2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:26

In the financial industry, there are many terms for transactions. One of them is a credit note. This tool is used in transactions between suppliers and buyers in international trade. Organizations that build a business not only in Russia, but also abroad, should understand what a credit note is.

The essence of the term

Expansion of trade relations promotes the use of new tools. One of them is a credit note. What is it in simple terms? In international trade, this is the name of the settlement document that the supplier issues to the buyer, providing the latter with a certain amount of funds on credit. Let's try to break this term into parts.

A credit note is a notice, an act issued by a supplier in case of a change in the client's debt. The document becomes legally effective only upon the occurrence of certain circumstances specified in the contract, and is used when the original terms of the transaction are changed.

Signs

- Issued in any form. Legislative samplecredit note not approved. Also, there are no requirements for its preparation in the regulatory documents.

- There is a bilateral agreement on the deal. The possibility of issuing this document is prescribed in advance in the supply contract.

- Single-sided design. The document comes into force as soon as the seller prepares it and sends it to the supplier.

- This document draws up discounts that will be provided some time after shipment.

Application

Suppliers use credit notes to motivate buyers by:

- Giving discounts to dealers. At the same time, the conditions under which the document comes into force must be spelled out in the contract. Most often, the minimum lot of goods is indicated, which the client must redeem for a certain period - a month, a quarter or a year.

- Settlement of settlements between the parties. For example, the contract may contain a clause on the supplier's covering the unforeseen expenses of the buyer.

- Simplify the procedure for returning products.

Let's consider each of these methods in more detail.

Discounts

A credit note is a great way to get a discount. In this case, the dealer will be able to purchase more products, and the manufacturer will be able to increase the output. A significant advantage of this scheme is that buyers cannot dump among themselves, because they do not know whether they will fulfill the plan and whether they will receive a discount. In this case, the credit note is treated as an additional bonus, whichthe buyer can receive after the fulfillment of the terms of the contract. In such situations, the credit note is not reflected in the accounting records. To fix it, an additional agreement.

Example

The supplier provides a discount in the form of a credit note to customers at the end of the quarter. To receive a bonus, you need to purchase goods worth at least 20 million rubles. In this case, a 3% discount is charged. One of the buyers for the quarter purchased products for 22 million rubles. Accordingly, the supplier issued him a credit note for 660 thousand rubles.

Mutual settlements

A credit note is a tool for repaying counter obligations to the buyer. The supplier can pay for unexpected, additional and costs for the return of defective products:

- transferring money to the buyer;

- by issuing an act of netting;

- by issuing a credit note.

Danger

In domestic practice, the latter method is rarely used, since the tax service may not accept this document to pay off counter obligations with VAT and consider the operation “debt forgiveness”. This is how the term is interpreted in Art. 415 of the Civil Code, Letter of the Ministry of Finance No. 02-3-08 / 84 dated July 25, 2002

Problems with using a credit note may arise if:

- the contract does not state that the discount is provided by reducing the initial cost of the product;

- primary documents are made without discount;

- discount notice has been issuedreference, report.

That is, the possibility of calculating a discount should be specified in the original contract.

Legislative regulation

There are no problems when paying an advance to a non-resident supplier. After all, payment was made before delivery, we are not talking about defects in the goods. The bank removes this operation from control at the time of import of products after receiving relevant information about the operation. The fact of issuing a credit note will be recorded after deregistration.

The situation is different if there is a partial payment for the goods. After the credit note is provided, the currency control will check the transaction. In this case, the amount of debt to the supplier, which has already been registered, will decrease. Unfortunately, there are no clear legislative norms to regulate this process.

Reflection in accounting

In BU, the amount of the discount provided reduces the seller's debt, while the price of the contract does not change. This part of accounts payable is included in non-operating income. This operation is reflected in accounting by the following entry: DT60 KT91-1. VAT on previously purchased goods upon receipt of a discount is subject to recovery. For this purpose, the following posting is used in the balance sheet: DT19 KT68. The amount of tax written off is reflected in other expenses for tax purposes. Most likely, the legitimacy of VAT recovery will have to be defended in court.

At the buyer

Algorithms for accounting transactionsthe buyer in the BU depends on:

- the fact of the sale of goods;

- shipping time (current or previous year).

The table below shows the posting of the credit note by the buyer.

| Fact of implementation | Debt adjustment | VAT adjustment |

| Shipment failed | DT41 KT60 | DT19 KT60 - reversal DT68 KT19 - recovery |

| Product sold in the reporting period | DT90-2 KT41 - cost adjustment; | DT41 KT60 - debt adjustment |

| Product shipped last year | DT60 KT91, 1 - reduction of debt to the supplier | DT91-2 KT68 |

At the seller

The seller after issuing a credit note should:

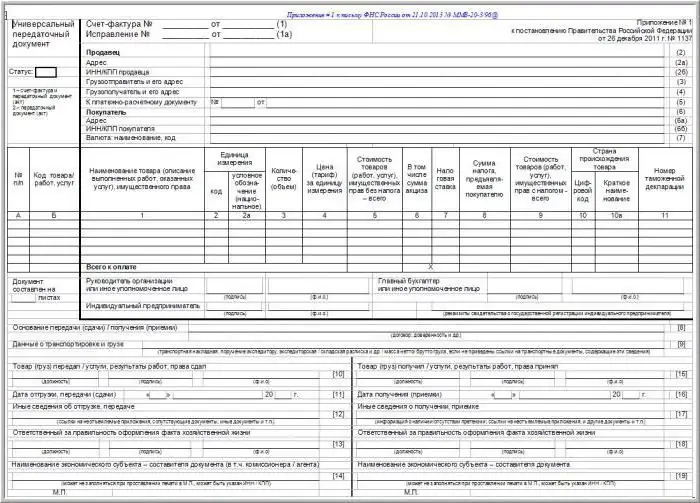

- reissue primary documents and invoice;

- adjust revenue: reversal method (if the shipment took place in the current year), reflect the amount of the discount in other expenses (if the shipment took place last year);

- Check the submission of the document for compliance with the requirements of Art. 252 NK (economically substantiate, confirm with documents).

If the buyer has already fully paid for the goods for which the discount is provided, the seller may not return the funds, but take them into account as an advance payment for future deliveries.

Return of defective products

If the buyer has already obtained ownership of the goods, he needs to:

- draw up an actto fix product defects;

- file a claim to the seller;

- reflect the return of defective products;

- reduce revenue;

- adjust VAT amount.

The buyer needs to prepare a full package of documents to justify the implementation with zero profitability.

Conclusion

Accounting for a credit note in domestic practice has not yet been regulated. Therefore, for registration of mutual settlements with counterparties within the party, you should always use standard accounting documents. If it is not possible to execute international economic transactions without a credit note, then the possibility of using this instrument should be specified in the contract. After the formation of the credit note, the supplier and the buyer must make the appropriate entries in accounting and redo the receipt documents, in particular the invoice.

Recommended:

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

How to make a credit history? How long is a credit history kept at a credit bureau?

Many people are interested in how to make a positive credit history if it was damaged as a result of regular delinquencies or other problems with past loans. The article provides effective and legal methods to improve the reputation of the borrower

Credit account: definition, meaning, how to open or close a credit account

Credit account is a banking measure aimed at monitoring and tracking the status of accounts of customers of a credit institution. It is useful for the recipient of the loan to be able to use it, however, when registering papers at the bank, it is necessary to pay attention to the details specified in the agreement

Promissory note: the essence of the paper, sample filling, maturities

Promissory note is a kind of security designed to determine the financial relationship between business entities. The bill was introduced into circulation in ancient times. As a universal settlement tool, it is still actively used in the circulation of financial resources