2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

When purchasing any banking product, any client, sometimes without knowing it, becomes the owner of an account with which you can carry out income and debit transactions. At the same time, there must certainly be a certain tool that allows any client to exercise control over the movement of their own funds. This is a bank statement. This is a document that is usually issued upon request to the client. However, not everyone is aware of this possibility. Let's fix this.

Bank statement - what is it?

Represents a reference financial document that allows you to track debit and credit transactions on an account for a certain period. Using an extract from a bank account, each client can confirm the fact of debiting or crediting moneyfunds or, conversely, to refute this information. You can get this document during a personal visit to an institution or remotely if a credit institution provides a similar service.

What do you need?

A bank statement, as you understand, reflects information not only about the current state of the account, but also about the movement of funds. Using this financial certificate, it is possible to confirm the crediting or debiting of funds, the amount of taxation and more.

A bank statement in 1C 8.3 displays information about debiting and receiving funds by bank transfer. Therefore, as a rule, it is used when it comes to financial transactions of an enterprise. In addition, bank statements in 1C contain information about the current state of the account.

When else are such certificates required? A bank statement for a visa may be required for those citizens who are planning a trip abroad. This document allows you to confirm your financial situation and convince the consulate that you do not plan to become an illegal immigrant, but have enough money to pay for your own stay in the country.

Design examples

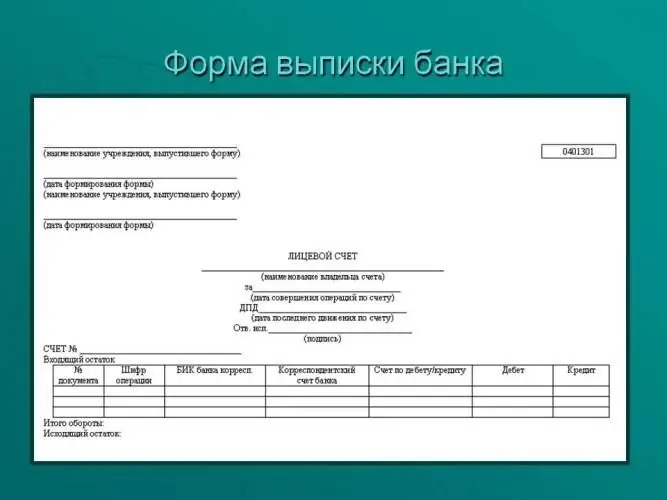

It must be said that the form of a bank statement is not enshrined in legislation or regulations. That is why design examples are often used to understand what is being said. However, at the same time, there is a whole list of items that it must certainly contain:

- Name of the bank and alsohis details.

- Information about the client indicating his current account.

- Date of compilation.

- Account balances at the beginning and end of the day.

- All transactions related to debiting or crediting funds.

In addition, each financial transaction that is listed in the statement must contain the following data:

- Date.

- of the document used to complete the transaction.

- Amount.

Required forms and forms

This information is not required by the client, as the bank uses pre-prepared forms and forms to provide relevant information. All that is required of you is to contact the company's office or request the necessary information remotely. Depending on the method of application, you will receive an extract in paper form or in electronic form, and later you can print it yourself. Below is a sample that contains standard information.

Features

A bank statement is a document that is generated daily for companies and entrepreneurs who own current accounts. However, you need to pick it up yourself when visiting the office. However, there are other ways to obtain a bank statement. It depends on the conditions of the particular institution where the client is served.

As for the certificate for an individual, the institution does not generate it automatically. Therefore, the client must request this information on their own. At the same time, certainlyyou must specify the period for which you want to receive financial information. The time it takes to generate a document depends on the conditions of the credit institution in which you are served. The period for compiling a bank statement at the bank can be from several minutes to several business days.

By the way, a similar period applies in cases where an entrepreneur or legal entity requests information for a period exceeding one cash day.

Views

A bank statement can have several different types, depending on the status of the account holder and the type of product they use:

- Current account statement.

- Statement of the deposit account.

- Loan statement.

- Electronic statement.

On current account

Formed daily for settlement accounts of individual entrepreneurs or legal entities. The information is generated automatically. At the same time, the account holder has the right to request a statement for the period of interest to him. This can be a calendar month, a quarter, and so on.

According to the deposit account

Formed by the bank upon receipt of a corresponding request from the client. This financial statement contains information on the amount on the account, the amount of accrued interest, as well as on income and expenditure transactions. An example of such a statement is the information that is displayed in a savings book. However, a similar statement can be generated for a customer using a debit or credit card.

On loan account

This information may be required for customers who have a bank loan. Such an extract contains the total amount of funds contributed by the borrower, the amount of payments indicating the principal debt and accrued interest, as well as the remaining debt. In the case of a credit card, it also lists the mandatory payment that must be made to prevent interest.

Electronic Statement

This is an alternative to the traditional paper certificate, which has certain advantages. For example, such a bank statement can be delivered to the client's email address. Subsequently, he can print it himself. In addition, to order such information, you do not have to personally contact the bank office. It is enough to use remote services.

How to get?

There are many ways to get a bank statement. Let's list it so you don't have any questions:

- Go to the bank office. This is the simplest and most familiar way for most customers. All that needs to be done is to visit the selected office, contact a specialist, wait in line, and request an extract from the desired account. Please be prepared to present your passport. This method is not suitable for those who absolutely do not have extra time for such actions. In addition, the situation may be complicated by the small number of branches of the bank where you are served.

- Terminal. In this device, most likely, it will not be possible to generate a full-fledged statement. However, this one canbe convenient for customers who only need information about the latest completed transactions.

- Personal account. Most companies offer their customers remote service methods. The convenience lies in the fact that you do not have to personally visit the bank office, waste time on the road and stand in queues. All you need to do is to pre-register in your personal account, and then order an extract, specifying the desired period. In addition, it is possible to set up regular receipt of a bank statement by e-mail. This will allow you to control your own finances without taking unnecessary actions in the future.

Sberbank

A bank statement from this financial institution can be obtained in several ways. The client can personally contact the office of the company or use the online service to expedite the procedure.

In the second case, you must first register using a bank card and mobile phone. This is necessary in order to gain access to your personal account, in which you can order an extract. The client will be able to independently choose the period, receive information in electronic form or print it out if technically possible.

A bank statement for a visa is often requested by citizens who apply to the consulate. The ability to receive it remotely allows you to somewhat speed up the process, as it does not require a personal appeal to the office.

How much?

This is a topical issuefor potential clients. As a rule, banks provide this service free of charge. If any organization requires payment for such a service, this is rather an exception to the rule. For example, in cases where it is necessary to provide an extract on an official letterhead with a seal. This statement is generated by a bank employee, and is not printed automatically. As you understand, this entails more time costs. Accordingly, the service is provided for customers for a fee.

When it comes to legal entities, slightly different conditions apply. Whether a bank statement will be paid or free depends on the package of services chosen by the company, as well as on the method of requesting information. As a rule, accountants use remote channels with EPC. At the same time, statements are issued in return, which are equated to paper counterparts and can be used as full-fledged accounting documents.

If the financial certificate is requested in one copy, the service is free of charge. However, fees may apply if you request this information again.

Now you know what a bank statement is and how to request and receive one. This information can be useful for both private clients and legal entities. You should be aware that a bank statement is generated in two copies, of which only one is issued to the client upon request. The second is stored in the electronic database of the financial institution.

Recommended:

Power of attorney for a bank from a legal entity: sample, features of filling, necessary forms and documents

Drawing up a power of attorney for both individuals and legal entities has some nuances. Even turning to a specialist for help, you need to know how the procedure goes, what documents you need to have with you, how long it will take to process, etc. In this article, we will talk about how a power of attorney is drawn up for a bank from a legal entity

Rules for filling out UPD: types of services, procedure for registration with samples, necessary forms and relevant examples

There are many questions about the rules for filling out the UPD (universal transfer document), because there are a limited number of samples with already entered data. The tax authorities are accustomed to returning the paper for correction without explaining what exactly is incorrectly drawn up and how to correct the error

Mutual settlements between organizations: drawing up an agreement, necessary documents, forms of forms and rules for filling out with examples

Settlement transactions (offsets and settlements) between business entities are quite common in business practice. The result of these operations is the termination of the mutual rights and obligations of participants in civil relations

Restaurant concept: marketing research, development, ready-made concepts with examples, description, menu, design and opening of a concept restaurant

This article will help you understand how to prepare a description of the concept of a restaurant and what you need to consider when developing it. It will also be possible to get acquainted with examples of ready-made concepts that can serve as inspiration for creating the idea of opening a restaurant

Insurance: essence, functions, forms, concept of insurance and types of insurance. The concept and types of social insurance

Today, insurance plays an important role in all spheres of life of citizens. The concept, essence, types of such relations are diverse, since the conditions and content of the contract directly depend on its object and parties