2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

Entrepreneurs pay taxes in carrying out their activities. Often there are situations of overpayment. Making a larger payment also occurs for individuals. This is due to various reasons. You need to know how to get a tax refund.

What do individuals pay?

Citizens of the Russian Federation pay the following fees:

- NDFL. The deductions that are collected from individuals go to the Federal budget. It is taken for various incomes. For example, personal income tax is levied on wages from employers. It is paid by citizens of the Russian Federation, foreign persons and stateless persons.

- On property. This tax is considered local. It is charged for apartments, houses, other housing, buildings, vehicles, excluding cars and motorcycles. Payment is made every year.

- Transport. The payers are the owners of the transport. The tax is paid before maintenance, for the calculation you should know the power and the minimum wage.

- For donation. When receiving property as a gift, you need to pay tax. But this will be only if the price of the inherited property is more than 850 minimum wages and more than 80 minimum wages withdonated.

- Land. The tax is levied on agricultural land, land that was received by a private individual for subsidiary farming, housing construction.

What does IP pay for?

Entrepreneurs need to make the following payments:

- USN. In order to work under this system, individual entrepreneurs must comply with the restrictions on employed persons. There are residual value and income requirements.

- UTII. The Tax Code of the Russian Federation provides a list of types of activities when an entrepreneur can conduct his activities under this system.

- BASIC. If an individual entrepreneur has a large turnover, then this system is applied.

- PSN. If an individual entrepreneur works on those types of activities that are included in the patent system, then you can switch to it.

LLC pay UTII, UAT, BASIC, STS. Any payment may result in an overpayment that can be refunded or set off against another fee.

Is it possible to return?

If an overpayment on payments is detected, then you first need to understand why this happened. This phenomenon usually occurs in the following cases:

- Error calculating taxes.

- If there are more advance payments based on the results for the year compared to the annual declaration.

- Using tax benefits when payment and withdrawal are made together based on the decision of the Federal Tax Service.

The overpayment is returned when the tax service agrees with this fact. The Tax Code of the Russian Federation states that the IFTS is obliged within 10 days from the date of discovery of the surplusnotify the payer of this for a decision to be made. But this rarely happens.

The taxpayer can also apply for a tax refund. But first he needs to reconcile with the IFTS according to the calculations. This may not be carried out, then the inspectors, when questions arise, will request documents about the fact of the surplus. Refund of overpayment on taxes is possible only if 3 years have not passed on the date of overpayment.

If this phenomenon occurred due to the tax authorities, then the return is carried out within a month from the moment of detection or from the date of validity of the court decision. But in the last situation, the IFTS can use the time within 3 months to check and make a decision.

When is no refund possible?

There are also cases when the IFTS refuses to return the overpayment. Often the reason for this is that the taxpayer missed the limitation period - 3 years, if this arose through the fault of the enterprise. A 1 month is given for cases where the wine is on inspection.

In this case, the role has proof of the time of discovery of the fact. If the payer can provide them, then with the help of the court it will be possible to return the surplus. Refusal follows also in the presence of arrears at the enterprise before the budget. Since then the IFTS still conducts a non-acceptance set-off procedure.

Return or offset?

Before you learn how to return an overpayment of taxes, you should find out what actions are possible in this case. After all, each of the documents is drawn up differently. In addition to a refund, an overpayment fortax, can be set off in the existing obligations to the budget. But there is a limitation. It is carried out only for taxes within the same budget. The decision to return or offset is usually taken only by taxpayers. Everyone should decide for himself which of these procedures is best.

Tax professionals usually opt for set-off, as there is no refund required. Therefore, this process is faster, moreover, fewer documents are needed. The status in which the surplus occurred also matters. If, when overpaid to tax agents, the amounts are not taken into account, they can only be returned.

Detection

Both the tax authorities and the payer can detect an overpayment. The second option is the most common. For some taxes advance payments are paid monthly or quarterly. Therefore, the surplus on these taxes will be determined after the preparation of the annual report.

Many declarations require instructions on how to report advance payments and annual tax amounts. Therefore, overpayments are recorded in the report. This situation also arises if a clarification of the report is required, according to which, due to benefits or for another reason, the amount of the obligation to the budget is reduced.

Often, during the transfer of taxes, inaccuracies in payment orders are allowed. Therefore, you can detect an overpayment if the money is credited to the wrong place by regularly performing reconciliations with the budget. You can determine if there is a surplus in the following ways:

- The inspector calls or sends a letter. ATIn this case, you need to write down where the call came from, what tax the case concerns and what the overpayment is. Often, additional paperwork is required for verification.

- Using a personal account on the official tax resource. If a company or individual entrepreneur has a qualified EDS, then it will be possible to enter the taxpayer's personal account for free. This way you can keep track of underpayments and overpayments.

No matter how the violation is revealed, you need to know how to return the overpayment of taxes. This procedure is drawn up according to generally accepted rules.

Return procedure

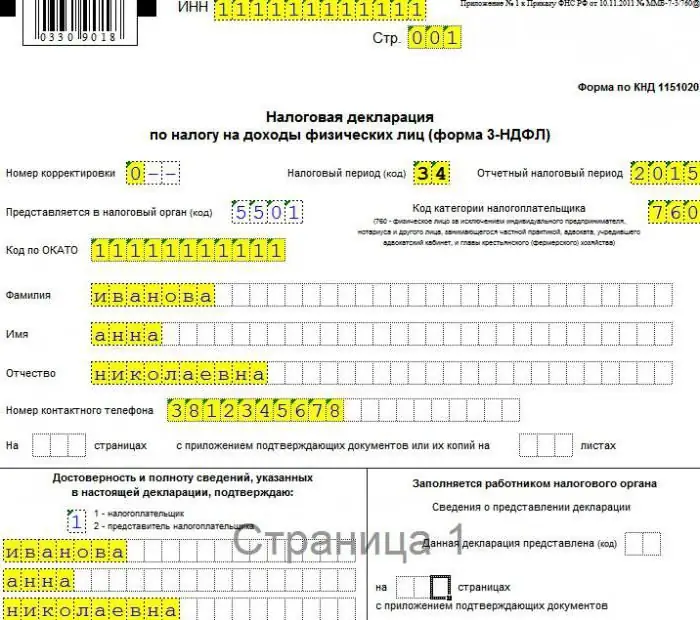

If an institution or an individual entrepreneur finds the paid surplus, then they can be returned or set off against another payment. How do I get my tax refund back? If the organization decides to return to the current account, then you need to write an application. It is compiled in the form of KND 1150058.

An application for the return of funds to a bank account is similar to a declaration. It is necessary to write in it the name of the company, the amount of the overpayment, the CCC for tax, account details. Once completed, the application can be submitted:

- In paper form personally by the payer or by a representative on the basis of a power of attorney.

- Mail with acknowledgment of receipt.

- In electronic form, but then a digital signature is required.

The return procedure is divided into the following steps:

- Determination of overpayment. This is done under the act of reconciliation of taxes. According to this document, it will be possible to identify, bywhat payments and how much there is a surplus.

- Drawing up an application. It records information about the institution, the amount and account details.

- Sending the application in any convenient way.

- After 10 days, get the results. If a refusal comes, then the preparation of documents for the court is required.

- Funds are transferred throughout the month.

- If there was no enrollment at the end of the time, you need to write a complaint to a higher authority and prepare papers for the court.

Tax credit

Instead of an overpayment on taxes of a legal entity, its offset can be performed. You can do this:

- For future payment of the same fee.

- To pay another tax debt.

With the offset of the overpayment of taxes, you must follow the rule - to offset the payment only within the budget of this level. It turns out that the overpayment of federal tax is credited only to another federal tax. The Federal Tax Service can independently carry out an offset with an underpayment for a different fee. Company permission is then not needed.

To complete the test, you must submit an application in the form of KND 1150057. This is done in 3 ways:

- In person or through a representative.

- Mail.

- 3Using the internet.

Set-off is allowed within 3 years from the date of the overpayment.

Deadlines

If the company wants to offset the surplus, then an application is required to the Federal Tax Service. Tax officials are required to consider the document within 10 days and then notify of the decision within 5 days. If athey themselves made a decision on offset, then this is done within 10 days from the date of detection. The body must notify the decision within 5 days.

If the amount is greater than the underpayment, then the tax offset is performed, then for the month the balance is credited to the current account. In case of violation of this period, the payer is en titled to interest.

Calculation

To calculate the amount of the fee, you need to use the tax calculator. For example, it can be used to calculate the transport fee. On the official website of the tax there are such calculators. You must enter:

- Year of car.

- View.

- Number of months of ownership.

- Engine power.

You need to click on the "Next" button. The tax calculator allows you to calculate the exact payment that all motorists must make.

Wrong tax write-off

The tax authority has the right to withdraw unpaid taxes, fines and pen alties from the payer without the permission of the payer. Often these actions occur erroneously, for example, a payment order did not come to the authority or the payer made a mistake and indicated the wrong details. In this case, the tax authorities must return the illegally paid amounts.

If the company has tax debts, then part of this payment can be spent on paying them. The rest of the money will be returned. To return, you must submit an application to the Federal Tax Service, which is written in free form. It sets out the circumstances, attaches a supporting paper to it, and indicates bank details.

Statement followsfile within 1 month from the date of illegal write-off. If this period is missed, then the return is possible only by a court decision. This is provided for 3 years. The application is processed within 10 days. Then 1 month is given to return the amount to the current account.

Drawing up an application

To send a letter for a refund of an overpayment of tax, you must complete an application. If the payer applies to the fiscal service, then the application is considered by the Federal Tax Service. Documentation must be done carefully. You must specify the reason for which you need a return. Overpayment of income tax or other payment is carried out in the same way. The application must include the following details:

- Name of the branch of the Federal Tax Service.

- Address of the location of the authority.

- Name of the organization, full name of the applicant or individual entrepreneur.

- Foundation.

- CBC and payment date.

- OKTMO and the amount paid.

- Amount of funds to be returned.

- Details of the account where you need to send the fee.

At the end is the date and signature of the applicant. If the payer is an individual, then the payer's TIN must be recorded. Denoting the reason, you need to refer to the confirmation of payment and the document. This is how an application is made for overpayment of transport tax and other payments.

If the tax office does not return the money - what to do?

The tax authorities may delay the processing of the application and the return procedure. Then there is no need to waste time, you should act actively. First you need to check if everything in the document is correct. If the tax authorities refuse to accept the application, then you need to send it by registered mail or via the Internet. In the latter case, there must be a qualified EDS.

During a conversation with an employee of the Federal Tax Service, it should be mentioned that the Tax Code sets a deadline for tax refunds within a month from the date of receipt of the application. If after this tax period no action has been taken, complaints should be written. This should only be done in writing, by mail. By law, the answer must also be in writing. It is not necessary to call and verbally resolve the issue. These appeals are not recorded, besides, they can say anything that is suitable, and during the trial it will not be possible to record this in the case.

If the deadlines have passed, and there was no return, you should draw up an application for the court. It fixes the requirements for the return of not only the surplus, but also interest for lateness. As practice shows, usually all cases are resolved in the direction of the payer. The court accepts the tax party only in case of violations in the execution of documentation.

Documents

When overpaying property tax or other payment, some documents should be prepared:

- Passport.

- Payment papers.

- Account details.

- TIN.

- Certificate of registration.

- Tax return.

- Documents confirming the need to pay tax.

No other paperwork needed. Copies of these documents are attached. Accurate information aboutpapers that are needed during the verification of the correctness of paying taxes, you need to find out from the Federal Tax Service. They will prompt you with information on all payments.

Terms for individuals

In this case, the same deadlines apply as with organizations. Which FTS should I contact? The application is submitted to the body that maintains tax records of the organization or citizen. In other words, all tax institutions in which the payer is registered must accept applications. Therefore, you can contact:

- At the place of registration of the company.

- FTS accounting for the head office of the company.

Individuals need to contact the service at the place of registration or temporary residence. If a person is not registered with the tax authorities, he cannot claim a refund through the Federal Tax Service.

Interest for delays

Institutions are en titled to receive the overpayment amount with interest if the funds were not returned on time. Then the inspectors make a decision on the return and send an order to the Department of the Treasury of Russia (clause 8, article 78 of the Tax Code of the Russian Federation). And the inspectors only control the correctness of the calculation of interest, if there is an error. To receive interest, the organization does not need to additionally contact the inspection. Upon application, interest is calculated for the delay.

Thus, the refund of overpaid taxes is fully controlled by law. Payers have the right to apply for the transfer of funds or set them off against other fees. And for the delay, compensation is due.

Recommended:

Refund of tax deduction when buying an apartment: documents. Deadline for tax refund when buying an apartment

So, today we will be interested in the deadline for the return of the tax deduction when buying an apartment, as well as the list of documents that will be required to provide to the appropriate authorities. In fact, this question is interesting and useful to many. After all, when paying taxes and making certain transactions, you can simply return the “nth” amount to your account. A nice bonus from the state, which attracts many. But such a process has its own deadlines and rules for registration

For Dummies: VAT (Value Added Tax). Tax return, tax rates and VAT refund procedure

VAT is one of the most common taxes not only in Russia but also abroad. Having a significant impact on the formation of the Russian budget, it is increasingly attracting the attention of the uninitiated. For dummies, VAT can be presented in a schematic form, without going into the smallest nuances

Refund of tax when buying property. Refund of overpaid tax

Income tax is refunded to all citizens who have submitted an appropriate application and a complete package of documents to the tax office. In order for the procedure for registering and receiving a sum of money to be successful, it is necessary to perform all actions according to the rules

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

Is it possible to get income tax refund when buying a car? Documents for income tax refund for education, treatment, purchase of housing

Any officially employed person knows that every month the employer transfers income tax from his salary to the Federal Tax Service. It makes up 13% of income. This is a necessity, and we have to put up with it. However, it is worth knowing that there are a number of cases when you can return the paid income tax, or at least part of it