2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

In the article we will consider what a blocking block of shares is. Investors who are interested in running a company often seek a stake that allows them to override decisions made by other shareholders. That is why many investors are interested in the question of the number of securities in a blocking stake. It is called that way.

In some situations, the owner has the opportunity not only to block, but also to make strategically important decisions regarding the development of the organization. This is possible not only if there is a sufficient percentage of preferred shares, but also in some other situations. We will tell you more about the blocking block of shares (more precisely, blocking) below.

Share package

Under a block of shares it is customary to understand a set of securities issued by a JSC and held by one owner. In this case, it is necessary to take into account not only the total number of securities issued by the joint-stock company, but also their ratio among all shareholders. In order to be able to resolve any issues as part of the directors of the organization, a sufficient percentage of ownership of shares issued by this JSC is required. You can hold a meeting of shareholders if you have 5% or more shares.

In addition to ordinary shares, the company has the right to issue preferred securities. They differ in that the shareholder who owns them cannot manage the company through meetings of shareholders. But during the liquidation of the joint-stock company, it has the right to participate in voting on various key points. In return for voting rights, holders of preferred shares have some other benefits:

- They receive dividends on their shares, which are independent of the company's earnings.

- When the joint-stock company is liquidated, they have the opportunity to receive part of the property, moreover, as a matter of priority. Holders of ordinary shares can only claim the property of the JSC after them.

In accordance with applicable law, a company may issue preferred shares in the amount of not more than 25% of the total number of securities. A blocking stake is how many percent? Let's figure it out.

Sizes of promotional packages: up to 10%

An individual who owns 1% of the company's shares has the right to access the register of shareholders. That is, the shareholder has the opportunity to view the state of the register on a daily basis in order to analyze the profit and further actions related to the purchase or sale of shares. Every strategic investorstarts acquiring shares of a certain company with exactly 1%.

If the shareholder's share reaches 2%, he has the right to nominate his representative, who will participate in the board of directors. In addition, he acquires the ability to manage the joint-stock company, since the board of directors will have to reckon with his vote.

With a 10% stake, a shareholder has the right to hold extraordinary meetings of directors. In addition, the owner of a package of such a volume may require an audit, and an unscheduled one, of the financial activities of the JSC. But this is far from a blockable stake.

Above 20%

To purchase a 20% stake, an investor must obtain a permit from the Federal Antimonopoly Service. A shareholder who owns 20% of all securities issued by the company has great prospects. He also gains freedom of action in relation to the management of the company.

Blockable block of shares (blocking)

Often, shareholders wonder about its size. The owner of such a package of securities may at its own discretion and solely block any decision and issue raised for discussion. So, how much is a blocking stake?

The shareholder must have a package of 25% + 1 security. The owner of the blocking shareholding is able to reject significant decisions concerning the management of the joint-stock company, but also make decisions of a managerial nature in general if the owner of the controlling shareholding of securities is absent. This possibility is preserved even ifwhen more than one shareholder has a controlling stake. For many investors, the priority is to obtain a blocking stake, not a controlling one.

Control package

If a shareholder wishes to own a controlling stake in securities, he will need to accumulate 50% + 1 share of all issued financial documents. An investor who has a controlling blocking stake at his disposal has the right to resolve issues related to dividend payments. His opinion is also weighty in matters of the organization's strategic development.

What share of securities should in practice be contained in a controlling stake?

As mentioned above, theoretically, a shareholder must own 50%+1 security in order to have a controlling interest in financial documents. But in practice, this number is much lower, usually ranging from 20-25%. In addition, there are examples in history when owning 10% of the shares was enough to block objectionable decisions and manage the company. Such options are possible if one of the following conditions is met:

- Securities of the organization are accumulated in the hands of investors who are currently geographically remote. For this reason, not all of them can constantly attend stock meetings held out of turn.

- Shareholders are passive about meetings.

- Certain share of the issued shares of JSC - preferred. Therefore, their voting rights holders are nothave. In such a case, the redistribution of shares held by investors is carried out.

If the shareholder meeting was attended by shareholders whose total block of shares is only 80%, then the size of the blocking block is not 25% + 1 security. The possibility of blocking decisions arises for a participant with a smaller share of shares. In addition, the following statistics are observed: the share of blocking and controlling stakes can be the smaller, the more minority investors in the company.

Differences between blocking and controlling stakes

The study of the concepts of these packages allows us to conclude that a shareholder with a controlling stake is automatically considered the owner of a blocking stake.

The owner of the blocking stake can veto the decisions of other investors. But it should be noted that the owner of a controlling stake can, in turn, both block the ideas of other directors and solve many management issues in terms of the direction of development and the payment of dividends.

More than 75% what do you need?

Some issues in the management of the company, but require more than 75% of the vote. These include:

- Questions about the liquidation of JSC.

- Consideration of options for changing the status, reorganization, merger.

- Reducing the size of the authorized capital (UK) by reducing the nominal price of each security.

- Increasing the size of the UK.

- Determining the value of securities before the upcoming issue.

- Decision to acquire its publicly traded shares.

- Planning a major deal worth more than half of the company's assets.

Thus, the shareholding of a blocking stake may be different. In theory, it is equal to 25% + 1 security, but in practice it often happens that it is much less. Similar situations arise under a variety of conditions.

Recommended:

How can an individual make money on Gazprom shares? Dividend payments on Gazprom shares

A lot of people have heard about the potential to make money on stocks. However, not everyone knows how to do this and what is needed for this. In short, there are two opportunities for profit in this way, namely: dividends and growth in market value. Gazprom is known as the largest energy company listed on the Russian market. For this reason, it attracts potential investors

The difference between ordinary shares and preferred shares: types, comparative characteristics

In the article we will consider what is the difference between ordinary shares and preferred shares. The latter are a financial instrument that is between ordinary shares and bonds. And if dividends are paid regularly, then such elements are somewhat reminiscent of paper with a variable coupon. And when they are not paid, they can be equated to ordinary shares

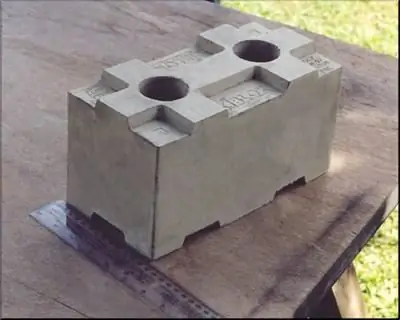

Foam block: foam block dimensions, history of appearance and application prospects

Each movement of the bricklayer is performed at a certain speed. An ordinary clay brick weighing about 3 kg or a large foam block of the same mass will be installed in the wall in the same time. But the dimensions of the foam block are eight or even twelve times the size of a brick, which dramatically increases the speed of masonry. Another important advantage of a light and warm building material is that it requires an adhesive rather than a complex cement-sand mortar

What is the meaning of labor discipline? The concept, essence and meaning of labor discipline

It is difficult to overestimate the importance of labor discipline. Indeed, in labor relations, the employer and employee often face situations where both consider themselves right, but their opinions do not lead to agreement. Labor discipline legally regulates many points in which disputes and dissatisfaction among participants in labor relations simply do not arise. The next article is about the main points of labor discipline

"Golden share" is "Golden share": definition, features and requirements

This term is not new in the world and in our country. But for sure, many now have encountered it for the first time, so rarely do we hear it in the media and in non-specialized circles, despite its importance. Therefore, it would be useful to analyze what a "golden share" is, what rights it gives its owner, and what place it has among other securities