2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:34

Foreign currency is banknotes, which are the legal tender of the respective state. Their exchange for each other is carried out within the framework of the foreign exchange market, namely the system of economic relations between banks, their clients, professional participants and government institutions. Purchase and sale transactions here are concluded exclusively in non-cash form.

OTC market

Currency trading can take place in two areas: on the organized and over-the-counter markets.

Off-exchange transactions are concluded directly between the buyer and the seller of the currency. As a rule, this role is performed by commercial banks. Moreover, they can both conclude transactions on their own behalf and for their own needs, and represent the interests of clients. The buyer and the seller, in the process of negotiations, determine the conditions for the sale and purchase of foreign currency, which include the amount, exchange rate, terms and procedure for settlements. A feature of trading on the OTC market is that both parties assume certain risks (after all, any of them can at any time refuse their obligations), therefore, such operations are carried out between partners who fully trust each other.friend.

Organized foreign exchange market

Exchange trading in the foreign exchange market implies the presence of a third party, namely the organizer of trading - the currency exchange. In this case, as such, there is no negotiation process between the buyer and the seller. Each of them submits applications to the exchange indicating the terms of the transaction that suit them. If at some point in time the interests of the buyer and the seller coincide, the operation is carried out automatically. The exchange not only greatly simplifies the process of concluding transactions, it is also a kind of guarantor. Therefore, neither for the buyer nor for the seller it does not matter who exactly acts as the second party. A deal can only be concluded if each of its participants has the necessary amount of the corresponding currency at their disposal.

There is another option for conducting such transactions, when negotiations between counterparties go directly, and all settlements go through the exchange. This is done in order to eliminate the risk of non-performance by one of the parties of its obligations under the transaction.

MICEX: history of origin

The Moscow Interbank Currency Exchange is Russia's main trading platform. The MICEX Group includes the stock and commodity exchanges, CJSC MICEX, a clearing center, a national depository, and regional settlement centers.

MICEX was founded in 1992. Operations with currency from the very beginning were the main direction of its activity. Trading sections for stocks, bonds, commodities and derivatives were organized later.

At the end of 2011 there was a merger of two platforms of the Russian stock market - MICEX and RTS. This united structure was called the Moscow Exchange. Since then, currency trading on the MICEX has been held within the framework of a single exchange space.

Technical evolution of foreign exchange transactions

Initially, trading on the MICEX took place in the form of auctions. The so-called "broker" collected bids from buyers and sellers, indicating the amount of foreign currency and the exchange rate. Then a competition was held, according to the results of which the winner was determined.

From June 2, 1997, currency trading on the MICEX began to be conducted in the electronic trading system (SELT). It was SELT that became the first such system of the exchange market in Russia. This was a truly revolutionary breakthrough in the field of organized trade. With its help, buyers and sellers got the opportunity to conclude an unlimited number of transactions during the entire trading session in real time.

Conclusion of transactions on MICEX

Operations on the MICEX are carried out through the electronic trading system. Its meaning lies in the fact that each participant submits an electronic application indicating the amount of currency bought or sold and the price at which he is ready to make a deal. All of them enter into a single system. When two buy and sell orders have the same prices, they are executed automatically. The volume of the concluded transaction will be equal to the smaller volume of the two executed orders.

Unfulfilled orders that have been queued can be removed at any time if the participant who placed it wants to change their conditions.

It is SELT that allows real-time currency trading. Placing, modifying and canceling orders, as well as making deals at the current rate come down to a simple click of a button. For the convenience of the participants, already issued instructions are displayed on the computer screen. This allows you to assess the current state of the market and predict its possible direction of movement.

Procedure for execution of electronic orders

If the order price does not correspond to the current level, then one of the following options occurs with it:

- For an order to buy foreign currency. If its price is below the current market rate, it is queued and will be executed if the quote drops to a certain level. If it is higher, it is executed according to the market.

- For orders to sell foreign currency. If its price is below the market rate, it will be satisfied at the current quote. If it is higher, it will be queued until the currency value rises to the level specified in the application.

Trading schedule

Currency auctions are held in accordance with the approved schedule. Transactions with “today” settlements for the dollar-ruble pair are concluded from 10:00 to 17:15 Moscow timetime, for the euro-ruble pair - from 10:00 to 15:00 Moscow time. Trades in other instruments (Belarusian ruble, Kazakh tenge, Ukrainian hryvnia and Chinese yuan) are held for only one hour, from 10 am to 11 am Moscow time.

The MICEX also offers its members the opportunity to conclude transactions in the so-called mode of off-system transactions. They combine elements of the exchange and over-the-counter markets. The parties to the transaction directly agree on all its conditions. But the purchase and sale operation itself is carried out within the framework of the electronic space of the exchange. The buyer and seller put up targeted bids. Only a specific participant, for whom it is exhibited, can become the second party on it. The conclusion of such transactions for all currency pairs is possible until 23-50 Moscow time.

The importance of an organized foreign exchange market

Organized currency trading within the MICEX platform perform several very important functions at once.

Firstly, with their help, everyone can take part in the pricing process. This can be done by both a professional participant, having received direct access to exchange trading, and absolutely anyone who has nothing to do with the world of finance. To do this, he needs to conclude an appropriate agreement with a broker who has direct access to the MICEX exchange. In this case, he will already represent the interests of his client.

Secondly, the Central Bank, as a state body that regulates monetary policy, influences the current exchange rate of the nationalcurrencies, carrying out interventions within the framework of the MICEX platform. In addition, the results of foreign exchange trading are taken into account when the Bank of Russia sets official exchange rates against the ruble.

MICEX is, without exaggeration, the main platform of the stock market in Russia. MICEX currency trading today is one of the instruments of the state monetary policy. It is this platform that gives its participants the opportunity to conclude transactions in real time. The volume of foreign exchange trading is constantly growing. In 2002 they amounted to 65 billion dollars, in 2008 - 2.7 trillion dollars, in 2014 only by the end of January this figure amounted to more than 13 trillion rubles.

Recommended:

Trading sessions indicator for MT4. Trading platform for "Forex" MetaTrader 4

Trading session indicators for MT4 in trading is one of the most important parameters. Each time period has its own characteristics, characteristics, market liquidity and volatility. The future profitability or loss for a currency speculator depends on all these parameters. Therefore, traders and experts have specially developed tools for certain market phases and trading sessions

Trading strategy: development, example, analysis of trading strategies. The Best Forex Trading Strategies

For successful and profitable trading on the Forex currency market, each trader uses a trading strategy. What is it and how to create your own trading strategy, you can learn from this article

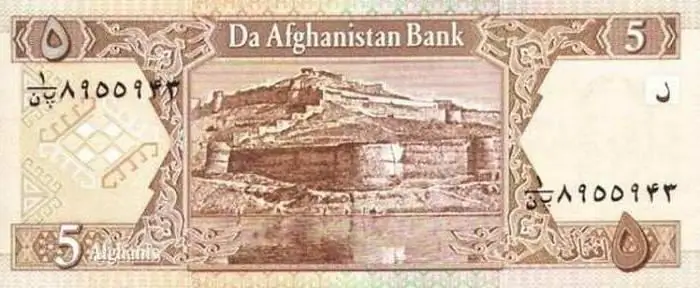

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article

Currency market of the Moscow Exchange. Currency trading on the Moscow Exchange

Moscow Exchange was opened in 2011. Every year its popularity is growing. So, in 2012, the growth of trading on the exchange amounted to 33%, and in 2014 - 46.5%. Private investors were also allowed to trade on the stock exchange through brokerage companies. How to trade on the Moscow Exchange and how is it different from Forex? These and other questions are answered in this article