2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:37

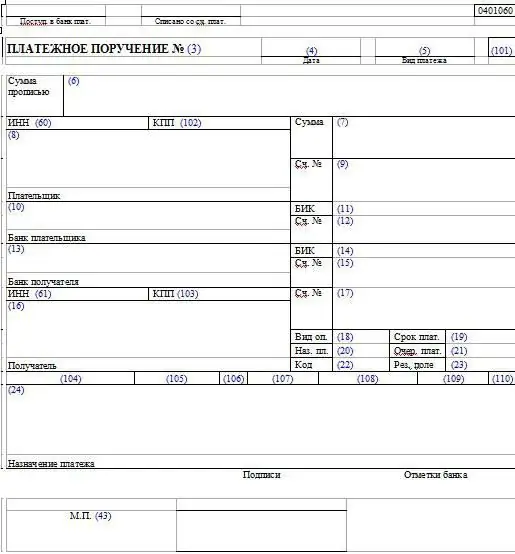

Both citizens and organizations have to fill out payment orders from time to time. The preparation of relevant documents is quite strictly regulated by law. Therefore, it is highly recommended to follow the criteria approved in legal acts. What are the specifics of the formation of payment orders, with the help of which an organization or an individual carries out transactions on taxes, contributions, fees and other grounds?

Follow the rules of the law

The legislation governing the formation of financial documents in the Russian Federation changes quite often. Therefore, before studying the samples of filling out payment orders, it will be useful to pay attention to a number of important provisions in legal acts related to the relevant procedure. Among the key sources today is the Order of the Ministry of Finance of the Russian Federation No. 107n dated November 12, 2013, which approved the rules for indicating information in payment orders. What provisions of this source of law deserve special attention?

So, for example, in field 101 of payment orders, firms with the status of a tax agent should indicatecorresponding status, namely 01 or 02.

If there is a question about the need to transfer insurance premiums - to the PFR, FSS and FFOMS - then the status should be 08. Previously, it was indicated only for transactions in the FSS.

The most important innovation - in field 105 you need to specify not OKATO, but another attribute - OKTMO.

Another notable innovation introduced by order of the Ministry of Finance - UIN. It is indicated in field 22 of the payment order. To find out the correct UIN, you need to seek advice from the territorial department of the Federal Tax Service at the place of business of the organization.

Significantly simplified the procedure for specifying the type of payment in field 110. In accordance with the order of the Ministry of Finance noted above, there are 3 options for specifying the corresponding details - PE (pen alties on taxes to the budget), PC (interest on fees) or 0 (other fees).

Another important innovation approved by the authorities is that only one BCC can be indicated in a single payment order.

It's interesting with the requisite in field 106, which fixes the reasons for the payment. It is supplemented by such items as the repayment of an investment loan (or IN), debts during bankruptcy (TL, RK), current debts (RT).

In the fields reflecting the information about the payee, you must specify the full or abbreviated name of the subject. Many lawyers, when creating for their clients a sample of filling out an individual entrepreneur's payment order, pay attention to the fact that the entrepreneur needs to indicate the full name and status in the corresponding field.

Practicework with payments

So, having studied the basic legal nuances of filling out payment orders, let's move on to the practice of working with these documents. What criteria must a payment order meet? A sample of filling it, whatever it may be, will include several key fields in its structure, each of which has a unique code. Let's study their totality.

Payer and recipient data

Any samples of filling out payment orders will include such details as the payer's TIN (with code 60). If for some reason the subject of legal relations does not have it, then it is necessary to set 0. If the payment form is filled in by an individual who is not registered as an individual entrepreneur, then, provided that the corresponding identifier is indicated in the requisite 108, the field with code 60 is optional. If an enterprise transfers part of an employee's salary to the budget, then the TIN of the corresponding employee is indicated.

The details of the checkpoint with code 102 are filled in by legal entities that have the appropriate certificate. Individuals do not have it, so this field is set to 0 (as well as enterprises that transfer funds from employees' salaries to the budget).

Payer data

The "Payer" requisite with code 8 is the most important in the document. Regardless of who generates the payment order, the sample filling in the source will include data on the corresponding subject. Payers can be:

- legal entities (in this case, their name is indicated);

- notaries (they enter into the documentFULL NAME. and your status, registration address);

- heads of farms (indicate full name, status, address);

- natural person (fill in full name and address).

- consolidated groups of payers (indicate the name of the responsible participant);

- firms that withhold part of the salary for the purpose of transferring to the budget (enter the name).

If you need to specify an address, it is recommended to put two slashes after it //.

The next important requisite is the “TIN of the recipient of funds” with code 61. It can be found in the relevant government agency that administers this or that type of collection. This attribute is adjacent to another one - “KPP of the recipient of funds” with code 16. Similarly, it must be recognized in the relevant government agencies.

Data on the originator of the payment

Very important is the requisite with code 101, which contains information about the entity that forms the payment order. The sample filling (taxes, fees, fines) of this document will always include this item. There are 26 possible values for the corresponding attribute (for example, 01 - taxpayer, 02 - tax agent, 09 - individual entrepreneur, etc.).

Drafting instructions for paying taxes, pen alties and fines

Let's consider the specifics of the formation of a payment order when paying taxes, pen alties and fines. The details that we will now study will be included in almost any document - for transferring personal income tax, simplified tax system, VAT payment order. The filling pattern of this type of source will be optimal if its structure conforms to the followingcriteria.

Among the most important fields is that which has the code 104. This is the CSC. It is highly undesirable to make mistakes in it, otherwise the financial transaction simply will not reach the addressee. This item is almost always included in the sample of filling out a payment order. PFR, FSS, MHIF, FTS - entities that have their own CCC. It is possible, of course, in case of an error with the indication of the CCC, to send corrective documents to these institutions, but if the term of the corresponding transaction has passed, then the incorrect indication of the corresponding code may initially be interpreted by these departments as the payer's evasion of obligations stipulated by law.

Samples for filling out payment orders always include the OKTMO code - in field 105. Previously, it was the OKATO code.

Field 106 contains the basis of the financial transaction. Samples of filling out payment orders also always include it. There are a large number of options for specifying the relevant details (for example, TP - current payments, OT - repayment of deferred debts, TR - payment of debts at the request of the Federal Tax Service, etc.).

Correct period

Code 107 corresponds to the attribute in which the tax period is fixed. In its structure - 10 characters (of which 8 have practical significance, others are separating). The first two indicate the frequency of the transaction - MS, KV, PL, GD (month, quarter, half year or year). In the fourth and fifth - the number of the month, quarter, half year for the corresponding payments. If the transaction is subject toimplementation once a year, then you need to set 0, if there are several terms for transferring funds, then you need to set the dates for transferring funds. The remaining characters in the props are used to indicate the year in which the fee is paid.

Correct document number

Code 108 corresponds to the attribute, which contains the document number, which is the basis for the transaction. A large number of options are also possible here (for example, TR - the number of the FTS requirement for the payment of fees, OT - decisions to defer debt, TP - arbitration decisions, etc.). It can be noted that individuals who pay taxes indicated in the declaration must put 0.

Correct date

Code 109 corresponds to the requisite, which indicates the date of the document that is the basis for the transaction. Its structure is also represented by 10 characters. In the first two, a specific day of the month is put, in the fourth and fifth - the month, in the seventh, eighth and tenth - the year. A dot is used as the third and sixth characters. If the payment has the current status - TP, then you need to indicate the date corresponding to the one when the declaration or other document was signed by the payer. If we are talking about voluntary repayment of debt for expired periods, then you must put 0 in the corresponding requisite. If the basis of payment is a demand, TR, then you need to specify the date of its formation. The same goes for paying off debts. If the requisite is filled in by an individual who pays tax on the declaration, then he needs to set the date,corresponding to the submission of this document to the Federal Tax Service.

Code 110 - Simplified

Code 110 corresponds to such a detail as the type of payment. Compiled for almost any enterprise, a sample of filling out a payment order (personal income tax, pen alties, interest) will include it. Here, as we noted above, 3 options are possible - PE (for pen alties), PC (for interest) or 0 (for taxes, fines, advance transactions). Similarly, 0 is set if the originator of the document finds it difficult to indicate the correct type of payment.

Code 21 corresponds to such a detail as the order of payment. It is recommended to set the number 5 - in accordance with the provisions of Article 855 of the Civil Code of the Russian Federation.

Features of UIN

Code 22 corresponds to the new attribute noted above - UIN (or a unique accrual identifier). You need to recognize it, as we noted above, at the Federal Tax Service, to which the payment order will be provided. Some lawyers recommend, however, to contact banks for relevant information. For example, if a payment order (sample filling) of Sberbank is being drawn up, then perhaps the best option is to consult with the specialists of this financial institution. At the same time, as experts note, if it is impossible to indicate the UIN, you can indicate 0. in the corresponding requisite.

Code 24 is related to the purpose of the payment. This may be, for example, payment for services, goods. But if we are talking about transferring part of the employee's salary to the budget by the organization, then it is necessary to indicate the specialist's personal data in the appropriate field - full name, TIN.

So weconsidered what criteria the payments must meet in order to transfer taxes, pen alties, and fines to the budget. In general, the same rules apply if the basis for drawing up such a document as a payment order is a state duty. The filling pattern of this source will correspond to the algorithm we have considered.

Specifics of drawing up payments to funds

The preparation of payments to state funds is characterized by certain specifics. A sample of filling out a payment order (FFOMS, PFR, FSS may be its addressees) of the appropriate type will be optimal if it meets the following basic criteria.

So, in this type of documents, as in the case of payment of taxes, pen alties and fines, field 104, that is, CCC, will be used. As in the case of payments of the previous type, only one CCC can be indicated in a single document. The correct BCC must be requested from the fund to which the corresponding transaction is sent.

Similarly, code 105, corresponding to such a detail as OKTMO, must also be indicated in the payment. It, as in the case of documents for the transfer of taxes, pen alties and fines, replaces OKATO.

If a fee is paid to one or another state fund, 0 can be indicated in the details with codes 106 and 107.

Code 108 is important. If in field 101 above - that is, in the one that contains data on the status of the subject that forms the payment - numbers such as 03, 19, 20, or 24 are marked, then in the requisite 108 you need putindividual identifier. This can be, for example, SNILS, his passport data, the series and number of the driver's license, etc.

ID variability

It is also important to specify the correct identifier type. It can be represented in the following spectrum:

- 01 (the main identity document of a citizen of the Russian Federation - a passport);

- 02 (birth certificate);

- 03 (sailor's passport);

- 04 (military identification document);

- 05 (military ID);

- 06 (a document that temporarily certifies a person's identity);

- 07 (certificate of the release of a citizen after serving a prison sentence);

- 08 (foreigner's passport);

- 09 (residence permit);

- 10 (document allowing temporary residence in the Russian Federation);

- 11 (document certifying refugee status for a person);

- 12 (migration card);

- 13 (USSR passport);

- 14 (SNILS);

- 22 (driving license);

- 24 (certificate of state registration of the vehicle).

Fields 109 and 110 can be 0.

Universality of order

In field 21, that is, the priority of payment, you should put 5, as in the case when we considered the first scenario for compiling such a document as a payment order (sample filling). A fine, a tax, a fee to the state fund is always put, thus, with the priority 5.

Props with code 22, i.e. UIN, as inin the case of payments of the previous type, you should find out either at the state institution to which the funds are sent, or at the bank.

Props with code 24 assumes the correct indication of the purpose of the transaction. These can be, for example, insurance premiums for the OPS.

Recommended:

Payment order: filling order, purpose

The payment order is mentioned in the Regulation of the Central Bank No. 383-P of 2012. This settlement document is created in a banking institution to make a partial transfer of funds

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Filling out a sick leave: the procedure for filling out, norms and requirements, an example

To receive a payment from the employer, it is necessary that the sick leave is filled out correctly. How to do this and how to work with sick leave in general is described later in the article. An example of filling out a sick leave will also be given below

Order journal. Filling out magazines-orders. Account journals

Each company has the opportunity to independently choose the system and form of tax and accounting. The prevailing principles for the formation of accounting data are: reliability, transparency, accessibility of perception, the possibility of obtaining a report on any asset or type of settlement, exclusion of data leakage and distortion