2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

For the citizens of Russia, mortgage, on the one hand, is the only chance to find housing, on the other hand, long-term debt bondage. The crisis of 2015 deprived the majority of the opportunity to pay the first installment. For those who cannot solve the problem on their own, the banking sector has developed a budgetary lending program. For more information on what constitutes a state-supported mortgage (Sberbank of Russia), on what terms and to whom the loan is granted, read on.

Statistics

Mortgage in Sberbank with state support, the terms of which are different in each region, is very popular. In two weeks after the launch of the program (2015-18-03), more than 150 applications were submitted in the North Caucasus alone. Sberbank lends to clients who buy housing in a new building. The maximum loan amount will be 8 million rubles for the capital and St. Petersburg, for other regions - 3 million rubles. Housing is purchased only from legal entities in accredited real estate. Borrower risks are minimized. They do not require additional collateral. Insurethe object can be directly in the branch of Sberbank of Russia.

Mortgage with state support will be valid until the end of February 2016. During this time, it is planned to provide loans totaling 225 billion rubles. As of November 30, 2015, loans for 180 billion rubles were issued. 1.5 thousand applications each. Approximately 30% of Sberbank's mortgage products were provided under the new program.

Program Goals

- Stimulate the construction industry.

- Help citizens solve their housing problem.

Sberbank: state-supported mortgage

Loan conditions are simple:

- Down payment: 20% of the cost of housing.

- Term: 1-30 years (inclusive).

- Interest rate: from 11.9% in rubles.

- Minimum loan amount: RUB 45,000

- Maximum amount: from 3 to 8 million rubles. (depending on region).

A loan in rubles is issued against the security of the acquired real estate. Residents of the capital and St. Petersburg can count on 8 million rubles. Other citizens can get a loan for a total amount of 3 million rubles. You can choose an object among apartments under construction, finished new buildings or from accredited sellers. The date of delivery of the property does not matter. Documents for the selected premises should be submitted no later than 60 days after receiving a preliminary positive decision. Additionally, a credit institution will require you to take out life and he alth insurance for its client. Sberbank's minimum rate on state-supported mortgages is 11.9%. She isdoes not change after the registration of the object. But it is affected by the size of the down payment, the period of participation in the program, membership in a salary project, a “good” credit history in the past. No commission is charged for issuing a loan. Additional expenses may include: payment for life and he alth insurance services, appraisal of the acquired object, notarization of documents.

Requirements for the borrower

- Age: minimum 21, maximum 55 (women), 60 (men).

- Passport of a citizen of the Russian Federation.

- Experience at last job: 6 months.

- Total seniority: 12 months.

The client will have to involve co-borrowers (spouses, relatives and friends). This will help ease your credit burden. The more "assistants", the higher will be the total income, which determines the maximum loan amount.

Action algorithm

To apply for participation in the Mortgage with State Support (Sberbank of Russia) program, you must:

- Fill out the form, a sample of which is on the website of the financial institution.

- Collect a standard package of documents for all participants: a copy of the passport, employer data, 2-personal income tax.

- Provide papers to any branch of Sberbank of Russia.

- Wait for the bank's decision.

In parallel, it is necessary to collect the second package of documents, which concerns the acquired property. It is most often used as collateral. It is extremely rare for banks to agree to use other housing as collateral. For such an object, it is necessary to provide: a registration certificate, a contract of sale, a cadastral passport, a certificate of no debt on payments for utilities, information about the residents.

Members

In which banks can I apply for the product "Mortgage with state support"? Sberbank, VTB24, Gazprom, Deltacredit, Bank of Moscow, RSHB. The desire to participate in the program was expressed by 30 not only large, but also small banks. The share of state financial institutions, as well as Svyaz-bank, Absolut-bank, Vozrozhdenie, accounts for most of the loans of the planned 400 million rubles. More than half of this amount is going to lend to Sberbank. Mortgages with state support during the previous crisis of 2008-2009 operated only through VTB. The choice of financial institution does not affect the terms of the loan. The rules for receiving money are as follows. The borrower pays a minimum of 11.9% per year of the amount. The maximum compensation that banks can count on from the state is 5.5%. The Ministry of Finance allocated 20 billion rubles from the state budget to finance the project. Since the plan was not fulfilled by the end of 2015, the program was extended.

Results

Since the program "Mortgage with state support" (Sberbank of Russia) is still operating, it is too early to sum up the results. So far, we can only talk about the dynamics of real estate sales. So, since April 2015, almost all developers have noted a sharp increase in the number of signed sales contracts. Firstprogram participants began to collect documents in January last year, but the deal was postponed until the launch of a new product. At first, contracts were concluded with a minimum budget. The loan was taken by persons who counted on early repayment (for them, the rate was not so important), as well as those who signed contracts for a short period (3-5 years) in order not to overpay interest.

From the middle of the year, clients began to appear who had long been asking the price of housing in new buildings. Despite the reduced demand, every month the range of real estate is reduced. This is especially noticeable in objects in a high stage of completion, in which housing has been sold for several years.

Features

Most transactions are made through Sberbank. Mortgages with state support, of course, spurred demand for real estate. But there are still clients who, despite the strong fall of the ruble, are ready to apply for a loan even on standard terms. If earlier clients applied to Sberbank, because there was the lowest rate, now, when they are refused, they apply to other institutions, and not only to government programs.

The conditions of the program have also changed. Previously, it was possible to repay a loan up to the age of 75. Now a new threshold has been set - 60 years for men and 55 for women. According to re altors, the average age of the borrower is 25-35 years, and the contract is concluded mainly for 10-15 years.

Additional financial support

Is it worth taking a mortgage from Sberbank withgovernment support? Each potential borrower answers this question for himself. Developers also have to fight for each client. To do this, they develop their own loy alty programs. Some of them are more profitable than the Sberbank program.

For example, FGC "Leader" and Bank "Opening" launched a subsidy program not only by the state, but also by the developer. The conditions are as follows: the first year the client pays 8 or 10 percent per annum, depending on the amount of the down payment. Starting from the second year, the rate increases to 11.95% or to the rate offered by the bank, depending on the financial situation of the borrower. A loan can be issued for a maximum of 30 years.

GC "Leader Group" holds a campaign for residents of the capital. Buyers of real estate in the Leader Park quarter, the City of Happiness and Lobnya City microdistricts receive a 12% discount on the total cost of the property if the property is purchased under a mortgage. With which particular credit institution the contract will be concluded, it does not matter.

Khimki-Group additionally subsidizes the rate by one percent. That is, if a mortgage is issued under the state support program, then the client pays not 11.9%, but 11%. "City-XXI Century" and "Absolut-Bank" created an affiliate program for the purchase of housing in the "Colors of Life" complex at 11.5%. Urban Group launched the "Support with State Support" project, under which the rate is reduced by four percent for all participants.

Sberbank. Mortgages with state support: reviews

The biggestThe disadvantage noted by the participants of the program is a small selection of real estate objects. Borrowers accredited by Sberbank have higher housing prices. And if you buy an apartment through another company, the rate will increase. The second problem is the high down payment. Under the terms of the standard program, the borrower could pay 10% in advance. Now this figure has increased to 20%. This means that if earlier a person could count on a "kopeck piece" in a residential area, now a one-room apartment or a studio apartment is hardly affordable for him. Another stumbling block is the interest rate. In fact, it increases by about 1%. We will calculate the mortgage with state support. Sberbank is ready to provide a loan to a client at 11.9%. At the same time, a mandatory condition for concluding an agreement is life insurance of the borrower for at least 1 year. After 12 months, the borrower must renew the insurance, otherwise the rate will increase to 12.9%.

At the same time, borrowers note positive aspects. Firstly, at the preparatory stage, the bank manager deals with all the paperwork. Clients appear exclusively for the signing of the contract. Secondly, even taking into account insurance payments, the monthly payment is slightly higher than the rent for a similar apartment.

In the bottom line

The budget program allows you to purchase real estate at a preferential percentage (from 11.9%) for up to 30 years. Borrowers have the right to use maternity capital to cover part of the debt, and then receivetax deduction. But the program has its drawbacks. First, the limited number of participating banks. There are only 30 of them. But in small provincial cities, de facto, you can apply only to VTB24 and Sberbank. The second is a 20% down payment. For comparison, in TransKapitalBank, within the framework of the same state program, you can get a loan by paying 15% as an advance. On the other hand, the more money a potential borrower makes as a down payment, the lower the interest rate he can count on.

Recommended:

Which bank gives a mortgage on a room: lists of banks, mortgage conditions, a package of documents, terms of consideration, payment and the amount of the mortgage loan rate

Your own housing is a necessity, but not everyone has it. Since apartment prices are high, when choosing a prestigious area, a large area and the cost increases markedly. Sometimes it is better to buy a room, which will be somewhat cheaper. This procedure has its own characteristics. Which banks give a mortgage on a room, is described in the article

State bank. Banks with state participation

State banks - the "fifth wheel" of the economy or a necessary financial institution? What are the features of the work of these institutions in Russia?

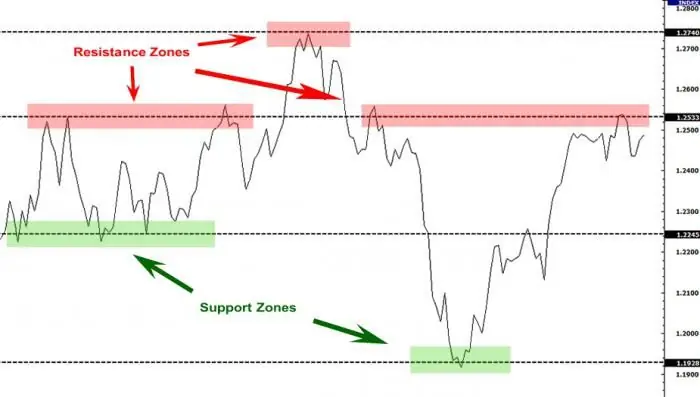

Support and resistance level. How to trade support and resistance levels correctly?

Support and resistance levels are the dominant concepts of the technical analysis of the foreign exchange market. Based on them, a large number of trading strategies have been developed, despite the fact that the lines belong to the category of inaccurate instruments

Mortgage with state support. Rosselkhozbank: mortgage conditions, reviews

Modern youth will be helped out when buying real estate by a mortgage with state support. Rosselkhozbank also implemented such a program. Thanks to her, a profitable mortgage is now available to almost everyone

Mortgage with state support: conditions for obtaining

Sadly, but in our country only a small percentage of the population can afford to purchase housing without loans and debts. What to do for those who have no money, but need to buy a house? Take out a mortgage. There are many options, but the most interesting one is the state-supported mortgage