2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

For some time now, every Russian has the right to dispose of his savings for old age, namely: to leave part of the pension, called funded, in the state pension fund, or to entrust hard-earned funds to a private company. As a rule, profitability is higher for non-state funds. But most citizens are in no hurry to trust savings to such companies.

Why you need to know

Firstly, in the minds of many Russians, state means stable. And private firms appearing in large numbers do not inspire confidence. Secondly, there are so many changes in this legislative area that it is sometimes very difficult to keep track of them, so future pensioners decide to leave everything as it is. Thirdly, due to the habit of postponing everything for later or hoping for "maybe", people simply do not deal with these issues. For young working citizens, the opinion is typical that "you still have to live until retirement." Although time passes quickly, and the moment of retirement is not far off.

The popularity of pension funds

When deciding to manage your savings on your own and entrust them to a private company, you first need to study the profitability rating of non-state pension funds. Today, such information can be found in many publications. Here is what the rating of pension funds for 2013 looks like according to one of them. The companies participating in the comparison were evaluated by the level of return on investment. The first place is occupied by NPF Transneft with a percentage of 16.9%. Silver goes to a company with the sonorous name "Prosperity". The power industry fund closes the top three with a return on investment of 10.9%. The fourth place belongs to NPF Lukoil-Garant, the fifth place belongs to NPF Sberbank with a yield of 9.26%. The rating agency "Expert RA", which studied the performance of companies, gives the sixth place to "Norilsk Nickel" with a numerical indicator of 9.3% per year. Close the rating of non-state pension funds of Russia "Surgutneftegaz", "Telecom-Soyuz", "Gazfond" and VTB "Pension Fund".

Other performance indicators for companies

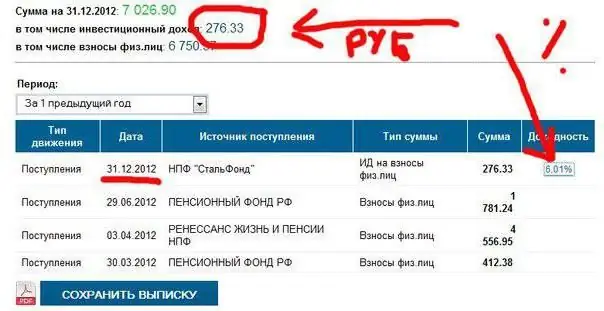

The previous rating of pension funds was compiled on the basis of an assessment of the level of return on investment, that is, the effectiveness of managing pension savings. But there are other criteria for analyzing the work of the company. For example, the reliability rating of pension funds. This indicator has three varieties: the highest level of reliability, very high and high. Highest rating in the rankingreliability for 2013, according to the National Rating Agency, received funds: "Welfare", "KIT Finance", "Sberbank", NPF of the electric power industry. These are companies that, even in the constantly changing and unstable conditions of the economy, keep their obligations. The middle niche in the "reliable" rating is occupied by: "Neftegarant", "Stalfond", "Sberfond RESO", "Doverie", "Uralsib". The rating of pension funds ends, according to the same National Agency, with funds with a high level of reliability - Blagovest and Vneshpromgarant.

Additional criteria for choosing an NPF

However, not only the rating of pension funds is decisive in choosing a particular company. You need to find out how long the company has been in existence. As a rule, the older she is, the more trust she deserves. Pension funds must obtain a license before starting their activities. These licenses are issued for a fixed period, but there are also unlimited ones. In addition, when evaluating the work of private funds, such indicators as pension savings, pension reserves, which constitute the property of the company, are taken into account. The criteria for the work of a particular NPF is the number of clients participating in the compulsory insurance system, as well as those who have entrusted their pension savings to this company. The higher these or other indicators, the more reason to trust the chosen fund. When comparing company performance, it is advisable to be guided by data for several years, and not for one year.

Guarantees

The activity of commercial funds is regulated by the current Russian legislation. In addition, in 2012, after the adoption of the relevant regulatory legal acts, the number of non-state pension funds was halved and amounted to just over a hundred. Mostly the largest companies remained. State control over such firms is tightened year by year. So the Russians need not be afraid for their money. It should be remembered that the location of pension savings can be changed once a year. To do this, you need to write an application to the Pension Fund Administration. An agreement is concluded between the future pensioner and the company, which is also a guarantee of the reliability of relations. The main thing is to take an active part in shaping your future pension today. Earn long service, have a salary with the necessary contributions to the pension fund and profitably place the funded part of the pension in income funds.

Recommended:

To whom are the tops, and to whom are the roots: how is the loan divided during a divorce?

Many Russian families at the initial stage of their existence enter into such a responsible and long-term project as the purchase of housing in a mortgage. Quite often the cell of society disintegrates before the main credit of all life has already been given to the bank. How is a loan divided during a divorce and what outcome can you expect in different life situations?

What does it mean to freeze pension savings for a year? What threatens the freezing of pension savings?

Retirement savings allow citizens to influence their incomes, and the economy to receive investment resources. For two years in a row they succumbed to temporary "conservation". The moratorium was extended to 2016. Read more about what it means to “freeze pension savings” and how it threatens the country's economy and population, read on

"KIT Finance" (non-state pension fund): reviews and place in the rating of pension funds

"KIT Finance" is a non-state pension fund that is of interest to many citizens. Can he be trusted? What do members and staff think of the organization? How reliable is this fund?

NPF "Stalfond": rating among other funds. Non-state pension funds

Choosing a non-state pension fund is not as easy as it seems. There are many similar organizations in Russia. One of them is "Stalfond". What are her pros and cons? How good is the company? What is the place in the rating of NPFs in Russia?

How to find out your pension savings. How to find out about your pension savings according to SNILS

Pension savings means funds accumulated in favor of insured persons, for which a part of the labor pension and / or urgent payment is established. Any resident of Russia can regularly check the amount of deductions. Read more about how to find out your pension savings