2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

When a citizen applies to state executive bodies, a state duty is paid to the budget. Its size is determined by the significance of the actions that the representative of the authorities or the applicant will perform. A sample application for the return of state duty to the tax is presented in the article.

When is the fee paid?

The state duty is paid by the applicant when applying or requesting a legal action, issuing documents that register or confirm the status of the applicant or his authority. Payment to be paid:

1. To world, constitutional, arbitration judges. The fee is required when filing an appeal, application, complaint, petition or request.

2. To judges of general jurisdiction. The tax is paid when the judge's decision is reviewed.

3. To tax inspectors to obtain a certificate of registration of a legal entity or individual entrepreneur, when applying for the termination of their existence, to obtain copies of documents, duplicate certificates.

State duty is paid to notaries for the provision of official documents, certification of photocopies, confirmation of the signature of responsible persons. It is paid in cash, at the cash desk of Sberbank, in your personal account. A certificate for the return of the state duty will serve as confirmation of the transfer of funds to the payer.

Who pays?

Each citizen, individual entrepreneur, legal entity has the right to pay this fee. This is confirmed by a receipt or payment order. If the payer is more than one person, then the payment is made by all participants in equal shares. The state duty does not need to be paid to legal entities or citizens, if they are exempted from it by law.

Individuals pay the fee from:

1. Submission of documents for the opening of IP, LLC, JSC.

2. By requesting status data in a single registry.

3. The use of the term "Russia" in the titles.

4. Termination of businessman's work.

Legal entities and official representatives apply to courts of various instances, arbitration or constitutional. The actions of public services are paid for when granting permits, licenses, tests, approbations.

When is the return?

The return of the paid state duty does not occur in every case. It is necessary to draw up an application with a request to receive funds in full or in part. It must be accompanied by proof of payment. According to Art. 333.40 of the Tax Code of the Russian Federation, the following return situations apply:

1. No action has been taken since the fee was paid.

2. The payment was more thanneed.

3. Production has been discontinued or left unconsidered.

4. The petition was returned to the payer.

5. An application for registration of intellectual property has been withdrawn.

6. The applicant was denied a passport.

If the parties signed a settlement agreement, the law allows you to return 50% of the fee to the payer. The payer has the right to set off the overpayment in future payments. A sample application for the return of state duty to the tax office will be required only if the application is submitted within 3 years.

Reason for rejection

There are some conditions when a return is not possible:

1. When performing actions in the registry office.

2. With the filing of a claim, when the defendant admitted and satisfied the claims.

3. Registration of rights to property, if the procedure was refused.

4. When testing, analyzing, branding jewelry.

Rejection follows when the application is received after 3 years. It is also important to record the reason why the return should be made. It is necessary to attach payment receipts, instructions confirming the receipt of the surplus. The decision on this is made within 1 month from the date of submission of the application. It is considered by the authorized body, to which the payer applies for a specific operation.

Drawing up an application

If the payer applied to the fiscal service, then the application is considered by the Federal Tax Service. It must be compiled carefully. Sample application for the return of state duty to the taxincludes the reason why the transfer is required. If this is due to a technical error, then you need to fix it in the base.

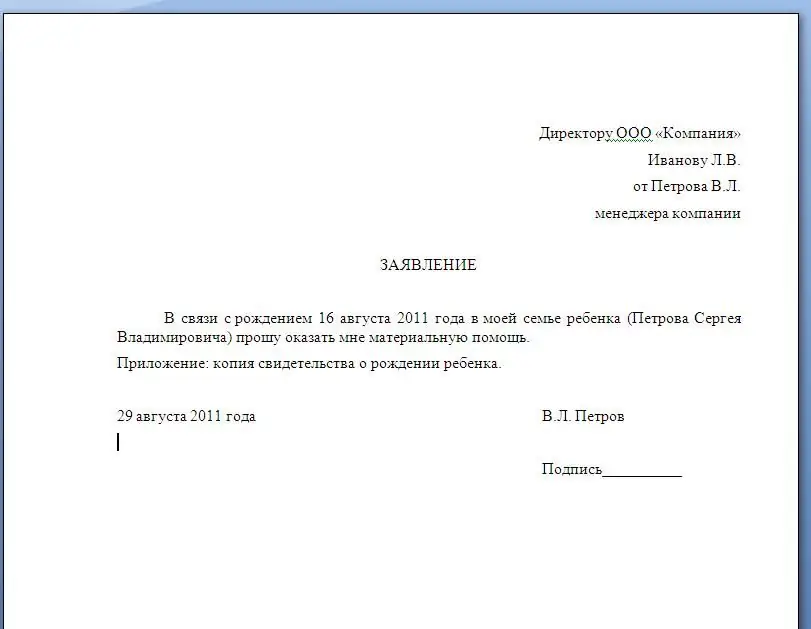

Sample application for the return of state duty to the tax office includes the following details:

1. Name of the branch of the Federal Tax Service.

2. Authority address.

3. Name of institution, full name. or IP.

4. Foundation.

5. CBC and due date.

6. OKTMO and the amount paid.

7. Amount to be returned.

8. Account details.

At the end of the application is dated and signed. If the payer is an individual, you need to fix the TIN of the payer. When specifying the reason for the return, you must specify proof of payment. Based on the application, the funds paid in vain are received.

Recommended:

Application for the return of loan insurance: sample, application rules, submission deadlines

In the process of obtaining a credit loan, banks offer potential borrowers to conclude an insurance contract. If the client is unable to pay off the debt, the obligation to close it to the bank lies with the insurance company. But in practice, the opposite situation often arises, and conscientious payers are wondering about the possibility of returning insurance on a loan in case of early repayment. But how much will be received? And who should give the money - the insurer or the bank?

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer

For Dummies: VAT (Value Added Tax). Tax return, tax rates and VAT refund procedure

VAT is one of the most common taxes not only in Russia but also abroad. Having a significant impact on the formation of the Russian budget, it is increasingly attracting the attention of the uninitiated. For dummies, VAT can be presented in a schematic form, without going into the smallest nuances

Tax return for land tax: sample filling, deadlines

A land tax return must only be filed by companies that own plots of land. The article tells what sections this document consists of, as well as what information is entered into it. The terms during which the documentation is submitted are given. Describes pen alties for companies violating legal requirements

Return of the state duty from the tax: all the nuances of the procedure

The Tax Code of the Russian Federation lists all situations where such a fee is required. In general, you will have to pay money whenever you need a service from the state