2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:41

A huge role in the life of a modern person is played by such a moment as money, in particular the budget. It is easy to guess that it consists of income and expenses. These are essential components, without which you cannot learn to control your budget.

Family income and expenses play a special role. How to save correctly? How should you keep track of cash inflows and outflows? This question interests many. After all, if you cope with the task, then you can easily learn not only to save, but also to save "extra" money for some needs, a "rainy day", and also just for the purpose of saving. All secrets and recommendations are presented to our attention. Maybe they will really help you.

Why

The first step is to figure out why you need to control family income and expenses at all. Maybe it's not worth it to beat your head with this case? Especially if finances, in principle, are more than good.

In fact, controlling money isan indispensable moment in the life of any modern person. And it doesn't matter if you have a deficit of these or not. As they say, money loves an account. So controlling your finances is a great way to be confident in the future. And as soon as the question concerns the family directly, then certain needs appear. And they need to be covered as needed. Only an accurate calculation of funds will help not to fall into a financial hole, as well as to correctly distribute the available money. The income and expenses of the family, which are kept under strict control, as a rule, even with a small amount of funds, can provide huge profits and efficiency. But you need to be able to calculate and calculate. What will help with this? What are the secrets here?

Records

In general, everyone recommends collecting checks and then saving them until the end of the month. This is a normal phenomenon that can really help with the distribution of the family budget. But only now, not everyone and not always succeed in collecting payment receipts. The thing is that a person who has not previously de alt with this business is unlikely to start accustoming himself to "collecting" checks so quickly. It's not that easy, to be honest.

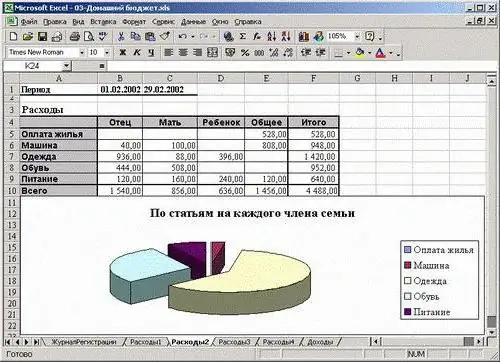

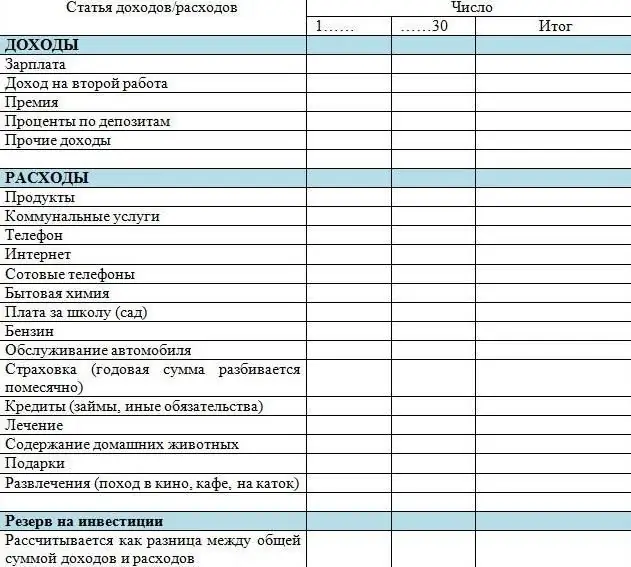

Therefore, there is one trick that will definitely help you keep a family budget (family income and expenses). Table! That is, the corresponding entry that reflects all your expenses during the month. It can be both electronic and paper. It is not necessary to keep receipts at the same time, it is enough just to know how much and on what you spent or received in a particular month. This kind of summaryIt helps to keep track of both your income and expenses on a monthly basis. In addition, such discipline will definitely help you find a way to save money.

Primitive

Well, let's use this option. The thing is that the income and expenses of the family - the table is very ambiguous. It may include a variety of items that are useful for certain situations. True, you can use the most primitive model. It is perfect for those who do not like specifics and paperwork.

What will it take? To keep track of income and expenses, you must draw up an appropriate table for the month. It should have at least 4 columns. This is:

- income;

- expenses;

- total profit;

- final expense.

As a matter of fact, every day you will need to make the necessary changes in the appropriate fields. During the month, only "income" and "expenses" are actively used. But in the end, you will have to calculate both columns and their difference. This is the simplest option that can only be found. Family income and expenses - a table that is not unique. But it is desirable to expand it. How exactly?

Specifics

The thing is that everything depends on your composure and organization. But remember: the more effort you put into compiling and maintaining such a thing as a family budget ("Family income and expenses" - table), the more effective your activities will be at the end of the month. Mostwe have considered a primitive variant. But this, as a rule, does not end the calculation.

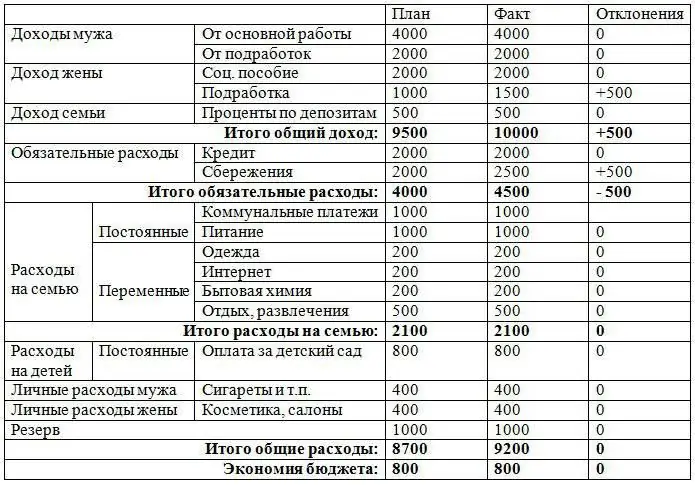

Most often it is more profitable to keep a complete and thorough account of the budget. That is, create a table that will contain at least the following columns:

- income;

- expense;

- comment;

- total income;

- total costs.

At the same time, add to the indicated points also small points that will help to establish the specifics. It is advisable to write them out separately, but include them in the expenses without fail. We are talking about such things as the main expenses, those without which you cannot live in principle. It would also be nice to have a separate savings column. All this is very convenient to do on a computer. Yes, dealing with a full table can be difficult. Especially when it comes to comments. They will have to paint what and why you bought. But it will ultimately give you the maximum effect. You can easily look at all the income and expenses of the family, and then see from the outside what exactly you spent money on. And, accordingly, exclude unnecessary expenses.

Savings

What else is worth seeing? To be honest, the savings line will become an important point. Moreover, it is desirable to exhibit it in several views. The first is the current state of your budget (or rather "extra" money). Let this column show how much money is deferred at the moment. You can even keep this account with comments. For example, if you are saving for something specific.

The second representation is the amount of money that will be set aside per month. It is with the help of this approach that the family budget is formed. Income, expenses, spending and receipts are important. But if you are faced with the task of saving, as well as saving, then try to include the appropriate items in your table. Let, depending on the savings, you immediately, at the beginning of the month, set aside 10% of the profit (salary, for example), and then distribute the rest of the funds for a month. Therefore, the second item in the "set aside money" section is a fixed amount, which usually reflects 1/10 of the total profit. Good way to save money.

Income

Well, it's very convenient now to use such a thing as a computer. It will help you quickly and easily control the income and expenses of the family. An Excel table is what we need. In general, the already given points and columns will suffice. But if you want detailed specifics, then special attention should be paid to the income item.

What can be included here? For starters, it's an advance. He comes out very often at work. After that, be sure to write down the salary and bonuses. They will help generate more accurate data. And, of course, you will be able to exclude this or that source of funds at any time.

Besides this, pay attention to receipts from gifts (let there be a separate column for this feature), interest from deposits, other sources of income (such asscholarships, property income, etc.). All this is signed in great detail so as not to miss anything important. In principle, such a table is usually more than enough.

Costs

Now look at the costs. They also play a very important role. Comments are good. But it is only better to thoroughly record where exactly and what you spend money on. The "Family Budget: Income and Expenses" table, which details your spending, is a treasure trove of savings and control.

What is better to include here? In a separate paragraph, take the section "Basic". Let it be utility bills. Subparagraphs will also have to be done. What are we talking about? Let separate columns be allocated for each account. In other words, write down in the table separately the amount of funds for general utility (house) needs, cold and hot water, heating, electricity, major repairs.

Among other things, a family's income and expenses usually involve the allocation of a budget for food, clothes, gifts, and transportation. Let at least these moments be reflected in your table. Bought something? Added to the list with a comment in the appropriate field. Did you go by transport? Recorded. Yes, at first it will be difficult, but then you will learn how to quickly make calculations, and also remember to write down expenses.

Remainder

Another very interesting technique is the inclusion of the so-called balance at the end of the month in the table. It is advisable to postpone it for your needs. Let itthere will be a nice bonus on top of 10% of your salary.

The balance at the end of the month is the difference between income and expenses. It is necessary to calculate the income and expenses of the family, and then subtract the second from the first paragraph. And you get how much money you have left. This technique helps very well when you need to learn how to accumulate funds. You can clearly see the difference at the end of each month.

Calculations

How to calculate family income and expenses? To be honest, the formulas built into Excel help a lot here. They will give you results quickly and accurately, and automatically. And then you will have to analyze the budget yourself.

To calculate the sum of expenses and incomes at the end of the month, you will have to insert the "Amount" formula in the corresponding total column. Then just select all the fields that relate to the receipt of funds, as well as their spending, respectively, and press Enter. The result will be displayed. Nothing difficult. Very convenient, especially considering that Excel will act as both a notebook and a calculator.

The interest on savings is calculated a little differently. You need to write=in the formula bar, then indicate the total income (the amount from which we will take 10%), then print "0.1". This algorithm will help you quickly calculate how much you need to put aside from your salary at the beginning of the month. In principle, no more formulas are required. All you need to do is constantly add, subtract and compare.

Secrets

Now a little about the secrets of saving money. Of course, taking into account the maintenance of our today's table. Without it, it is difficult to navigate spending.

The basic income and expenses of the family are mandatory items. These usually include salaries, utility bills and transport costs. Fill in the column data first. It is usually impossible to exclude something from them.

Pay special attention to your purchases. In particular, when you make large gifts or just buy products. Often you can take too much. Mention all items in the check in the appropriate comments. At the end of the month, you can take stock and see what you could do without. Good reception, but it requires careful analysis.

Be sure to put aside what is left at the end of the month from the money. You can record this money in a separate item. A very good way to save money and an additional source of income "for a rainy day." Over time, you will learn how to quickly increase this indicator with the help of analysis. This means that the income and expenses of the family (the table will help control them) will be in safe hands.

Don't want to draw tables and make summaries in Excel yourself? Then download and install ready-made templates. They, as a rule, help to sum up both monthly and annual results. It is this option that is in great demand among users.

Recommended:

Additional income. Additional income. Additional sources of income

If, in addition to the main income, you need additional income to allow you to spend more, make gifts for yourself and your loved ones, then from this article you will learn a lot of useful information

Family budget: structure of income and expenses

You need to be able to manage finances. Especially in the family. In this article we will talk about the formation and distribution of the family budget

Taxation "Income minus expenses": features, advantages and disadvantages

Income minus expenses taxation has many significant advantages for every entrepreneur over other systems. The article explains when this tax regime can be used, as well as how the amount of the fee is correctly calculated. The rules for compiling a tax return and the nuances of maintaining KUDiR are given

Simplified taxation system (STS): income, expenses and features

Many entrepreneurs or company executives choose the USN "Income" or "Income minus expenses" when choosing a tax regime. The article describes the main nuances of these regimes, the rules for calculating taxes and the deadlines for submitting a declaration

Business expenses - what is it? What does business expenses include?

Selling expenses are expenses that are aimed at the shipment and sale of products, as well as services for their packaging by third-party companies, delivery, loading, etc