2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

International settlements for ongoing commodity transactions play an important role in the business world of various countries. They cover all foreign trade operations for the exchange of goods or services, regulate the financial component of non-commercial operations, promote the active movement of capital, market improvement.

Principles, nature and forms of international settlements

International settlements are carried out through special accounts using foreign branches of banks or open correspondent (nostro) bank accounts in any foreign bank or current correspondent (loro) accounts for settlements and capital flow.

The organization and forms of payments in international trade are quite diverse. As a rule, all international settlements are carried outin convertible currencies, that is, in the national currencies of the leading countries in the economic sense.

In today's financial world, gold settlement obligations under special circumstances have disappeared, but countries can sell parts of their gold reserves in order to purchase convertible currencies. Thus, gold remains the guaranteeing foundation of all international transactions.

Usually, international payments are regulated by the currency laws of the countries participating in trade relations, the terms of contracts, the rules of international trade and the country's foreign economic activity. At the same time, in world economic practice, there are many types of non-cash payments under contracts that make it possible to effectively and flexibly use the financial reserves of countries, promote economic development, and use various banking methods for conducting international currency settlements.

Order and rules combined into an exchange system

International settlements, in fact, duplicate the forms of domestic settlements, from which they differ only in the currency component: they are the actual exchange of the domestic national currency for any other.

In legal terms, it is necessary to stipulate in which currency the transaction should be, since sometimes the requirements of traders capture several currencies of different countries.

Physically, banknotes do not participate in international settlements, and payments for transactions themselves are made in the form of documentary transactions, transfers, letters of credit, checks, bills of exchange. Expression of the form of international settlements -documentary turnover of countries.

At present, most countries' financial reserves are denominated in US dollars, which can be dangerous for some economically unstable countries, especially in times of financial crises.

Features of international payments include

- Mandatory execution of an international contract as a way to use the main forms of international payments.

- Payment of shipping and payment documents.

- Accounting and regulation of all international settlements by the laws of the countries participating in a foreign trade transaction.

- Unification of settlements through the documentary nature of transactions without the physical participation of gold and foreign exchange reserves of countries.

- Dependence of international settlements on the influence of currency quotes and rates.

- Using the unified rules and guarantees of trade operations adopted by the international economic community.

The essence, concept and forms of international cashless payments are the basis for the effectiveness of foreign trade transactions.

There are several basic types of payments. They are subdivided into:

- letter of credit and collection methods of payment;

- money transfers;

- settlements with advance money transfers using open currency accounts;

- bills and check payments;

- include credit and clearing forms of international currency settlements.

Letter of credit and other forms

Documentary forms of international settlements are payments based on issued documents. In fact, it is the obligation of the bank to make payments if there is a request from the bank's client to make a payment to a third party.

In international settlement practice, an irrevocable letter of credit is usually used, that is, without the right to revoke a transaction by a bank client. Forms of international settlements also include a documentary letter of credit.

In practice, this means that a third party - a participant in the transaction (the beneficiary) issues documents confirming the shipment of the goods, the bank client is obliged to give an order for payment, without physically receiving the goods.

A letter of credit can be confirmed, with guarantees of payment by two participating banks, and not confirmed, with a guarantee of one bank, to which the letter of credit is issued. Depending on the importance or riskiness of the transaction, the parties choose one or another form of letter of credit.

In addition, letter of credit forms of international settlements involve transactions with and without financial coverage.

- With a covered letter of credit, the entire amount of the transaction is immediately transferred to the seller's bank account.

- Unsecured letter of credit does not oblige the bank to transfer funds when opening a letter of credit.

Special features of a letter of credit and their use in foreign trade transactions

The special properties of a letter of credit include its transferability and revolving, as special forms of payment in international trade.

- Transferable ora transferable letter of credit allows funds to be transferred to third parties.

- A revolving letter of credit ensures the use of funds in parts, the possibility of paying advances before the full receipt of documentation.

The use of a letter of credit form in international transactions provides contracts with guarantees, is a kind of insurance in the implementation of effective and secured foreign trade transactions.

In the practice of bank settlements, several forms of execution of letters of credit are accepted.

- Delayed payments. They provide for the final payment after the actual receipt of the goods. In the system of foreign economic activity, this is the most unfavorable form of payment for the exporter.

- Payments at sight. They mean immediate payment upon presentation of documents in the amount indicated in the submitted documents.

- Payments with acceptance of urgent drafts. They provide for payment at the due date of payments specified in the documents. In this case, it is possible to provide for the receipt of payment amounts excluding bill interest, if bill payments are provided.

In the event that such a calculation is not provided, the letter of credit is called with installment payment and is carried out as documents are received with the deadlines.

Margin of safety: additional types of letters of credit in foreign trade

- Letter of credit with negotiation of drafts, that is, the possibility of making payments by any bank. In such a case, there is a risk of a discrepancy in the rules for processing documentation. That's why,when choosing the type of letter of credit, it is necessary to carefully study the very concept and forms of international payments.

- Letter of credit using invoice. In such calculations, the main document is a proforma invoice indicating the type and types of shipment, which guarantees the delivery of goods to the buyer even after payment.

Settlements with a red line are letters of credit that provide for the payment of advances.

Cash form

In the field of business and financial transactions, collection methods of financing contracts are especially popular and unified, widely used in the practice of international payments.

Collection is an obligation of the remitting bank (or exporter) to carry out all the necessary actions related to the order of the client-principal, and receive money from the payer - participant in the transaction, credit the funds to the account of the principal.

Organization and forms of international settlements in the form of collection payments are of two types: net and documentary.

- Net collection is payments on bills of exchange and promissory notes, checks; commercial documents are not involved in this type of payment receipt.

- Documentary collection is a collection of documents accompanying a commercial transaction: invoices, shipping, transport carnet (carnet-tir) documents.

As a rule, the collection form in international settlements is used between clients who have long-term cooperation.

This form is notprovides for unconditional payments, as, for example, with letters of credit forms of payment, however, it has its own undeniable advantages.

- First of all, lower risk of payment transactions compared to letter of credit.

- Ease of operation with direct savings on bank transactions, reduced overheads.

- Reduced degree of responsibility for banks participating in the transaction.

Parties preferring collection settlements in foreign trade transactions are determined by the current international legislation. This is the principal, the remitting bank, to which the principal has entrusted the receipt of payments; the collecting bank or the bank presenting the documents to the payer and, finally, the payer under the agreement.

At the same time, the remitting bank is not obliged to check the documents submitted by the recipient of the payment - the principal, the practice of verification is the responsibility of the exporter.

The documents themselves, the availability of details of banks and parties to the transaction are governed by the rules for the execution of collection orders. The rules also regulate the main terms of the transaction with the collection order.

Other forms and types of payments

In addition to letters of credit and collection payments, which are the main forms of international settlements in foreign trade transactions, other types of them are also widely used.

In addition to the above, they are represented by the following important types:

- Bank transfer is one of the accepted forms of foreign exchange transactions. Transfer is a direct payment of money to the recipient or transfercurrency funds from one bank to another on behalf of the bank's client. At the same time, the bank does not bear any obligations to fulfill the contract, which are the basis for currency transfers. According to the legislation of the Russian Federation, a bank is a currency control agent, but it fulfills its obligations within the framework established by law: it draws up transaction passports, monitors the timeliness of the sale of foreign currency from export operations, and receives customs documents confirming the passage of the transaction under customs control. All other obligations for the execution of the contract are assigned to the client - a participant in foreign economic activity.

- One of the varieties of bank payments is an advance payment. As a rule, it is carried out by importers, and the advance payment, according to world practice, can reach up to 30% of the transaction value. It is customary to pay advance payments for the supply of expensive metals, valuable equipment, and the execution of individual expensive orders under a contract.

- A type of bank transfers are documentary (conditional) transfers - they consist in the provision by the exporter's bank of guarantees to the importer's bank to pay the appropriate amount after providing documents confirming the shipment and quality of the goods. To make documentary transfers, the exporter provides the bank with shipping documents confirming the physical exit of the goods outside the exporting country, i.e. confirming the export of the goods from the export territory.

- Currency settlements on an open account - the current practice of using various formsinternational bank payments. This type of payment is used between clients who have long-term cooperation in the field of export-import operations, and therefore unconditionally trust each other. Open account transactions are characterized by the fact that, upon shipment of goods, the exporter opens an account for his partner in the contract - the importer of goods - in the bank in the name of the buyer, entering payments under the transaction to the debit of the open account. After the shipment of the goods, the importer settles the debt on the debit of the account, thus, the settlements under the contract are closed.

The mechanics of making a bank transfer to open an account is simple. The client opens an account and concludes an agreement with the bank on the obligation of the bank to keep the client's funds on this account and credit all incoming funds to the account opened by the client - in favor of the owner. At the same time:

- The transferring bank, the intermediary bank and the beneficiary (the transferring bank) in foreign exchange transactions are considered as third parties participating in the transaction.

- The procedure for using funds, their transfer and storage is negotiated when concluding an agreement for opening a correspondent account.

- For the bank's obligations to make a transfer, the client provides the bank with a payment order. The bank executes payments on the basis of a payment order and an account opening agreement.

Transfers to open an account, as a rule, are carried out in the SWIFT system and take no more than one hour. Mechanics of reporting periods of some bankssometimes delays the receipt of funds, which, passing through the correspondent accounts of the bank, are credited in a day to the client account and much later than the actual transfer by the buyer.

Currency clearing as one of the forms of bank settlements in foreign trade operations

This is the accepted form of payment based on an agreement between the governments of two or more countries. The agreement defines the mandatory mutual offset of obligations and claims.

The goals that are achieved with the help of clearing settlements are varied. As a rule, when concluding a clearing agreement, each state solves its own specific tasks. It could be:

- task to ensure balanced spending of gold and foreign exchange reserves through foreign trade transactions;

- a way to get a variety of soft loans;

- also used as a countermeasure against unfavorable contract terms from other countries;

- contributes to the provision of gratuitous economic assistance and targeted financing of countries lagging behind in economic development with passive balance sheets.

A feature of clearing settlements is the replacement of international (expensive) currency in settlements with clearing banks with the possibility of making payments in national currency to achieve the final offset of all claims.

In the field of international relations, clearing settlements play an important role and contribute to a more complete use of national currencies, the mutual exchange of currencies for conducting currentpayments, provides for the possibility of creating convertibility, within the framework of agreements, national currencies.

Form of currency clearing depends on the countries-participants of the agreement and can be bilateral and multilateral agreements. A striking example of multilateral clearing settlements is the former, historical association of the CMEA member countries, at present these are the EEC countries.

Conclusion

Bank forms of international payments play an important role in the development of the world economy. They regulate payments and obligations under foreign trade transactions.

Contribute to the development of economic, cultural and business ties between countries.

In direct proportion to the level of economic development of the country, the convertibility of the national currency is the expediency and rules for concluding trade transactions, the choice of the form of banking international payments.

All these conditions should be discussed in detail between the parties concerned with the obligatory consideration of mutually beneficial relations and legislation governing foreign exchange financial relations in the country.

Forms of international bank payments are the pinnacle of any foreign trade transaction. Banks not only regulate the timeliness of payments, but also act as a kind of guarantor of ongoing trade transactions.

Without banking participation, many trade relations would not be possible. The use of unified rules and documents allows exporters and importers - participants in the foreign trade market, to effectively and profitably carry outactivities, thereby contributing to the development of the international economy.

Recommended:

Basic forms of cashless payments: concept, types, classification and documentation

Accounting for unprepared people contains a lot of obscure terms. What can I say, sometimes even those who work in a related field get lost. To prevent this from happening, you need to learn. In the article, we will consider not only the main forms of cashless payments, but also the principles of their use

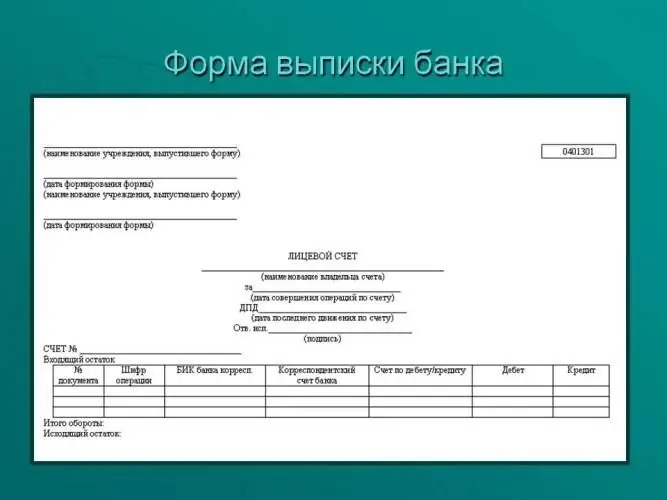

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Documents for property deduction: general information, required forms and forms

Registration of a property deduction is a procedure that many citizens of the Russian Federation are interested in. This article will show you how to get it. What needs to be prepared? Under what conditions and to what extent can one claim a property type deduction?

CMTPL payments in case of an accident. Amount and terms of payments

Quickly getting paid as a result of an accident is a burning desire of a car owner. But not all insurers pay damages. Sometimes you have to go to court. For more information about what insurance payments can be for OSAGO in case of an accident, read on