2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:33

Oh, the Internet! Having appeared as a means of transmitting information, it has rapidly transformed into a place for dating, games, and trade. And now, almost every second user has his own electronic wallets to pay for the services, services, goods provided. How not to get lost in numerous payment systems? Deal with their difficult, at times, rules? And in the end, how to choose one system, but such that the service is understandable, payments are made in the shortest possible time, and funds can be transferred to a card, bank account?

Of all Internet payment systems, QIWI holding can be singled out. Comfort, maximum financial transactions, a wide range of possibilities are the main characteristics of an electronic wallet familiar to many brands. Opening a QIWI personal account is as easy as launching a browser.

Introduction

The system has a very simple and accessible website interface. Not a single page is overloaded with unnecessary information. QIWI.ru is an uncomplicated domain name, by clicking on which the userbegins his acquaintance with one of the simplest payment systems in the terms and conditions.

The main page of the site contains the "Create Wallet" icon. This is a link to a simple registration page. The QIWI personal account will become available to the user after entering the phone number and a combination of numbers in the captcha. Of course, the future client must agree to the terms of the offer. By clicking on the "Register" icon, the user is taken to a page prompting you to create a password and enter the code sent to the subscriber's phone. This ends the QIWI requirements. Login to your personal account will become available when you enter your phone number and password.

Invoices

First login to your personal account QIWI opens a page with a list of wallet replenishment options. There are quite a few ways to do this, among them:

- crediting funds using a bank card, its number is easy to link to a wallet account on another page of the site;

- cash transfer through terminals, ATMs, communication stores;

- opportunity to recharge online using mobile operator account;

- transfers through payment systems.

The most convenient and fastest option is to transfer money online to a QIWI wallet. The personal account, however, allows users who do not have an account in world currency equivalents to get acquainted with the addresses of terminals in any, even the smallest, settlement in Russia and the CIS countries. To do this, on the website of the payment system there is a section "On the cardcities". By entering your location in the search bar, the client will immediately see the service points of the financial holding. The scale map shows not only the icons representing the terminals, but also their exact address.

Naturally, each method of replenishment takes some time, and a certain percentage of the commission is removed from the transferred amount. Its size is from 0 to 10%. The most expensive way to replenish an electronic wallet is to transfer funds from the accounts of mobile operators.

Withdraw money

Having an account, that is, a QIWI personal account, the user can easily not only replenish accounts: withdrawal of world currency equivalents from the wallet by transferring to a bank card or account is available to every client of the payment system.

QIWI commission is one of the lowest among Internet financial holdings. From 1.6 to 2.0% plus a fixed fee of 50 rubles - a fairly small fee for an instant transfer and the ability to withdraw cash on the day of transfer.

Other features

By registering a QIWI personal account, the user opens a small office for himself. From it, the holding's clients pay bills and purchases in online stores, cooperate with the company as investors, borrowers, take part in promotions, receive bonuses and prizes.

No special conditions are required to use the full range of services. It is enough for the client to have a QIWI wallet, a personal account. Logging into your account guarantees access to any product of the holding. Considera few of them in more detail.

On each page of the personal account, in its lowest lines, there are several links. One of them is Qiwi Bank. A private client has the opportunity to repay loans, pay utility bills, duties, fines, registrations, and make international money transfers.

It would be surprising if the bank did not provide the possibility of opening deposit accounts or did not provide loans. But the QIWI holding does not disappoint in these matters either. The unique, unparalleled system provides full banking functionality for its customers.

Mobile apps

It's hard to imagine a modern businessman without an excellent communicator, tablet or smartphone. Hundreds of mobile applications are being developed for business success. You can get acquainted with them on the pages of the site QIWI.ru. The user's personal account provides variations of mobile applications for various popular platforms. Including for:

- Windows Phone;

- iPhone;

- Android.

For each platform, the site contains instructions on where to download and how to install applications with which the client can use the services of the payment system anywhere and at a convenient time.

Safety

No matter how many products this or that payment system provides, for people involved in serious business, reliable protection of their funds will always come first. ClientsQIWI can not only not worry about their money, but also choose from several tools that ensure the security of financial transactions.

One of the most interesting security offers is the implementation of transfers, processing payments using the SMS service. Clients can transfer money to another user of the payment system, block a card, find out the account balance, enable or disable voice confirmation of financial transactions without additional installation of mobile applications.

The article lists far from all the possibilities of a user who has registered a personal account in the well-known QIWI payment system.

Recommended:

Bank accounts: current and current account. What is the difference between a checking account and a current account

There are different types of accounts. Some are designed for companies and are not suitable for personal use. Others, on the contrary, are suitable only for shopping. With some knowledge, the type of account can be easily determined by its number. This article will discuss this and other properties of bank accounts

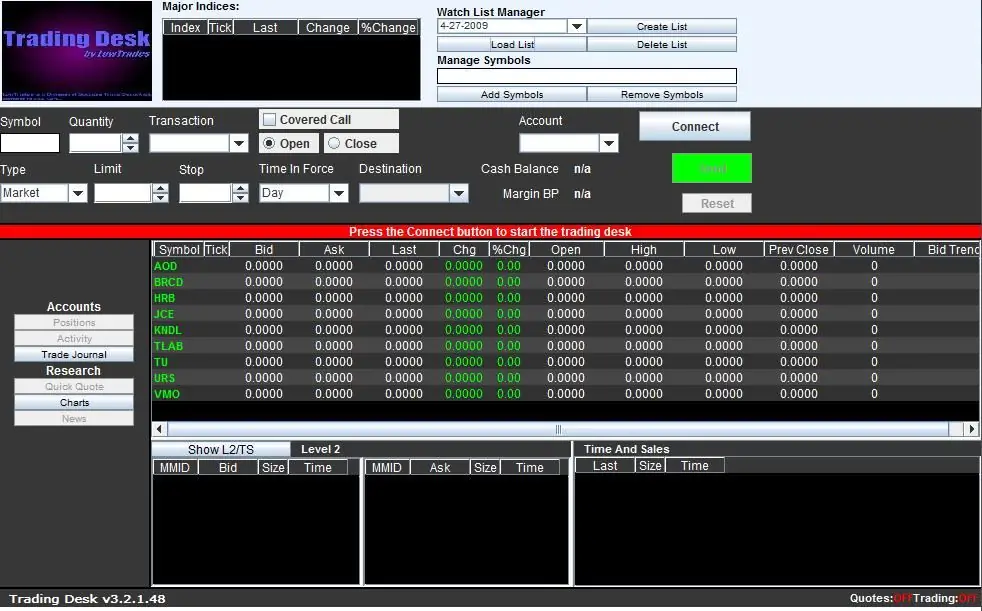

Just2Trade: reviews, account opening procedure, personal account

Choosing a broker is a very responsible step. Every beginner who has made the decision to become a trader faces it. To understand the degree of reliability of any brokerage company, you need to study the information and find out reviews about it

Individual personal account in a pension fund: checking and maintaining an account, the procedure for obtaining statements and certificates

If you want to know how things are going with your pension savings, in order to find out what your pension will be or what it is now, then you just need to find out about the status of your individual personal account in the Pension Fund. And here's how to do it, will be discussed in the article

How to top up a qiwi wallet in Belarus. Overview of Methods

Qiwi (or Qiwi) is already perhaps one of the most popular electronic payment systems in Russia. However, in Belarus it did not work immediately. And until now, users from the territory of the republic have certain questions about the service, to which it is far from always possible to quickly get an answer. The most common question is how to top up a qiwi wallet in Belarus. It is quite difficult to do this, but it is possible

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?