2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:45

Any officially employed person knows that every month the employer transfers income tax from his salary to the Federal Tax Service. It makes up 13% of income. It's a necessity and you have to put up with it.

Is it possible to get income tax refund when buying a car?

Most taxpayers don't even hope to ever get that money back. However, it is worth knowing that there are a number of cases when you can return the paid income tax, or at least part of it.

On the other hand, very often you can meet the question of whether it is possible to return income tax when buying a car.

For both categories of citizens, let's say that the Tax Code defines a list of cases when such a procedure is possible. You can get back the money paid to the state:

1. If you have been trained on a paid basis ininstitutions licensed for educational activities.

2. If you paid for the education of your children in such institutions.

3. If you were forced to use paid medical services or purchase expensive drugs.

4. If you additionally pay contributions to the funded part of the pension.

5. If you participate in the program of non-state pension insurance and pay contributions.

6. If you do charity work.

7. If you purchased or participated in the construction of housing, both at your own expense and at the expense of borrowed funds. This also includes the repayment of interest on mortgage lending.

As you can see, there is no income tax refund when buying a car.

Why keep documents

However, when buying a vehicle, it makes sense to keep all the documents drawn up during the transaction. In particular, this applies to the contract of sale and a receipt (check) for payment or a receipt if the car was bought "from hand". You may need them if you decide to sell your iron horse in less than three years. As you know, if a citizen has received income, he must pay a tax of 13%. Accordingly, after the sale of the car, part of the proceeds will have to be given to the state. But there are cases when this can be avoided or the tax burden reduced.

- If you have owned a car for more than three years, you will not have to pay tax after selling it.

- If the owner of thisvehicle you have been less than three years old, then you are en titled to a tax deduction. That is, you can reduce the amount with which you have to pay 13%. If you have documents confirming that you paid more for the car when you bought it than you received when selling it, you will be exempt from tax. If the sale price is higher than the purchase price, then you can reduce the tax base by the amount indicated in the documents issued upon purchase. In the event that supporting documents are not preserved, the property deduction can be maximum equal to only 250 thousand rubles.

As you can see, despite the fact that a tax refund is not possible when buying a car, it still makes sense to keep documents.

Required documents

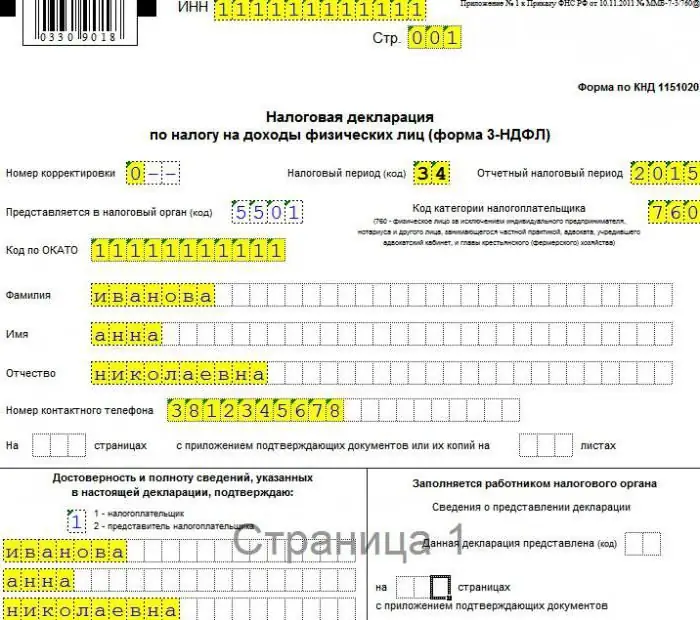

But let's get back to the cases when it is still possible to get back the money paid to the state. To carry out this procedure, you will need an income tax return declaration. It is filled in according to the approved form 3-NDFL. It contains your personal data (full name, passport information, income, expenses for education, treatment or purchase of housing, etc.). This form is submitted to the tax office at the place of residence. At the same time, it is necessary to submit documents to the inspector for the return of income tax. These include:

- Certificate from the employer - 2-personal income tax.

- Passport and a copy of the page with general information and registration.

- Copy and original TIN.

- Copy of a passbook or a document indicating the current account, where should befunds transferred.

- Receipts for payment of tuition, housing, treatment, etc. (copy and original)

- Child's birth certificate, if a deduction for his education or treatment is due, as well as a copy of it.

Special cases

This is a general list. In addition, other documents will be required for each case. So, in order to receive a social deduction for training, you will need a contract for the provision of services and a license from an educational institution. When reimbursing the costs of treatment, in addition to the contract, a certificate from the accounting department of the clinic will also come in handy. Receiving a property deduction when purchasing a home will not do without a purchase agreement, a certificate of registration of ownership, as well as a loan agreement and receipts for paying interest, if mortgage lending takes place. Naturally, situations often arise when the list of documents may change. Therefore, each case must be considered individually.

Income tax refund, timing

Declaration 3-NDFL and related documents are submitted after the year in which the tax was withheld, and there were circumstances giving the right to deduct. If at the same time some income was received, for example, the sale of a car or an apartment, then the declaration must be submitted no later than April 30 of the next year. If there were no such receipts of funds, then documents can be submitted at any time over the next three years. After the submission of papers, they are subject to cameral verification. ATwithin a month after its completion and the submission of an application for a tax refund, the money is transferred to the specified current account.

Conclusion

Despite the apparent confusion, there is nothing complicated in the procedure we are considering. Of course, the income tax refund when buying a car is not possible, but you can get a part of the cost of training in a driving school, advanced training courses, or even a child's stay in kindergarten.

Recommended:

Refund of tax deduction when buying an apartment: documents. Deadline for tax refund when buying an apartment

So, today we will be interested in the deadline for the return of the tax deduction when buying an apartment, as well as the list of documents that will be required to provide to the appropriate authorities. In fact, this question is interesting and useful to many. After all, when paying taxes and making certain transactions, you can simply return the “nth” amount to your account. A nice bonus from the state, which attracts many. But such a process has its own deadlines and rules for registration

Reimbursement of personal income tax for treatment. Treatment tax refund

The disease is accompanied not only by physical discomfort, but also by material costs. A doctor can get rid of the disease. As for the reimbursement of material costs, the legislation provides for certain financial guarantees for citizens

Refund of tax when buying property. Refund of overpaid tax

Income tax is refunded to all citizens who have submitted an appropriate application and a complete package of documents to the tax office. In order for the procedure for registering and receiving a sum of money to be successful, it is necessary to perform all actions according to the rules

Application for a refund of personal income tax for education: when you can get it, the rules for applying for a tax deduction

Getting tax deductions in Russia is a very simple process. This article will tell you all about how to get a tuition deduction and apply for a refund of the money spent

Deduction of taxes when buying a car. How to get a tax deduction when buying a car

Tax deductions are quite an interesting question that interests many. Of course, because you can get back 13% of the transaction! But is there such an opportunity when buying a car? And what is required for this deduction?