2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:26

The question of taxes is always considered quite acute. Citizens do not understand why they need to pay various fees and why the state regularly raises them. Moreover, not everyone knows what types of taxes exist in Russia. Let's try to fill in these gaps in knowledge and discuss taxes, their types and functions. This will allow you to understand for what purpose you need to pay various fees.

Definition

In accordance with the law, the term "tax" is understood as a mandatory gratuitous payment that is levied from legal entities, as well as individuals in order to ensure the functioning of the state and individual municipalities. By the way, fees from legal entities are slightly higher.

The concept of taxes arose in antiquity in connection with the emergence of the first states. In the future, the system for collecting mandatory payments was improved, gradually acquiringmodern look.

What are they for?

Taxes, their types and functions will be discussed later, but for now let's start with this question. So, first of all, they allow the state to realize its social functions, ensuring the comfortable existence of society. In particular, we are talking about protecting the life and he alth of citizens, the possibility of obtaining education, etc.

Thanks to tax deductions, the state can contain the structures necessary for the activities of the entire society. For example, police, customs, medical facilities, etc.

The role of taxes in state budget revenues is difficult to overestimate. In addition to all of the above, they allow the state to implement the social function assigned to it. In particular, to pay scholarships, pensions, unemployment benefits, etc. These funds support orphanages and the he althcare system.

Classification

Depending on the criterion that is the basis, different types of taxes can be distinguished. NK, for example, distinguishes three main types. They will be described in more detail. So these are federal, state and local taxes.

Let's briefly list the features.

Federal taxes are considered mandatory throughout the Russian Federation. Examples include various duties, insurance premiums. As well as personal income tax, value added tax.

Regional ones operate in separate subjects. This is a transport tax, property tax (for organizations), etc.e.

Local - within municipal limits. These are trading fees, taxes on property of citizens, etc.

Now you know their main features. Federal, regional and local taxes go to the respective budgets and are subsequently spent by various authorities. Goals range from unemployment benefits to road construction.

Direct and indirect

All taxes received by the budget of the Russian Federation are conventionally divided into two categories. They are called direct and indirect. Let's find out how they differ.

Direct taxes are paid on income or property. For example, this category includes the well-known personal income tax, which in the Russian Federation is thirteen percent. Also here should be added income tax, which is paid by various organizations. It is twenty percent of the profit.

Another example of a direct tax can be considered transport. It is paid by those persons who have a registered vehicle. It can be not only a car, but also a bus, an aircraft, a motor boat, etc. The amount of this fee is determined by a specific subject of the Russian Federation. Therefore, residents of the Moscow Region and the Krasnodar Territory may pay different amounts for the same car.

With indirect taxes, everything is somewhat simpler. They are included in the price of goods, so they do not need to be calculated separately. Any item you purchase is alreadycontains in the final cost, customs duties, value added tax, excises or other types of mandatory fees.

Difference

Now it is easy to understand what is the main difference between direct and indirect taxes. The former are subject to mandatory payment by citizens and legal entities with a certain frequency, the latter are already included in the cost of all goods they purchase. The peculiarity of indirect taxes is that they are formally paid by their sellers. In this case, in fact, this obligation is shifted to the end buyers.

Tax functions

Their types and some features are already familiar to you. It's time to discuss another issue. Let's talk about tax functions.

- Fiscal. Allows you to create financial resources, as well as material, which, in turn, ensure the functioning of the state. The task of the fiscal function is to provide a stable income for the federal, as well as regional and local budgets.

- Stimulating. It allows you to spur technical progress, increase the number of jobs, etc. The bottom line is that the profit that is spent on expanding or equipping certain industries is exempt from mandatory taxes.

- Redistributive. It is relevant when using a progressive tax system. The essence of this function is that the tax depends on the level of income. The higher it is, the more you have to paybudget. This reduces the social stratification of the population.

- Regulating. This means that the established amount of taxes either stimulates or, conversely, suppresses some activity.

Features

Now you know the main taxes, their types and functions. It is time to discuss a curious feature. It is characteristic of the Russian taxation system and concerns the tax on personal income. The media is actively broadcasting information about the low rate of thirteen percent.

However, at the same time, a rather high burden falls on the wage fund, from which employers are required to make contributions to the payment of pensions, sick leave and other social guarantees from the state. In fact, these funds are deducted from the salaries of employees, but the latter often do not know about it.

This is due to the fact that all deductions are made by the employer, as he performs the function of a tax agent. Considering that the total amount of deductions is quite high and amounts to more than thirty percent, a logical question arises. Where do payroll taxes go? This is a hot topic for every employee who honestly pays mandatory contributions.

What are taxes spent on?

For all individuals and legal entities on the territory of the Russian Federation, mandatory fees are established, the payment of which cannot be refused. However, not all citizens know why they need to pay taxes. Let's find out what the state spends onfunds thus received.

- Medical care. Despite the fact that citizens are skeptical about free medicine, the state finances he althcare institutions, allowing citizens to receive qualified assistance.

- Pension payments. Employers transfer a rather impressive percentage to the pension fund for employees. In the future, this allows them to count on receiving a labor pension. Individual entrepreneurs cannot count on receiving these payments, so they must take care of the upcoming old age.

- Social payments. The part of the funds that goes to the Social Insurance Fund goes to the payment of unemployment benefits, maternity, etc.

Maintenance of law enforcement agencies, as well as civil servants. In fact, the salaries of officials and the president are also paid from the tax revenues of citizens

Results

Now issues related to the taxation system in the Russian Federation will no longer be so difficult for you. We examined in detail the means by which the state can pay unemployment benefits, maintain he alth care facilities, the police and officials.

The difference between direct and indirect taxes has also become more apparent. If the former are directly paid to the budget by an individual or legal entity, then the situation with the latter is somewhat more complicated. Sellers include indirect taxes in the cost of goods, but in fact they are paid by the finalconsumers. Thus, the more purchases an object makes, the higher the amount of taxes it pays to the budget of the Russian Federation.

Recommended:

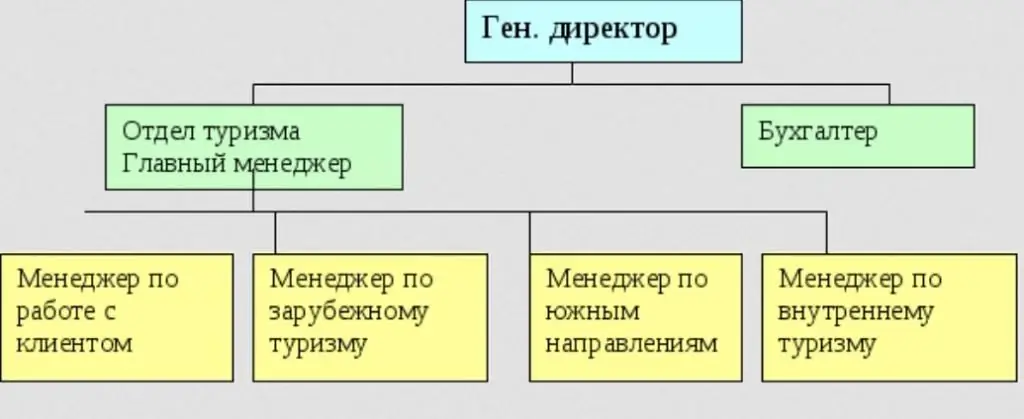

The main functions of a leader: types of managers and their responsibilities

To understand what are the management functions performed by the manager, one should be guided by the features of this position. Managers are considered to be those who replace people who occupy managerial positions in the hierarchy of the enterprise. All of them should know and take on the basic functions of a leader. Let's consider them in more detail

Types of tour operators and their characteristics. Functions and features of the activities of tour operators

The tour operator provides a wide range of travel services and simplifies the reservation of services in other cities and countries, taking on these tasks. In the field of tourism services, it occupies a special niche. In the article we will consider the types of activities of tour operators

Collection is Paying taxes and fees. Federal and local fees

Today we will talk about fiscal fees as an instrument of the most important domestic mechanism aimed at replenishing the budget. We will learn about their functions, varieties, shortcomings, and also suggest ways to improve them

Federal taxes include a tax on what? What taxes are federal: list, features and calculation

Federal taxes and fees include different payments. Each type is provided for a certain branch of life. It is the duty of citizens to pay the necessary taxes

Local taxes and fees are introduced by which authorities? Local taxes and fees in the Russian Federation

The tax system of the Russian Federation provides for local taxes and fees. What are their specifics? Which authorities set them up?