2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

In financial news, you can often see the term "currency conversion". But not everyone knows the meaning of this phrase.

In a general sense, currency conversion is the exchange of one currency for the currencies of other states. It can be carried out both within the country and abroad.

Types of currency convertibility

There are freely convertible, partially convertible and non-convertible currencies.

Freely convertible is the currency that is exchanged in any country in the world. There are few such currencies in the world. This is the American and Canadian dollars, the euro, the yen and others. Freely convertible currency is a great advantage for the foreign economic activity of the state.

Partially convertible is a currency that is not exchanged in all states. Thus, the Russian ruble is a partially convertible currency.

A non-convertible currency is a government currency that can only be exchanged for foreign currency with the help or permission of the central bank.

In addition, the conversion can be external and internal, current, capital and so on.

External conversion is an opportunity to carry outcurrency exchanges by non-residents, and the internal one is the same, only for residents.

Benefits of hard currency

If the currency of the state is freely convertible, then this indicates a developed state of the economy of this state. The conversion of foreign currencies by market participants indicates that they trust it. And therefore, citizens of a state with a freely convertible currency have a fairly high standard of living.

Russia is also striving to make its currency freely convertible, at least so that settlements between states buying anything from the Russian Federation are carried out in rubles, and not in dollars or euros. Thus, this will raise the level of the economy and raise the ruble to a qualitatively different level of development. In addition, the status of Russia with a freely convertible currency will also grow.

Currency conversion is cash and non-cash transactions

When making a cash transaction, it is supposed to convert the currency at a bank, an exchange office or an ATM by withdrawing money from a bank card. Cash conversion is very popular.

Meanwhile, non-cash currency conversion is often much more profitable than cash. This operation is performed, for example, in electronic wallets, in electronic payment systems, online in your personal account on the bank's website, where an account is opened and, of course, using bank cards.

Currency conversion is one of the types of funds transfer between accounts. Money is transferred from one currency account to another, asusually in electronic form. To complete this type of transaction, a smaller commission will be required than with cash conversion, and in some systems there will be no commission charged at all.

How currency is converted online

Tools for online currency exchange are the so-called currency converters or currency calculators. Thanks to them, the currency is automatically converted at the rate set by the Central Bank of the Russian Federation. All calculations are carried out in real time.

Converters can navigate by dates. Thus, it becomes possible to make calculations based on the value of the currency as of a particular date. Thanks to this function, the user can compare the results of calculations and decide whether it is worth converting the currency now or better to wait.

How to calculate the fee charged when withdrawing funds from a bank card abroad

Many Russians today prefer to travel abroad not to take all the cash, but to pay with bank cards. This is really a very convenient and useful thing. The main advantage for tourists, probably, is its safety, since even in the event of theft, the card simply needs to be blocked, and then it will be impossible to carry out operations with it. With the help of bank cards, payments are made, and currency conversion is also carried out. These are transfers of the currency of one country (which is on your card) to another (which you currently need to pay your bill or receive cash).

The main thing is to know for sure that you can pay with this card on a trip to the destination. It is also necessary to make sure once again that the card will be valid at the moment and for the duration of the trip.

In order to calculate what will be the commission charged from the account when making a payment abroad, it is necessary to take into account the fact whether a commission is charged for all transactions abroad. Banks sometimes do not charge this fee, or they provide a small fixed fee or a percentage of the payment amount.

People often want to know before the trip how much they will receive when withdrawing money abroad. However, the bank does not know this for sure, because depending on the time, place, conditions of partner banks, the requirements of local legislation for the process of withdrawing money, the amount may be different.

Recommended:

Currency borrowers. All-Russian movement of foreign currency borrowers

At the end of last year, an all-Russian movement of foreign currency mortgage borrowers was formed. This was due to the sharp devaluation of the ruble, which made it almost impossible to service loans of this type

A conversion operation is Types of conversion operations. Conversion transactions

A conversion operation is a transaction carried out by participants in the foreign exchange market to exchange the currency of one state for the monetary unit of another. At the same time, their volumes are agreed in advance, as is the course with settlements after a certain time. If we consider the concept from a legal point of view, we can conclude that a conversion operation is a currency purchase and sale transaction

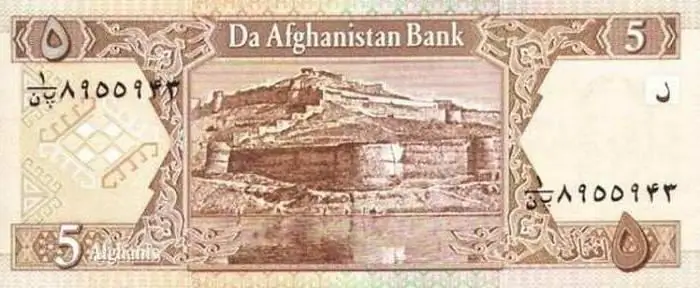

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material

What is a currency? Russian currency. Dollar currency

What is the state currency? What does currency turnover mean? What needs to be done to make the Russian currency freely convertible? What currencies are classified as world currencies? Why do I need a currency converter and where can I find it? We answer these and other questions in the article

Currency conversion is Currency exchange rules

Currency conversion is… A list of freely convertible currencies: dollar, euro, ruble, hryvnia, tenge, yuan and others