2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Housing is the main problem for many young families. And it's natural! How can you buy an apartment / house on your own, when the cost of real estate is growing inexorably, and wages remain practically at the same level. Then there is only one answer: get your own housing thanks to the mortgage programs of banks.

Yes, many families are afraid to get involved in this bondage. After all, sometimes interest rates on loans break all the limits of what is permitted. So, some borrowers who bought housing, for example, for 3 million rubles, end up having to pay for 5-6, or even more million. Naturally, no one wants to pay such sums "down the drain".

The state, wishing to help young families realize their dream of acquiring real estate, has introduced a new product. It's called a government-backed mortgage. "Rosselkhozbank", not wanting to lag behind many of its competitors, hastened to implement such a proposal. What came of it, you can find out further.

Use cases

Unlike conventional loan programs, you can not buy an apartment on a mortgage with state support in any house. So, such a purchase is permissible only in new buildings (regardless of whether the house is completed or not), provided that it is sold by a legal entity. Moreover, it is important to note that even meeting these two requirements is not a reason to give borrowers a soft loan. After all, a mortgage loan with state support is issued only for the purchase of apartments in houses built by a state-accredited developer.

If it is understood that a mortgage with state support from Rosselkhozbank will help when buying an apartment, potential borrowers can first familiarize themselves with the list of buildings in their city where purchases under this preferential program are acceptable. To do this, they just need to go to the official website of a financial institution, find the "Mortgage" tab and study the material presented. The second option to get acquainted with apartments available for such lending is to contact the bank branch itself.

Offer Benefits

Mortgage with the state support of Rosselkhozbank is not only low interest rates on a loan for the purchase of real estate, but also:

- A fixed rate for the entire loan period. Its size is from 11.3% per annum.

- No loan fees.

- Possibility of prematuredebt coverage at any time.

- Availability of confirming your income in total in the form of a bank.

Mortgage in Rosselkhozbank: terms and conditions

Many potential borrowers want to know, first of all, about the conditions for providing such a soft loan to buy an apartment. So they are:

| Interest rate | From 11.3% p.a. |

| Loan currency | Russian rubles |

| Loan amount |

100 thousand - 3 million rubles for regions; 100 thousand - 8 million rubles for residents of Moscow and the Moscow region, St. Petersburg and the Leningrad region |

| Credit period | Under 30 |

| Having own funds | From 20% of property value |

| Fees | Not available |

| Mortgage Collateral | Deposit of purchased property |

| Insurance | Compulsory insurance: object of purchase, life and he alth of the borrower |

| Need for co-borrowers | Husband / wife must act as a co-borrower, you can additionally attract up to 3 people. This will provide access to a larger loan amount |

| Application processing time | Up to 5 working days |

| Validity period of approved application | 3 months |

| Disbursement of loan funds | One time full amount |

This is what Rosselkhozbank offers! Mortgages, the conditions and reviews of which are quite positive, will appeal to almost every borrower.

Value of interest rates

According to the preferential program of mortgage lending, the loan is provided at an interest rate of 11.3% per annum. However, if the borrower fails to fulfill certain requirements of the bank (for example, in the absence of the necessary insurance), the lender has the right to increase the amount of interest by 7 points. As a result, the loan will be calculated at a rate equal to 18.3% per annum. These are the conditions provided by Rosselkhozbank!

Mortgage with state support: conditions for the collection of documents

To qualify for a mortgage from Rosselkhozbank, you should prepare and submit the following list of documents to an employee of a financial institution:

- Filled-out application in the form of a bank.

- Identity document. This is a passport of a citizen of the Russian Federation or a special document of military service.

- For male borrowers under the age of 27 - a military ID or registration certificate.

- Documents showingmarital status/children.

- Proof of employment and sufficient income.

- Documents for the acquired property.

In some cases, the bank has the right to change the list of required documents.

Requirements for borrowers

So what should be the borrower to meet the requirements of an institution called "Rosselkhozbank"? Mortgages with state support, which not everyone has the right to receive, are issued only to a certain circle of people. So, potential borrowers must meet the following requirements:

- Age of the client is from 21 to 65 years. The maximum age is indicated at the time of full coverage of mortgage payments. That is, having taken a mortgage at the age of 60, the borrower has the right to choose a loan term of only 5 years.

- Having Russian citizenship.

- Having a certain length of service:

- At least half a year at the last place of work and from a year during the last 5 years.

- For recipients of wages on the card of "Rosselkhozbank" or with a positive credit history in this institution: from 3 months at the last place of employment and from 6 months of the total "working" period for the last 5 years.

- Clients who receive a pension on the card of this bank are not subject to the requirement of a mandatory work experience of 1 year.

- Citizens running private farms must provide an entry in the household book of the local government about their household plots within 12 months at the time of applying for a loan.

Registration in Russia at the place of residence or stay

Service Option

According to the presented mortgage product, the borrower will be obliged to pay loan payments in equal installments throughout the entire term of the loan. If you wish to repay the loan ahead of schedule, he will be required to submit an appropriate application and ensure that the required amount is available in the account by the time of the next monthly payment. A big plus of the proposal under consideration is that additional commissions and payments for early debt repayment are not provided.

Now we know what a government-backed mortgage is. "Rosselkhozbank", reviews of which are mostly positive, proved to be on the best side, offering the issuance of such a loan even to owners of personal subsidiary plots. And this is a certain advantage in relation to other financial institutions!

Recommended:

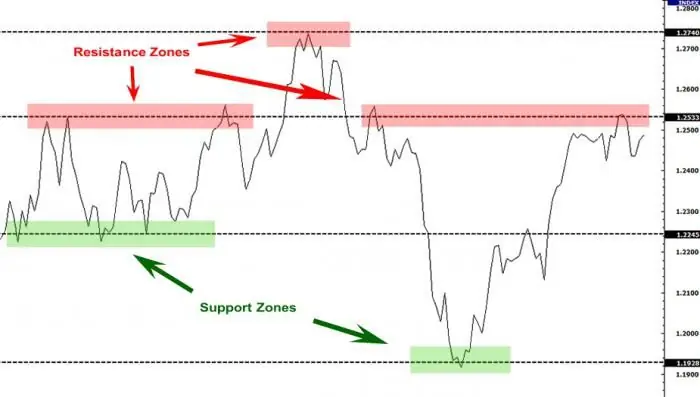

Support and resistance level. How to trade support and resistance levels correctly?

Support and resistance levels are the dominant concepts of the technical analysis of the foreign exchange market. Based on them, a large number of trading strategies have been developed, despite the fact that the lines belong to the category of inaccurate instruments

Mortgage with state support: Sberbank of Russia. Feedback on the program and conditions of participation

For the citizens of Russia, mortgage, on the one hand, is the only chance to find housing, on the other hand, long-term debt bondage. The crisis of 2015 deprived the majority of the opportunity to pay the first installment

Geodetic support of construction. Topographic survey and support

Correction of errors is an additional cost, the investor will not be happy. That is why they resort to the help of specialists in geodetic support of construction. This is the main reason for using their services. It's worth it. The building material will be exactly the one indicated in the estimate. All payments will pay off due to the lack of restoration measures

Maternity capital obligation. Mortgage under state support

Today, many parents are puzzled by the question: "What is the obligation of the borrower to maternity capital?" You can find this and other useful information in this article

Mortgage with state support: conditions for obtaining

Sadly, but in our country only a small percentage of the population can afford to purchase housing without loans and debts. What to do for those who have no money, but need to buy a house? Take out a mortgage. There are many options, but the most interesting one is the state-supported mortgage