2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

Analysis of the profit or loss received by the enterprise based on the results of the reporting period should be based on the structure of this indicator. This will provide an opportunity for further planning of expenses and stabilization of income values. The dynamics of the indicator, its composition can be analyzed on the basis of tax and accounting data of the enterprise.

The concept of income and expenses of the organization

Every commercial enterprise is created for the purpose of generating income (economic benefits). To obtain a more significant amount of income, the owners choose the type of activity that, in their opinion, will ensure a stable and high level of profitability of the enterprise.

When forming the final result of the work based on the results of the current reporting (interim or main period), each organization receives a loss or profit from the implementation of its main activity. In case of excess of proceeds from the sale of goods, services over the amount of funds invested in the production process, the enterprise has income for the analyzed period. If the operating costsexceed the revenue received, then the company receives a loss based on the results of work. The definition of income and loss of the enterprise is not unambiguous, with the help of accounting operations, postings and primary documents, it is necessary to constantly analyze the structure of revenue and expenses. Both profit and loss are formed not only as a result of the main activity of the organization, there are a number of positions that affect the final economic result of a particular company, an enterprise not in the direction chosen as prevailing. In accounting, management and tax accounting, these positions are reflected in the account "Other income and expenses" 91 and its sub-accounts.

Company income structure

In accordance with the regulation PBU 9/99, the income of an enterprise includes an increase in the economic benefit of the organization in connection with the receipt of assets (cash, current and non-current assets) and the fulfillment of obligations, which leads to an increase in capital (the exception is the investment of owners through authorized capital). The following receipts are not income:

- Advances from buyer.

- Pledged property.

- Amounts of taxes received to be transferred from budgets of different levels (excises, VAT, duties, sales tax, etc.).

The income of each commercial enterprise can be divided into two aggregated types: other and income from the main activity. Proceeds from the sale of released (manufactured) products, services rendered, works performed within the selected direction,refers to income from the main line of business (account 90), other types of income include:

1. Operating (91 accounts):

- Sale of property.

- Interest on loans issued.

- Income from renting out OS.

- Participation in the authorized capital of a third organization, etc.

2. Non-operating (91 accounts):

- Inventory surplus.

- Foreign exchange differences, positive.

- Pen alties received from counterparties.

- Delayed debt of the organization of the creditor (over 3 years).

3. The organization receives extraordinary income as a result of emergency situations (insurance payments, the sale of parts of property affected by a natural disaster, etc.).

Expense classification

Expenses of the enterprise are classified according to the requirements of PBU 10/99. As expenses, a decrease in the economic indicator from the work of the organization due to the disposal of assets and the occurrence of situations associated with a decrease in capital is taken into account. Depending on the type and nature of the occurrence, all expenses are divided into other and received as a result of the implementation of the main line of business. Expenses related to the main line of business arise in the formation of costs for production, manufacture of products, in the process of providing services and carrying out work. If the organization has chosen the lease of non-current assets, structures,machinery and equipment, then all costs for this type are related to the main production costs. Other expenses are subdivided into:

1. Operating (91 accounts):

- Taxes transferred to various budgets.

- Fee for the use of borrowed (attracted) funds.

- Paying bank services for maintaining accounts and providing information on them.

- Acquisition of non-current assets, disposal of fixed assets as a result of wear and tear (physical or moral) or equipment failure (in case of impossibility of repair, modernization).

2. Non-operating (91 accounts):

- Fee, pen alties, fines under contracts with counterparties (in case of violation of contractual obligations by the company).

- Charity spending.

- Overdue accounts receivable (overdue for more than 3 years).

- Exchange rate differences are negative (in the presence of foreign exchange agreements).

- Shortages above the rate of attrition, discovered by the results of the inventory (in the absence of the guilty person).

3. The company receives extraordinary expenses as a result of natural disasters, man-made accidents, fires, etc.

Reflection in accounting

Accounting account 91 is designed to reflect other, non-operating, operating expenses and income in the organization's accounting. The entire period preceding the annual report, other expenses and income of the organization are accumulated on an active-passive accounting 91 account, which in terms ofaccounts (unified) accounting is called - "Other income and expenses". At the same time, the correspondence of account 91 depends on the item of expenditure and (or) income, analytical accounting should be carried out separately for each position on the basis of the accounting policy of the organization, this will greatly simplify the analysis of the composition of the indicator when assessing the result of the enterprise. Sub-accounts of the following plan must be opened for this account:

- 91/1 "Other income" - designed to reflect all types (except extraordinary) income of the enterprise, not related to its main activities.

- 91/2 “Other expenses” - this sub-account reflects other, non-current, operating expenses.

- 91/9 “Balance of other income and expenses” - account 91 is closed through this sub-account.

Document flow on account 91

Postings on 91 accounts are compiled on the basis of well-formed primary documents, which are filled in by the accounting department, respectively, for each specific type of expense and income. The following documents apply:

- Accounting statement is used when crediting reserves of unused payments to income (operating, non-operating, other), calculation of deviations in the cost of goods and materials taken into account, amounts of deferred income.

- The invoice is used when calculating interest on loans, loans, loans, income from participation in the share (authorized capital) of a third enterprise, income from holding securities.

- Inventory, expenses and income on the basis of this document are held on account 91 in correspondence with active accounts for accounting for goods and materials, finished products, cost accounts of the main and auxiliary industries.

- Act of acceptance and transfer of fixed non-current assets when writing off the residual value of sold or written off non-current assets.

- The depreciation statement is used to write off depreciation accrued on leased fixed assets.

Reflection on debit of 91 accounts

On debit (account 91), the following entries are made: expenses for the maintenance and servicing of mothballed property units, retirement, write-off of fixed production assets, operations with containers, losses from previous periods discovered in the current year, overdue receivables, pen alties, pen alties for non-fulfillment of contractual obligations, exchange differences, fees for the use of loans, credits, borrowings, costs of litigation, etc.

Correspondence of accounting accounts

| Debit | Credit |

| 91 “Other income and expenses” | 08, 07 Non-current assets |

| 10, 11, 15, 14 Current assets | |

| 20, 29, 23, 28 cost accounts, manufacturing defects | |

| 41, 43, 45 Finished, shipped products | |

| 50, 52, 59, 57, 51, 58, 55 cashfunds | |

| 60, 63, 66, 62, 67 settlements with counterparties, loans | |

| 71, 76, 79, 73 various debtors and creditors, accountable persons | |

| 96, 99, 98 financial results, reserves, funds |

Reflection of information on the credit of the account 91

Account 91, credit entries are made for the following types of business transactions: income from the sale of fixed assets, proceeds from the gratuitous receipt of assets (current and non-current), fines received, pen alties under contracts with counterparties, exchange differences, dividends, received from participation in other partnerships, income from loans, loans, proceeds from the sale of intangible assets, innovative developments, the amount of overdue debts of creditors, etc.

Correspondence of possible accounts

| Debit | Credit |

| 01, 04, 07, 02, 08, 03 NMA and OS | 91 “Other income and expenses” |

| 19, 16, 15, 14, 11, 10 Current assets, VAT | |

| 21, 20, 28, 29, 23 Marriage, unit costs | |

| 58, 59 reserves, investments | |

| 66, 68, 69, 67, 60, 63 Settlements, loans | |

| 70, 76, 73, 79, 71 Settlements with personnel and other creditors, debtors | |

| 98, 99, 94 financial result, funds, losses and shortfallsItems |

The process of closing 91 accounts

For each reporting period, information on income and non-operating expenses is collected on the credit and debit of 91 accounts. Before the closing of each reporting period, the turnover of sub-accounts is summarized for all analytical positions. The turnover (debit) of sub-account 91/2 “expenses” and the turnover (credit) of sub-account 91/1 “income” are compared, the difference in turnover shows whether the organization received income or loss from other (non-core) activities for the current period. The amount received is the balance for sub-account 91/9. Every month, 91/9 is transferred to the financial and economic result of the organization and should not be reflected in the annual balance sheet (has no intermediate balance).

Closing 91 accounts, transactions:

- Dt 91/9 Kt 99. Subaccount balance (income) closed.

- Dt 99 Kt 91/9. Closed balance (loss).

The entry is made on the basis of the prepared accounting statement, which reflects the process of closing sub-accounts of 91 accounts. At the same time, turnovers are accumulated sequentially on open sub-accounts, throughout all reporting interim periods (month, quarter, half a year).

Accounts (sub-accounts) on the 91st are finally closed at the end of each year, when the balance is reformed, sequentially by the following business transactions:

- Dt 91/1; Kt 91/9 closing of the sub-account “Other income”.

- Dt 91/9; in correspondence with Kt 91/2 closing of the sub-account "Other expenses".

In the annual balance sheet, account 91 and its sub-accounts should notbe reflected, all turnovers are closed on the financial result. When analyzing the income received for the analyzed period, non-operating and other income should be less than 5-6% of the total volume, in this case, the profit of the enterprise has a clear structure and is received from the main activity of the organization.

Recommended:

Travel expenses: payment, size, postings

In order to fulfill their official duties, employees are often sent on business trips. All expenses related to travel, accommodation and meals are paid by the organization. Read more about how the accrual and payment of travel expenses in 2018 is carried out

Taxation "Income minus expenses": features, advantages and disadvantages

Income minus expenses taxation has many significant advantages for every entrepreneur over other systems. The article explains when this tax regime can be used, as well as how the amount of the fee is correctly calculated. The rules for compiling a tax return and the nuances of maintaining KUDiR are given

Business expenses - what is it? What does business expenses include?

Selling expenses are expenses that are aimed at the shipment and sale of products, as well as services for their packaging by third-party companies, delivery, loading, etc

How to withdraw money from the IP account? IP withdraws money from the current account: postings

Almost every individual entrepreneur has a bank account. The peculiarity of this type of activity is that it is quite difficult to cash out funds. The state does not restrict individual entrepreneurs in matters of the use of property. But restrictions on operations are still set. For more information on how to withdraw money from an individual entrepreneur's current account, read on

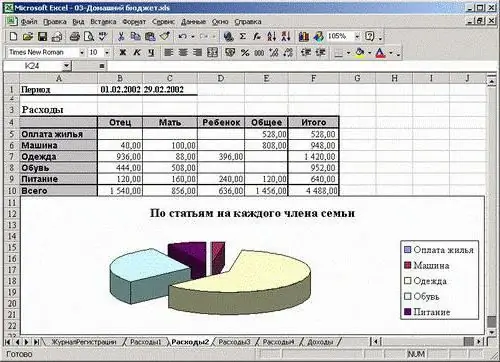

Family income and expenses - calculation features and recommendations

Maintaining a family budget is not an easy question. You need to know how to properly carry out this operation. What can help? How to budget? How to save and even accumulate it? All the secrets of this process are presented in the article