2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

Today, the Russian economy is at the stage of integration into the world economic system. This explains the need for domestic companies to raise funds in foreign currency. Obtaining loans from foreign organizations is one way to solve this problem.

Who is a borrower?

The borrower is a party to a credit relationship that received a loan and assumed the obligation to repay it within the agreed timeframe and pay interest for the period of using the loan.

In the framework of credit relations, the same economic entity can act simultaneously as a creditor and borrower. If a company receives a loan from a bank, it will be the borrower and the other party will be the lender. But if an organization keeps its funds in a bank, they will act in opposite roles.

When borrowing, this economic entity will be a party in relations with the creditor. It borrows a certain amount of money or other items with a specific accessory. In accordance with the agreement, the borrower must return a similaran amount of money or an equal amount of things of the same kind and quality.

If the object of the loan will be funds denominated in the monetary units of another state, the economic entity will be a foreign currency borrower.

For what purposes do currency borrowers raise funds?

The purpose of attracting foreign currency can be any. However, it is worth highlighting the most common of them:

- payment for services, works or intellectual property purchased from foreign or domestic companies;

- payment for goods that can also be purchased under international leasing contracts;

- when opening representative offices of the company abroad;

- acquisition of securities denominated in the currency of another state;

- buying real estate using foreign currency;

- participation in the investment activities of a foreign company;

- for other uses.

It is worth noting that in Russia, obtaining a loan in foreign currency from domestic companies is prohibited by law. Services to foreign currency borrowers are provided by authorized financial institutions. As a rule, they charge higher interest rates than regular banks.

What are the costs for a foreign currency borrower?

Using loans comes with additional costs, which you should be aware of before resorting to this method of obtaining funds. Ignorance in this matter can lead tonegative consequences. Foreign exchange borrowers will have the following costs:

- interest paid to lenders on loans granted;

- the difference in the exchange rate, formed under the terms of the agreement from the moment interest is accrued until its full repayment.

Interest on the loan must be paid in accordance with the procedure provided for in the contract. If it does not specify the appropriate deadlines, they must be paid up to a full refund on a monthly basis. When recalculating accrued interest, the unrealized expense or income will be the amount of a negative or positive exchange difference.

Mortgage lending

Considering this situation, it is worth highlighting mortgage lending. This is a long-term loan provided by a financial institution to an individual or legal entity. In this case, the object of collateral is mandatory real estate. It can be premises, structures, as well as residential and industrial buildings. It is worth noting that foreign currency mortgage borrowers are persons who have been granted a loan in foreign currency.

The most common use of mortgage lending in Russia is the purchase by citizens of real estate on credit. Basically, the purchased housing becomes the object of collateral, but it can also be existing buildings. Real estate provided under a mortgage is registered with the relevant authorities, so foreign currency mortgage borrowers will not be able tosell it before the loan is paid off without performing special actions.

Currency mortgage loans

In the current economic situation of the state in the most difficult situation were the holders of mortgage loans in foreign currency. This is due to the fact that most of these citizens receive income in rubles, and the cost of monthly payments in dollars or euros has risen almost several times, which has put a large number of families on the brink of default. The following solutions to the problem are discussed:

- fixing a certain exchange rate;

- imposition of a moratorium on collection of overdue debts;

- Revision of the interest rate on the loan.

It is worth noting that the final decision has not been made, so foreign currency mortgage borrowers are seeking serious action from the state. Every month there are more and more loan debtors, as citizens are not able to make payments on time in large amounts. Among them may be half of the borrowers who borrowed funds in foreign currency. The government should take adequate measures against citizens of this category, as the State Duma is preparing to freeze payments. At the same time, the Central Bank offered to provide assistance to foreign currency borrowers by converting loans in the monetary units of other countries into rubles, focusing on a specific exchange rate. However, experts say that citizens who have taken out a loan will have to cope with the consequences, without weighing all the pros and cons.

Movement of foreign exchange mortgage borrowers

At the end of last year, an all-Russian movement of foreign currency mortgage borrowers was formed. This was due to the sharp devaluation of the ruble, which made it almost impossible to service loans of this type. This movement has the only goal, which is to transfer the balance of loans to conditions acceptable to citizens, maximally equalizing payments in foreign currency and rubles.

The all-Russian movement of foreign currency borrowers includes participants who are citizens of the state who have issued bad loans at different times. They are represented in various social networks and have their own website. Participants in the movement under consideration perform certain tasks to the best of their ability. They are:

- participation in various conferences;

- event organization;

- negotiating with government representatives and financial institutions;

- working with the media.

All-Russian movement of foreign currency mortgage borrowers involves participation on a voluntary basis. Each of the participants has the right to express their opinion, as well as to make constructive proposals based on competent arguments.

How does the foreign exchange borrowing community feel about government?

The society in question emphasizes the absence of political goals, which leaves loy alty to the government as a priority. The all-Russian movement of foreign currency borrowers is alsofollows a consistent approach to commercial banks. This allows you to achieve the optimal solution to the problem with a mortgage in a foreign currency.

In communication with the media, the movement of foreign exchange borrowers does not comment on the opinion on the country's foreign policy. In the press there are references to society in the context of state policy, but mostly they are a provocation. Quite often, various currents try to make borrowers their allies as a result of an unstable economic situation.

It is worth noting that the movement of foreign currency borrowers prohibits its participants from illegal actions. Otherwise, they will be personally liable for violation of this requirement. For this reason, they will not receive society's help.

Commercial benefit to society

In the course of existence, foreign exchange mortgage borrowers do not derive commercial benefits. Participants, by their own disinterested desire, strive to set real tasks to solve the existing problem. Commercialization of activity in any form is a violation of the traffic rules.

Problem Solving

A large number of citizens who find themselves in a difficult situation are seeking from the government and commercial banks to provide more suitable conditions for repaying loans. Foreign currency borrowers also wish that mortgage loans were not issued in foreign currency at the present time. The Central Bank also insists on this, but banks continue to provide this service. This is due to the fact that institutions also facedcrisis and want to get as much profit as possible. Citizens can determine for themselves how risky this is. At the moment, foreign currency borrowers hope for a favorable development of the situation. The number of citizens who take loans in foreign currency has significantly decreased. This confirms the fact that borrowers weigh the pros and cons, making the right choice.

Recommended:

Movement of an employee: the order of movement, the nuances

Movement of an employee can be represented in several ways. The article describes when and how this procedure is performed. The main differences between the process and the translation are given, as well as the rules for processing the transfer

Gold and foreign exchange reserves of the countries of the world. What is it - a gold and foreign exchange reserve?

Gold and foreign exchange reserves are the reserves of foreign currency and gold of the country. They are kept in the Central Bank

Foreign economic activity is Management of foreign economic activity

Foreign economic activity is the activity of the state in the sphere of the economy outside of domestic trade. It has many different aspects, but all of them are somehow connected with the market, the promotion of various kinds of services on it: transportation, sale of goods. In fact, it is a complex system consisting of many interdependent links

Manager for foreign economic activity (foreign economic activity): tasks, duties, requirements

Foreign trade manager - who is this? Two main lines of business and day-to-day tasks. The main duties of a specialist. Requirements for the applicant, the necessary personal qualities. Consider the pros and cons of the profession. How to become a foreign trade manager? Getting started and career advancement. The question of wages

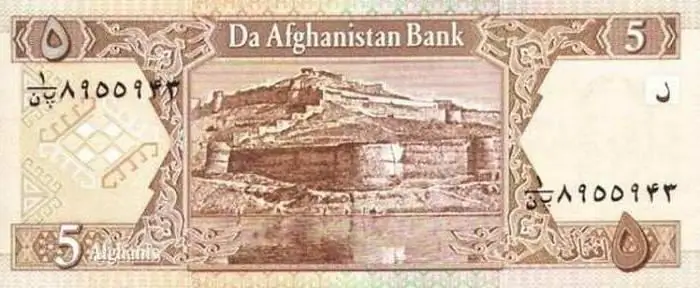

The currency of Afghanistan: the history of the currency. Curious information about the currency

Afghan currency Afghani has almost a century of history, which will be discussed in this material