2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:27

Finding a non-state pension fund that could be entrusted with one's own pension savings is now extremely difficult. Moreover, the competition in this area among organizations is simply huge. And in order to attract customers, very often many simply deceive visitors. What is Gazfond (NPF) really? Feedback about this organization from customers and employees is what will help you decide.

Maybe your funded part of your pension should really be transferred here? Or, on the contrary, never use the services of this company and look for its better analogue? Immediately understand for yourself - there is no single exact opinion. After all, how many people - so many reviews. All conclusions will have to be done independently.

What does he do?

Really, it's not really that much of a problem. After evaluating all the pros and cons of the company, everyone can make one or another conclusion for themselves. So let's start with the activities of the organization. Maybe she will scare you away already.

Although it shouldn't. After all, reviews of the NPF "Gazfond" (Russia, St. Petersburg and other cities) are left as a place,which offers the population to invest and keep their funded part of the pension. Of course, with its pluses - it is possible to multiply cash deposits. And when the time comes, Gazfond will pay you the funds in your account as a pension. Or rather, only its cumulative part. There is nothing suspicious here. Quite a normal company that offers the necessary services to the population. This is not the Vedeno-Oyatsky Monastery, not a fraudulent organization. Which means you can trust her. This is what many customers believe.

How is an employer?

What reviews does the NPF "Gazfond" receive? Sometimes, by the opinions of employees alone, one can say with accuracy how conscientious a company is. With regard to Gazfond, the situation is very ambiguous.

Why? The thing is that the majority of employees adhere to a neutral position regarding our current organization. But at the same time, personnel and applicants emphasize some of the shortcomings of the company. Yes, she also has pluses, but for some they will seem not so significant.

Among the benefits is a stable income, as well as working conditions. You will work in comfortable offices. More or less stable schedule also takes place. And Gazfond is not a fraudulent company. It really exists and offers real vacancies for employment. But that's where the positives end.

"Gazfond" (NPF) does not earn the best reviews due to the fact that all employees are forcedtransfer the funded part of the pension to this particular corporation. And there are even threats of dismissal. That is, the company acts by hook or by crook, honest methods of influencing employees and not so much. This is alarming - why would a conscientious firm that is popular even force someone to make deposits? Suspicious, and only!

Rating

Nevertheless, this is not a reason to refuse to "communicate" with this company. NPF Gazfond earns a variety of customer reviews. And it's impossible to say for sure whether to trust him or not.

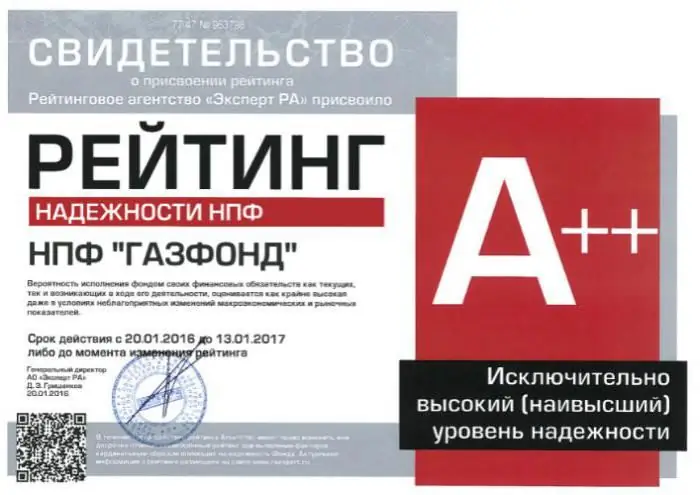

In any case, the so-called rating of pension funds plays a huge role. It indicates all such organizations, taking into account the level of customer confidence, stability of work, as well as popularity among visitors. And Gazfond is in the top five. It follows that we are dealing with a truly stable corporation.

By the way, she has the highest level of trust - A++. In any case, this is indicated by statistics. Therefore, it should be assumed that the pension fund is trustworthy. At least the minimum. This is not some small office that no one knows about, but a really large and well-known organization.

Yield

Collects and multiplies pension savings by OAO NPF "Gazfond". Reviews about this organization are left by customers, as already mentioned, ambiguous. Yes, according to statistics, the level of population trust is high. Moreover, the company is intop five NPFs in Russia. But the important points don't stop there.

What else should I pay attention to? To what NPF "Gazfond" receives feedback on the profitability of the fund. This is an important point. It's not enough to save your retirement savings. Funds also offer to increase them. This means that profitability plays a huge role in the firm's rating.

This corporation offers not too high figures. The thing is that the average profitability of Gazfond reaches 4.17%. Not much, but it's more than many similar companies can offer. Therefore, Gazfond (NPF) receives reviews as a fund that really helps, albeit slightly, to increase pension savings.

Surprises from the company

Special attention requires membership in the company. It causes the most confusion and indignation on the part of customers. Why? All due to the fact that you can suddenly find out for yourself that your funded part of the pension is already in the Gazfond, even though you personally did not apply there. How does it work?

"Gazfond" makes deals with different employers, as a result of which all employees of the company become investors. Their personal presence, as well as consent, is not required. Thus, unsuspecting citizens keep the funded part of the pension in the Gazfond. When checking this information pops up. The fund itself allows you to refuse membership without problems, butyour employer is unlikely to agree. This is the picture that practice shows.

In person

But if you decide to become a contributor on your own, you will not find any problems, negative or negative sides. Moreover, NPF "Gazfond" receives positive customer reviews for its conditions, which it offers to all visitors.

The contract is drawn up taking into account and indicating all the rules of emerging relations. In addition, you are given the opportunity to change the pension fund to some other one at any time upon a personal application. It turns out that customers are not burdened with anything. They can freely choose where to keep their pension savings. And this, of course, pleases. At least at the very beginning of the membership.

Hard reality

Only in practice a different picture emerges. It pushes many people away from the fund. How are things really going with Gazfond? Not in the best way. After all, despite the proposed terms of cooperation, you do not get anything special. Just an extra headache. This is what some customers claim.

Where does this statement come from? All this is due to the fact that, in fact, Gazfond will not let you easily change the fund for storing pension contributions. To achieve your goal, you will have to write an application for the transfer of funds several times. It can be said that justice must be sought "with a fight".

It also turns out that Gazfond often has problems withpayments of pension savings that are already in the account. Sometimes citizens wait for their money for 2-3 months. This is normal for this non-state pension fund. And not only for Gazfond, but also for other similar corporations. Although delays in payments are repulsive, they are present everywhere in Russia.

Laurels of Glory

Only Gazfond (NPF) reviews are mostly positive. Where do they come from, if in fact the company does not have many advantages? And the population tends to warn more about the negative than about the positive.

Everything is extremely simple - praise for the pension fund is bought. People were paid positive reviews that could attract new customers. This is a normal phenomenon that has long been used by all organizations - both scammers and bona fide firms.

Should I trust Gazfond? It's up to you to decide. In any case, one should not trust the opinions pointing to the ideal position of the fund in the services market. Yes, this is a company that will not be closed, it is unlikely to go bankrupt. Therefore, she deserves a minimum of trust.

Recommended:

NPF Sberbank: reviews. NPF of Sberbank: profitability

How does the activity of the NPF of Sberbank correlate with the positions of the parent organization, which is the leader of the credit and financial market in Russia? How profitable can cooperation with this non-state pension fund be?

IIS in Sberbank: reviews, opening conditions, rules for depositing funds and profitability

Since 2015, it has been offered to open an individual investment account, which provides a good profit. In fact, this is a depository contribution to brokerage accounts, the income from which can be received in the form of tax deductions, as well as in the form of interest due to competent cash management

Mushroom production in Russia: equipment, profitability, reviews

Today, the demand for mushrooms is constantly increasing, as meat becomes more expensive every year. Due to this, people are forced to look for alternative foods that are highly nutritious. As statistics show, the level of demand significantly exceeds supply, so the production of mushrooms in Russia is one of the most attractive areas

NPF "Future": customer reviews, profitability rating

JSC NPF "Future" is one of the largest financial institutions that provides Russian citizens with the opportunity to increase their pension contributions as a result of concluding OPS agreements. The company started its activity in the market more than 18 years ago. Now it is a merger of large NPFs - Welfare and Stalfond

"Promagrofond", non-state pension fund: reviews, rating of reliability and profitability

Promagrofond is an organization that has existed in Russia for a long time. It conducts a very useful activity for the population. But what kind of company is this? Today we have to sort it out. After all, Promagrofond is a non-state pension fund