2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:43

Money may be needed at any time, no one is safe from this. But what if the only source of funds now is the mobile phone balance? Or did you accidentally make a mistake and put in more than you planned? How to transfer money from MTS to a bank card, and is it real? Let's figure it out.

Possibilities of mobile operators

The services of mobile operators are now far from being limited only to the provision of cellular communications. Money transfers are included in the list of services, and a large number of people use them.

Why are they needed? This makes it possible to make transfers without opening a bank account. It is also an opportunity to transfer money to people who are in other cities and even countries.

This method is often used to raise funds for charitable purposes.

How to transfer money from MTS to a card?

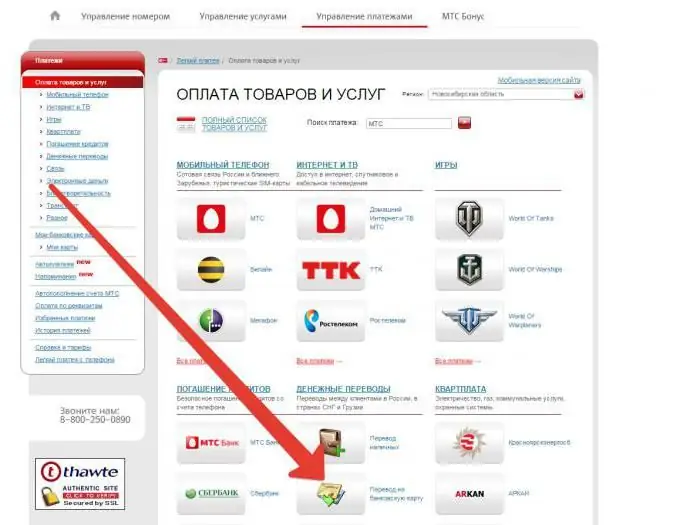

The algorithm is the following. You need to go to pay.mts.ru. There you will see a large number of different icons. We are interested in "Transfer to a bank card". Let's try to transfer money from MTS to a Sberbank card.

You will see a special form. You need to fill in the fields carefully. Enter the cell number from which you are going to make a transfer. Note that it starts at +7. Then you need to enter the amount. The next line will automatically calculate the amount, taking into account the cost of services. It will be debited from your account. By default, there is a dot in the column "from the MTS account", you can change it to transfer from the card.

Press the "Next" button. A window opens in which you need to specify the recipient's details. This is the payment card number. Click "Next".

Receipt for transfer opens. It indicates the source - this is the MTS personal account, the mobile number from which the transfer will be debited, the card number of the person to whom the payment is intended, the amount of the transfer and the amount with a commission to be debited. These data must be carefully checked. If all is well, you need to click the "Get password" link at the bottom of the receipt.

A password will be sent to the specified number, which must be entered in a special field and click on the "Confirm transfer" button. Almost all steps in the algorithm of how to transfer money from MTS to a card have been completed.

Next, you will receive an SMS message on your cell phone. It will duplicate the data from the receipt. You will need to confirm the operation or refuse it. Send to confirmreply SMS any text, to refuse, you need to send 0. This completes the operation. So it is possible to transfer money from MTS to a Visa card of any bank.

Cost of transfer from MTS to card

Operation, of course, paid. The commission is 4% of the amount, but not less than 60 rubles.

If you transfer from card to card, and not from phone balance to card, then the commission is less - 1%, the minimum fee is 40 rubles.

There are also limits on the amount and number of transfers. The minimum transfer amount is 50 rubles, the maximum is 15,000. You cannot transfer money from MTS to a bank card more than five times a day.

Which card can I transfer to?

Money transfer system works with cards of any banks. It can be Visa or MasterCard.

If you want to transfer money from MTS to a Sberbank card, then the algorithm of actions will be similar to that described above. The amount of the commission does not change, the restrictions on the amount and number of transactions are identical. You will need to act in the same way if you want to transfer money from MTS to a VTB card.

What other transfers are possible?

You can transfer money from MTS not only to bank cards. You can replenish the electronic wallet "Yandex". There is no minimum amount, the maximum is 15,000 rubles. The cost of services is 10 rubles per operation.

Consider the electronic wallet "WebMoney". There is no minimum amount, the maximum is 5000 rubles. The cost of the service is also 10 rubles. And a whole list of different electronic wallets. Need to act onthe same algorithm as in the case of a bank card.

You can make contributions to various charitable organizations, there are about 30 of them on the site. Including such popular ones as Greenpeace, the World Wildlife Fund, the Khabensky Foundation, AIF "Kind Heart" and many others. In the transfer form, you only need to indicate the amount, all other details are already indicated. If desired, you can set up auto payment.

Transfers to the card from other operators

Two more major operators - "Beeline" and "Megafon" - also offer money transfer services. How do they implement this service?

"Beeline" provides the ability to transfer from Visa, MasterCard and Maestro cards. This can be done through the website or via SMS. If you make a transfer from the site, then you need to find the subsection “Pay from your phone account” in the “Payment” section, and there already the sub-item “Money transfers”. Among the dropped pictures you need to find "To a bank card".

Then select the "Transfer from site" option. Next, we find the icon "Transfer to Visa card". Fill out the receipt. You will need the card number of the person to whom the payment is intended, mobile number, amount and code from the picture. Next, a tick in the line of agreement with the terms of service and the button "Pay".

If you want to make a transfer via SMS, then you need to send an SMS to number 7878 with a text that contains the word Visa, then the card number of the person to whom the payment is addressed, and the amount, all this without spaces. Persending SMS payment is not taken.

If the transfer amount is from 50 to 1000 rubles, then the commission amount is fixed - 50 rubles. When transferring from 1,001 to 14,000 rubles, the commission fee is 5.95% + 10 rubles.

Let's move on to "Megaphone". We need the site money.megafon.ru. Here, in the left column, select the item "To a bank card".

There is also a choice: you can do it via SMS or through the form on the site. You will need to receive a password on your mobile phone, for this you must enter a number. Then enter the card details and the transfer amount. The commission for services depends on the amount of the transfer. If the amount is up to 5,000 rubles, then the fee is 7.35% of the amount, and 95 rubles must be added to this. If the amount is over 5,000 rubles, then another 259 rubles must be added to the same commission percentage.

Well, SMS. To number 3116 you need to send a message according to the template: type of card, its number, month, year, amount. All these data must be entered in the message separated by a space. It is necessary. The system works for VISA and MasterCard cards. Crediting occurs within a period of several minutes to five days.

Now you have an algorithm for how to transfer money from MTS to a card of any bank, electronic wallets, and other operators also have instructions for money transfers. Use it - it's very convenient.

Recommended:

Is it possible to transfer money from a credit card: transfer features, all available methods

Along with debit cards, on which it is convenient to place your own funds so as not to carry large amounts of cash with you, and with salary cards, thanks to which you do not have to wait for the withdrawal of earned money through the cashier, credit cards are especially popular. But is it always convenient to use them on your own? Can I transfer money from a credit card?

How to send money to a Sberbank card. How to transfer money from a Sberbank card to another card

Sberbank is truly the people's bank of the Russian Federation, which has been placing, saving and increasing funds of both ordinary citizens and entrepreneurs and organizations for several decades

How to check a Sberbank card: by number, phone, SMS and other ways to check the balance and the number of bonuses on the card

More than 80% of Sberbank customers have plastic cards. It is easy and convenient to use them, besides, they allow you to save time when performing transactions. To always be aware of the amount of funds on a credit card, you need to know how to check a Sberbank card

"MTS Money" (card): reviews and conditions. How to issue, receive, activate, check the balance or close the MTS Money card?

Are you an MTS subscriber? You are offered to become a holder of the MTS Money credit card, but you doubt whether it is worth taking it? We offer to dispel or strengthen your doubts and make the right decision by reading this article about this banking product

How to put money on a card without a card: available ways to transfer money, instructions and recommendations

Bank card allows you to quickly and easily perform various payment transactions. But what to do if there is no “plastic”, but you need to replenish your account. There are many ways to put money on a card without a card. Each of them has its own characteristics and a certain procedure. The right one is selected depending on the situation