2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:35

From July 1, 2014, amendments to the Civil Code came into force, according to which Russians were allowed to open joint accounts with relatives. You will learn about the essence, prospects and conditions of service from this article.

Background

The first attempts to introduce a nominal account were made back in 2007. Then the mortgage lending market was actively developing. In other countries, 80% of real estate transactions are carried out using escrow accounts. The main idea of their implementation is to reduce the risks in transactions with intermediaries, which are real estate agents.

Changes in legislation appeared in 2014. Now citizens will be able to use two new services. Open a nominal account and make transactions with funds that belong to the beneficiary. Or use the services of an intermediary (escrow) when making transactions.

Essence

Nominal account is a safe deposit box in a bank, which is opened by a third party to make transactions with the beneficiary's funds. A service contract may be concluded without the participation of the beneficiary. If aa nominal account with Sberbank is opened for several beneficiaries, then the credit institution must take into account the interests of each of them in the context of special items, unless otherwise specified in the agreement.

The agreement should spell out the procedure for obtaining information on the disposal of funds, as well as the level of participation of the person who opened the account and the beneficiary. The agreement may impose on the bank the obligation to control the procedure and grounds for the use of funds. Suspension of transactions, arrest and write-off of money for the obligations of the account holder are not allowed. In the case of a beneficiary, this will require court permission.

If a commercial organization opens a nominal bank account, then it is reflected under article 40702. Then, according to the Regulation of the Central Bank No. 385-P, the institution is obliged to transfer information to the tax office. If the application is submitted by an individual, then all movements will be displayed under Article 40802, which falls under the Federal Law "On Deposit Insurance". The bank's obligation to control escrow payments is not provided for by law, that is, it will be regulated by the contract.

Escrow

The Bank opens a special account to account for funds received from the owner (depositor) in order to transfer them to the beneficiary on the grounds provided for by the agreement. Escrow fees cannot be charged to the funds in the safe deposit box unless it is specified in the document. Such accounts are governed by the general provisions of the bank.

Crediting to the escrow of other funds of the depositor, except for the amounts specified incontract is unacceptable. The parties can use the money only under the agreed conditions. But they have the right to demand a printout of the account and other information that constitutes banking secrecy. The account is closed at the end of the contract. Written demands of one of the parties are not valid in this case.

A nominee account can be opened by an attorney, commission agent, agent, executor of a will to make transactions with the beneficiary's funds. The contract prescribes the procedure for obtaining information about the use of money. The main feature of escrow is that it is opened not for the accumulation of funds, but for the fulfillment of obligations. Usually in real estate transactions. The scheme is as follows: the buyer of the apartment opens an escrow and puts a certain amount on it. Upon completion of the transaction, the seller receives the money after providing documents confirming the transfer of ownership.

Destination

In Europe, a nominal account is used for settlements between counterparties, participants in the maritime transport market, as well as in construction. It allows you to quickly get a bank guarantee on favorable terms. This service is also actively used by lawyers and notaries in their activities. Online stores use it to ensure that the buyer pays for the goods. Any transaction that involves the existence of certain conditions can be carried out with such accounts. Especially if there is a need for additional control.

Alternative way

New accounts can be usedand for personal purposes. For example, if a client has a brother who lives in another city, you can open a safe deposit box in a bank and control the spending of funds. The documents must be in the name of the relative, but the beneficiary is the person who finances him. Only the beneficiary has access to bank statements. Other restrictions may be specified in the contract. For example, specify that money should be used only to pay utility bills, and cash withdrawals from the account should be prohibited.

Implementation issues

In world practice, joint accounts are widely used, but Russians have a lot of questions about the purpose of this transaction. To date, the real analogues of escrow are a letter of credit and a safe deposit box. But these services are not always offered by credit organizations.

Specialists also have a lot of questions. For example, who will become the agent's creditor if the bank's license is revoked? Most likely, it will have to be determined by the insurer or act through the court. But for this, the procedures for paying compensation must be clearly formalized at the legislative level.

Banks in Kazakhstan and Kyrgyzstan have been offering intermediary services to their clients for a long time. Opening a nominal account and its maintenance is not cheap. Depending on the institution and goals, the cost can range from 1 to 10 thousand rubles. You will have to pay three times more to open a letter of credit in Kazakhstan. Russian banks were in no hurry to offer escrow to their clients for a long time, as the introduced law was notbacked by instructions from the Central Bank.

Insurance compensation

All bank deposits of Russians are protected by the state. Even the salary, which is transferred to the account, is insured. In the event of a bank failure, plastic owners must receive a refund within 14 days after the license is revoked from a credit institution.

The calculation of compensation includes all due interest on the deposit. But the maximum amount per person is limited to 1.4 million rubles. (since 2015), that is, if a client has several deposits opened in one bank, for example, in different branches, in the event of an insured event, the total amount of funds in all accounts will be taken into account. Compensation for foreign currency deposits is paid in rubles at the exchange rate of the Central Bank. This is what the standard procedure looks like.

There are questions about joint accounts. If there are several beneficiaries, the share of each should be clearly defined. The amount of compensation that the depositor will receive depends on this value. The legislation provides for the allocation of owners only upon arrest of money and termination of the contract. Instructions regarding actions to be taken in case of liquidation of an organization have recently appeared.

If, for example, a nominal bank account was opened by several beneficiaries in the amount of more than 14 million rubles, then the amount of insurance compensation will be calculated based on the total balance, and not separately for each beneficiary. There is logic in this. If the cell is joint, then the amount of compensation should be distributed to all participants.

Since 2015, it is possible to sign a nominal account agreement only with institutions in which 50% of the capital belongs to the state. When implementing the service, banks faced a number of problems: the lack of the necessary software and internal instructions regulating the service procedure. Therefore, the choice of organizations is limited.

Nominal Guardian Account

Previously, all the amounts due to the ward were credited to his cell in the bank. The guardian could monthly withdraw, without the permission of the state body, an amount not exceeding the subsistence level. According to the new rules, all payments due to a minor person go to a nominal account opened for a third party. The guardian may use these funds in full without obtaining permission.

Nominal account is a safe deposit box to which pensions, alimony, allowances and other amounts paid for the maintenance of the ward are credited. Exceptions are salaries and scholarships for students. The nominal account of the guardian is opened upon presentation of a document from the guardianship authority. To conclude an agreement, you must provide the details of the beneficiary: full name, date and place of birth, certified photocopies of the identity document of the ward, address of residence. A nominal account agreement may provide for the possibility of transferring the balance of funds to a safe deposit box opened in another institution, or issuing them in cash, provided that the current guardian closes it. Funds can be recovered to pay the obligations of the ward only by court order.

Security account

Amendments to the Civil Code have created another type of bank cells. The amounts of money received by the creditor from the debtor may be credited to a special collateral account. This opportunity appears after the transfer of a copy of the contract. At the request of the pledgee, the bank must provide information on the balance of funds, transactions performed, prohibitions and restrictions. All pen alties are written off, in accordance with Art. 349 of the Civil Code of the Russian Federation, from the pledge account of the debtor. Such a safe deposit box is not subject to the Rules on the sale of property (Articles 350-350.2 of the Civil Code of the Russian Federation), as well as the Rules for the collection of funds (Chapter 45 of the Civil Code of the Russian Federation).

Conclusion

After amending the Civil Code, new types of accounts will appear in the banking services market: nominal and escrow. Such cells can be opened by third parties, but the rights to the funds belong to the beneficiary. What is a Nominal Guardian Account? This is a bank cell to which funds are credited for the maintenance of wards. In world practice, escrow is opened when buying real estate in order to guarantee payment for the transaction. The Russians are still wary of the new service. And the number of institutions where you can open a joint cell is limited.

Recommended:

Bank accounts: current and current account. What is the difference between a checking account and a current account

There are different types of accounts. Some are designed for companies and are not suitable for personal use. Others, on the contrary, are suitable only for shopping. With some knowledge, the type of account can be easily determined by its number. This article will discuss this and other properties of bank accounts

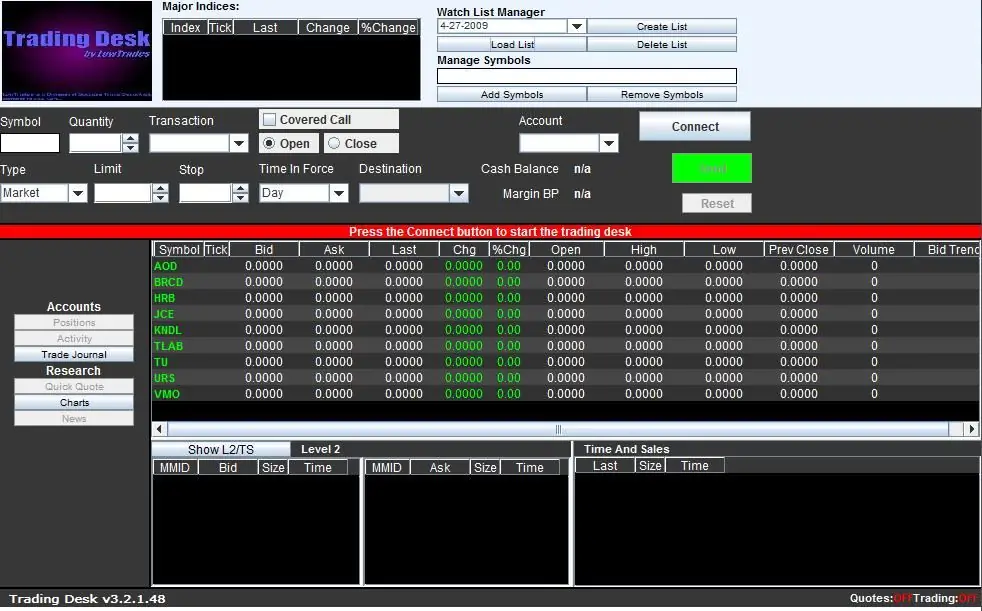

Just2Trade: reviews, account opening procedure, personal account

Choosing a broker is a very responsible step. Every beginner who has made the decision to become a trader faces it. To understand the degree of reliability of any brokerage company, you need to study the information and find out reviews about it

Savings account is Concept, pros and cons of the account, opening conditions and interest rate

Those who want to become bank customers often encounter a lot of new terms and definitions, for example, what is a savings account, what conditions must be met to open it, what documents are needed? It is worth studying the information in detail so that later you do not have to open another account for the needs of the client

Master account "VTB 24" - what is it? Appointment how to use?

VTB 24 clients often find themselves in a situation where they do not have access to the services they need. For example, not all banking products are available for remote account registration or in the online account. This means that a comprehensive service agreement has not been concluded and there is no VTB 24 master account. What is it and how to connect the service is described in the article

A settlement account is Opening a settlement account. IP account. Closing a current account

Settlement account - what is it? Why is it needed? How to get a savings bank account? What documents need to be submitted to the bank? What are the features of opening, servicing and closing accounts for individual entrepreneurs and LLCs? How to decrypt bank account number?