2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:32

Each entrepreneur who starts his/her business should figure out what taxation system they will apply. Individual entrepreneurs and firms have the opportunity to use a simplified regime called the simplified tax system. It is presented in two varieties, since revenue or net profit can act as a tax base. If the company is engaged in the sale of various goods with a minimum margin, then the “Income minus expenses” taxation is ideal. In this case, to determine the tax base, you must first find the difference between the cash receipts of the business and the costs of doing business.

Features of the simplified tax system

The simplified system can be used by both private entrepreneurs and different companies. "Simplified" for individual entrepreneurs and firms has numerous undeniable advantages. Each entrepreneur can choose one option for this mode:

- payment of 15% of net profit;

- paying 6% of the company's total revenue.

If the margin on goods is low, then it is advisable to choose the taxation "Income minus expenses". To switch to this mode, you must submit an appropriate application to the Federal Tax Service. The difficulties of such a system lie in the specificity of accounting, since it will be necessary to maintain KUDiR, and in order to reduce the tax base, all expenses should be confirmed with official documents.

Most often this system is chosen by representatives of small or medium-sized businesses. Features of taxation of the USN "Income minus expenses" are listed in Ch. 26.2 NK. Here are the requirements for entrepreneurs, the nuances of using the system, the tax rates are set, and the nuances of determining the tax base.

Who can use?

The simplified taxation system "Income minus expenses" can be applied both by individual entrepreneurs and by different companies. The tax base is net income, therefore, to determine the tax base, expenses must be deducted from all cash receipts of the business.

The main requirements for entrepreneurs include the following:

- income per year cannot exceed 45 million rubles;

- transition to this mode is not allowed for companies that have different representative offices or branches;

- the value of fixed assets belonging to this organization should not exceed 150 million rubles;

- not allowed to usesystems by different insurance companies, banks or foreign organizations;

- the regime is not applied by non-state PFs or by market participants in which various transactions with securities are carried out;

- The simplified tax system does not apply to companies that are representatives of the gambling business or manufacturers of excisable goods;

- the company should employ no more than 100 people;

- notaries or pawnshop owners don't use this system.

It is forbidden to combine the simplified tax system with the UAT, so if an individual entrepreneur or company specializes in agriculture, then only the UAT will have to be used.

Nuances of the system

The "Income minus expenses" taxation system has certain features. These include:

- a single tax is paid instead of several fees represented by property tax, personal income tax, VAT or income tax;

- by reducing the number of taxes paid, the tax burden on the taxpayer is reduced;

- declaration for this regime is submitted to the Federal Tax Service annually;

- tax is paid in advance, after which the final amount is calculated and paid early next year.

The declaration is considered easy to draw up, so entrepreneurs who are just starting their business can independently engage in the reporting process, which saves on accountant fees.

What are the ways to switch to the mode?

Beforeusing this system, the entrepreneur must understand the mode. The system "Income minus expenses" - what kind of taxation? It is represented by a version of the simplified tax system, in which the tax base is represented by the net profit of the enterprise.

You can switch to this mode in different ways:

- when directly registering a company or individual entrepreneur, you can immediately submit an application, on the basis of which the entrepreneur selects the appropriate tax regime;

- if an individual entrepreneur works on UTII, then he can switch to the simplified tax system at any time;

- if another tax regime is used, for example, OSNO or PSN, then the transition is possible only from the beginning of the next calendar year, and the application must be submitted to the Federal Tax Service before the end of December.

Before applying, you should figure out what is included in the USN "Income minus expenses", what are the pros and cons of this system, as well as what difficulties entrepreneurs face.

Pros of the regime

Simplified regimes are specially introduced by the state to facilitate the work of many entrepreneurs or companies. If the simplified taxation system “Income minus expenses” is chosen, then businessmen can enjoy some undeniable advantages. These include:

- one tax replaces numerous fees, which reduces the tax burden on a company or individual entrepreneur;

- the process of drawing up a declaration is considered simple and understandable, and this documentation is submitted to the Federal Tax Service only once a year;

- if an individual entrepreneur has no employees on the simplified tax system, then maintenance is not requiredaccounting, since it is enough only to have KUDiR;

- you can apply this mode when working on almost any type of activity;

- entrepreneurs decide on their own what type of simplified tax system will be applied during work;

- the amount of tax depends entirely on the incoming revenue or profit, so if there is no income, then only the minimum amount of the fee is paid, and it is also possible to draw up and submit a zero declaration to the Federal Tax Service.

It is advisable to apply for the transition to this mode directly in the process of registering an LLC or individual entrepreneur. Another significant plus is that newcomers to business can count on tax holidays when using the simplified tax system. This relief is offered to entrepreneurs who register for the first time until 2020. They must choose a field of activity related to the provision of domestic services, the production of various goods, or work in the scientific or social sphere. Local authorities in each region, for various reasons, can reduce the rate, which significantly reduces the tax burden.

System flaws

Income minus expenses taxation has not only significant advantages, but also some disadvantages.

They are:

- it is not allowed to hire more than 100 employees, therefore this system is suitable only for companies that are small or medium, and not only full-time employees are taken into account, but also people with whom it is drawn upcivil law contract;

- per year, profit from activities should not exceed 50 million rubles;

- the value of assets should not be more than 150 million rubles;

- it is not possible to switch to another simplified regime until the beginning of next year.

In fact, the shortcomings of such a system are considered not too significant and serious. Therefore, the mode is used by numerous entrepreneurs and companies.

Nuances of reporting

When choosing the “Income minus expenses” taxation system, businessmen should prepare for the need to draw up a fairly simple and understandable annual declaration.

The rules for its design are as follows:

- document can be completed by hand or on a computer;

- it is allowed to use special programs created and published in the public domain by employees of the Federal Tax Service, which greatly simplifies the procedure for entering information into this document;

- the tax period for this regime is a calendar year;

- before March 31 of each year, you must submit a declaration to the Federal Tax Service;

- only reporting to insurance funds is submitted monthly and quarterly if the entrepreneur has employees;

- annually submit reports containing information on the average number of employees in the company;

- Additionally, if you have employees, you have to submit a 6-NDFL declaration and 2-NDFL certificates.

Entrepreneurs should understand the rules for maintaining KUDiR, since only this document canindicate the income and expenses of an individual entrepreneur or company. If during a tax audit it turns out that this document is missing or incorrectly maintained, this will be the basis for holding the entrepreneur liable.

Who benefits from this regime?

Often chosen by the "Income minus expenses" system for individual entrepreneurs and business owners, but it is important to make sure that working on such a regime will bring certain benefits to the business. It is advisable to use this method of calculating taxes in the following situations:

- an entrepreneur specializes in retail trade using small stationary commercial premises, but the simplified tax system is applied only if it is impossible to use UTII in a particular region;

- ideal system for small companies represented by entertainment organizations or enterprises providing various services to the population;

- It is best to use the calculation of income and expenses if the margin is small, so it is advisable to calculate the net income represented by the tax base.

It is not very profitable to use a simplified system if the company interacts with counterparties that apply VAT, since in this case it will not be possible to return some of the funds from the state in the form of a VAT refund. Additionally, this regime is not suitable for large enterprises, since they simply will not comply with the requirements of the simplified tax system. You will not be able to participate in tenders using this system.

Accounting features

The object of taxation with "Income minus expenses" is net profit, so the specifics of accounting is the need to calculate the tax base. To do this, all officially confirmed and justified expenses must be deducted from income.

Revenues from activities include:

- transfer of funds by buyers to the settlement account of an entrepreneur or company;

- receipt of money from retail sales of goods;

- income from the difference in exchange rates;

- receipt of intangible assets;

- commission reward;

- advance refund by buyers.

All of the above cash receipts will certainly be registered in KUDiR. Under the "Income minus expenses" system, how much interest is charged on the tax base? Once the net profit is correctly determined, 15% is charged from it.

What is included in expenses?

Before applying for the transition to "Income minus expenses", the entrepreneur must make sure that he can really cope with the correct calculation of the tax base. Tax inspectors have many requirements for expenses that reduce business income. They must be supported by official documents, and must also be substantiated. As confirmation, primary payment papers are used, represented by various checks, waybills, invoices or contracts.

To the main costs that entrepreneurs have to face,include:

- purchase of fixed assets;

- purchasing direct goods for resale, as well as materials or raw materials for production activities;

- travel costs associated with the purchase of goods for doing business;

- services provided by third parties for a fee;

- rent for used commercial space;

- value-added tax imposed by companies with which the entrepreneur cooperates;

- wages of hired specialists;

- taxes and insurance premiums for yourself and employees.

"Simplification" for individual entrepreneurs is an excellent option, but an entrepreneur must be well versed in how to properly account for expenses and income. The correctness of the calculation of the tax depends on this. Advance payments under the simplified tax system must be paid quarterly, therefore, it is necessary to fill out KUDiR in a timely manner. Particularly much attention is paid to the expenditure side, as often entrepreneurs are faced with the fact that after a tax audit, inspectors charge additional tax due to the lack of confirmation of certain expenses.

KUDiR rules

Reporting for “Income minus expenses” is presented by the USN declaration, which is submitted annually. Additionally, a ledger is required to record all cash receipts, as well as officially confirmed expenses.

The following applies to the rules for filling out KUDiR:

- all entrepreneurs using the simplified tax system are required to complete this book;

- the document has twoparts, since one part is for income and the other is used to enter business expenses;

- data are entered on a cumulative basis;

- can be filled in paper or electronic form;

- a separate book is made for each calendar year;

- if a paper version of the document is used, then before entering information, the book is numbered and stitched;

- if a computer is used to maintain the document, then when submitting the USN declaration, the book must be printed and endorsed.

All individual entrepreneurs on “Income minus expenses” must understand the rules for maintaining this reporting. Otherwise, entrepreneurs may be held accountable by tax inspectors.

How is tax calculated?

It is important to pay advance payments on the simplified tax system quarterly. The following algorithm is used to calculate the tax:

- for three months, all official income from activities is summed up;

- expenses are calculated that are documented and substantiated, as well as included in the KUDiR;

- expenses deducted from income;

- the tax base is adjusted if there is a loss in previous periods of work;

- tax deduction is used if the merchant has already paid the trading fee;

- as soon as the tax base is determined, you should find out if any reduced tax rate applies in the region where the entrepreneur lives;

- calculate sizetax, for which the standard rate (15%) is used, or a reduced rate that an entrepreneur can use.

The calculation is carried out on an accrual basis. The last payment is made at the beginning of the next year, and for its calculation all cash receipts and expenditures for one year of work are taken into account. After determining the tax base and the amount of tax, the payment is reduced by the funds previously transferred to the budget. Based on the values obtained, the USN declaration is correctly filled out, which is handed over to the Federal Tax Service before March 31.

Rules for completing the declaration

Entrepreneurs using this regime are required to annually submit a USN declaration to the Federal Tax Service. It includes the following information:

- information about the entrepreneur or company;

- rules for calculating the tax base;

- received income for the year of work;

- expenses that must be justified and supported by official documents;

- deduction is indicated if the entrepreneur can use it;

- given the exact amount paid by the firm or individual entrepreneur in the form of tax.

It is allowed to use special programs to fill out this documentation, which greatly simplifies the procedure for generating a declaration.

The nuances of paying the minimum tax

It is not uncommon for entrepreneurs to face a lack of profit. In this case, they can submit a zero declaration to the Federal Tax Service, but at the same time the minimum tax is paid at “Income minus expenses”. Its size is equal to 1% of allcash receipts from the business.

The difference between the standard tax and the minimum tax may be included in the company's deferred expenses.

The minimum fee is calculated only at the end of the year, since when calculating advance payments, it is not possible to determine whether there will be a profit from the company's activities at the end of the tax period. Therefore, quarterly it is necessary to calculate advance payments, for which 15% is determined and paid from net profit. At the end of the year, you can determine exactly what tax you will have to pay: standard or minimum. If it turns out that you need to pay the minimum fee, then it may be reduced by the previously transferred advance payments. If at all such payments exceed the minimum tax, then it can not be paid.

Therefore, even if an individual entrepreneur or company has no official profit, you still have to transfer a certain minimum fee to the Federal Tax Service. It was introduced relatively recently, and the main reason for its application was that many entrepreneurs deliberately used the regime to draw up a zero declaration and not pay any funds to the Federal Tax Service.

Conclusion

When choosing the taxation system of the simplified tax system, in which 15% is charged on correctly calculated net profit, entrepreneurs can enjoy many undeniable advantages. But such a regime has some disadvantages that every businessman should take into account.

For proper work on this system, it is important to pay quarterly advance payments, as well as annually submit tax returns to the Federal Tax Servicedeclaration. Additionally, it is required to correctly conduct KUDiR.

Recommended:

Taxation. UTII: advantages and disadvantages

Taxation according to UTII is a special regime provided for individual entrepreneurs and organizations engaged in certain types of activities. Unlike the simplified tax system, the income actually received by the subject does not matter. The calculation of UTII for individual entrepreneurs and legal entities is based on the profit established by the state

Common taxation system: advantages and disadvantages, transition

The general taxation system is considered the most complex regime in the Russian Federation. The article describes how you can switch to this system. All taxes that individual entrepreneurs and companies have to calculate and pay are listed. Various declarations and reports that need to be submitted to the Federal Tax Service on a regular basis are indicated

USN "Income minus expenses" - rate, accounting and calculation

A significant incentive in the development of SMEs is the taxation system. Its reform in Russia began in the 90s (the Soviet system simply did not imagine such a business). This constructive process was started in 1996 by the Federal Law "On the Simplified Taxation System". STS "Income minus expenses" and, as an alternative, STS "Income" were proposed as options for easing the tax burden for start-up entrepreneurs

Simplified taxation system (STS): income, expenses and features

Many entrepreneurs or company executives choose the USN "Income" or "Income minus expenses" when choosing a tax regime. The article describes the main nuances of these regimes, the rules for calculating taxes and the deadlines for submitting a declaration

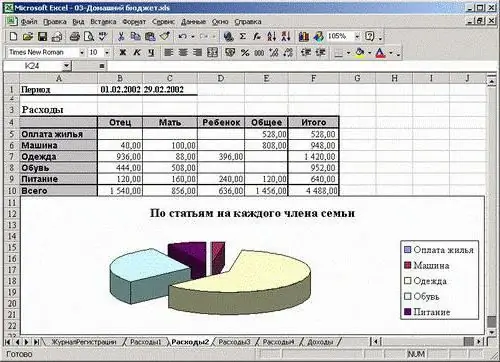

Family income and expenses - calculation features and recommendations

Maintaining a family budget is not an easy question. You need to know how to properly carry out this operation. What can help? How to budget? How to save and even accumulate it? All the secrets of this process are presented in the article