2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

What are the main forms of cashless payments do you know? Surely your knowledge does not spread that far? Meanwhile, at least to have an idea about this is necessary, so to speak, for the general development. In the article, we will consider not only the main forms of cashless payments, but also the principles of their use.

Concept

Before you understand the issue, you need to understand what it is. Banking operations are called cashless payments, the essence of which is the transfer of conditional monetary forms from one account to another. In other words, there is no direct money exchange.

Non-cash payments are made on accounts through the Bank of Russia or credit institutions. The basis for opening an account is a bank account agreement or a correspondent account agreement, unless otherwise provided by law or another form of payment is used.

As a rule, non-cash payments are made between firms for amounts not less thansixty thousand. Only one current account can be opened for each organization. It is opened by the whole organization, and the form of ownership is not important, because the current account has the status of a legal entity and works on a commercial basis. The owner of such an account manages his own funds and acts as an independent payer for payments to the budget. The account holder may enter into other agreements with the bank.

Current account is opened by an institution that is not engaged in commercial activities. As a rule, various public organizations use such an account. It is noteworthy that the owner of such an account can use funds from it only in accordance with the estimate of the parent organization.

Terms of cashless payments

Before analyzing the main forms of cashless payments, it is worth mentioning the conditions under which they are carried out:

- Having an account with a banking organization. This is the most important condition of all. In order to freely carry out non-cash payments, it is necessary to open a current account. To do this, you need to contact the bank, where they will explain what documents are required.

- Be sure to conduct all transactions through the bank and keep money in the accounts of the same bank.

- Payment can only be made if there are funds in the account, and the owner can take out a loan.

- Requires all payments to be made as agreed.

- The payer must be notified of all transactions that occur on his account.

- The legislation of our country provides for sever althe main forms of cashless payments and types of payments, which means that another condition will be freedom of choice. Simply put, the bank cannot set restrictions on the choice of settlement forms; only counterparty organizations can do this.

- Standardization of payment documents. This is due to the fact that all calculations are carried out on the basis of payment documentation, which, in turn, is drawn up according to general rules and standards. All settlement documents must be drawn up on forms of a single form and contain certain details.

Details of settlement documents

We have already said that there are several basic forms of cashless payments in the Russian Federation, it is also written above about the details for any settlement documentation. But in the previous chapter there is no specifics, but meanwhile you need to know about the details.

So, the documents should be:

- Name of settlement document.

- Payment type.

- Payment document number and date of issue.

- Name of the payer, his tax identification number, account number, name and address of the payer's bank. The bank identification code, subaccount or correspondent account number must also be indicated here.

- It is necessary to indicate the recipient of money, his TIN, account number, address and name of the recipient's bank, BIC, subaccount or correspondent account number.

- You also need to write the purpose of payment.

- As for the payment amount, it must be indicated both in numbers and in words.

- Priority of payment.

- On certain occasionsthe signature and seal of authorized persons is required.

It is important to remember that nothing can be corrected in settlement documents. You can submit settlement documentation within ten days, the date of issue is not included in the period.

A large selection of the main forms of non-cash payments in the Russian Federation and in the world is due to the fact that information technologies are constantly developing. This allows you to use electronic money and saves time.

Essence of calculations

Operations on the organization's current account show changes in debt obligations and claims, and within the organization reflect the redistribution and distribution of gross national product and national income.

If banks work well, then non-cash accounts contribute:

- To accelerate the turnover of funds.

- Reduce cash needed for circulation.

- Faster payments.

- Reducing the additional cost of storing, printing and transporting a large number of banknotes that are needed for cash payments.

Based on this, it can be seen that the forms of organizing cashless payments have long since replaced cash transactions.

The current legislation says that non-cash transactions between enterprises can be made not only by banks, but also by non-bank credit institutions. As for banks, they interact with each other through correspondent accounts opened with counterparty banks.

Principles

Before moving on to forms of organizationcashless payments, it is worth talking about the principles of these very calculations. Their observance allows to ensure compliance with the requirements and the calculations themselves. Requirements include reliability, timeliness and efficiency.

There are only seven principles of various forms of bank non-cash payments, and all of them are worth talking about:

- Legal regime for making payments and settlements. In other words, everything must comply with the regulatory framework. This principle assumes the existence of several regulatory documents, according to which the calculation is carried out. The main legislative sources are the Civil Code, the Arbitration Code and the Code of Civil Procedure.

- Conducting settlements mainly on bank accounts. What does it mean? The main forms of non-cash payments in Russia, both between legal entities and between individuals, are carried out through the bank in which the account is opened. For servicing, a bank account agreement is concluded between the client and the bank.

- Maintaining liquidity. We are talking about the level when payments are made smoothly. Thanks to this principle, all obligations are fulfilled unconditionally and clearly. This is due to the fact that payers need to know the exact timing of the receipt of money in order to plan payments correctly.

- The payer must agree to the payment. The implementation of this principle is achieved through the use of a payment instrument, for example, a payment order or a check, or a special documentary acceptance, which is issued by the recipient of funds. By the way, the lawprovides for the withdrawal of funds that do not require consent. This could include shortfalls in taxes or other obligatory payments.

- Urgency payment. Funds must be continuously spent within the time frame specified in the contracts. If the deadlines are not met, then the circulation of funds is disrupted, which sooner or later leads to a payment crisis. By the way, the principle of urgency can also be attributed to the fulfillment of bank obligations in relation to settlement transactions.

- Control over the correctness of the calculations. Supervision is divided into several types, but all of them are subject to the federal law "On Accounting", that is, accounting statements must be publicly available.

- Property liability for non-compliance with the terms of the contract. Violation of the contract by any party leads to civil liability, which is expressed in the payment of a pen alty and damages.

Form content

Before we break down cashless payments, their organization and basic forms, let's take a look at what each form contains.

So, the elements of the payment form are:

- Type of settlement document.

- Method of transmitting information.

- Document flow.

Payment form

So we got to the main point. So, the main forms of cashless payments are:

- Payment orders.

- Checks.

- Letter of credit.

- Settlements for collection.

- Other payments that are provided by law andused in banking practice.

Since these methods are the main forms of cashless payments, they must have common features. And they are:

- Responsibility for improper fulfillment or non-fulfillment of obligations for the implementation of banking operations lies directly with the banking organization.

- Requisites, form, content, as well as the procedure for the execution of various settlement methods are regulated not only by law, but also by banking rules.

By the way, the characteristics of the main forms of non-cash payments are very similar to the principles of these very calculations, so we will not dwell in detail. It is better to tell about each of the methods of cashless payment.

Payment order

This is the name of the settlement document, which is issued on a form of a certain form. It contains the owner's instruction to the issuing bank to transfer some amount to the recipient's account. By the way, the latter can have an account opened both in this and in another bank.

Most often, a payment order is issued in four copies. One of them is received by the payer, the document is stamped by the bank, which means that the order is equivalent to a receipt for the receipt of the settlement document.

If the calculation takes place according to this form, then the bank undertakes, on behalf of the account holder, to transfer money to the recipient on the provided details within the period prescribed by law or contract. The obligations of the issuing bank appear after the conclusion of a bank deposit or bank account agreement. For this reason, the institution must complypayment order in any case. There are only two exceptions provided by law:

- No funds on the owner's account.

- The form and content of the payment order does not comply with the rules and legal requirements.

Financial institution must transfer money to the beneficiary's account in any bank. When transferring funds, the organization performs two obligations at once:

- Debits funds from the owner's account.

- Provides the transfer of money to the details of the recipient.

It is noteworthy that the obligation is fulfilled only if the money has been credited to the recipient's account. This is due to the fact that the bank is responsible not only for its own actions, but also for the actions of the entities it has involved in making settlements.

Now what are the main forms of cashless payments? And the first thing that comes to mind is a payment order. All because of the popularity of this form of payment, because it can be used to pay both individuals and legal entities.

Letter of credit

Among the forms of non-cash payments in Russia, settlement by letter of credit is quite popular. Article 867 of the Civil Code establishes that a bank that acts on behalf of the owner to open a letter of credit undertakes:

- Make a payment to the recipient of the money.

- Give authority to another bank to make payments to the beneficiary or accept, pay or discount a bill of exchange.

- Issue, pay or accept a bill of exchange.

Importantremember that the issuing bank is subject to the rules on the executing bank with all rights and obligations.

Payment by letter of credit is not as widespread as it used to be, but nevertheless still remains the most guaranteed payment method and the most acceptable form of payment.

Letter of credit relations are quite complex in structure, since the issuing bank has several legal relations with different entities. This is:

- Payer.

- The attracted bank.

- Executing bank.

- Beneficiary or recipient.

The involved banks are those that were involved by the issuing bank for settlements. Such an institution may be the organization in which the payer's account is opened, although in some cases it may not exist. It turns out that the bank account agreement in this case is not considered the basis for the emergence of a letter of credit obligation.

Collection

If they say, describe the main forms of cashless payments, do not forget about such a method of transferring funds as collection. What it is? This method of payment provides for obligations on the part of the bank regarding the implementation of the receipt of payment at the initiative of the recipient.

The procedure for collection settlements is governed by legislation that does not contradict banking rules. The collection operation is different in that the recipient of the funds, and not the payer, applies to the bank. For this reason, the international name "debit transfer" was adopted. When calculations applyby collection? Only in two cases: when it is agreed between the recipient and the payer, and if such a calculation is provided for by law.

The main form of non-cash payments in the bank is as follows: the recipient applies to the financial institution with an instruction to send a request to pay in the prescribed form to the payer. The form of the claim is affected by the selected settlement document.

The following documents apply for collection:

- Payment request without acceptance.

- Payment request with acceptance.

- Collection order.

Checks

Among the 23 main forms of non-cash payments in the Russian Federation, checks stand out. This is the name of securities that contain the order of the drawer of the check to the bank to issue a certain amount to the holder of the check. This security is usually issued as payment for goods or services. It is important to remember that the issuance of a check does not extinguish the monetary obligation in relation to which it was issued.

Only a bank where the drawer has funds can be a payer on a check. It is necessary that the owner of the money could freely dispose of them. You cannot revoke a check if the deadline for presenting it has expired. In addition to this moment, the legislation regulates the procedure, as well as the conditions for the use of checks. Everything is written in the Civil Code of our country.

In order to be able to pay by check, an agreement must be concluded between the two parties or the corresponding condition is written in the agreement with the financial institution. On the basis of such a document, the owner receives a checkbook, whichmade according to the requirements of the bank and the legislation on the details of the check. You can open a separate account from which funds will be debited upon presentation of a request of the appropriate format.

Only the credit institution that issued it is en titled to pay the check, and this is done at the expense of the owner. As a rule, it is used for interbank settlements if there is a correspondent agreement.

The payer of the check must check by all means the originality of the check and also the authority of the drawer to manage the account. If the payer has losses due to the fact that he paid with a forged or stolen check, then the one who caused the trouble will compensate them.

The person who paid the check has the right to demand that it be handed over to him along with a receipt that the payment has been received. This document is not only able to provide increased payment guarantees, there are other advantages. Among them:

- Irrevocable.

- Equivalent opportunities with security.

- Present and order checks can be transferred from the holder of the check to other persons.

- The holder of the check may hand over the check to the bank for collection.

- Guarantee of payment in part or in full aval.

- The holder of the check may demand payment of money to him in case of refusal.

As you can see, accounting can't be learned in half an hour, but it's worth spending more. Do not forget that the more a person develops, the more he is of value, first of allqueue, for himself.

Recommended:

The concept and types of power in management. Fundamentals and forms of manifestation of power in management

A person who occupies a leadership position always takes on a great responsibility. Managers must control the production process as well as manage the company's employees. How it looks in practice and what types of power exist in management, read below

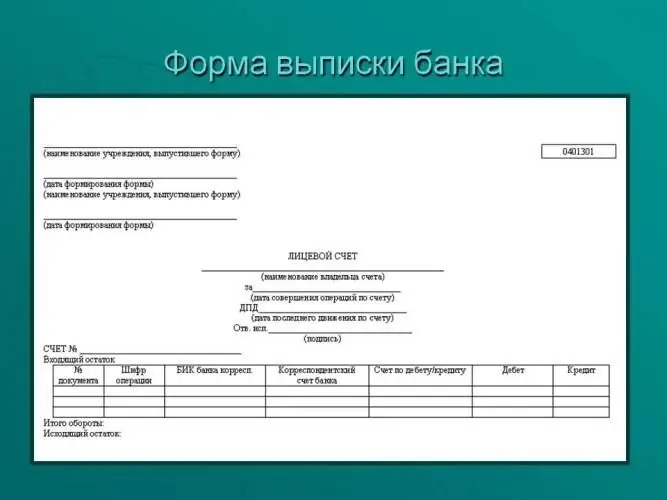

A bank statement is The concept, necessary forms and forms, design examples

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility

Collective investments: concept, types and forms, advantages and disadvantages

Collective investment is a type of trust management with a low entry threshold that allows small investors to invest in the stock market, real estate market, precious metals and others, making a profit from investing their money. This is an investment of the joint capital of investors, which makes it possible to earn money by significantly increasing their capital

Tax and tax payments - what is it? Classification, types, concept and types

Currently, the tax system is a set of taxes and fees established by the current legislation of the Russian Federation, which are levied in the budgets of different levels. This system is based on the principles provided by law. Let us consider in more detail the issues of essence, classification, functions and calculation of tax payments

Insurance: essence, functions, forms, concept of insurance and types of insurance. The concept and types of social insurance

Today, insurance plays an important role in all spheres of life of citizens. The concept, essence, types of such relations are diverse, since the conditions and content of the contract directly depend on its object and parties