2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:29

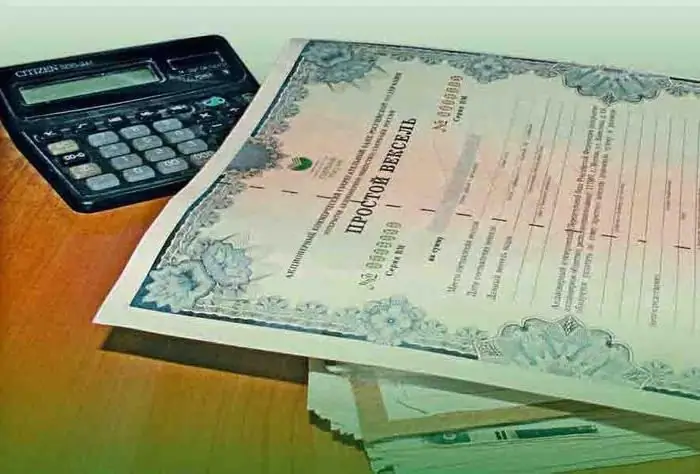

Promissory note is a kind of security designed to determine the financial relationship between business entities. The bill was introduced into circulation in ancient times. As a universal settlement tool, it is still actively used in the circulation of financial resources.

Promissory note: essence of paper, sample filling, maturity dates

The procedure for the circulation of bills was officially fixed in legislative form in 1930 under the convention in Geneva. The USSR adopted this practice in 1936. A year later, its own regulation on the procedure for using bills appeared. In the same official event, the types of bills were defined: promissory note and bill of exchange.

According to the basic essence of all descriptions, a promissory note is a special type of securities, which is a promissory note holder. Considered according to types, the bill of exchange performs a slightly different function. It is intended to transfer debt obligations to a third party. A promissory note, in turn, assumes that itsthe owner is en titled to repay the debt only to the one who is the holder of his bills.

There are special requirements for both types of documents, one of which is the possibility of selling documents only in paper form. Requirements for them are also fixed at the official level. Thus, the list of obligatory details for bills of exchange was established by Decree No. 104/1341 in 1937 and is still relevant.

Contents

The contents of the two types of bills are slightly different from each other. The promissory note filling pattern must follow the following structure:

- Name of security. The definition is written in the language in which the entire document is drawn up.

- Formulation about who and how much to pay. Moreover, the conditions for the emergence of debt obligations are not indicated.

- Date of payment.

- Where the payment should be addressed.

- Owner's initials.

- Date and place of the document.

- Signature of the bill holder.

Content of bill of exchange type

The transfer type follows the following structure:

- Document name. Type is not specified.

- Arbitrary wording about the purpose of the document: to whom and how much you need to pay for it.

- Payer's initials.

- Determine the due date.

- Where the payment should be directed.

- To whom funds should be directed.

- Date and placedrafting a document.

- Signature of holder.

This is the difference between bills of exchange and promissory notes. What this document looks like will be discussed below. Given the financial and legal importance of this type of securities, the procedure for their circulation is regulated at the federal legislative level. Further, each item will be considered from the point of view of laws.

The sum and its features

What amounts can be transferred by bill of exchange? Are there any restrictions or recommendations? The form of a promissory note or any other type must contain the amount in figures and in words. If these two indicators differ, then the amount indicated in words is considered correct. If it is allowed to indicate several different amounts of debts, then the one that is less than all the others is considered correct.

The maturity of a promissory note is valid with a caveat: it must be specified or not specified. If not specified, then subject to immediate redemption. However, partial repayments are not allowed: the entire specified amount must be paid at one time.

The principle of debt formation is at the choice and agreement of the parties. They may agree to pay interest or other premiums on the loan. If there are such conditions, they can be written in the form of a promissory note or indicated as a separate application. The right to receive interest is valid if the document itself indicates the payment deadline or the presentation deadline is set. If these conditions are not met, then it is considered that the interest rates on the debt are not specified in the bill. If the amount isproperly, then, according to the general rules, the holder must pay this amount without reference to any other conditions.

Payment terms

Legislation provides the right to choose for each stage of circulation of bills. Payment of a promissory note or any other type of securities from this series is no exception. There are four types of payment terms for the holder to choose from:

- "On a specific day" - due on the specified date.

- "Specific date from the moment of drawing up" - the countdown for repayment should start from the date of drawing up, which is indicated in the document itself.

- "Specific period from the moment of presentation" - the time should be counted from the date of receipt in hand. The date of presentation is fixed in the document itself.

- "Upon presentation". Despite the categorical name, the legislation allows reservations: by law, it must be presented within 1 year from the date of issuance.

If the document does not specify the due date, then you should focus on the issue date. The promissory note and bill of exchange statute states that such instruments must be redeemed within one year from the date of issue. If neither the issue date nor the maturity date is indicated, then the document loses its financial and legal force.

Where and how to make a payment? The term for a promissory note and other payment parameters are indicated in the document itself. If not, then by default, the place of payment is the location of the payer. If there are severaldifferent places for payment or none are indicated, then this fact also serves as the basis for the loss of financial and legal force of the document.

What is an aval bill?

The payment obligation has the right to require a guarantee. In bill circulation this aspect is called aval. The avalist may be a financial institution represented by a bank or another person guaranteeing the payment. At the same time, it is not necessary that the avalist is directly related to the obligations of the document. A promissory note or other types of agreement may formulate this aspect as a guarantee of a bill of exchange

The appendix to the bill of exchange agreement, where you should describe the order of the avalist, is called allonge. The position of the avalist is also allowed to be indicated by a direct inscription in the very form of the bill. If an allonge is issued, then the following information must be indicated in it:

- For whom the payment guarantee is issued.

- Place and date of document formation.

- Signatures of participants: these are usually the first persons of the financial institution and their seals.

Upon signing this document, the responsibility for payments is divided equally between the availer and the person for whom the guarantee is issued. The provision on a promissory note in the bill of exchange legislation states that if the payment is repaid by the availer alone, then the bill of exchange rights and all its consequences are transferred to it unconditionally.

The practical benefit of avalization is that the procedure increases the reliability of such documents. It can be applied in cases wherethe creditor has doubts about the integrity of the debtor. In such cases, the creditor has the right to demand additional guarantees in the person of those organizations that he himself trusts. Avalization is applicable to promissory and transferable bills of exchange. It may concern the entire amount of the payment or part of it.

Document Appearance

The fact that a bill is, in simple terms, a transferred obligation, has already been sorted out. In the same regulation, where the bill was officially recognized as a financial instrument, clear requirements are given for other parameters. So, its main difference from other securities is the indication that this is a bill of exchange. Information about the transferor and the one who receives is also mandatory. The difference in the drafting of the two types of documents is that the bill of exchange indicates the person who is obliged to repay the debt.

Be sure to take into account: if the person repaying the debt is not specified, then the document loses its status.

Promissory note in its functionality contains several reservations. They are as follows:

- If the address for the debt is not indicated in the document, then by default this place is the address of the debtor.

- If you forgot to indicate the place of formation of the document, it is considered that it was drawn up at the place of residence of the holder of the bill.

- If a specific due date is given, then you should obey it. If not, then the debt should be repaid upon receipt of the bill in the hands of the recipient.

Which paper should the sample promissory note use? Beforeforms issued by Goznak of the USSR were used. They contained special watermarks and other anti-counterfeiting measures. This form remained in use until the 1990s. Blanks were strictly controlled, and their appearance was easily recognizable. Currently, the Promissory Note Law allows the use of plain paper.

Views

Since the official recognition of bills, other types have appeared in circulation. Classification is carried out according to different parameters. Consider them in detail:

- Commodity. This type is used for mutual settlements in commodity circulation. Acts as a guarantor of payment for the purchase and sale of goods, bypassing the bank guarantee.

- Order. It has other names: nominal or blank. It differs in that only a specific person indicated in the document itself has the right to receive funds for the debt.

- Advance is a promissory note used as an advance payment for work to be done. The holder issues it upon receipt of funds.

- Treasury type bills are issued by the Central Bank based on the request of the Government. The validity of such bills usually does not exceed six months.

- Bank promissory notes are en titled to be received by persons providing loans to the bank.

Atypical types of bills

Any financial instrument can be used for dishonest purposes. Bills are no exception. But in this case there is a paradox. The bill of exchange legislation mentions such types of bills as bronze or friendly. They arediffer in that the recipient of the bill of exchange is a fictitious person. The scheme is simple: two parties, by prior agreement, issue promissory notes and provide these documents to financial institutions for various purposes.

Both types of bills have no real financial relationship. Despite this, it will be very difficult to prove in court that this method is fraudulent, since bill legislation allows such a use case. Such types of bills are prohibited for circulation in many countries.

A more practical option is promissory notes for friends and relatives, which are often used in the West. This document has full legal force and can be used to transfer debt obligations to your loved ones. Filling out a promissory note in this case is carried out in an arbitrary order and does not require notarization.

Where does it apply?

In the CIS countries and in particular Russia, the largest share of the bill turnover falls on banks and other financial institutions. According to the Central Bank of the Russian Federation, in 2017 the total amount for issuing bills of exchange is about 450 billion rubles. However, this type of activity, like all the activities of the banking sector, is under the close attention of the Central Bank of the Russian Federation. When in 2014 the Central Bank switched to a more stringent regime of work in the field of checking the activities of banks, it was possible to find out that some of these institutions used friendly and bronze bills in practice. These establishments have lost their licenses.

At bills likefinancial instruments have their own economic purposes. They can be used in favor of representatives of small and medium-sized businesses. Given the fact that the redemption of a promissory note means real money, we can say that the document acts as a guarantor for long-term cooperation between companies and individuals. Unlike typical legal contracts or IOUs, a promissory note can be used as a full-fledged financial instrument with the right to transfer to other persons.

Difference to other securities

If a promissory note is, in simple words, a transfer of debt obligations, then what is its difference between a receipt or legal contracts? That difference is its versatility. In fact, as part of the implementation of the bill, the debtor recognizes his obligations without reference to other conditions. From this point of view, the document is a convenient tool both for individuals and in the practice of legal entities or government agencies.

The main purpose of a bill is the ability to transfer it to others, the so-called endorsement. The fact of the transfer will be recorded by the definition of "Endorsement" and indicated on the back of the form.

The holder, transferring the document to another person, must put the label "Pay by order" with reference to the new holder and put his signature.

There can be several promissory notes for one debt obligation. In such a case, the obligation to repay applies to all holders. If one of the owners does not have the financial capacity, then he can transfer the repayment of a promissory noteto another holder. If the holder does not want to receive such offers, then during the transfer he can make a note “no turnover on me”. In this case, other holders cannot transfer their obligations to him.

Legal framework in Russia

Provisions in Russian legislation are based on the concepts of international law. At the same time, the Russian Federation is the legal successor of the Soviet Union. This is evidenced by some legal regulations and provisions dating back to the time of the great power.

”, adopted in 1997.

In addition to these laws, other normative acts on the regulation of bill relations are also applied. They are considered to be all laws that do not contradict the principles of the main listed documents. In particular, these are the Civil and Civil Procedure Codes, Federal Laws, Decrees and Resolutions of the President and Government of the Russian Federation, regulations of the Central Bank and the Ministry of Finance on the procedure for the circulation of securities in the Russian Federation.

Controversial issues in this industry are considered under the guidance of the provisions of the Letter of the Presidium of the Supreme Arbitration Court of the Russian Federation "Review of the practice of resolving disputes related to the use of a bill."

The main normative act - "On a bill of exchange and a promissory note" since 1997 consists of 8 articles in solidarity with international provisions in this industry.

According to datanorms, legal entities and individuals of the Russian Federation can be receivers of promissory notes. State and municipal bodies, as well as their territorial subdivisions, may bear a promissory note obligation only in the cases described in Article 2 of the Federal Law “On transferable and promissory notes”. In other words, obligations under securities issued in other countries cannot be regulated by Russian laws, regardless of the type of promissory note.

It is also important to pay attention to the clause regulating the procedure for paying interest and pen alties on promissory notes. Article 3 of the main Federal Law states that interest and pen alties are paid on the basis of the discount rate of the Central Bank of the Russian Federation. A direct reference to this procedure is Article 395 of the Civil Code of the Russian Federation, which clearly states that interest must be accrued for the use of funds of other persons, and in case of delay, pen alties are added to them. The interest rate is tied to the location of the subjects of the transaction and must be determined in relation to the current rates of the Central Bank of the Russian Federation.

If we are talking about a judicial procedure for collecting debt obligations, then the judicial authorities should also be guided by the discount rates of the FB of the Russian Federation. If the creditor suffers losses that exceed the amount of payment for obligations, then he has the right to demand compensation for the losses incurred in addition to repayment of the principal debt.

Acceptance of bill of exchange

The essence of a promissory note is that the document carries with it an obligation to pay a certain amount. A person who assumes such an obligation takes such a step voluntarily and with awareness of responsibility. The consent of a person to such conditions is called acceptance. It applies to bills of exchange.

It is important to remember that the payer must produce the amount in favor of the drawer, and the bill of exchange in this case is not issued by the debtor himself, but by the person who issues the funds for use - the creditor. The document is sent to the recipient with his prior consent of the parties. If this does not happen, then one of the parties has the right not to accept obligations.

Acceptance, as well as aval, may concern the partial payment of a payment. It is marked on the front side of the form to the left of the aval.

A bill, like any other type of security, can be transferred from one holder to another. Such an appeal may be based on certain economic conditions reached between the parties.

What is endorsement and its types

The right to transfer bills is enshrined in law. In bill legislation, this process is called endorsement. In other words, an endorsement is an unconditional order from a previous holder to transfer rights and obligations to a new holder. The receiving party is called the endorser, and the transferring party is referred to as the "endorser".

The fact of the transfer is indicated on the back of the document or in the annex (allonge) with the wording "Pay by order" or "Pay in favor" of a specific person. Taking into account the fact that promissory notes are not conditional on anything, endorsement is carried out according to the same principle - the unconditional transfer of rights and obligations.

Unlike aval andacceptance, in this case partial endorsement is excluded. In other words, it is impossible to transfer the obligation to pay part of the funds. The holder must personally sign the document and fix it with his seal. After the transfer, the obligations of acceptance and aval remain with the holder. To relieve himself of these obligations, he needs to make a note on the form: "without turnover on me." Thus, the holder excludes himself from the bill of exchange chain. In terms of turnover, this phenomenon is regarded as a negative trend, as it leads to a decrease in the value of bills.

Also, the owner has the right to put a restriction on the further transfer of bills, whether it be a simple bill of a bank or another organization. For these purposes, he can put a special note on the form. In this case, further movement of bills can be carried out only on the basis of a sales contract.

There are several types of endorsement: pledge, nominal, blank and collection.

There is also a similar procedure, which implies the right to transfer obligations - cession. Assignment differs from endorsement in the following ways:

- If an endorsement implies a unilateral transfer procedure, then an assignment is a bilateral agreement on the same action.

- An endorsement may not have a specific bearer, but an assignment is directed to a specific person.

- Endorsement will be fixed on the allonge or an additional note on the form itself. The cession procedure involves a sales contract or a simple inscription on the form itself.

- Endorsement transfers the right to pay a debtwith a guarantee of performance, and the assignment transfers only the property right itself without additional guarantees.

Promissory note in practice

The vast majority of promissory notes in Russia belong to Sberbank. There are real reasons for this. It is Sberbank that holds about 70 percent of all household deposits. And from the deposits of legal entities it takes 5 percent of the total. With such data, the main bank of the country practices bill lending to legal entities and issues discount bills.

Promonty, transferable, multi-currency and interest-bearing bills are available in circulation. A promissory note of Sberbank is accepted in any region of the country in the regional branches of this bank. Its primary task is to accelerate the turnover of funds between entities.

Bill accounting

As it turned out from the above, the main function of the bill is the money declared by it. This rule applies to all types of securities. A situation is permissible in which the holder of the bills has a need for funds, but the maturity of the bill has not yet come. In this case, he can transfer the document to the bank and receive a certain amount for it. The amount receivable will differ from the actual amount, as the bank has the right to deduct a certain percentage for early receipt of money. This amount is called bank discount.

The amount of the discount is set by the bank itself, taking into account the risk of investments. First of all, the solvency of the holder is taken into account.

Also, the term "accounting for bills" means their order of reflection in the accounting of the organization. Russian business entities keep accounting in accordance with IFRS rules. According to IFRS rules, bills of exchange purchased by the organization are reflected in account 58.2, which is called “Debt securities”. If the organization itself issues and sells bills, then accounts 66 are used for short-term bills and account 67 for long-term ones.

If bills have been paid, then promissory note transactions are reflected in debit on account 76, on credit - on 51. The same principle applies to drawers.

Conclusion

The use of bills in settlements is a convenient tool for both trade and money circulation. In practice, bills solve a number of problems, the main of which are the following:

- As a security - easy to trade, simplifies credit relations and other financial transactions.

- As a type of loan, it serves to satisfy mutual requirements between business entities, regardless of whether they are legal entities or individuals.

- A sample promissory note helps to make transactions without the participation of money, but in compliance with the exact terms and other obligations.

- Serves as a guarantor of timely payment for goods and services and increases trust between participants in transactions.

Also, the bill of exchange form of payment is applicable for repayment of own debt obligations by an individual. The document even plays an investment role when it is necessary to keep it until the specified deadline for submission. Or you can sell it before the due date and get paid for it.

If the bill is missing one of the above important information, it loses financial and legal force. Therefore, be careful when filling out.

Recommended:

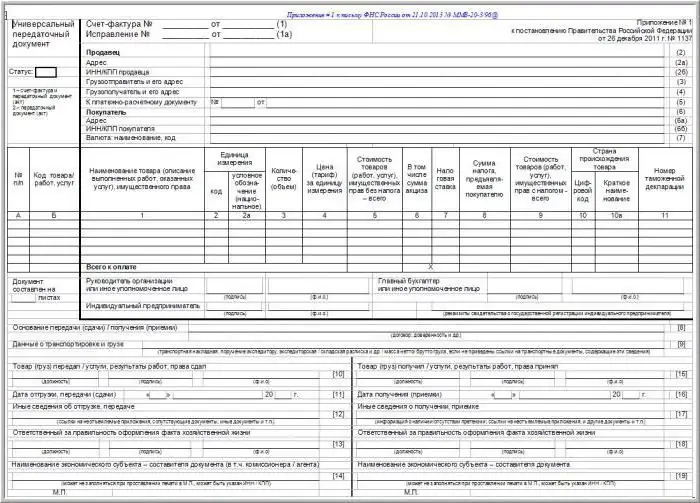

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Promissory note surety. Types and rules for issuing bills of exchange

Security, the issue and circulation of which is regulated by bill of exchange law, is called a bill. Its purpose is to satisfy in cash the debt of one person (that is, the debtor) to another person (that is, the creditor). The rights to this type of securities may be transferred to a third party without the consent of the issuer, but by order of the owner

What is a bearer promissory note and how can I cash it?

Bearer bill is a financial instrument that allows for quick settlements. It is also used for collateral as part of a loan or as a tool for the accumulation of financial resources. You can cash out such paper to bearer simply by showing it at any bank branch that works with securities

Non-equity securities: examples. Promissory note - non-issue security

Non-equity securities are financial instruments that are mainly issued individually or serially. These include bills, checks, bills of lading, savings and deposit certificates, mortgages. Their issue and circulation are mainly regulated not by the law "On the RZB", but by the law relating to the types of bills, the Civil Code of the Russian Federation and the regulatory documents of the Central Bank of the Russian Federation