2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

In order to fulfill their official duties, employees are often sent on business trips. All expenses related to travel, accommodation and meals are paid by the organization. Read more about how travel expenses are calculated and paid in 2018.

Legislative regulation

Daily allowance is an employee's expenses associated with his living outside the place of residence. According to Art. 168 of the Labor Code of the Russian Federation, these costs must be paid by the employer in the amount prescribed in the organization's statutory policy.

Travel expenses in Russia are not remuneration for work, but compensation payments. Daily allowances do not depend on the performance of labor functions by the employee. Even if these duties were not performed during a business trip due to downtime, the enterprise must still pay per diems.

At the legislative level, there are norms for travel expenses that are not taxed. According to Art. 217 of the Tax Code, if the amount of compensation does not exceed 700 rubles for business trips within the country and 2500 rubles for business trips abroad, thenthe organization may not pay taxes. This does not mean that the organization does not have the right to establish a payment above the norm. You just have to pay tax on the difference. If the accounting policy of the enterprise indicates the amount of travel allowances at the level of 1000 rubles, then personal income tax should be withheld from the difference (1000 - 700=300 rubles).

Payout procedure

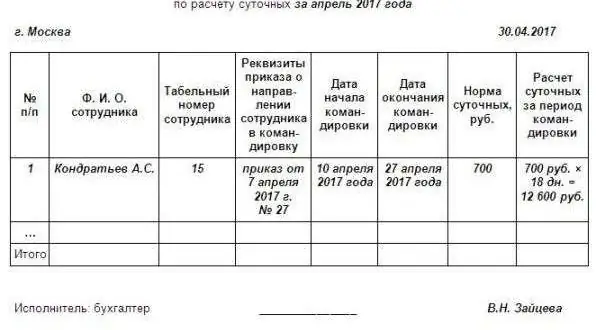

Daily allowance is reimbursed for each day spent on a business trip. Weekends, non-working, holidays and travel days are also paid. If the employee left on Sunday morning and returned a week later on Saturday, then all weekends for this period (4 days) must be compensated. The legislation does not provide for payments for one-day daily allowances, but the employer, at its discretion, may introduce such a clause into the accounting policy. At the same time, he is obliged to issue an advance before the trip.

Reimbursable expenses:

- for travel and rental housing;

- living expenses (per diem);

- other expenses incurred at the direction or with the permission of the manager, even if they were not agreed in advance.

Example 1

The company's accounting policy provides for a payment of 45 euros (3,330 rubles) per day on a business trip abroad and 700 rubles. - on the territory of the Russian Federation. The employee was absent for 10 days: from 1 to 10 July. For the first 9 days, he is en titled to a payment of 45 x 9=405 euros (29,965 rubles). Day return to Russia is paid at the rate of 700 rubles. On the date of the advance payment, the euro exchange rate was 70 rubles, and on the day of approvaladvance report - 68 rubles. Calculate the amount of travel expenses.

Since the employee received compensation before the trip, the recalculation of the amounts issued will be carried out at the rate of issuance of funds:

- 405 x 70=28,350 rubles - for the first 9 days.

- Total accrued: 28,350 + 700=29,050 rubles

- The rate of tax-free payments under the law=9 x 2500=22,500 rubles.

- Difference: 29,050 - 22,500=6,550 rubles - personal income tax should be withheld from this amount.

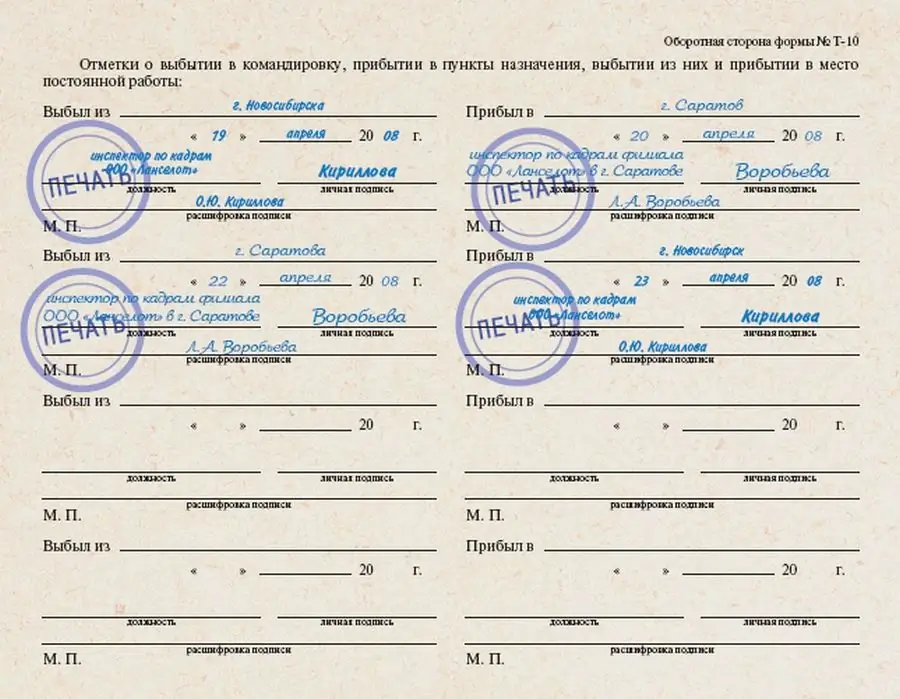

Documentation

The basis for going on a trip is a written order from the employer - an order. The organization can use the unified form No. T-9 or develop its own. The document must indicate the place, date, purpose of the trip, certificate number, job assignment. The same act prescribes the amount of daily allowance and other limited payments.

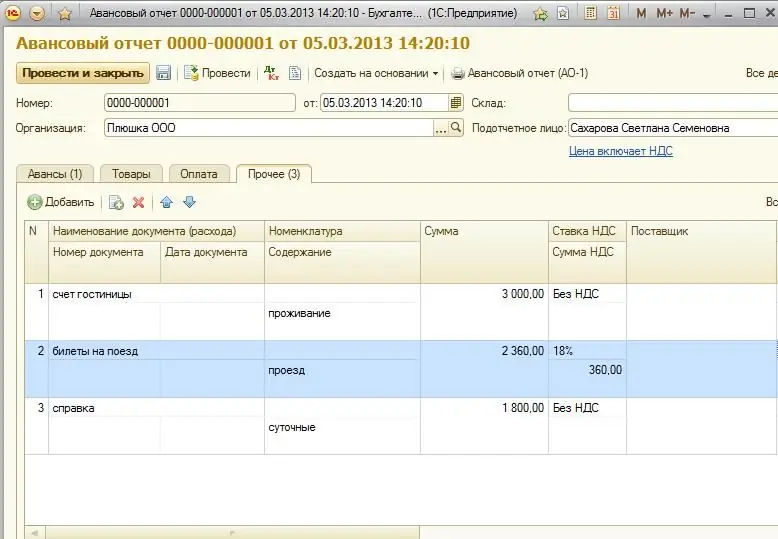

Before the trip, the employee must receive an advance payment, and upon return, provide a report on the use of funds and the completed task. Three days are allocated for the preparation of the document. The organization develops the report form itself. In addition to the document, originals of all consumable documents should be attached.

If the manager accepts the work of the employee, then the accountant is obliged to reflect all expenses in the balance sheet. If the purpose of the trip is not fulfilled, then part of the expenses may be deducted from the employee's income. If an employee spent more money than he received from the cash register, thenthere have been changes in travel expenses, you should pay the overrun. The unspent amount must be returned to the cashier, otherwise the balance will be deducted from the employee's income.

Foreign business trips

On international trips, the date of crossing the border is the first day of a business trip abroad, and when traveling to the Russian Federation, it is paid at the rate provided for domestic business trips. Calculations are made according to the marks of the border authorities in the passport.

If an employee goes on a trip abroad, he will have to purchase the currency of the host country. This function can be assumed by the organization by prescribing in local acts the payment of funds in foreign currency. Dollars and euros can be exchanged at any bank in the country, unlike rarer national units. This should be taken into account when drawing up local acts. If the organization is ready to pay travel expenses in foreign currency, then it is better to exchange for the dollar or euro.

Accounting for such amounts in accounting records is still carried out in rubles, but taking into account the following features:

- if an advance payment is transferred to a ruble card, then the amount should be calculated at the exchange rate on the date of payment;

- if payment is made in cash, then the ruble conversion rate specified in the currency purchase certificate should be applied.

Number of days

The actual length of stay on a business trip is determined by travel documents, that is, tickets. If the employee went on a business trip by car, then calculatedays can be on a memo, which he is obliged to provide upon his return. In addition, all documents confirming the use of transport (waybill, invoices, receipts, checks, etc.) must be attached.

Day Trips

There is no legally specified minimum period for a business trip. The task of the leader can be completed in one day. How can I recover the costs in this case? The process of documenting a business trip does not depend on its duration. The accounting department must draw up an order, put a mark in the time sheet and issue an advance payment to the employee. After returning, he is obliged to report on the expenses incurred, and return the difference to the cash desk of the organization. There is no per diem allowance for short trips. However, leaving an employee without money is not a good idea. In this case, the employer can pay him a certain amount, for example, 50% of the due compensation per day. This compensation is tax-free.

CIS countries

Trips to the CIS countries are taken into account separately. Since there is no stamp in the passport when crossing the border, the period is determined by travel documents. The day of departure is the date of departure of the vehicle, and the day of arrival is the day on which the time of arrival of the vehicle in the hometown falls. The amount of the payment is determined by the employer. Non-taxable amounts of compensation remain the same - 700 and 2500 rubles. Delays on the way are paid by the decision of the head if there are documents confirming the fact of forceddelays.

Example 2

An employee goes on a business trip for 3 days.

- 10.08.17 at 22:10 the employee took the train to Astana.

- 11.08.17 at 11:00 the train arrived in Astana. That is, the employee crossed the border already on 11.08.17.

- 11.08 and 12.07 the employee was on duty.

- 12.08 - the train to Russia left at 15:05.

- 12.08 at 23:40 the train arrived in Russia. That is, the employee crossed the border already on 12.08.17.

Daily allowance in the Russian Federation in the amount of 700 rubles was accrued for August 10 and 12. For August 11, a payment of 2,500 rubles should be accrued. In total, for the business trip period, the employee will receive: 700 x 2 + 2500=3900 rubles

Operations in BU

Accounting for travel expenses in 2018, as before, is carried out on the basis of an advance report. Expenses are reflected in the expense accounts because a business trip is a business trip.

A prerequisite for the trip is the preliminary issuance of an advance. The accountant can issue funds from the cash register or transfer to a bank card. The advance payment is calculated based on the duration of the trip and the approximate costs of the business trip. In BU this operation is carried out as follows:

- Dt 71 Ct 50 - issuance of accountable amounts from the cash desk.

- Dt 71 Ct 51 - transfer of accountable amounts to the card.

Further posting of travel expenses depends on the purpose of the trip. The costs will be charged to the cost accounting of the unit whose problems are directed.decide the employee. For example:

- Dt 20 Kt 71 - the employee was sent on a trip to perform work with the customer.

- Dt 44 Kt 71 - the trip is related to the sale of goods.

- Dt 08 Ct 71 - an employee goes on a business trip to complete a transaction for the sale of property.

- Dt 28 Kt 71 - the need for business trips to return defective products.

- Dt 19 Kt 71 - accounting for VAT on advance amounts.

- Dt 68 Ct 19 - tax deduction on invoice.

The return of unspent funds is reflected in the following transactions:

- Dt 50 Kt 71 - advance payment to the cashier.

- Dt 51 Kt 71 - depositing the balance of funds to the current account.

- Dt 70 Kt 71 - withholding the balance of the advance from wages.

You can keep the amount only if more than a month has passed and the employee does not object to this operation. Otherwise, the employer will have to go to court.

UST, social contributions and other taxes

According to Federal Law No. 216 “On Amendments to the Tax Code of the Russian Federation”, from 01.01.2008 reimbursement of travel expenses exceeding 700 rubles. and 2500 rubles. for each day of being on a business trip in the territory of the Russian Federation and abroad, they are subject to personal income tax, UST and social contributions. The employer himself sets the amount of compensation payments. Regardless of their size, the income tax base is reduced by the actual payment of compensation.

For tax purposes, the organization's expenses include:

- Worker's travel toboth sides.

- Renting accommodation, including additional services in the hotel (except for the cost of service in bars, in the room, for the use of wellness facilities).

- Issue and issuance of visas.

- Vehicle entry.

Features of calculations

Employee is not required to report where he used per diems. However, the Federal Tax Service can check the fair calculation of the amount based on the duration of the trip. These can be documents confirming travel, accommodation, or a travel document.

During a business trip, there may be expenses that have not been agreed in advance. For example, the cost of packing luggage. Reimbursement of these expenses is allowed only if the possibility of their compensation is specified in the local act and there is evidence that the operation was carried out for production purposes. That is, it was necessary to pack the documents, property of the organization. Otherwise, such expenses will have to be attributed to the employee's income with the subsequent withholding of personal income tax.

Meal reimbursement is not related to business travel. It is understood that the employee compensates these expenses independently in the amount of daily allowance. But the management can, in local acts, provide for the cost of paying for food in addition to the daily allowance and withhold personal income tax from these amounts. If the cost of accommodation in a hotel, flight or travel includes the cost of food, then the tax is not withheld.

We will separately consider the situation in which the trip is initiated by the ordering organization. Very often the parties agree thatreimbursement will be based on actual costs. However, an organization can send only its employees on a business trip. And in this case, the customer does not keep the accounting expenses, since this is considered a payment for the services of another organization (executor). In this case, the contract between enterprises should state that the reimbursement of such expenses will be included in the price of the goods, as well as indicate the requirements for documents and the deadlines for their submission. For travel tickets and other checks, the customer can only check the correctness of the cost calculation. If the contractor is on the general taxation system, then the cost of services is subject to VAT. If the customer is a foreign company, there is no tax refund.

Conclusion

If an employee is sent on a business trip, they should be reimbursed for travel expenses. The daily allowance is set by the employer and is fixed in local acts. Daily allowance is paid for every day on a business trip, including days off, holidays. Before the trip, the employee must accrue and pay an advance. He reports on all accountable amounts after the trip. Unspent amounts must be refunded to the cashier, and overspending must be compensated to the employee immediately after the travel report is approved.

Recommended:

The size of the dollar in millimeters. Do banknotes vary in size?

What is the size of the US dollar in millimeters? Does the size of a banknote depend on its denomination? What is the rarest currency in the United States? Why is 1 dollar the most common in the world, what is the reason for this? Circulation of the monetary unit outside the country and within it

91 account - "Other income and expenses". Account 91: postings

Analysis of the profit or loss received by the enterprise based on the results of the reporting period should be based on the structure of this indicator. This will provide an opportunity for further planning of expenses and stabilization of income values

Payment of sick leave: calculation and terms of payment, size

The amount of payment directly depends on the length of service of a person and on average earnings. As part of the calculation of the average earnings, they take the amount of his labor income for the last two years, starting from the moment the employee's disability began. That is, any payments for which the employer accrued insurance premiums

Business expenses - what is it? What does business expenses include?

Selling expenses are expenses that are aimed at the shipment and sale of products, as well as services for their packaging by third-party companies, delivery, loading, etc

Travel agencies of Minsk. Travel agency "Rosting" (Minsk). "Smolyanka" - travel agency (Minsk)

Going on vacation from the Belarusian capital is not difficult at all - there are a lot of travel companies in Minsk. But which ones are better?