2026 Author: Howard Calhoun | [email protected]. Last modified: 2025-01-24 13:10:30

It is well known that money should not be in a safe, but should work. There are many opinions about exactly how and where exactly they should do this. But absolutely all experts agree on one thing: the most reliable place to store savings is a bank. Here you can leave funds intended to pay for an expensive purchase or simply accumulated over a period of time.

But you can also keep money in the bank in different ways. This is a safe deposit box, in which banknotes are simply put and left under multi-level protection, and a regular current account, and a savings deposit. Despite the we alth of options to choose from, most bank customers prefer term deposits.

Each financial institution, as a rule, has several such programs, according to which you can leave money at interest for a specific period. Some of them provide for early withdrawal of money, others do not, there are deposits with the possibility of replenishing the account, and there are also without. There are other nuances in the contracts. But any term deposit in any bank will obviously bring more income,than a savings or checking account.

When opening a deposit, the client wants to be sure that he will be able to freely return his money and collect interest. In order to sleep peacefully, investors are advised not to pursue high profits, but to open accounts in trusted reliable banks with large loan and deposit portfolios. In this regard, term deposits of Sberbank are so popular. After all, this institution has been tested not for years, but for decades. Sberbank has a huge number of branches and offices across the country, and its deposit portfolio indicates a high level of trust from existing customers.

Some financiers, however, referring to the fact that all deposits of individuals are insured, recommend not to pay special attention to the reliability of the bank, but to look only at the benefit, that is, at the size of the interest rate and the scheme for calculating it. They are mostly right, but not in everything.

Firstly, there is a limit on the maximum amount for deposit insurance. Secondly, in the event of force majeure, then running around the authorities and literally “knocking out” your money is not a pleasant occupation. And there can be no question of any restful sleep in this case.

Of course, when making a deposit, it is better to ask if the bank participates in the insurance system. So it will be calmer, but you should not count on it too much either. It should be said that all deposits are insured in banks: term, savings, demand deposits, but only on condition that the amount on them does not exceed the maximumpermitted under applicable law and the client is a private individual.

To make money work, you can invest it in various funds, buy real estate or precious metals. But the simplest and most reliable option was and still is a term deposit. Firstly, in this case, the client does not need to worry about quotes or price fluctuations in the market. Secondly, you can choose a convenient deposit option so that, for example, you can receive your interest every month or withdraw it in six months or a year. And thirdly, any term deposit can be terminated in advance. Of course, in this case, interest is lost, but in no other case can the money be returned as quickly and simply as in the case of a deposit.

Recommended:

Long-term investments are The concept, types, characteristics and possible risks of long-term investments

Is it profitable to invest money for the long term? Are there any risks for investors? What are the types of long-term investments and how to choose the right source of future income? What steps should an investor take in order to invest money for the long term safely and profitably?

How to save money with a small salary? How to save correctly?

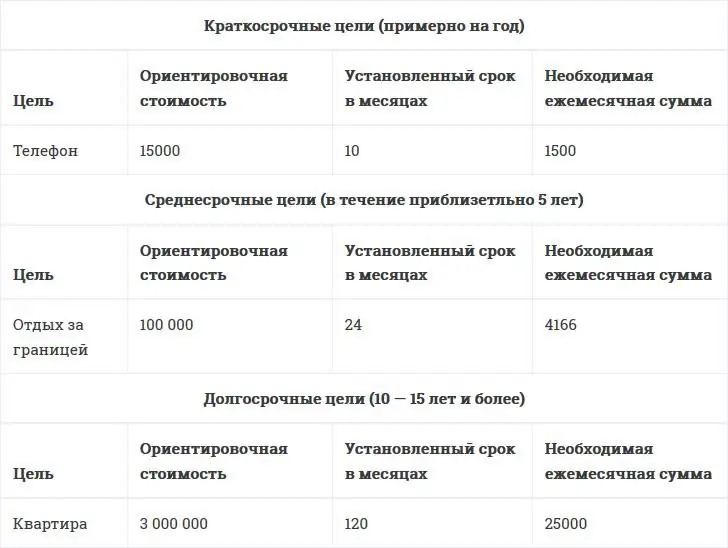

In addition to monthly expenses for utility bills, groceries and other expenses, I want to save up money for a long-awaited vacation, buying real estate or educating children. Unfortunately, not everyone succeeds, and some are so obsessed with savings that they cross the line on the path to outright stinginess. So how to save money with a small salary, while not infringing on the little things?

Mortgage: minimum term, conditions for obtaining. Minimum term of a military mortgage

People who want to solve financial problems often decide to apply for a loan. Or, if you need housing, take a mortgage. And everyone wants to get even with debts as soon as possible. Therefore, all people, before deciding to take such a responsible step, carefully calculate the amounts, terms, interest - just to get the maximum benefit. Well, the topic is interesting, therefore it is worth considering it in all its details

How to make money without money? Ways to make money. How to earn real money in the game

Today everyone can make good money. To do this, you need to have free time, desire, and also a little patience, because not everything will work out the first time. Many are interested in the question: "How to make money without money?" It's a perfectly natural desire. After all, not everyone wants to invest their money, if any, in, say, the Internet. This is a risk, and quite a big one. Let's deal with this issue and consider the main ways to make money online without vlo

Deposit "Save" (Sberbank): interest and conditions. What is the interest rate of the "Save" pension deposit in Sberbank of Russia?

Deposit "Save" is one of the most profitable deposit programs of Sberbank. There are higher interest rates for pensioners. Flexible partnership terms available