2026 Author: Howard Calhoun | calhoun@techconfronts.com. Last modified: 2025-01-24 13:10:28

In the process of financial and economic activity, organizations carry out a lot of operations: the production of goods, the provision of services, settlements with suppliers and customers, payments for taxes and fees, and other operations stipulated by the types of activities and legislation. The organization must report on all these operations and their financial results to the regulatory authorities, submit certain reports on time. In addition to reporting to the tax service and other authorities, companies must report financial results to their shareholders and founders, partners and even some debtors. Reporting is also required for internal use. For all this, there is internal control, for the convenience of which an internal financial control card is used. This article is devoted to this topic. From it it will become known what internal control is,what is the procedure for its implementation, and why do we need an internal financial control card, its components, specifics and filling rules.

What is internal control

Internal control in the organization is carried out by the accounting department or by the director himself, if the organization is small and he took on the role of chief accountant. Regulates the procedure for exercising internal financial control Federal Law No. 402 of December 6, 2011. It is called the Law - "On Accounting". It refers specifically to internal control in Article 19. It describes a number of key requirements for ongoing accounting, the need for its maintenance for all organizations without exception, as well as sanctions for organizations that do not comply with these requirements.

What internal control should look like

The procedure for exercising internal financial control implies the implementation of several principles. Compliance is important both for internal users in the organization and for external reviewers.

- Reliability. All documentation and reporting must fully correspond to the operations carried out. All actually completed processes should be reflected, with a real amount and terms.

- Completeness. Documents and reporting should contain all data that is important to stakeholders. Operations should be specified, if necessary, contain explanatory comments.

- Neutrality. Interests should not be indicated in documentation and reportingany persons.

- Continuity. The hierarchy of documents and reports is observed, the sequence of reflection of the total amounts, the cumulative total for the reporting periods. All documents are linked.

Ways to implement

All organizations are in different situations. In some, only one person works, who is both the founder, and the director, and the accountant, and the sales and purchase manager all rolled into one. In others, on the contrary, there is a huge staff of people, each of whom is engaged in his own business. In one case, it is more convenient for an organization to conduct its own calculations, in another, it simply does not have enough personnel for this. Based on this, companies have two possible ways out of the situation, each of which has its pros and cons.

- Self-registration. Even in an organization with a single employee, it is possible to keep records on their own. In this case, the director himself is in charge of accounting. This implies that he has knowledge in the field of accounting and reporting, rules and regulations on accounting, office work and workflow. To date, there are online services that help a lot in work, even with minimal knowledge in the field. You can hire an individual accountant or even an entire accounting department, depending on the needs of the company. In this case, accountants get a job in accordance with the requirements of the Labor Code, they are paid wages and contributions to specialized funds.

- Agreement with an audit orconsulting third party. In this case, all accounting responsibilities fall on the shoulders of specialists from a third-party company. The main concern of the customer is to pay for services on time. No need to look for candidates for the position of an accountant, test it and choose from a mass of applicants, no need to pay wages and contributions to social funds. But usually the price of consulting services is many times higher than the salary of an average accountant.

Subjects and objects of internal control

In the process of control, its subjects and objects can be distinguished. Subjects - persons carrying out actions aimed at obtaining the result of an audit, that is, owners or officials who are entrusted with these obligations. There are several levels of subjects:

- first level - owners or members of the organization who initiate the audit out of necessity or by their own decision;

- second level - executors of the control process (members of the inspection commission, or third-party auditors who are entrusted with these obligations by virtue of their position or contractual obligations);

- third level - employees whose job responsibilities include the implementation of control functions;

- fourth level - personnel carrying out inspection due to the need.

Objects of checks are objects to which control is directed. These can be the resources of the organization,security systems, personnel, financial results and other components of economic activity that are of interest to various users of the information sought.

Organization of the internal control system

Internal control provides information and confidence in the organization to many users at once. It should be designed in such a way as to satisfy the interests of all persons for whom information about the financial condition of the company and its position in the market is important. To do this, control should relate to the following components of business activity:

- completeness and reliability of information reflected in accounting, tax and management accounting, its comparability and continuity;

- the activity of the enterprise as a whole and the degree of its reflection in accounting documents;

- legitimate and efficient use of funds at the disposal of the enterprise;

- reliability of protection of trade secrets;

- the attitude of the organization's management to the identified shortcomings, the speed and approach to correct them;

- speedy transfer of internal information and reporting to persons whose job responsibilities include making managerial decisions.

What is an internal financial control card

The implementation of internal control must be approached systematically. In order to make the process most convenient, there is a special document -internal financial control card. In simple terms, this is a control action plan indicating procedures and responsible persons (objects and subjects). The process of documenting internal control contains a number of interrelated forms and reports. At the same time, it should be noted that the internal financial control card for some organizations is mandatory, for others it is just a convenient tool used at will.

The Ministry of Finance has developed a unified form of the internal financial control card of a public institution. An example of such a form is given in this material. It is mandatory for organizations that use budgetary funds in their activities. That is, state, state and municipal structures.

Card of internal financial control for 2017: verified information

In the internal control of organizations, both commercial and public, it is important to touch on all components of business activity. The following control procedures were reflected in the internal financial control cards for 2017:

- Reconciliation of the balances indicated in the documentation and listed on the balance sheet accounts. Cash books, bank statements, acts of reconciliation with counterparties, cashier reports, warehouse reports, that is, primary documentation are considered.

- Comparison of the amounts indicated in the balance sheet at the beginning of the year, the annual report for the last reporting period, indicatorsof the General Ledger and the amounts reflected in the sections of the balance sheet as of the current date.

- Inventory of inventories, valuables, property.

- Control and reconciliation of accounts payable and receivable.

- Checking the correctness of document management, compliance of paperwork with the requirements of legislation, accounting policies of the organization, chart of accounts, other regulations related to the field of activity.

- Checking the availability and correct execution of primary documentation, on the basis of which data was entered into accounting and reporting.

Contents of internal control chart

The procedure for the formation of internal financial control cards may vary in companies depending on the legal form, features of work, field of activity. But in all the variety of document forms, it is possible to single out details that are common to all of them. The Financial Control Card contains the following information:

- document name;

- name of the organization in which it was adopted and approved;

- time period for which the card is approved;

- name of control objects;

- an official who is responsible for the operation, in other words, the performer;

- the official who controls the transactions - the controller;

- method by which control is carried out (for example, checking the execution of a document, reconciling data during inventory withactual figures);

- method of control (full current control, continuous subsequent, selective current, selective subsequent and others);

- frequency with which control actions are carried out (in the process of formation, before approval, before the transfer of the document, after transactions);

- position title, date of drawing up the internal financial control card of a public institution, example of a signature, surname and initials of the controller.

What is taken into account when developing a map

The specifics of the internal financial control card depends on the conditions in which the organization operates, its form of ownership, market niche, availability of labor, material and financial resources, and many other factors. For state and municipal organizations, clear sample maps have been established. Privately owned companies may develop this document themselves for internal use. When compiling it, several important points should be taken into account, namely:

- relevance of different types, types and forms of inspections for a particular organization at a particular moment of activity;

- periodicity and frequency of inspections in which the organization will work most productively;

- the state of the organization, its availability of resources necessary for the implementation of inspections (financial, labor, technical, material, temporary);

- uniform load distribution whenconducting a check on the current controllers, since excessive labor activity generates fatigue, and that, in turn, entails errors, missing important information from view and other unpleasant consequences.

Additional requirements for public sector control cards

Budget transactions for the internal financial control card - the basis and reason for its compilation. In the public sector, this document is indispensable. But if in commercial organizations the map structure can be approached creatively and based on the needs of the company itself at a given time, then with state-owned enterprises the situation is more complicated. Before signing an order to approve an internal financial control card for a municipal or state organization, you must make sure that all the requirements for its structure and composition are met. These requirements can be represented by the following list:

- transparent in understanding the direction of inspections;

- reflecting areas of business in which audits of budget operations are carried out;

- detailed description of the algorithms used for verification;

- clearly established deadlines for inspections, their observance and confirmation;

- boundaries within which control activities are carried out.

Some public sector entities have mandated inspection plans issued at the departmental level. It is to them that companies must strictlyto follow. These instructions can be issued at different levels of government:

- Federal documents, regulations and letters agreed with the Ministry of Finance of the Russian Federation and binding throughout the Russian Federation.

- Regional regulations, regulations, letters, ordinances and requirements in force in the territory of a certain area, county or province. For companies that are geographically located within these boundaries, these requirements for the content and structure of internal financial control cards are mandatory. A sample of filling out when issuing such documents is agreed with Rosfinnadzor.

Evasion of due diligence requirements or non-compliance with regulations may result in severe sanctions under the RF Codes depending on the severity of the financial crime.

Recommended:

Sample internal regulations of the organization. Model internal labor regulations

What is the Internal Regulations of the organization? Copy a sample or modify it? Responsibility of the employer for PWTR. Required sections of the document. What should not be included? Adoption and approval of the Rules, taking into account the opinion of the trade union. Registration of the title page, general provisions. Sections: disciplinary responsibility, labor time, payment of compensation, etc. Validity of the document, changes

Filling out TORG-12: rules for filling out a consignment note

This article discusses the primary documents, the TORG-12 consignment note, the rules for filling out, the form and the form, its purpose and the requirements of the inspection inspections

Samples of filling out a consignment note. Rules for filling out a consignment note

In order for the company's activities to fully comply with the requirements of the law, when filling out the documents, you must follow the established instructions. This article discusses samples of filling out a consignment note and other accompanying documents, their purpose, structure and meaning in the activities of organizations

Filling out a sick leave: the procedure for filling out, norms and requirements, an example

To receive a payment from the employer, it is necessary that the sick leave is filled out correctly. How to do this and how to work with sick leave in general is described later in the article. An example of filling out a sick leave will also be given below

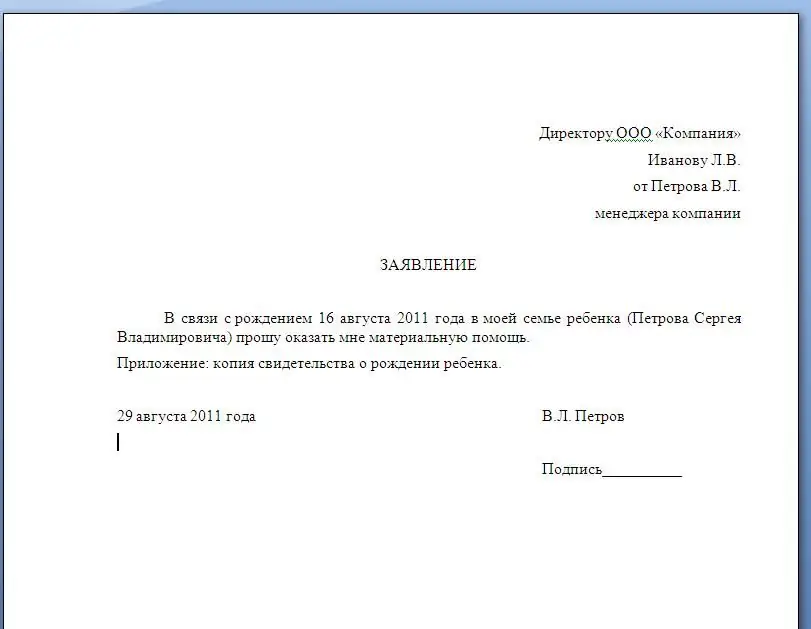

Application for financial assistance: sample and form of writing with an example, types of financial assistance

Material assistance is provided at work to many employees who have significant events in their lives. The article provides sample applications for financial assistance. Describes the rules for assigning payments to the employer