2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:31

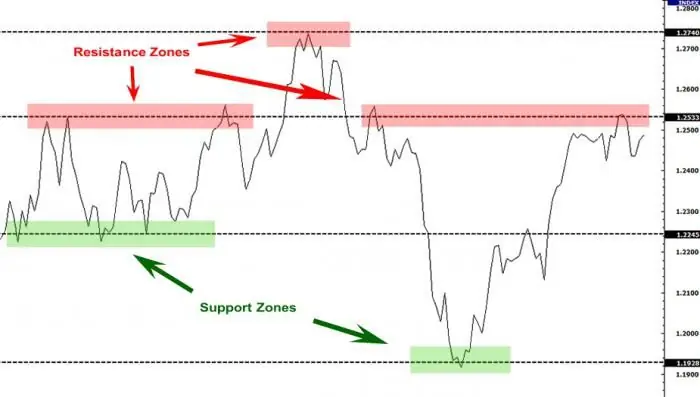

The level of support and resistance is the basis of technical analysis, concepts that are familiar not only to professional traders, but also to beginners. As practice has shown, prices for trading instruments change within a clear price channel. Its upper limit is the resistance level, and the lower limit acts as a support line. Sometimes straight lines flow smoothly from one to another, performing completely opposite functions. Trading systems based on building levels are very popular. This is due to the simplicity and accessibility of the chart analysis tool.

The subtleties of building levels: the psychology of trading

The level of support and resistance is built on the basis of reversal zones on the chart, also known as pivots. The construction of lines can be carried out after the formation of only one pivot point. When the price, after a reversal, again reaches the previous high or low and cannot break through it, this is pure psychology, whichdue to the uncertainty of market participants in their forecasts and determines the further direction of the price. Ultimately, the price breaks the level and follows the trend, or reverses, bouncing off the extreme, and goes in the opposite direction. The more times the price of an asset bounces off a certain level, the more power it will have. If you build a graph, some kind of beacons will form. They signal the presence of areas in which the price will behave in a manner characteristic of the pattern.

What are support and resistance levels?

The support level is a line that the price is unable to overcome in a downtrend. This is a certain point that is perceived by traders as a place of a successful entry into the market. When the price reaches the mentioned mark, traders consider long positions. There is a huge number of pending orders in the area, after the activation of which the price goes south. The resistance level is a similar line, but already the one that the price is not able to break through during the northern movement. Resistance is considered a profitable area for opening short positions. In the area, it is customary to set a huge number of pending orders, the triggering of which pushes the price down.

Specifics of working out levels

Every trader should be aware that the level of support and resistance is a very subjective concept that does not differ in characteristic accuracy. Clear lines on the chart rarely work. Commonorientation to certain zones when making trading decisions. Support and resistance zones are a price range in which a large number of orders are concentrated. The situation is caused by the use of identical methods of technical analysis by most traders in their trading strategies. The dominant number of market participants choose similar entry points to the market, which determines the price movement. When the price crosses one of the levels, there is a clear signal to buy or sell an asset, which is facilitated by the acceleration of movement at a certain point in time. The prerequisite is the mass closing of orders on stop orders, which were focused on the reverse movement. When learning how to determine support and resistance levels, you need to take into account the fact that the price moves quite often from one channel to another, which determines the transformation of support into resistance and vice versa.

Unity of opinion is the key to successful trading

Support and resistance levels (the indicator helps to determine them as accurately as possible in a matter of seconds) are visually perceived by almost all participants in the currency market. These are lines that hold back the price movement in a certain range for a certain period of time. Areas are always viewed by traders as potentially profitable market entry points. Unity of opinion turns the price in the opposite direction. The ease of using lines in trading is determined by history. Correct technical analysis works in 90% of situations. Even when positionedextremums at different levels, the run between them turns out to be insignificant, and the efficiency of trading does not fall.

The strength of the levels and its impact on the price

The level of support and resistance can have completely different strengths. The parameter will depend on how often and how exactly the price reacted to the line. The more bounces from levels in history were formed and the stronger impulses were formed as a result of contact with the price, the more power the technical analysis tool will have and the more likely it is that the price will not be able to break through the range again. When the price over and over again ignores the lines, we can say that their use in trading according to the standard will be ineffective. The attention of currency market participants is attracted by those zones of concentration of orders that alternately play the role of both support and resistance. The strength of the levels allows you to make the most accurate forecast regarding further developments.

Does foundation matter?

Trading when important lines are broken or taking profit on a rebound is very simple, as it does not require an analysis of fundamental factors. The reaction of the price to a certain value can be due to several factors at the same time. The prerequisites may be orders to buy or sell, the prevalence of opinions that the market has already exhausted itself, or hopes that there are forces to continue moving. If there is information from analysts explaining the reasons for a rebound or a breakout, we can say in advance thatshe is nothing more than a bluff.

Subtleties of construction or rules that are forbidden to break

Trading strategy, in which support and resistance levels play a dominant role, comes down to buying from support lines and selling from resistance. Sometimes a bet can be made on the breakdown of key lines. The ability to benefit from basic technical analysis is based on the ability to correctly build key lines. Ideal lines within which you can profitably enter the market must meet the main criteria. Otherwise, the levels of support and resistance, which are not recognized by Forex, will lead to the drain of the deposit. The line from which the price of a trading instrument bounced at least two times is considered to be a working and priority line. The more the price reacts to certain price indicators in an identical way, the higher the strength of the levels will be. Levels that have shown themselves well in history, in comparison with those that have worked out relatively recently, have a secondary role.

Permissible errors

Neither a professional trader, nor the best indicator of support and resistance levels is able to build up to a point. Experienced market participants are well aware that the price quite often breaks through the channel, and then rebounds from its upper or lower border with renewed vigor and follows in the opposite direction. Situations are allowed when the price simply does not reach the levels, but stillrevolves rapidly in the opposite direction. These inaccuracies and errors must be taken into account when using tools in trading. When the levels break through the price several times, first in one and then in the other direction, they begin to be ignored by the majority of market participants, and their use in any strategy becomes ineffective. Given the lack of point accuracy, the lines make it possible to trade with a stop-to-profit ratio within 1:3, or even 1:4 or even more.

Building levels at different time intervals

The most effective and less risky trading is when a trader undertakes to build a chart simultaneously on several time intervals. This approach allows you to see the market situation as clearly as possible and, therefore, helps you make the right trading decision. Buying or selling an asset will be accompanied by minimal risks when the levels from different timeframes match. The strategy will avoid opening deals against the trend, which will increase the chances of making a profit. You need to pay attention to the fact that the levels will not always be purely horizontal. It is allowed to overlay diagonals with a slight slope on the chart. Clear support and resistance can take place in the terminal not only during flat periods, but also during downtrends and uptrends.

Comparison of levels and other technical analysis tools

An effective approach to trading is considered to be when the levels of support and resistance (an indicator of theirdraws on a graph within a few seconds) are compared with other analysis tools. We can talk about the use of option levels in trading, which show price labels with the maximum number of orders to close deals at profit. As an option, it is allowed to overlay Gann angles and Fibonacci levels on the chart. We welcome indicators that can show the amount of accumulated funds within each price range. To get stable profits, it is not enough to know how to determine the level. You need to be able to track additional signals. The probability of the price hike from the level both in the south and in the north is exactly 50%. Hoping for luck in trading is unacceptable. The forecast must necessarily be supported by at least three powerful signals, which are almost impossible to refute. Understanding how to determine support, resistance levels only improves, but does not form a strategy.

Recommended:

Trade union - what is it? Russian trade unions. Law on Trade Unions

Today, the trade union is the only organization designed to fully represent and protect the rights and interests of employees of enterprises. And also able to help the company itself control labor safety, resolve labor disputes, etc

Best support and resistance indicator for MT4

This article will tell you what support and resistance level indicators are, and why it is better to determine them yourself

Heat resistance and heat resistance are important characteristics of steels

Ordinary structural steels, when heated, abruptly change their mechanical and physical properties, begin to actively oxidize and form scale, which is completely unacceptable and creates a threat of failure of the entire assembly, and possibly a serious accident. To work at elevated temperatures, materials engineers, with the help of metallurgists, created a number of special steels and alloys. This article gives a brief description of them

How to identify support and resistance levels

Support and resistance levels are the most important tools that are used to analyze the Forex currency market. They are an important part of almost every trading strategy, and their definition plays an important role

How child support is calculated. Formula and example for calculating child support for one and two children

Helping loved ones who cannot take care of themselves on their own is reflected in the legislation of the Russian Federation. The state created alimony as a protection mechanism for low-income relatives. They can be paid both for the maintenance of children and other close relatives who cannot take care of themselves. Read more about how child support is calculated