following:

- Fill out an application form and prepare documents according to the list established by the bank.

- Submit documents to a branch of Sberbank or a car dealership cooperating with a credit institution.

- Get loan application approved.

- Select and issue a vehicle in a car dealership (at a dealer, manufacturer or its official representative).

- Take out an insurance policy with any company that provides auto insurance against possible risks, including theft, damage and other types of loss of the vehicle. (The list of insurance companies is available on the website of the credit organization).

- Sign a pledge agreement with the bank.

After the actions taken by the borrower, the bank will transfer the loan funds directly to the seller's account, and, if necessary, to the insurance company. The client picks up his car and fulfills the terms of the contract regarding the reimbursement of the funds provided. After paying the last installment, the borrower will only have to remove the encumbrance from the vehicle and place it in full possession.

Basic conditions for granting loans foracquisition of TC

General conditions for car loans at Sberbank of Russia are as follows:

- The loan is provided in Russian currency.

- The amount of loan funds varies from forty-five thousand to five million rubles.

- Loans are provided for a period of three months to five years without commission fees for issuing a loan. If the borrower has temporary registration, the loan is granted for a period not exceeding the validity of registration, except for citizens who are payroll clients or receive pension payments to an account opened with Sberbank.

- Mandatory execution of a pledge agreement.

- The insurance policy must include the following mandatory conditions:

- the presence in the policy of such risks as "damage" and "theft";

- for the risk of "damage", the beneficiary under the insurance agreement must be the borrower / insured, for the risks of "damage" and "theft" subject to the complete destruction of the vehicle - in the amount of the debt under the loan agreement.

The interest rate of a car loan at Sberbank is determined depending on the validity period of the drawn up agreement. Before signing it, you should check with the manager for the exact figure. So, the percentage of a car loan in Sberbank on a loan issued:

- for up to one year inclusive, provides for a rate of 14.5%;

- for a period of one to three years - 15.5%;

- from three to five years inclusive, the rate will be 16%.

Preferential terms for regular customers. In this case, the ratecar loan at Sberbank is reduced by 1 percent.

Requirements for borrowers

The basic requirements for potential car loan borrowers are not much different from the requirements for consumer loans, and include the following conditions:

- Russian citizenship.

- Age from 21 to 75 years old (at the time of payment of the last installment) and up to 65 years old if the borrower cannot prove income.

- Work experience of at least six months at the current place of work (for salary clients and pensioners receiving payments to the bank account - at least three months) and at least a year of total experience for the last five years, except for pensioners-clients of Sberbank.

- No co-borrowers required.

The list of documents required by a financial institution for car loans is somewhat wider and, in addition to the standard set, includes: a copy of the TCP, a document confirming payment for the purchase, an agreement with the seller. If a car loan at Sberbank is issued without proof of income, the borrower, in addition to a passport, will additionally need a driver's license or any other identity document.

Conclusion

Despite the fact that Sberbank now provides car loans through subsidiaries, the conditions and requirements for car loans are fully consistent with the main policy aimed at creating the most favorable conditions for providing loans.

Recommended:

How to return car loan insurance? Is life insurance required for a car loan?

When applying for a car loan, banks require borrowers to obtain life insurance and comprehensive insurance. But there are several options that allow you to refuse such policies by receiving the required amount of funds from the insurance company

Car loan or consumer loan: what is more profitable? Which loan to choose: reviews

According to statistics, the average cost of a car in Russia reaches 800,000 rubles. It is worth emphasizing that this figure may vary depending on the region. At first glance, it is clear that it is impossible for a simple layman to earn such money even in a year. As always, credit organizations come to the rescue. Often the population asks the question: "Car loan or consumer loan, which is more profitable?"

The most profitable car loans: conditions, banks. What is more profitable - a car loan or a consumer loan?

When there is a desire to buy a car, but there is no money for it, you can use a loan. Each bank offers its own conditions: terms, interest rates and amounts of payments. The borrower needs to find out about all this in advance by examining advantageous offers for car loans

On-lending in Sberbank loan, car loan: reviews. Is it possible to make on-lending at Sberbank?

Refinancing at Sberbank is a great opportunity to get rid of an "expensive" loan. What are the programs for on-lending at Sberbank today? Who can borrow and under what conditions? Read more about it

Car loan for a used car without a down payment - features, conditions and reviews

Now loans are gaining more and more popularity. People buy everything on credit: from household appliances to real estate. According to the latest data, a car loan and the conditions for obtaining it for used cars are of the greatest interest